Where is the next battlefield for order book exchanges?

Editor’s Note: Central Limit Order Book Decentralized Exchanges (CLOB DEXs) represent the prevailing architecture behind Perpetual Contract DEXs, capturing more than 92% of market share. This report examines the CLOB DEX ecosystem, dissecting its dominance in derivatives, opportunities for spot market growth, and emerging sector challenges, providing insights into the trajectory of decentralized trading.

Key Points

- Zero-fee competition is squeezing profit margins across the CLOB DEX landscape. Despite stable trading volumes, Hyperliquid’s September revenue decreased 39% to $68.93 million. At the same time, Lighter processes $133 billion in monthly trades and offers zero fees to retail users, adding pressure across the industry.

- New monetization models are emerging beyond standard trading fees. Paradex utilizes Payment for Order Flow (PFOF)—charging market makers 0.5 to 3 basis points (bps)—and user deposit yields for profit. ADEN.io (from Bugscoin) applies an infrastructure revenue-sharing model to generate infrastructure-related fees.

- While appchains are currently leading, high-performance monolithic Layer 1 blockchains are gaining momentum. These chains, with advanced parallelization and efficient virtual machines, could become the next core infrastructure for decentralized trading.

- CLOB spot market penetration is only 12.4%, highlighting immense room for expansion. Recent monthly data shows AMMs reached $212 billion in spot volume, while CLOBs handled just $26.4 billion—a stark contrast that confirms CLOB’s growth potential in spot trading.

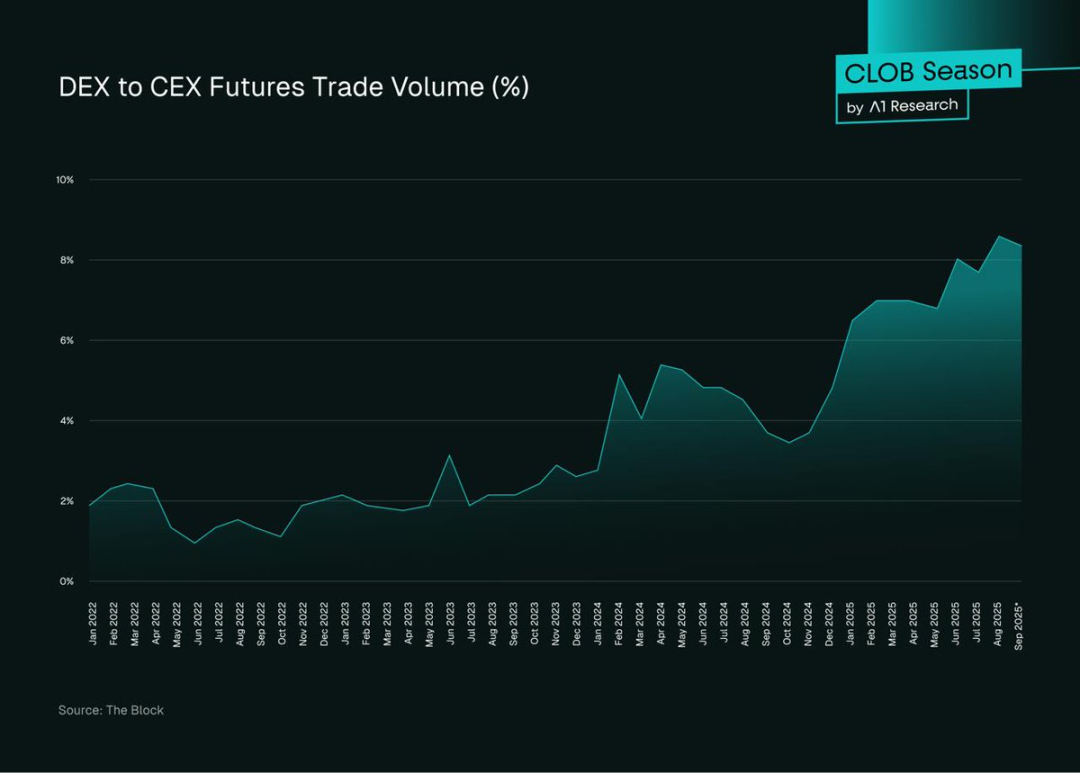

- Between 2022 and 2025, DEX futures volume as a share of CEX futures rose from under 2% to 8%, signaling a clear trend of users favoring DEXs—especially those built on the CLOB model.

