Why Bitcoin May Never Fall Below $100,000: Unveiling the Core Support Logic

The Psychological Impact of Bitcoin at “$100,000”

In the crypto market, $100,000 has become a symbolic price level drawing significant investor attention. If Bitcoin remains above this threshold, it may shift from a resistance level to a new long-term support. Historically, Bitcoin has shown similar behavior at several key round numbers—$10, $1,000, and $10,000 each transitioned from resistance points to support. Market psychology often turns these figures into key dividing lines for price movement. Today, many analysts believe $100,000 will follow the same path.

Latest Market News and Price Updates

Image: https://www.gate.com/zh/learn/articles/gate-vault-user-guide/12794

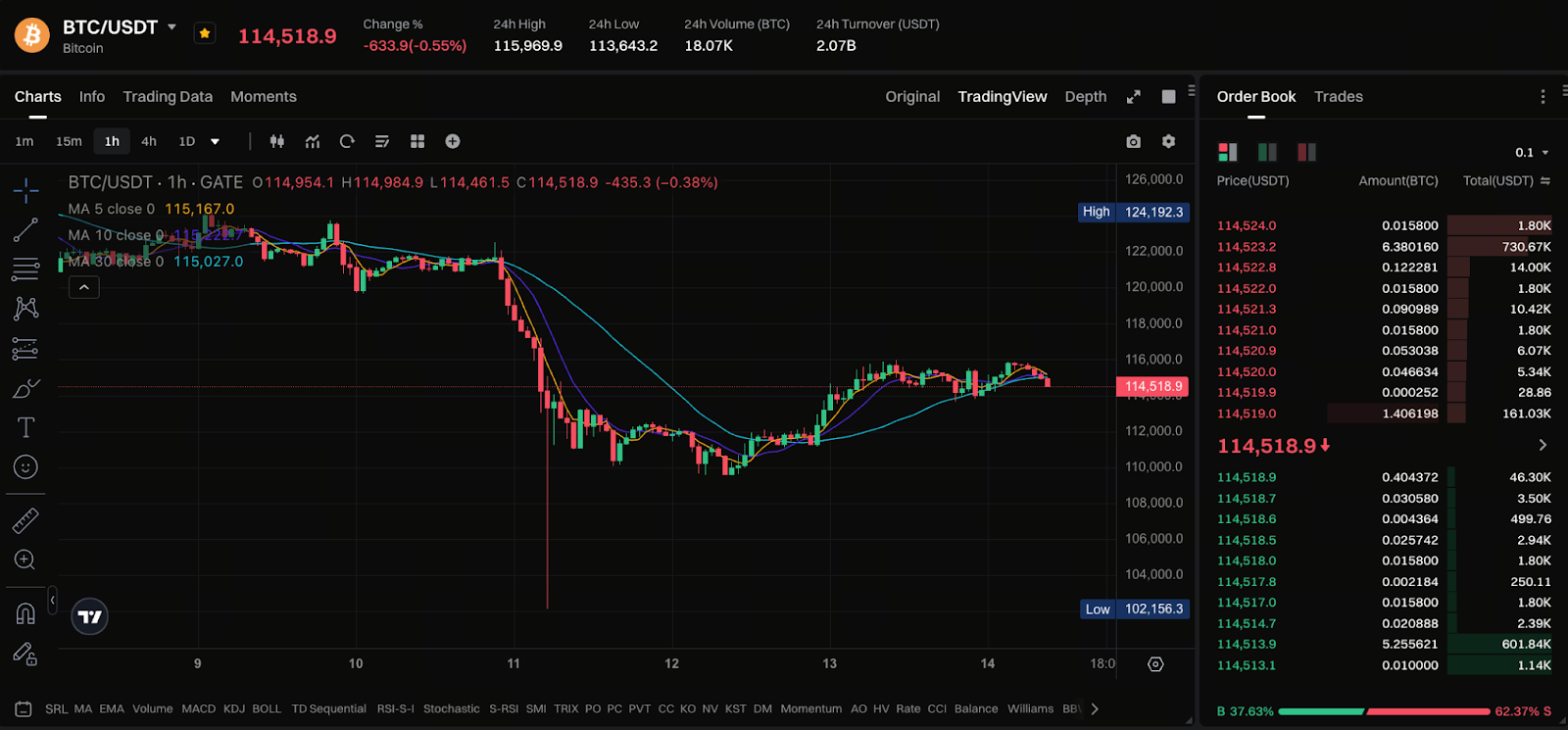

In early October, global markets saw sharp volatility as the U.S. imposed new tariffs and tightened export rules, and investors became more risk-averse. Bitcoin briefly dropped to around $104,700, but quickly rebounded, climbing back to the $114,000 range and showing strong buying support.

Technical analysts note that if daily closes stay above $101,900, it will be hard for prices to fall below $100,000 in the near term. Major financial institutions such as Standard Chartered and Citigroup remain bullish on Bitcoin’s potential to surpass $130,000 this year, boosting market confidence.

Three Core Reasons Bitcoin May Hold Above $100,000

1. Scarcity and Supply Constraints: Bitcoin’s total supply is fixed at 21 million coins. As mining difficulty increases and more holders opt for long-term storage, circulating supply keeps shrinking. Whales and institutional investors favor long-term holding, easing selling pressure and reinforcing price support.

2. Ongoing Institutional and ETF Investment: Since 2024, several countries have approved Bitcoin ETFs, attracting substantial traditional capital. Large funds, insurers, and publicly traded companies are adding Bitcoin to their portfolios. As these long-term investors enter, market volatility decreases. The price floor rises.

3. Technical Structure and Long-Term Trend Support: Technical analysis indicates that when a key price level holds through repeated monthly or quarterly tests, it naturally becomes strong support. The $100,000 zone is now in this phase. Consistent monthly closes above this level will establish it as a long-term price floor, similar to $10,000 previously.

Potential Headwinds and Risk Considerations

Despite sound logic, no price assumption is foolproof. Sharp corrections may occur due to macroeconomic shifts, regulatory tightening, liquidity crunches, or extreme events.

If institutional capital exits or attention shifts to new assets, market sentiment could quickly turn, causing prices to break support. Investors should avoid the assumption that prices “cannot fall below” a given level.

Strategic Approaches Under This Assumption

- Buy gradually: Buy incrementally between $105,000 and $110,000 to avoid overcommitting funds at once.

- Implement stop-losses: Even with confidence in support, allow for risk management.

- Monitor trading volume and capital inflows: Monitor institutional buying and ETF inflows to gauge support strength.

- Maintain long-term discipline: Bitcoin remains highly volatile; patience and consistency are essential.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution