Trade

Trading Type

Spot

Trade crypto freely

Pre-Market

Trade new tokens before they are officially listed

Margin

Magnify your profit with leverage

Convert & Block Trading

0 Fees

Trade any size with no fees and no slippage

Alpha

Points

Get promising tokens in streamlined on-chain trading

Leveraged Tokens

Get exposure to leveraged positions simply

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

Smart Leverage

NEW

No forced liquidation before maturity, worry-free leveraged gains

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

Trending Topics

View More15.9K Popularity

29.29K Popularity

42.21K Popularity

84.77K Popularity

3.11K Popularity

Pin

[Exchange Rate] The Meaning of the Strong Yen at 140 Yen Since April | Yoshida Tsune's Exchange Rate Daily | Moneyクリ Monex Securities Investment Information and Media Useful for Money

The drop in the USD/JPY has paused at below 140 yen due to being “downward movement too much” as one of the reasons.

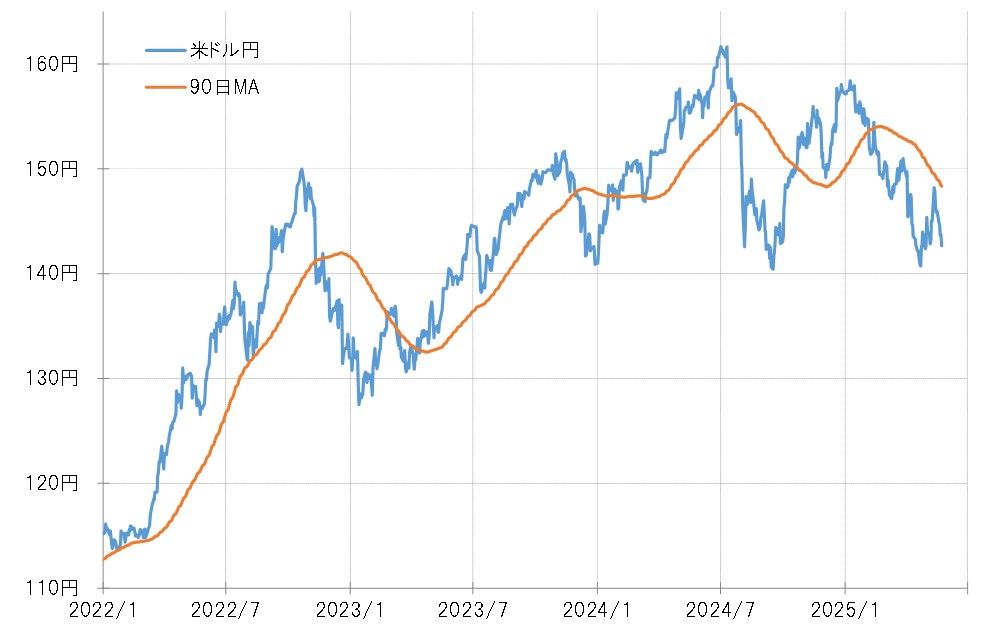

The recent low for the Dollar/Yen was recorded at 139.8 yen on April 22 (see Chart 1). Following President Trump’s remarks suggesting the dismissal of Fed Chair Powell, concerns about the credibility of the Dollar expanded, leading to a drop below the 140 yen mark. However, after President Trump effectively retracted this statement, buying back of the Dollar spread.

[Figure 1] Daily chart of the Dollar/Yen (from February 2025 onward) Source: Manex Trader FX

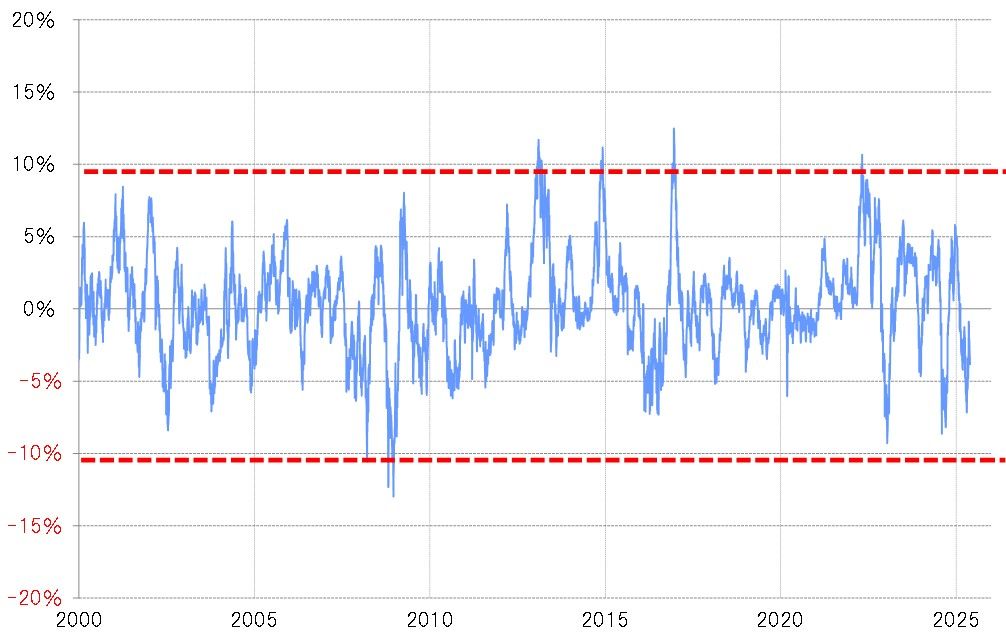

At this time, the rebound in the USD/JPY after the downward movement may have been significantly influenced by technical factors. At that time, the divergence rate of the 90-day MA (moving average) for USD/JPY expanded to over -7%. This divergence rate has only expanded to over -10% a few times since 2000 (see Chart 2). In other words, when the divergence rate approaches -10%, concerns about a short-term “too much decline” become stronger.

Source: Manex Trader FX

At this time, the rebound in the USD/JPY after the downward movement may have been significantly influenced by technical factors. At that time, the divergence rate of the 90-day MA (moving average) for USD/JPY expanded to over -7%. This divergence rate has only expanded to over -10% a few times since 2000 (see Chart 2). In other words, when the divergence rate approaches -10%, concerns about a short-term “too much decline” become stronger.

[Figure 2] USD/JPY 90-day MA deviation rate (2000 onwards) Source: Created by Monex Securities from data provided by Refinitiv.

Triggered by President Trump’s remarks about dismissing the Fed chair, the US Dollar weakened and the Yen strengthened. At one point, it fell below 140 Yen, but concerns about the US Dollar/Yen being “downward movement too much” were also growing. At such a time, President Trump moved to retract his dismissal remarks, which may have served as a catalyst for the “downward movement too much” correction, resulting in a stabilization of the US Dollar/Yen decline.

Source: Created by Monex Securities from data provided by Refinitiv.

Triggered by President Trump’s remarks about dismissing the Fed chair, the US Dollar weakened and the Yen strengthened. At one point, it fell below 140 Yen, but concerns about the US Dollar/Yen being “downward movement too much” were also growing. At such a time, President Trump moved to retract his dismissal remarks, which may have served as a catalyst for the “downward movement too much” correction, resulting in a stabilization of the US Dollar/Yen decline.

Will concerns about being “too low” intensify until it breaks below 137 Yen? = US Dollar/Yen

After that, the USD/JPY rebounded to the 148 yen level, but last week (the week of May 19), it again fell to the 142 yen level. More than a month has passed since the USD/JPY recorded the 139 yen level on April 22, and it seems that there has been a change in the short-term assessment of the USD/JPY being “downward movement too much.”

The 90-day MA for USD/JPY was 151.5 yen on April 22, when it hit the 139 yen level, but fell to 148.3 yen on May 23 (see Figure 3). As a result, as of April 22, the 90-day MA deviation rate expanded to minus 7.5% at 140 yen, but at present, the expansion of the same MA deviation rate is only minus 5.5% even at the same 140 yen.

[Figure 3] USD/JPY and 90-day MA (January 2022 - ) Source: Created by Monex Securities based on data from Refinitiv.

By the way, if we set the 90-day MA at 148.3 yen, that means it would fall 7.5% to 137.1 yen. In other words, by late April, there were strong concerns about the short-term “downward movement” of the USD/JPY below 140 yen, but currently, it seems that the same strong concerns about “downward movement” have shifted to below 137 yen.

Source: Created by Monex Securities based on data from Refinitiv.

By the way, if we set the 90-day MA at 148.3 yen, that means it would fall 7.5% to 137.1 yen. In other words, by late April, there were strong concerns about the short-term “downward movement” of the USD/JPY below 140 yen, but currently, it seems that the same strong concerns about “downward movement” have shifted to below 137 yen.

Looking at it this way, it seems that the downward movement of the Dollar/Yen below 140 yen in April came to a halt partly due to short-term “overselling”, but this time it appears that at least “overselling” will not be the reason for the downward movement of the Dollar/Yen to stop below 140 yen.