This analysis leverages data-driven methodologies, focusing exclusively on live, mainnet CLOB platforms with observable metrics. Projects in pre-mainnet or testnet phases are excluded from primary comparisons.

Competitive Landscape

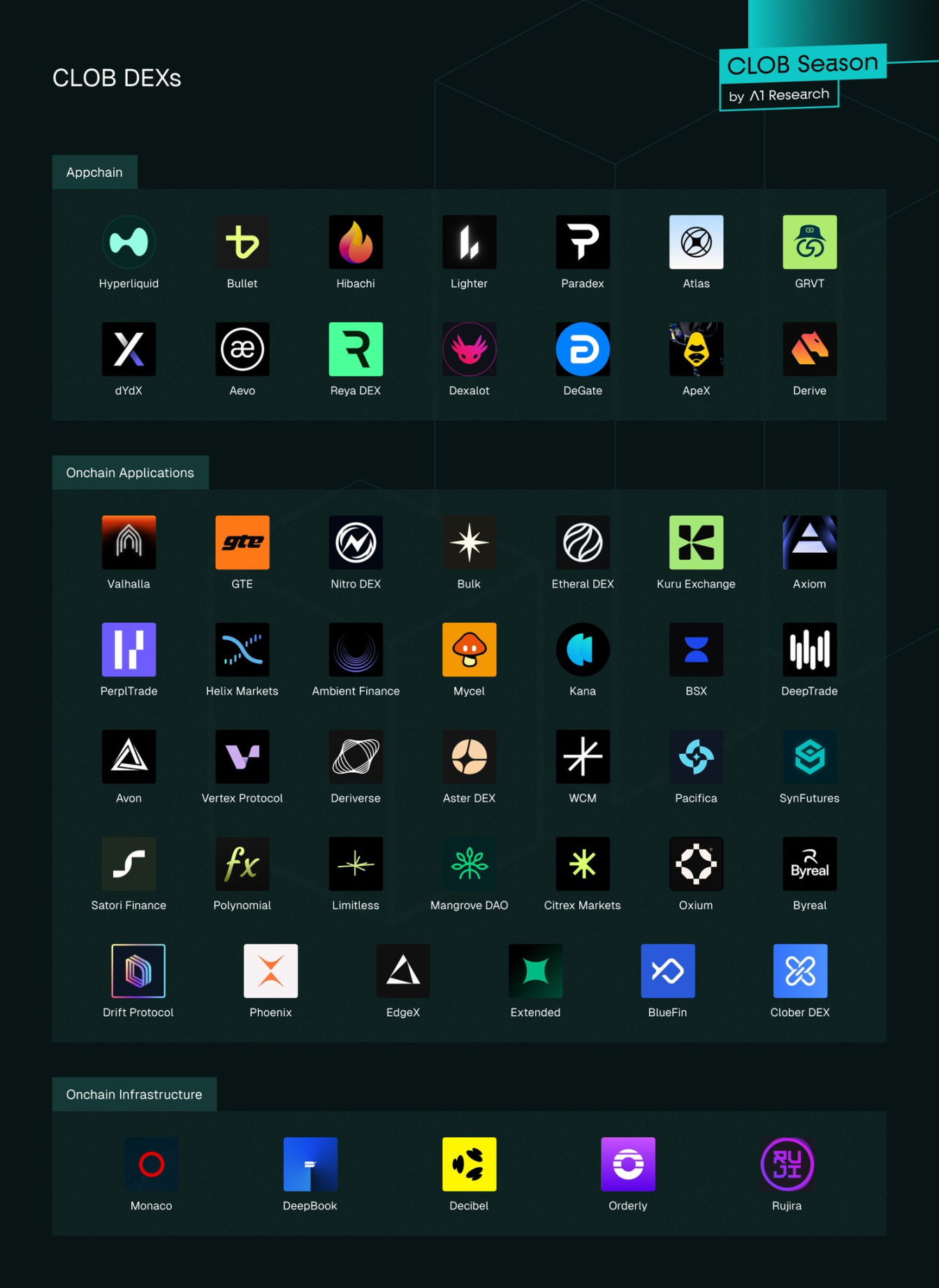

In just two months, a single DEX broke monthly trading records twice: July 2025 saw it surpass $319 billion in Perp volume, with August climbing to nearly $398 billion—setting an all-time high for on-chain platforms. That exchange is Hyperliquid, a fully on-chain CLOB built atop a proprietary Layer 1, engineered for low-latency matching and CEX-grade throughput.

