XRP Price Prediction: Rebound from $2.7 Support Targets $3.6 Resistance

Preface

Recently, Ripple extended its collaboration with Singapore payment firm Thunes—building on their partnership since 2020—to further scale its global payments network. This initiative aims to integrate blockchain technology with existing payment infrastructures, boosting efficiency in cross-border transactions across more than 90 markets, with a focus on emerging economies and underbanked regions.

Expanding Cross-Border Payment Impact

Thunes operates an “intelligent superhighway” for payments, connecting banks, digital wallets, and card issuers. By partnering with Ripple, businesses will be able to manage liquidity more efficiently and speed up settlements. This is especially important for regions with limited access to traditional banking, where cross-border remittances are still hindered by high costs and fragmentation.

The core of this collaboration is the integration of Ripple’s blockchain platform with Thunes’ SmartX Treasury system, which manages liquidity flows within the network and supports payments in local currencies. This is ideal for markets dominated by mobile wallets. Platforms like M-Pesa, GCash, and WeChat Pay remain vital gateways to financial services.

Additionally, Ripple maintains a strong focus on compliance and transparency, enhancing market trust through on-chain proof-of-reserves reports and independent audits. Thunes operates a global network spanning over 130 countries, supporting more than 80 currencies, 3 billion mobile wallets, and 4 billion bank accounts. This enables real-time cross-border payments.

This partnership not only lowers costs for businesses transferring funds but also accelerates transaction speeds and broadens access to cross-border financial services for consumers, particularly in regions underserved by traditional banks.

XRP Technical Analysis and Price Outlook

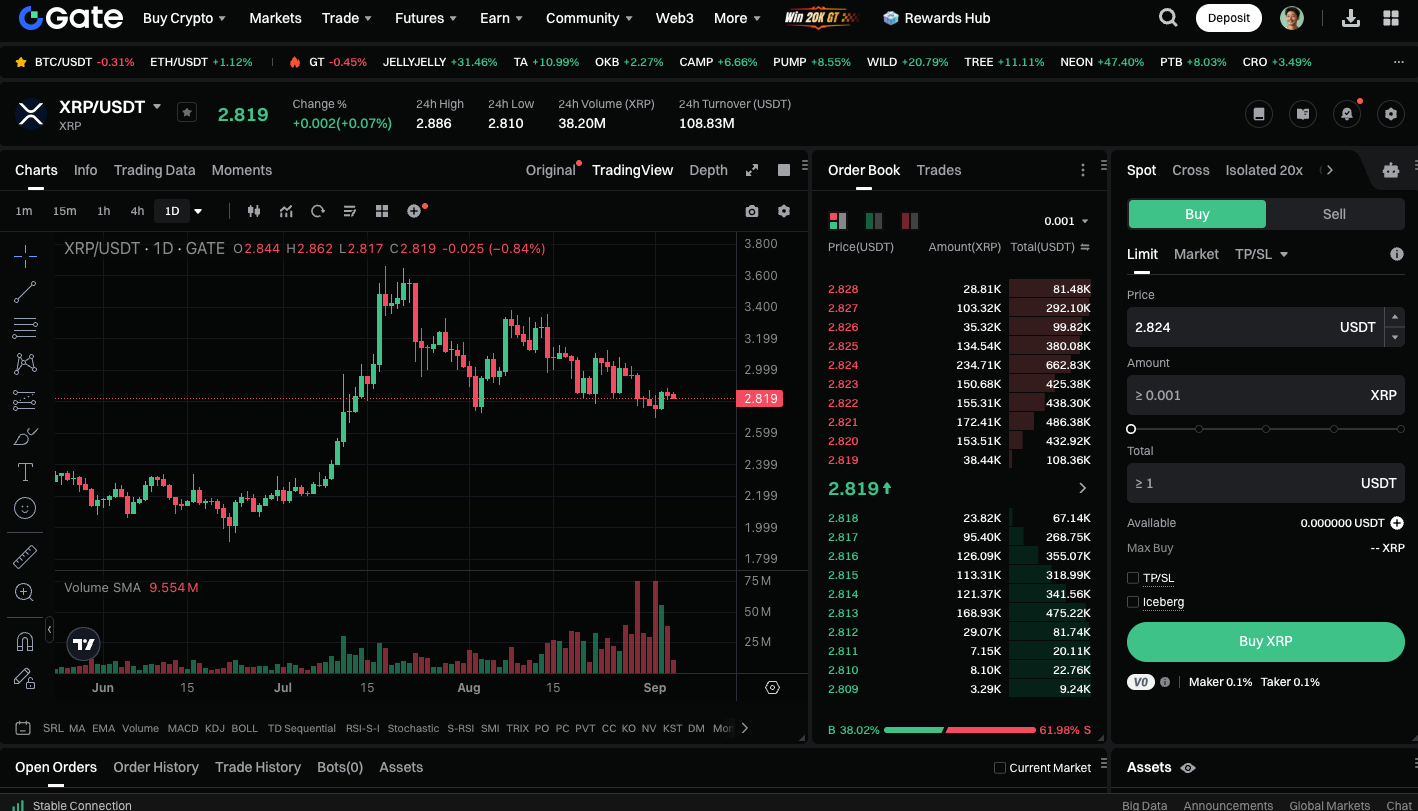

From a technical perspective, XRP recently bounced sharply after testing support at $2.7, establishing this level as a multi-week low. If buyers continue stepping in, XRP may target short-term resistance at $3 to $3.6.

- Key support levels: $2.7, $2.5

- Key resistance levels: $3, $3.6, $4

Lately, XRP has been on a downward trend, forming a descending triangle pattern with $2.7 as the base. Trading volume has decreased, signaling continued dominance by bears, and the near-term direction is likely to become clearer by mid-September. If $2.7 support breaks, the next level to watch is $2.5.

Start trading XRP spot now: https://www.gate.com/trade/XRP_USDT

Conclusion

The partnership between Ripple and Thunes highlights the potential for synergy between blockchain and traditional payment networks. In the short term, XRP may remain range-bound between $2.7 and $3.6; a breakout above resistance would pave the way for further upside. To better anticipate the next move, investors should closely track the $2.7 support and $3.6 resistance levels.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution