Trade

Trading Type

Spot

Trade crypto freely

Pre-Market

Trade new tokens before they are officially listed

Margin

Magnify your profit with leverage

Convert & Block Trading

0 Fees

Trade any size with no fees and no slippage

Alpha

Points

Get promising tokens in streamlined on-chain trading

Leveraged Tokens

Get exposure to leveraged positions simply

Futures

Futures

Hundreds of contracts settled in USDT or BTC

Options

HOT

Trade European-style vanilla options

Unified Account

Maximize your capital efficiency

Demo Trading

Futures Kickoff

Get prepared for your futures trading

Futures Events

Participate in events to win generous rewards

Demo Trading

Use virtual funds to experience risk-free trading

Earn

Launch

CandyDrop

Collect candies to earn airdrops

Launchpool

Quick staking, earn potential new tokens

HODLer Airdrop

Hold GT and get massive airdrops for free

Launchpad

Be early to the next big token project

Alpha Points

NEW

Trade on-chain assets and enjoy airdrop rewards!

Futures Points

NEW

Earn futures points and claim airdrop rewards

Investment

Simple Earn

Earn interests with idle tokens

Auto-Invest

Auto-invest on a regular basis

Dual Investment

Buy low and sell high to take profits from price fluctuations

Soft Staking

Earn rewards with flexible staking

Crypto Loan

0 Fees

Pledge one crypto to borrow another

Lending Center

One-stop lending hub

VIP Wealth Hub

Customized wealth management empowers your assets growth

Private Wealth Management

Customized asset management to grow your digital assets

Quant Fund

Top asset management team helps you profit without hassle

Staking

Stake cryptos to earn in PoS products

BTC Staking

HOT

Stake BTC and earn 10% APR

GUSD Minting

Use USDT/USDC to mint GUSD for treasury-level yields

More

Promotions

Activity Center

Join activities and win big cash prizes and exclusive merch

Referral

20 USDT

Earn 40% commission or up to 500 USDT rewards

Announcements

Announcements of new listings, activities, upgrades, etc

Gate Blog

Crypto industry articles

VIP Services

Huge fee discounts

Proof of Reserves

Gate promises 100% proof of reserves

Trending Topics

View More141.45K Popularity

14.83K Popularity

76.3K Popularity

1.67K Popularity

2.53K Popularity

Pin

[U.S. Stocks: Stock Discovery] 5 Stocks with Upward Performance: Johnson & Johnson [JNJ], Upward Revision of Full-Year 2025 Revenue Forecast Following M&A Completion | U.S. Stocks, Industry Trends, and Stock Analysis | Money Creation, a Media Resource for Investment Information and Financial Assistance from Monex Securities

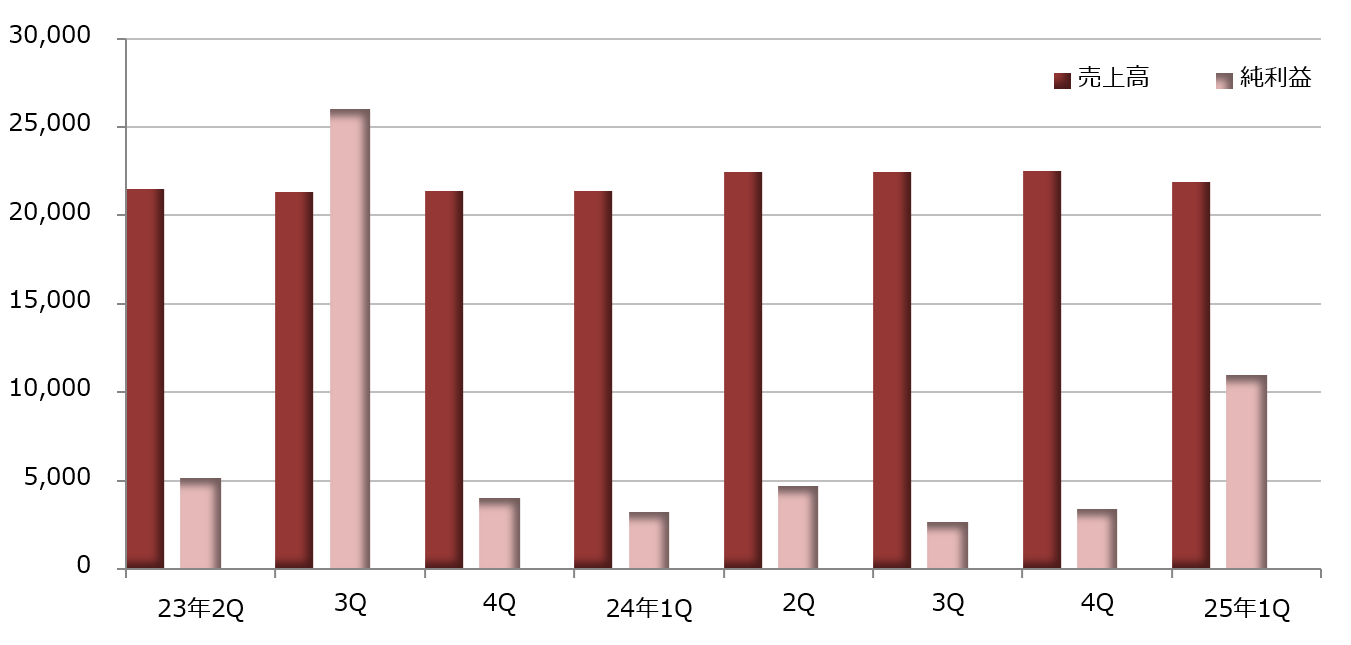

Johnson & Johnson [JNJ], both the pharmaceutical and medical devices sectors are strong

Johnson & Johnson [JNJ] reported that its earnings for the first quarter of 2025 were $21.893 billion, a 2.4% increase compared to the same period last year, and its net profit was $10.999 billion, up 3.4 times. The adjusted EPS (earnings per share) was $2.77, exceeding the market forecast of $2.59 compiled by LSEG (London Stock Exchange Group) by 7.0%.

While sales revenue increased slightly, the cost of sales ballooned by 13.0% to $7.357 billion, leading to a deterioration in the gross profit margin. However, by controlling selling expenses and research and development costs, the profit margin has widened. Additionally, other income of $7.321 billion was added (compared to an expenditure of $2.404 billion in the same period last year), resulting in a significant expansion of net profit. The adjusted net profit, excluding special factors, increased by 1.9% to $6.706 billion.

Sales by Business Segment: Cancer treatment drugs are performing well, while immunological disease drugs are underperforming.

By business segment, the sales of the pharmaceuticals division were steady with a 2.3% increase to 13.873 billion USD. By field, sales of cancer treatment drugs rose by 17.9% to 5.678 billion USD, performing well. In particular, the flagship anticancer drug “Darzalex” increased by 20.2% to 3.237 billion USD, driving the overall growth. Sales of metabolic and cardiovascular disease treatment drugs rose by 22.2% to 1.013 billion USD, showing steady growth.

On the other hand, the treatment drugs for immune diseases have declined by 12.7% to $3.77 billion, particularly with “Stelara” falling by 33.7% to $1.625 billion. Treatment drugs for mental and neurological disorders decreased by 8.7% to $1.647 billion, pulmonary hypertension treatment drugs decreased by 8.7% to $1.025 billion, and infectious disease treatment drugs shrank by 2.3% to $800 million.

The medical devices division has reported a 2.5% increase in revenue to $8.02 billion. By treatment area, cardiovascular diseases have grown by 16.4% to $2.103 billion, whereas orthopedics has decreased by 4.2% to $2.241 billion, and medical surgery has fallen by 0.8% to $2.396 billion.

upward revision of expected sales

The company set its guidance for full-year revenue for December 2025 at $91.6 billion to $92.4 billion, an upward revision from its previous forecast of $90.9 billion to $91.7 billion as of January 2025. This reflects the completion of the acquisition of Intra-Cellular Therapies, known for its schizophrenia treatment drug “Caplyta (Luma-Teperone).”

Joaquin Duato, CEO, pointed out that the mutual tariffs led by President Trump could disrupt the pharmaceutical supply chain, and expressed the view that tax incentives would be more effective in increasing the production capacity of pharmaceuticals and medical devices in the United States.

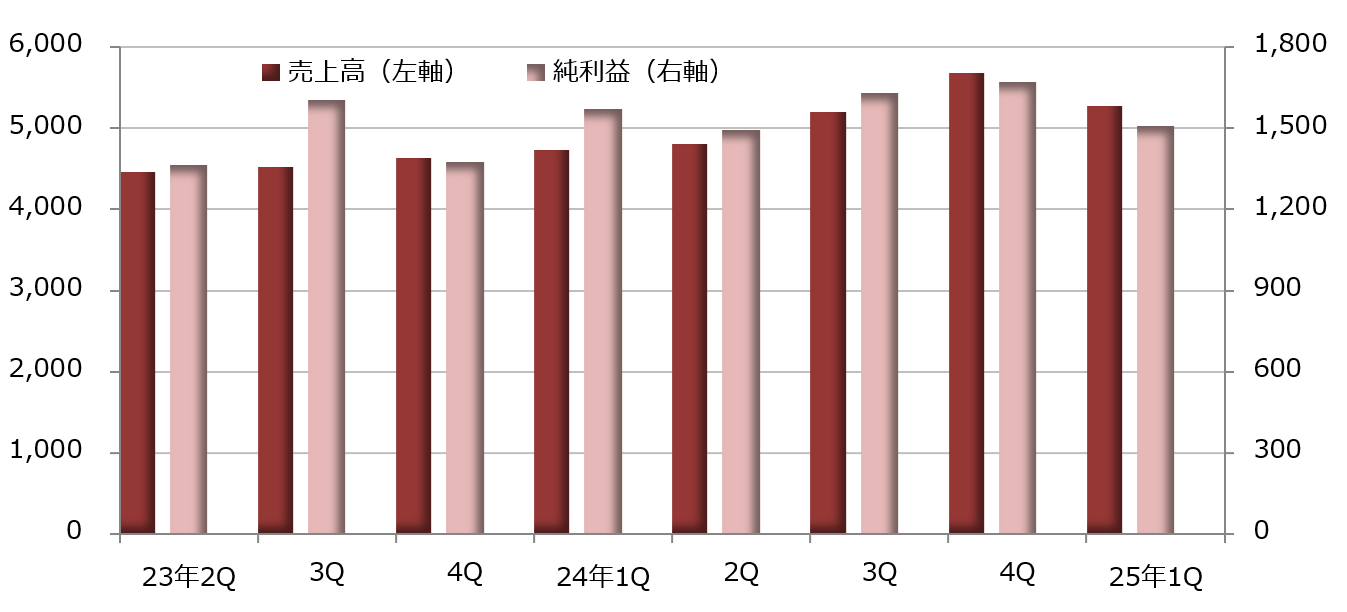

[Figure 1] Johnson & Johnson [JNJ]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is December.

Source: Created by DZH Financial Research from LSEG

*The end of the term is December.

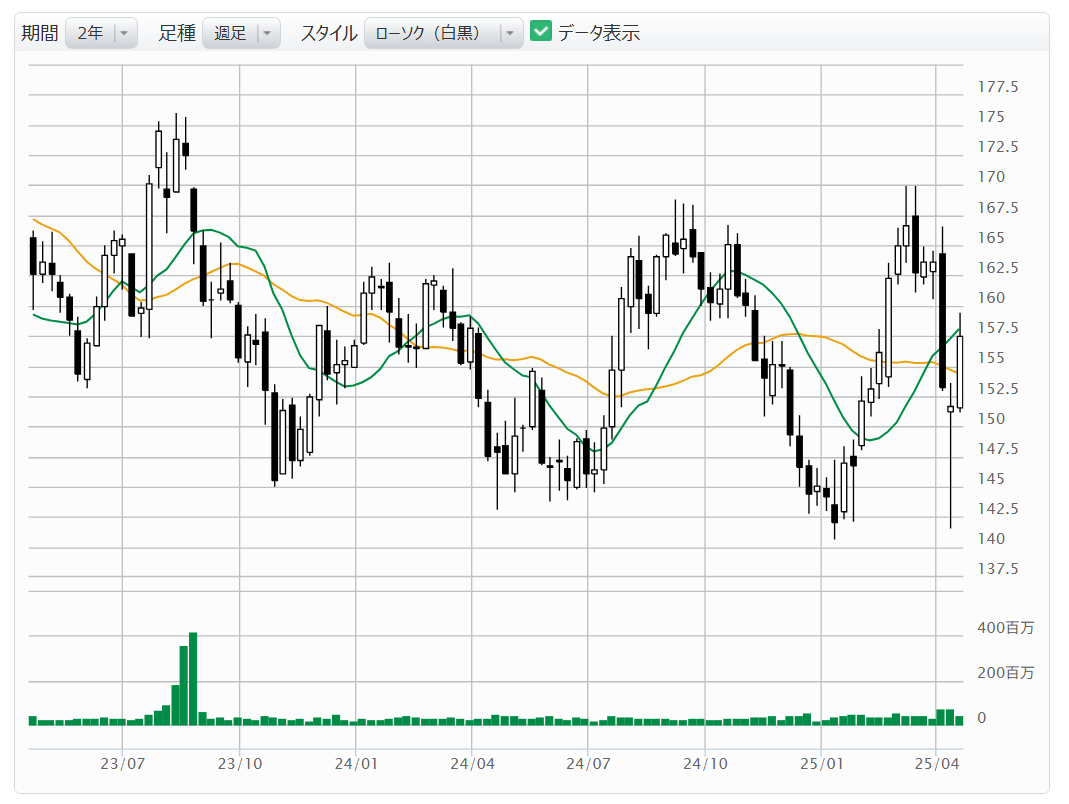

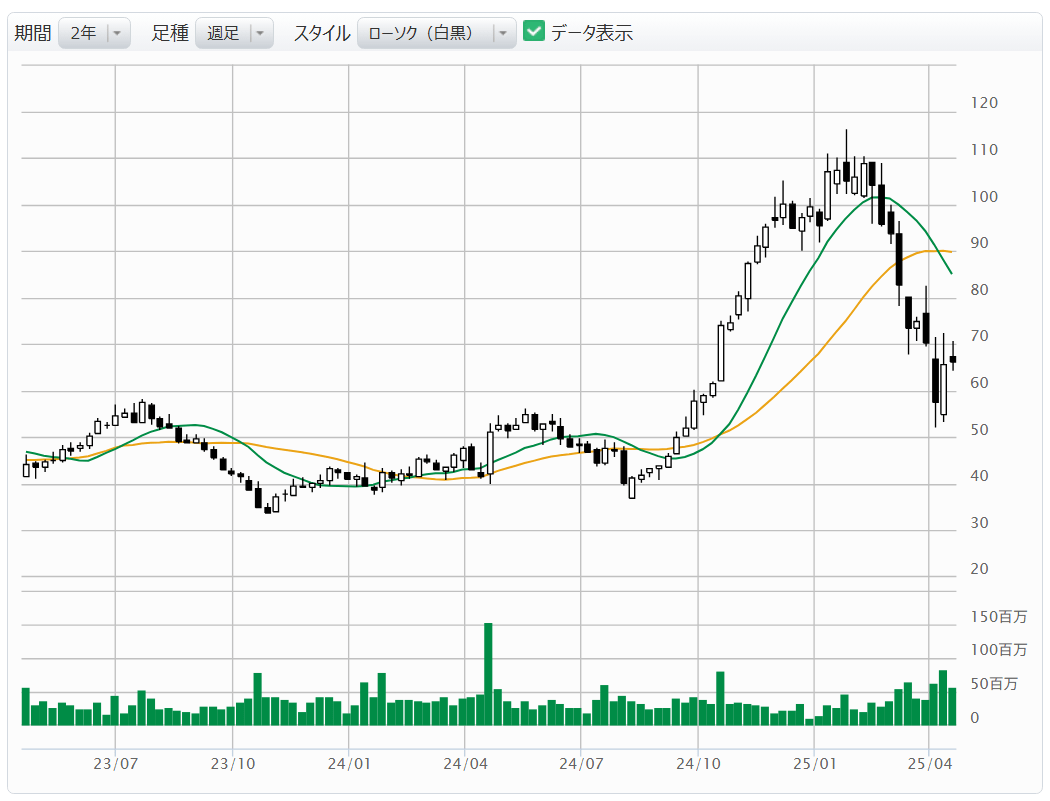

[Figure 2] Johnson & Johnson [JNJ]: Weekly Chart (Moving Average Lines Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of April 18, 2025)

Source: Monex Securities website (as of April 18, 2025)

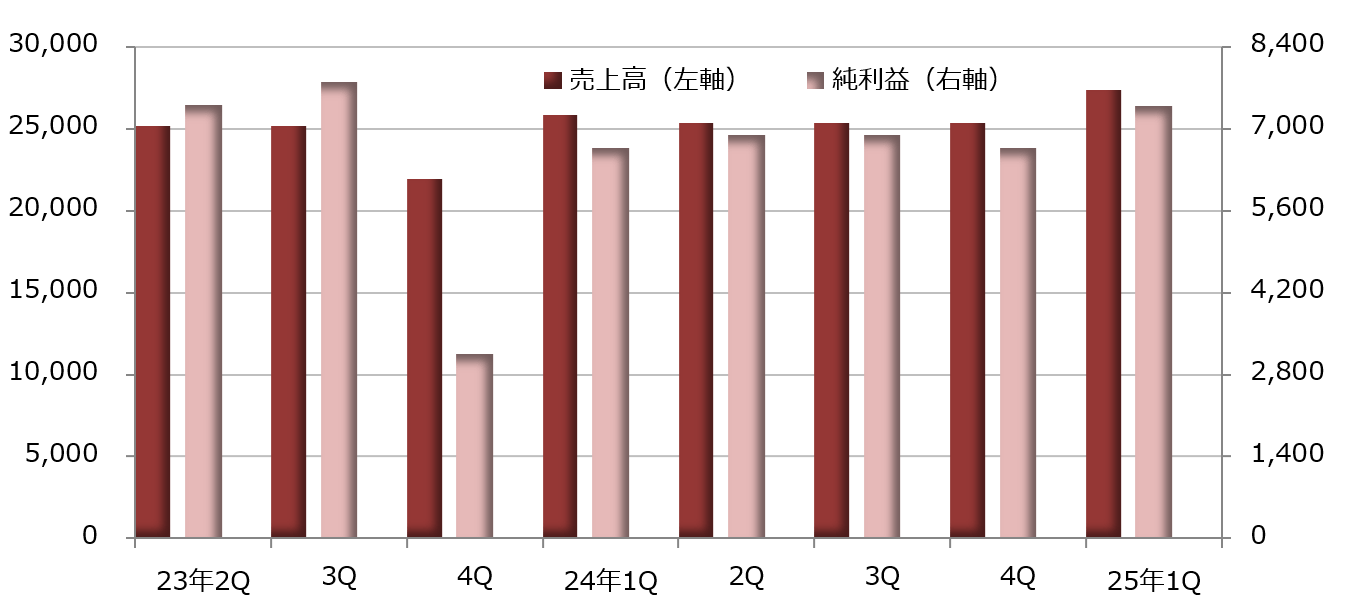

Bank of America [BAC] performs well in the market sector amid stock market volatility