Despite these milestones, industry competition is intensifying. Data from September reveals that emerging CLOB DEXs are ramping up pressure, offering similar latency, lower fees, and robust incentives. The rise of CLOB DEXs rests on their deep liquidity and transparent, efficient price discovery—qualities that now pose a real challenge to centralized exchanges.

In 2025, infrastructure advancements—faster Layer 1s, improved Rollup SDKs, zero-knowledge technology, and high-throughput data availability—plus rising institutional demand for self-custodied derivatives, have transformed CLOB from a promising DeFi experiment into core trading infrastructure. Yet, early leaders like dYdX v4 and Dexalot have ceded their top spots, raising the question: what truly determines market leadership in this fast-evolving sector?

This report analyzes the competitive dynamics of CLOB platforms across five dimensions: trading volume, open interest, user growth, fee economics, and infrastructure selection, with comprehensive insights on the top 10 protocols using September 2025 data from DeFiLlama, Token Terminal, Artemis, and Flipside Crypto.

Deep Dive: Market Metrics

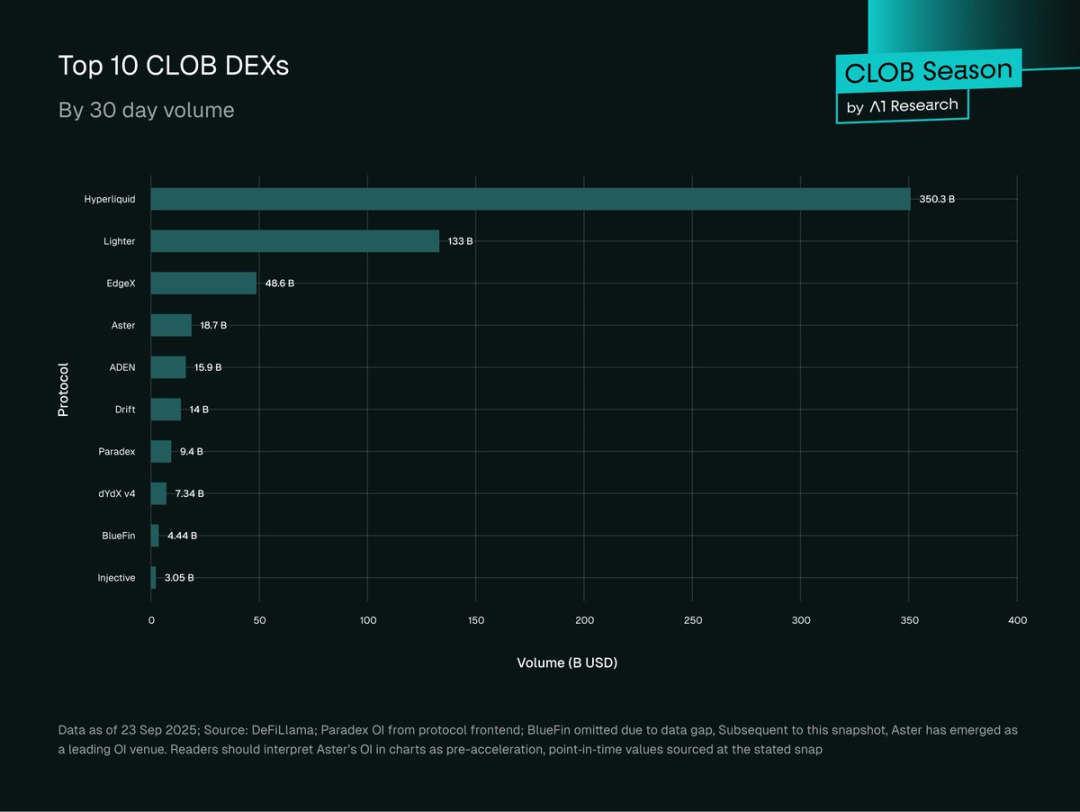

The core analysis targets the 10 largest on-chain CLOB platforms with 30-day data up to extraction. These protocols stand out for their significant market share and open interest.

