Trade

Trading Type

Spot

Trade crypto freely

Pre-Market

Trade new tokens before they are officially listed

Margin

Magnify your profit with leverage

Convert & Block Trading

0 Fees

Trade any size with no fees and no slippage

Alpha

Points

Get promising tokens in streamlined on-chain trading

Leveraged Tokens

Get exposure to leveraged positions simply

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

NEW

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

[Forex] Considering the "Sequel" of USD/JPY in 2025 | Yoshida Tsune's Forex Daily | Moneyクリ Monex Securities' Investment Information and Media Useful for Money

Since 2022, there has been a significant price range of over 30 yen annually.

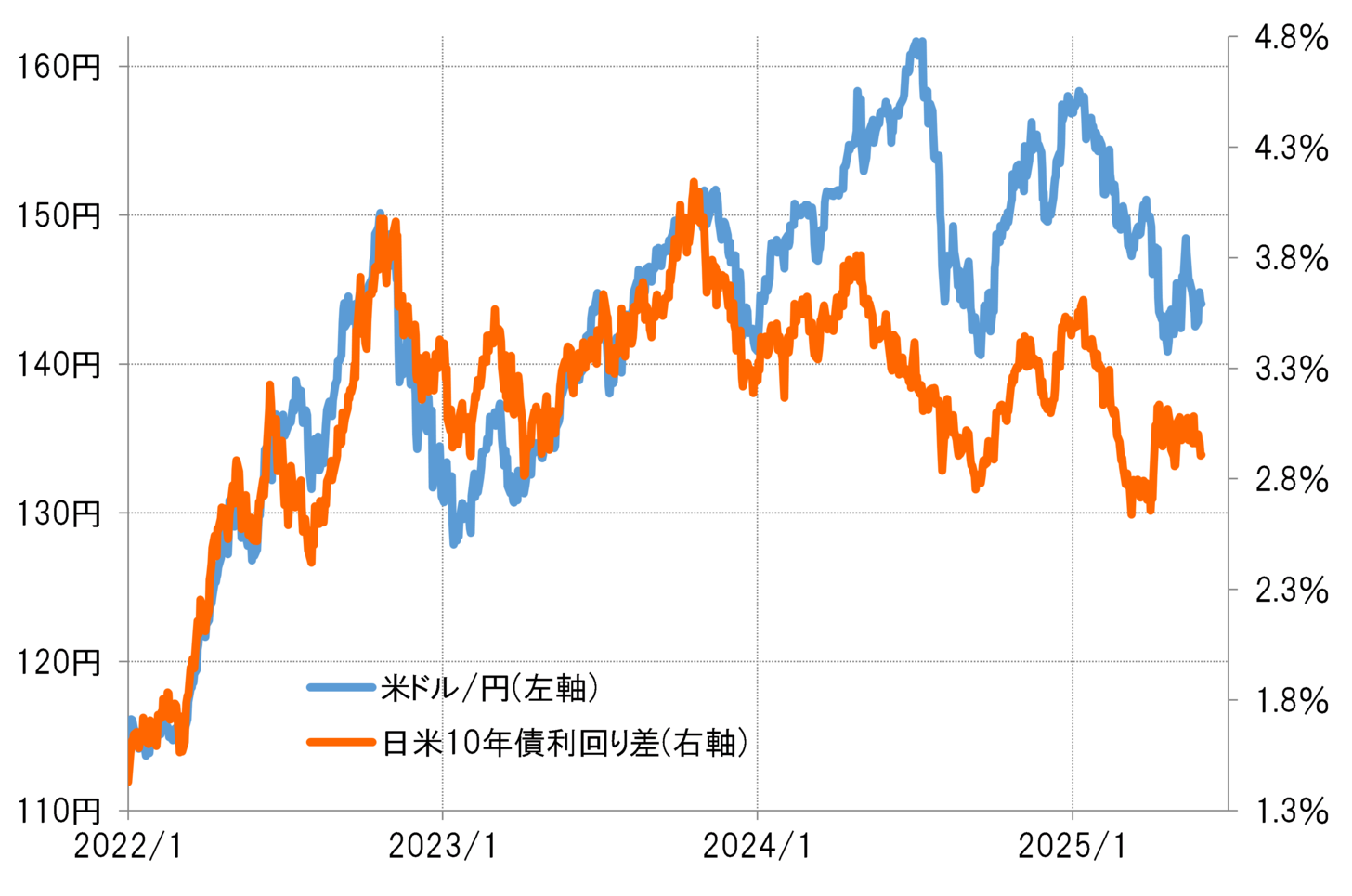

The maximum annual price range for USD/JPY is 113~151 yen at 38 yen in 2022, 127~151 yen at 24 yen in 2023, and 22 yen at 139~161 yen in 2024. On the other hand, in 2025, it will be 19 yen at 139~158 yen by the end of May (see Figure 1). In the sense that the price range has already expanded closer to the past two years, is it likely that the price range expansion in 2025 will be limited?

[Figure 1] USD/JPY and the US-Japan 10-Year Bond Yield Spread (From January 2022) Source: Created by Monex Securities from Refinitiv data

However, in 2023, where the annual price range remained in the 20 yen range, there was significant volatility within that range in 2024. For example, the USD/JPY rose from 127 yen to 151 yen in 2023, and then significantly fell to 140 yen towards the end of the year. When combining the ranges of increases and decreases, the cumulative range exceeds 30 yen.

Source: Created by Monex Securities from Refinitiv data

However, in 2023, where the annual price range remained in the 20 yen range, there was significant volatility within that range in 2024. For example, the USD/JPY rose from 127 yen to 151 yen in 2023, and then significantly fell to 140 yen towards the end of the year. When combining the ranges of increases and decreases, the cumulative range exceeds 30 yen.