Bank of America [BAC] announced that its financial results for the first quarter of 2025 showed a net operating revenue of $27.366 billion, an increase of 6.6% compared to the same period last year, and a net profit of $7.396 billion, an increase of 10.8%. The EPS (earnings per share) was $0.90, exceeding the market estimate of $0.82 compiled by LSEG by 9.9%.

one of the six major banks in the United States

The company is positioned as one of the six largest banks in the United States. Although the six major banks each have their own characteristics, they can broadly be divided into commercial banks and investment banks.

For example, Morgan Stanley [MS] is a typical investment bank where the proportion of net interest income to net operating revenue for the fiscal year ending December 2024 is only 13.9%. In contrast, Citigroup [C] has this proportion reaching 66.7%, which could be considered more like a commercial bank.

Bank of America has a ratio of 55.0%, which positions it between Wells Fargo [WFC] at 57.9% and JPMorgan Chase [JPM] at 52.1%. Bank of America acquired Merrill Lynch, which was one of the three major investment banks at the time of the Lehman Shock in 2008, thereby strengthening its investment banking division.

The Global Markets Division is performing well.

In the performance for the first quarter of 2025, net interest income increased by 2.9% to $14.443 billion, and non-interest income grew by 9.6% to $12.923 billion, showing steady growth.

By business segment, the Global Markets division performed well, with net operating revenue increasing by 11.9% to $6.584 billion and net profit increasing by 13.1% to $1.949 billion, resulting in more than a 10% increase in both revenue and profit. Following President Trump’s inauguration, it seems that trading opportunities have increased amid the volatility of the stock market. Trading revenue from equities rose by 16.7% to $2.182 billion, while fixed income, currencies, and commodities (FICC) increased by 4.7% to $3.463 billion.

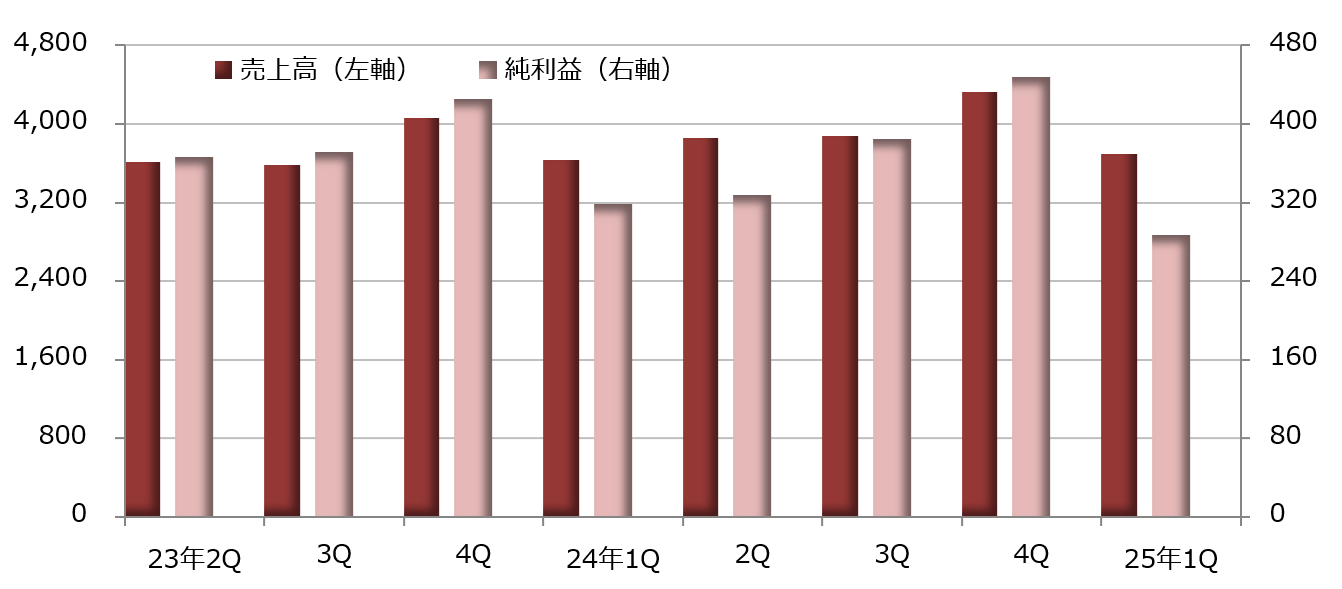

[Figure 3] Bank of America [BAC]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is in December.