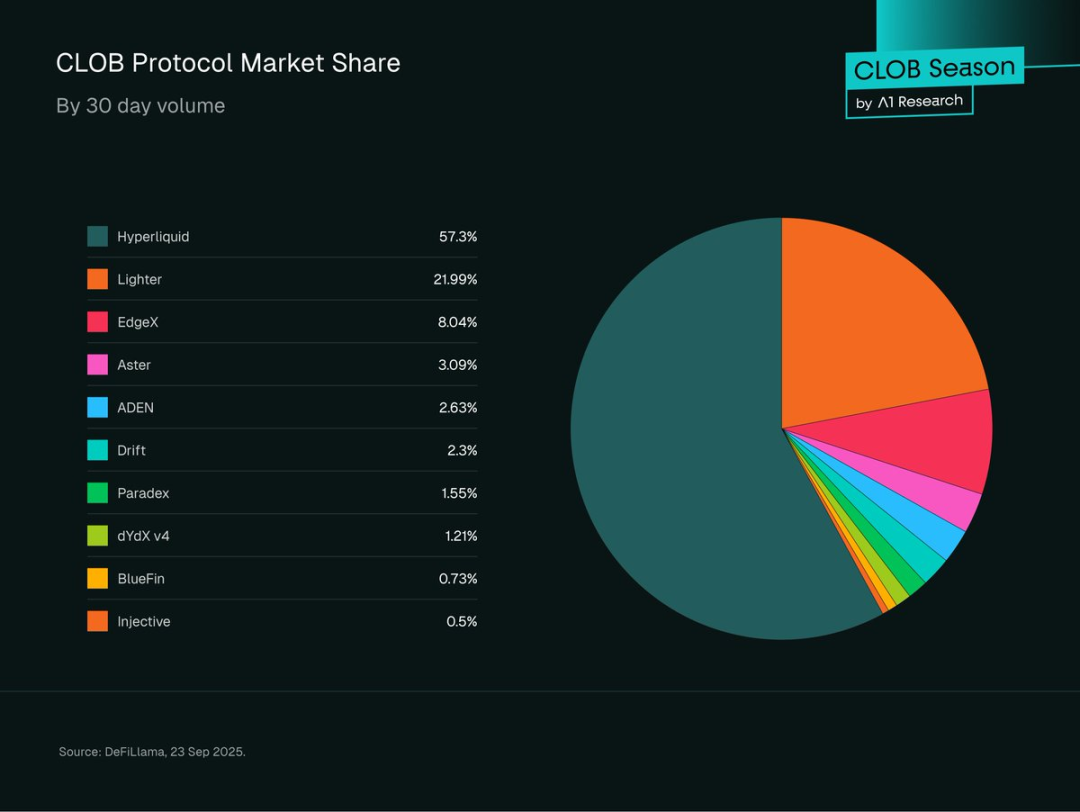

Figure 1: Pie chart of market share by 30-day volume (Hyperliquid, Lighter, EdgeX, Aster, ADEN, Drift, Paradex, dYdX v4, BlueFin, Injective). Source: DeFiLlama, September 23, 2025 (UTC).