From this perspective, the cumulative price range in 2024 will be even larger. USD/JPY rose from 141 yen in January to 161 yen in July in 2024, but then plunged to 139 yen. However, by the end of the year, it had risen again to 158 yen. After a rise of 20 yen, it plummeted by more than 20 yen, and then rose again by nearly 20 yen, so the cumulative price range is calculated to be about 60 yen.

Looking at it this way, it can be said that the USD/JPY for the next three years until 2024 will either expand to an annual maximum range of over 30 yen in one direction, or continue to show a record expansion of price movements with a cumulative range significantly exceeding 30 yen as a result of large fluctuations in both directions.

The main reason for the surge in volatility is the rapid widening of interest rate differentials.

So why has the movement of the USD/JPY become so volatile? The volatility, in other words, the fluctuations, is greatly influenced by interest rate differentials. Essentially, it can also be understood that higher interest rate currencies tend to have greater volatility. From this perspective, the significant increase in the volatility of USD/JPY since 2022 is likely largely influenced by the rapid widening of the interest rate differential between Japan and the United States.

The difference in 10-year bond yields between Japan and the U.S. has narrowed from over 4% to briefly below 3% recently. However, a interest rate differential of around 3% still seems significant. If that is the case, there is a possibility that the fluctuations in the USD/JPY exchange rate will continue to expand until the latter half of 2025 due to this significant interest rate differential. Now, will this expansion in fluctuations lead to a further decline in the USD/JPY, or will it be brought about by a rebound in the USD/JPY?

Will the price range expand in the latter half of 2025 towards a weaker US dollar and stronger yen?

