ZEC Market Trend Analysis: Why Are Privacy Coins Surging Again?

Recent ZEC Price Performance

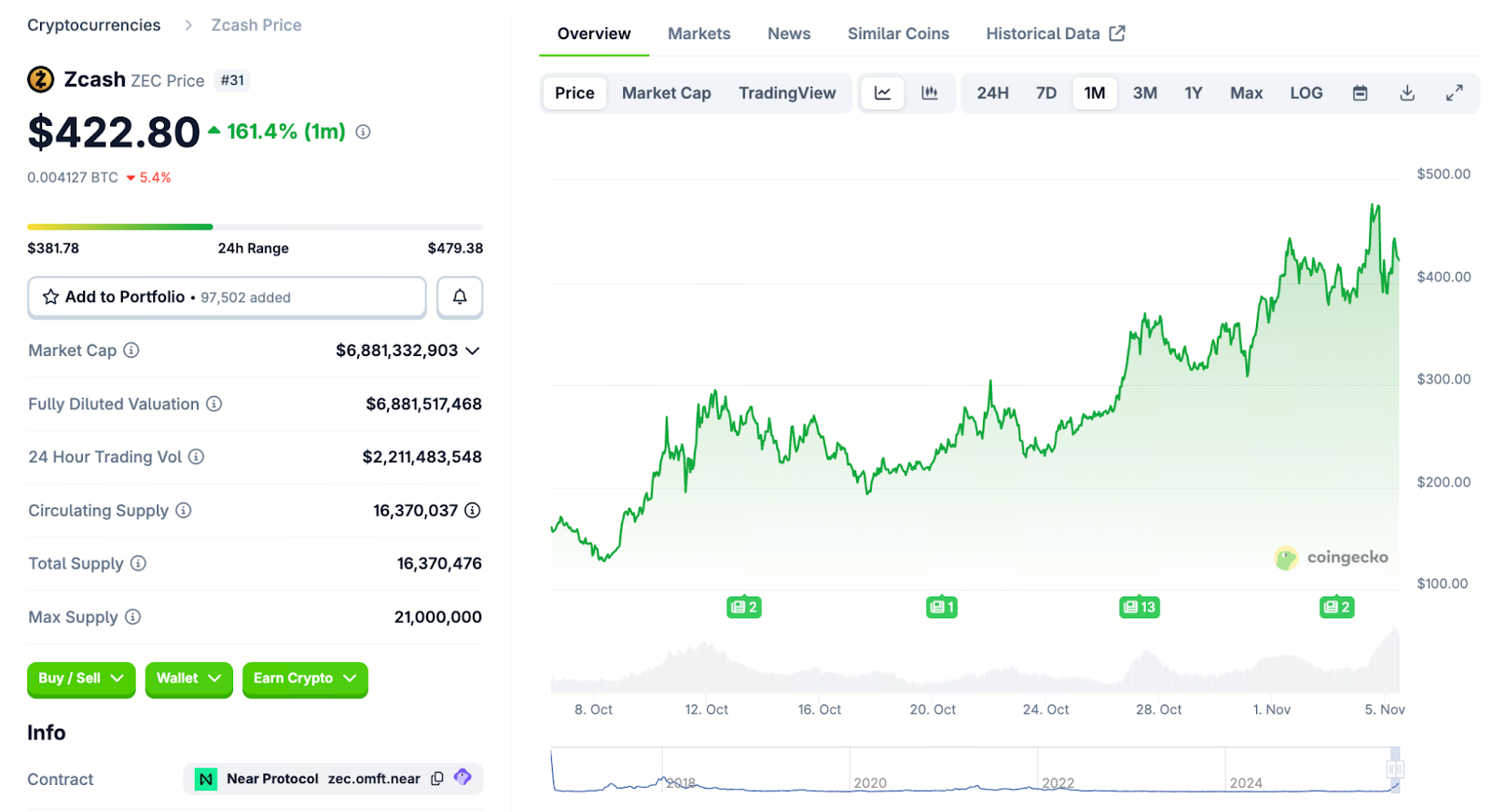

Source: https://www.coingecko.com/en/coins/zcash

ZEC has seen a substantial price rally recently. At the time of writing, its price is around $420. According to reports, ZEC’s price has soared more than 1000% over the past three months—a remarkable surge. Not only has it broken through the $400 threshold, but several leading analysis firms are projecting even higher price targets.

This surge stands out in the broader cryptocurrency market, where most altcoins have not shown similarly robust momentum. ZEC’s recent performance has clearly captured the attention of the market.

Key Drivers: Privacy Reassessment and On-Chain Activity

What’s driving ZEC’s impressive rally? The main factors include:

- Renewed Emphasis on Privacy Coins: As a leading privacy-focused cryptocurrency, ZEC’s “selective transaction shielding” model is being revalued by the market amid the growing focus on balancing privacy with regulatory compliance.

- Boost in On-Chain Activity: Reports indicate ZEC’s network hashrate reached a record high, with mining and transaction volumes climbing sharply. This indicates a strengthening core network rather than mere price speculation.

- Technical Breakout Momentum: BeInCrypto analysts highlight that since mid-October, ZEC has completed a flag breakout pattern, fueling market bets on a next target of $594 or higher.

The combination of these three factors has propelled ZEC from a period of relative stagnation back into the investment spotlight.

Key Technical Support and Resistance Levels

For newcomers, recognizing critical support and resistance levels is essential to assess whether a trend may continue or reverse:

- If ZEC holds above roughly $438, the current flag breakout pattern suggests a continued push toward $594, or even $847.

- If ZEC falls below the key support at around $342, it could trigger a new round of pullbacks or bearish pressure.

- Meanwhile, on-chain futures open interest and RSI metrics show that while the rally is strong, long positions are crowded, increasing the risk of profit-taking.

We recommend that new investors closely watch these key technical levels.

Risk Considerations for New Investors

Despite ZEC’s powerful momentum, new investors should be mindful of the following risks when trading or monitoring the market:

- High Exposure Risk: Rapid gains often involve leveraged contracts and concentrated capital. As a result, any shift in sentiment or loss of positive catalysts could lead to sharp corrections.

- Potential for Pullback: Although technicals are favorable, RSI divergence suggests that upward momentum could stall.

- Market Sentiment Volatility: Privacy coins are gaining attention; however, changes in policy, regulation, or on-chain technology could disrupt market expectations.

- Avoid Chasing Highs: New investors should refrain from going all-in at market peaks, set stop-losses and define clear investment objectives and time horizons.

Conclusion

In summary, ZEC’s recent market action has been remarkable, with significant price breakouts, heightened on-chain activity, and a renewed assessment of privacy coin value. For newcomers, it serves as a valuable case study in observing cryptocurrency markets. However, investors should not ignore the risks that accompany rapid rallies. Beginners should observe or start with small positions, use support and resistance analysis, practice sound risk management and stop-loss strategies, and approach the market rationally.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution

Understand Baby doge coin in one article