Market Overview

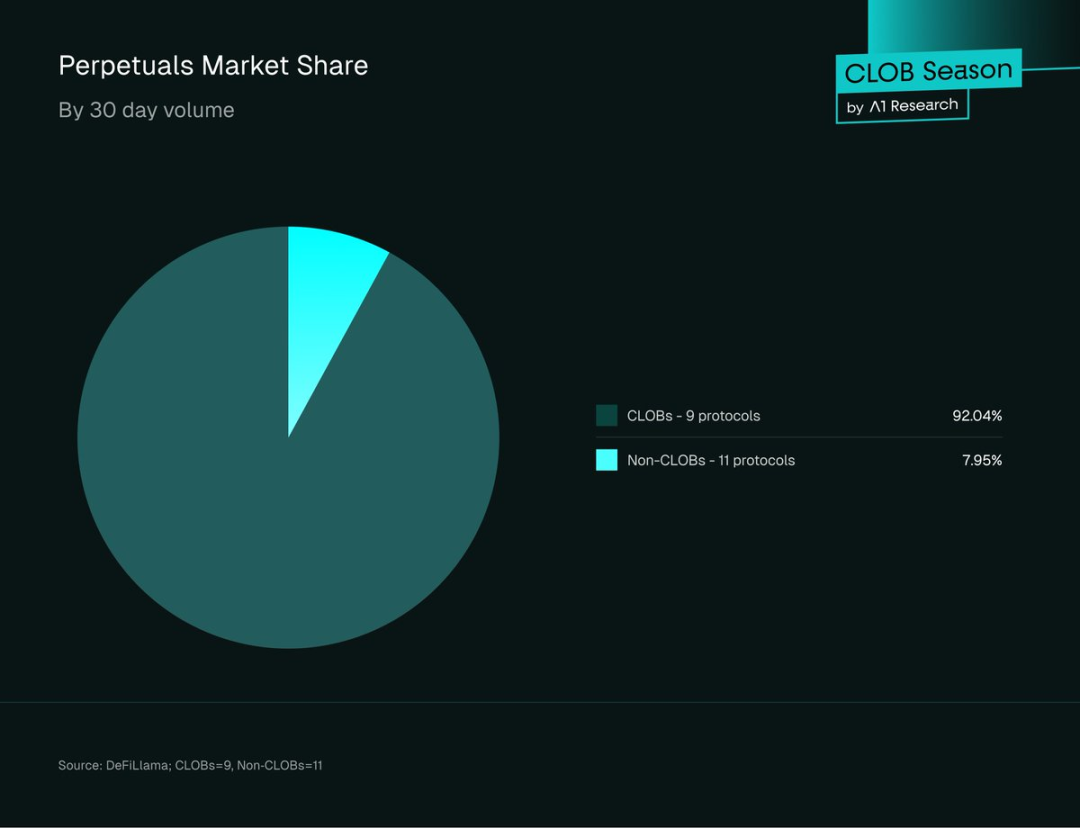

On-chain derivatives trading saw dramatic transformation in 2025: CLOB DEXs now own the perpetual futures market and have carved out key spot market segments.

Across the top 20 decentralized perpetual protocols, CLOB DEXs have a 92.04% market share and $607 billion in 30-day volume; non-CLOB protocols account for only $48.37 billion.

Figure 2: 30-day volume share among top 20 Perp DEXs (data as of September 23, 2025 UTC; Source: DeFiLlama; 11 CLOB and 9 non-CLOB protocols).

This is a marked contrast to early DeFi, when AMMs dominated all trading.