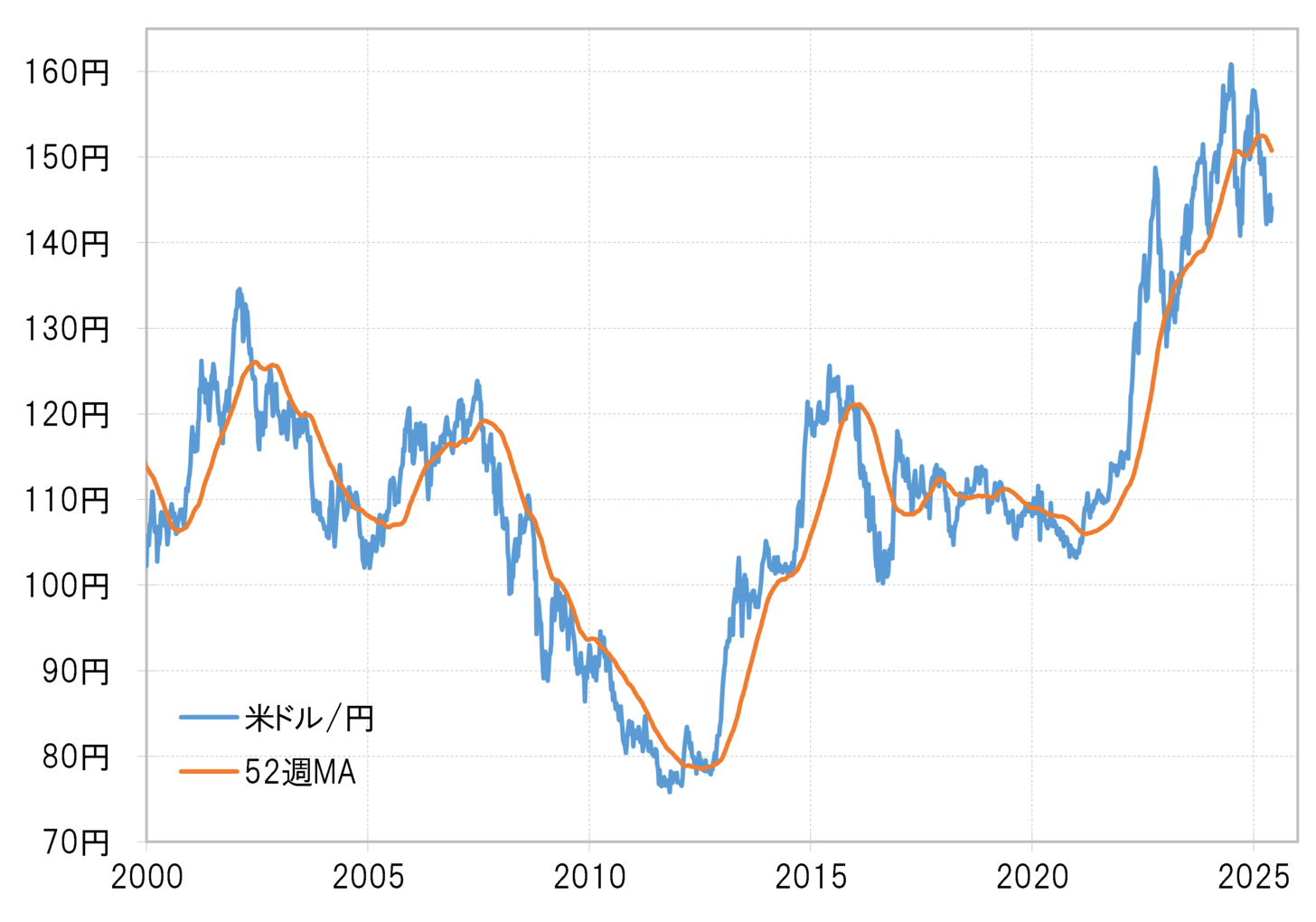

Looking at the relationship between the USD/JPY and the 52-week moving average, there is a possibility that it shifted from an upward trend to a downward trend at 161 yen in July 2024 (see Figure 2). If that is the case, the increase in volatility may lead to an expansion of downward potential, meaning it is likely to break below the recent low of 139 yen for the USD/JPY.

[Figure 2] USD/JPY and 52-week MA (2000 - ) Source: Created by Monex Securities from Refinitiv data

Source: Created by Monex Securities from Refinitiv data