Source: Created by DZH Financial Research from LSEG

*The end of the term is in December.

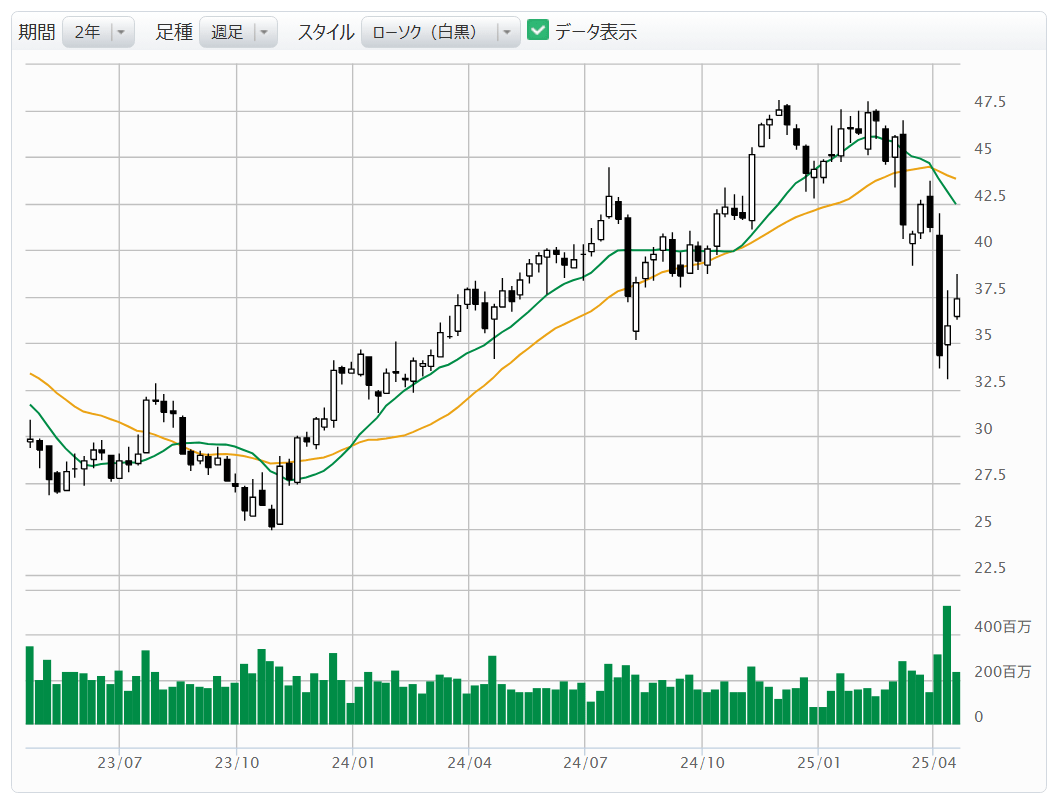

[Chart 4] Bank of America [BAC]: Weekly Chart (Moving Averages Green: 13 weeks, Orange: 26 weeks) Source: Monex Securities website (as of April 18, 2025)

Source: Monex Securities website (as of April 18, 2025)

BlackRock Funding [BLK], adjusted net income increased by 20%

The earnings report for the first quarter of 2025 released by the world’s largest asset management company, BlackRock [BLK], showed an operating revenue of $5.276 billion, an increase of 11.6% compared to the same period last year, and a net profit of $1.51 billion, a decrease of 4.0%. The adjusted EPS (earnings per share) was $11.30, exceeding the market forecast of $10.14 compiled by LSEG by 11.4%.

Investment advisory and management fee revenue increased by 17.0% to $4.244 billion, and operating revenue grew steadily; however, increases in personnel costs, operating expenses, general administrative expenses, and depreciation expenses pressured profits. On the other hand, the non-GAAP (Generally Accepted Accounting Principles in the U.S.) adjusted operating income, after accounting for special factors like depreciation of intangible assets, rose by 14.5% to $2.032 billion, and adjusted net income also grew by 20.2% to $2.032 billion, showing robust performance.

As of the end of March 2025, the total amount of managed assets was $11.5839 trillion, an increase of 10.6% compared to the same period last year. The breakdown shows that exchange-traded funds (ETFs) developed under the “iShares” brand have steadily expanded, increasing by 1.7% to $4.3028 trillion.

The proportion of bond investments in asset management is increasing.

The assets under management of individual investors have increased slightly by 0.8% to $1.0229 trillion. In response to the caution of investors following the emergence of the Trump administration and the volatility of stock prices, equities have decreased slightly, while bond investments have expanded.

Institutional investors composed of pension funds, foundations, public institutions, and financial institutions have seen a slight decrease in the proportion of equities in their asset management, while the proportion of bond investments has increased. The total managed assets decreased by 1.1% to $5.3277 trillion, with active management increasing by 0.9% to $2.1552 trillion and index management decreasing by 2.4% to $3.1725 trillion.

Larry Fink, Chairman and CEO, commented in the earnings announcement that “the connection with customers has never been stronger.” He pointed out that the autonomous growth of fee income, excluding the effects of acquisitions, reached 6%, the highest since 2021.

[Figure 5] BlackRock [BLK]: Performance Trends (Unit: Millions of Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is December.

Source: Created by DZH Financial Research from LSEG

*The end of the term is December.

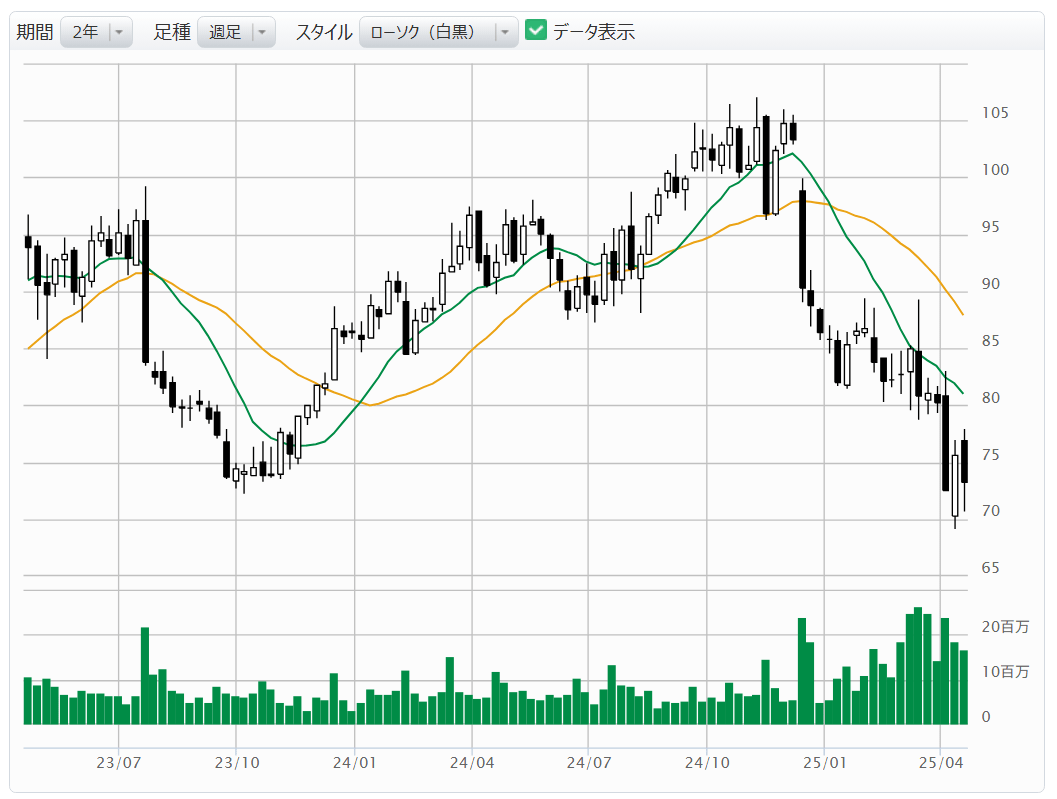

[Chart 6] BlackRock [BLK]: Weekly Chart (Moving Averages Green: 13 Weeks, Orange: 26 Weeks) ! Source: Monex Securities website (as of April 18, 2025)

Omnicom Group [OMC] reports a solid organic revenue growth rate of 3.4%.

The financial results for the first quarter of 2025 announced by Omnicom Group [OMC], which is engaged in advertising and marketing, showed a revenue of $3.69 billion, a 1.6% increase compared to the same period last year, and a net profit of $288 million, a decrease of 9.7%. The adjusted EPS (earnings per share) was $1.70, exceeding the market forecast of $1.62 compiled by LSEG by 5.0%.

Sales growth, excluding the effects of acquisitions, is robust at a self-sustaining growth rate of 3.4%. The self-sustaining growth rate in the large-scale Media & Advertising division reached 7.2%, serving as a driving force. The Precision Marketing division saw a 5.8% increase, which was positive, while the Public Relations division experienced a 4.5% decline, and the Health Care division faced a 3.2% decrease, resulting in negative growth.

Omnicom Group’s focus on organic growth rates in its earnings report is believed to be due to the impending large-scale mergers and acquisitions (M&A). The company reached an agreement to acquire major advertising firm Interpublic Group (IPG) in December 2024.

If this M&A is realized, one of the world’s largest advertising companies will be born. In its financial statements, Omnicom Group maintains its previous view that the M&A will be completed in the second half of 2025.

[Figure 7] Omnicom Group [OMC]: Performance Trends (Unit: Million Dollars) Source: Prepared by DZH Financial Research from LSEG

*The end of the term is in December.