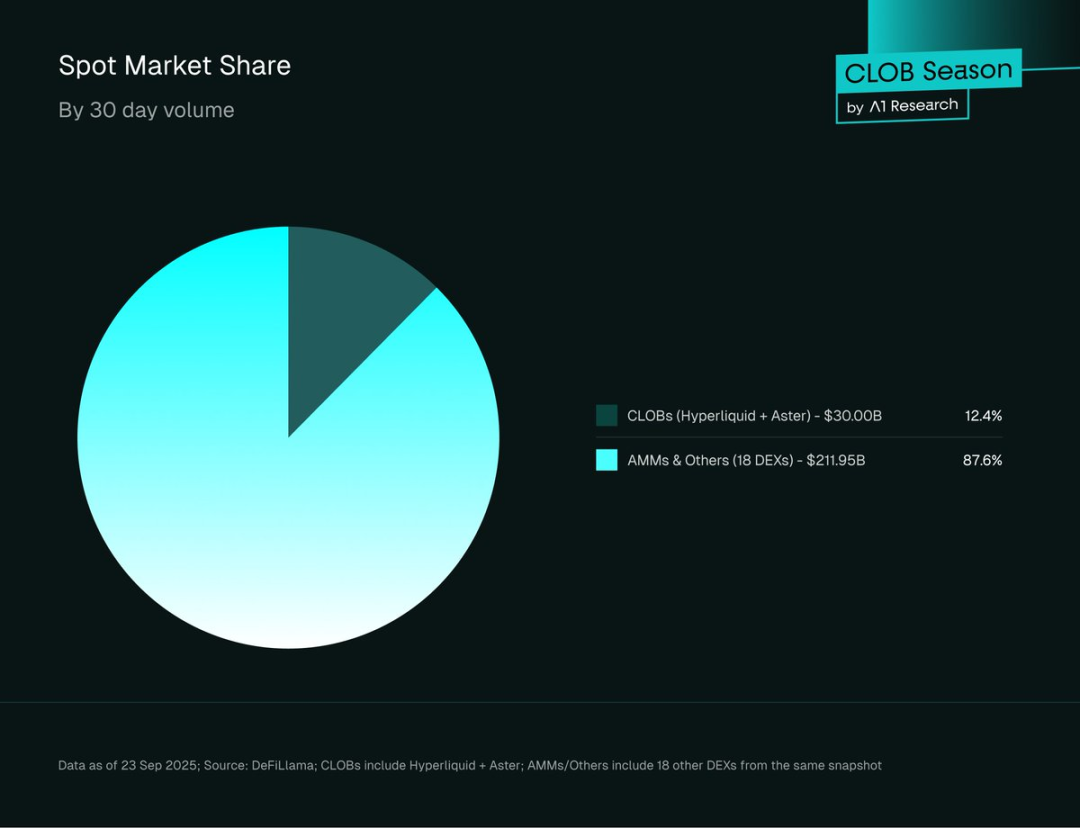

In spot trading, however, AMMs still reign: CLOB protocols account for just 12.4% ($26.4 billion) of spot volume, while AMMs and others reach 87.6% ($212 billion).

Figure 3: Market share for spot volume (CLOB vs. AMM), as of September 23, 2025 UTC. Source: DeFiLlama; CLOB includes Hyperliquid and Aster; AMM/Other covers 18 DEXs.

The divergence highlights CLOB’s specialization: it excels in derivatives but faces structural hurdles in spot liquidity competition with AMMs. This gap signals major untapped potential—should CLOB platforms gain ground in spot, the market and revenue opportunity would surge.

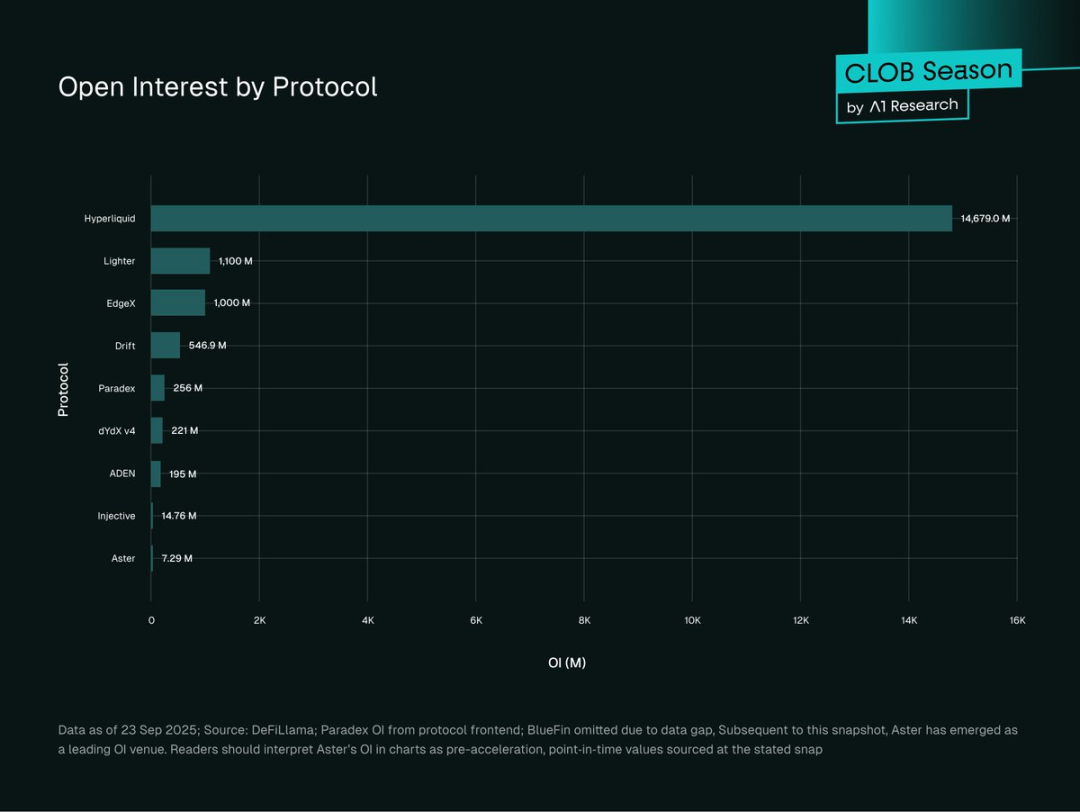

Open Interest Trends

Figure 4: Open interest by CLOB DEX (USD millions), data as of September 23, 2025 UTC. Source: DeFiLlama; Paradex data from frontend; BlueFin not included. Note: Aster’s open interest has accelerated since, so the chart reflects pre-acceleration values.

Hyperliquid leads in CLOB open interest at $14.77 billion (81.56%), followed by Lighter ($1.1 billion, 6.07%), EdgeX ($1 billion, 5.52%), and Drift ($546.9 million, 3.02%). Paradex ($255 million, 1.41%), dYdX v4 ($221 million, 1.22%), and ADEN ($195 million, 1.08%) follow. Injective ($15 million, 0.08%) and Aster ($7 million, 0.04%) are smallest.

Open Interest (OI) gauges not just volume but also capital deployed and risk exposure. High OI plus high volume signals deep liquidity and institutional participation; low OI and volume often indicate retail-driven short-term activity or new protocols building liquidity.

Hyperliquid controls 77% of open interest (context: 81.56% share among analyzed CLOBs; 77% overall), reflecting its strong liquidity moat and network effects—liquidity attracts more liquidity; large traders favor tight spreads and low slippage.

This concentration poses systemic risk: should Hyperliquid experience issues, the entire on-chain derivatives market could be affected.

A more balanced open interest distribution would boost systemic resilience. Crypto history (FTX, Mt. Gox, Terra) shows that excessive concentration amplifies systemic risk and can trigger market-wide crises.

User Growth Metrics

- Hyperliquid: 361,300 monthly active users (Token Terminal, September 2025); H1 2025 users up 78%, wallets from 291,000 to 518,000.

- Lighter: 171,000+ deposit users by 2025; daily wallet registrations surged, peaking at 6,000 in September (Dune Analytics).

- Aster: 330,000 wallets created within 24 hours of token launch; 2+ million claims (likely inflated by airdrops and support from Binance’s CZ); 545,529 weekly trades; daily volume peak $3.67 billion (Dune Analytics).

- dYdX v4: 19,900 stable monthly active users; weekly traders above 15,000 for over two years (Token Terminal).

- Drift: 18,600 monthly active users, growth tied to Solana cross-margin perps and DeFi integration (Token Terminal).

- Paradex: Steadily rising deposit users, accelerated growth since mid-2025, backed by Paradigm (Dune Analytics).

Hyperliquid demonstrates sustained, institutional-recognized growth. Aster’s spike likely owes to support from Binance’s CZ and aggressive incentives, though long-term engagement remains uncertain.

dYdX v4 and Drift, early entrants, have smaller but stable bases with high retention—likely benefits of early market positioning.

Fee Revenue Analysis

Monthly fee data exposes distinct differences in profitability and positioning across CLOB platforms. Six protocols’ statements show varied trends in revenue and fee capture rates.

September 2025:

- Hyperliquid: $68.93 million (down from $113.73 million in August).

- Aster: $21.28 million (up from $16.57 million).

- Drift: $4.10 million (down from $4.87 million).

- BlueFin: $2.56 million (down from $3.24 million).

- dYdX v4: $940,987 (stable).

- ADEN: $396,919 infrastructure fees (up from $303,556).

Fee capture efficiency (September 2025):

- dYdX v4: 1.28% ($940,000 ÷ $73.4 billion).

- Aster: 1.14% ($21.28 million ÷ $1.87 billion).

- Drift: 0.29% ($4.10 million ÷ $1.4 billion).

- ADEN: 0.25% ($400,000 ÷ $1.59 billion).

- Hyperliquid: 0.20% ($68.93 million ÷ $350.3 billion).