Source: Prepared by DZH Financial Research from LSEG

*The end of the term is in December.

[Figure 8] Omnicom Group [OMC]: Weekly Chart (Moving Average Lines Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of April 18, 2025)

Source: Monex Securities website (as of April 18, 2025)

United Airlines Holdings [UAL] keeps full-year EPS forecast unchanged

United Airlines Holdings [UAL] announced that its net income for the first quarter of 2025 was $387 million, turning from a net loss of $124 million in the same period last year to a profit. Revenue increased by 5.4% year-on-year to $13.213 billion. The adjusted EPS (earnings per share) was $0.91, exceeding the market expectation of $0.76 compiled by LSEG by 20.2%.

International flights are performing well, with RASM (Revenue per Available Seat Mile) on the Atlantic routes increasing by 4.7% and RASM on the Pacific routes increasing by 8.5%, both showing growth. As travel demand recovers, the effect of a 4.9% increase in transportation capacity is becoming apparent.

In the guidance during the earnings announcement, the adjusted EPS for the full year ending December 2025 was projected to be between $11.50 and $13.50, maintaining the forecast announced in January of this year. However, a new forecast scenario for a recession has been added, projecting the EPS to be between $7.00 and $9.00. Additionally, the adjusted EPS for the period from April to June 2025 is expected to be between $3.25 and $4.25.

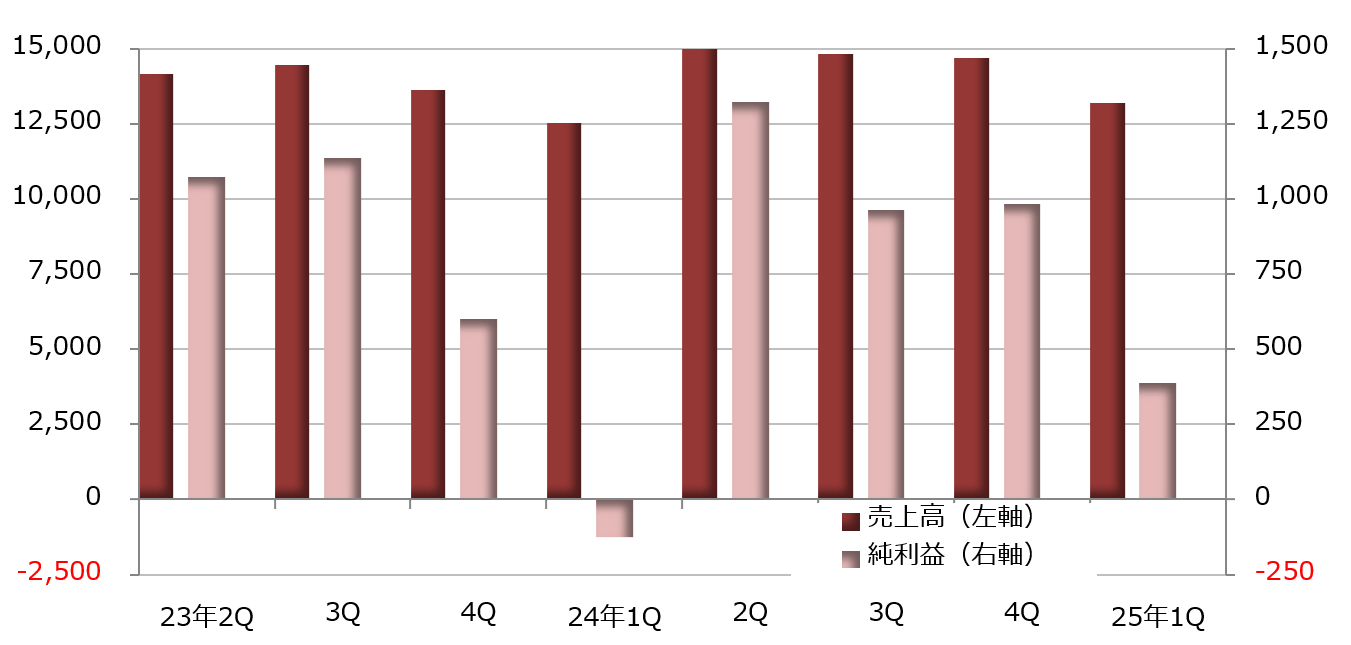

[Chart 9] United Airlines Holdings [UAL]: Performance Trends (Unit: Million Dollars) Source: Created by DZH Financial Research from LSEG

*The end of the term is in December.

Source: Created by DZH Financial Research from LSEG

*The end of the term is in December.

[Figure 10] United Airlines Holdings [UAL]: Weekly Chart (Moving Average Line Green: 13 Weeks, Orange: 26 Weeks) Source: Monex Securities website (as of April 18, 2025)

Source: Monex Securities website (as of April 18, 2025)