- BlueFin: 0.06% ($2.56 million ÷ $440 million).

Note: ADEN’s fees are infrastructure/developer, not direct trading fees.

Six-month trends:

- Hyperliquid: Revenue dropped sharply, reflecting mounting competitive pressure despite volume leadership.

- dYdX v4: Revenue steady near $1 million, indicating a stable but limited user base.

- Aster: Rapid revenue growth, showing strong market penetration.

- Drift: Slight decline, facing Solana ecosystem competition.

- ADEN: Consistent backend revenue growth, up 30% month-over-month.

- BlueFin: Fluctuating, recently declining, with fee capture challenges in the Sui ecosystem.

Fee Models

High-efficiency fee models:

dYdX v4 and Aster have the highest fee capture rates (1.28% and 1.14%), suggesting either a high-end user focus or less competitive niches. Aster’s rate is likely driven by incentive-driven users; dYdX’s rate reflects loyalty and brand trust.

Scale-driven models:

Hyperliquid’s low fee (0.20%) is offset by massive volume, driving total revenue well above peers.

Infrastructure revenue models:

ADEN profits from backend partnerships rather than consumer trading fees, exemplifying B2B infrastructure monetization.

Competitive Pressure

Fee capture rates are broadly down for mature protocols (notably Hyperliquid’s 39% drop), underscoring pressure from zero-fee rivals like Lighter ($133 billion monthly, retail zero fee). Lighter still charges market makers and HFTs. This trend may shift as fee strategies evolve and cost structures converge.

Protocols without profit data:

- Lighter: No retail trading fee but charges market makers/HFTs—major threat to fee-based DEXs.

- Paradex: PFOF charges (0.5–3 bps) for order flow, enabling zero user fees; also profits from user deposit yields, vault fees, and money market spreads.

- Injective Orderbook: Flexible, community-governed fee structure (negative maker, positive taker), with INJ staking/volume rewards for VIP discounts.

- EdgeX: Maker (0.015%) and taker (0.038%) fees, ambassador program, and rewards via edgeX points for trading and community contributions.

Platform Analysis

Figure 5: Top 10 CLOBs by 30-day Perp volume (Hyperliquid, Lighter, EdgeX, Aster, ADEN, Drift, Paradex, dYdX v4, BlueFin, Injective). Source: DeFiLlama, September 23, 2025 (UTC).

Tier 1: >$100 billion monthly volume

The CLOB ecosystem is highly concentrated, with two leaders capturing nearly 80% of total volume.

Hyperliquid leads with $350.3 billion in volume (57.9% share), 77% open interest ($13 billion). Its custom HyperBFT Layer1 delivers zero gas, sub-1-second finality, and nano-sorting for under-50ms latency with decentralization. This technical edge yields tighter spreads and deeper books, driving a liquidity moat that attracts professional traders.

Lighter ($133 billion, 22% share) trails in open interest versus volume, built on custom low-latency Ethereum Layer2, with ZK circuits for verifiable matching. Zero retail fees and 5ms recursive SNARK latency make it attractive to retail users, with batch ZK settlement and Ethereum security. Sustainability of the zero-fee model for retail remains to be seen.

Tier 2: $15–50 billion monthly volume

EdgeX ($48.6 billion) leads challengers with StarkEX-powered hybrid matching, off-chain Rust engine, 10ms latency, and $52.6 million fees. Aster ($18.7 billion) runs on BNB Chain, offers dark pools, yield collateral, and 1001x leverage, with $39.8 million cumulative fees. ADEN ($15.9 billion) uses Orderly Layer2 and shared CLOB, earning from ecosystem revenue sharing. Drift ($14 billion) on Solana features triple liquidity (CLOB, AMM, JIT auction), GPU keepers, and multi-asset cross-margin.

Tier 3: $3–15 billion monthly volume

Paradex ($9.4 billion) is retail-friendly, with Layer2 CairoVM, zero retail fees, zero-knowledge privacy and verifiability, and dual-market structure. dYdX v4 ($7.34 billion) is a Cosmos SDK appchain with decentralized books but lags in speed. BlueFin ($4.4 billion) leverages Sui’s gas-free, parallel execution. Injective ($3.05 billion) is Cosmos SDK-based, with batch auction MEV protection and cross-chain IBC.

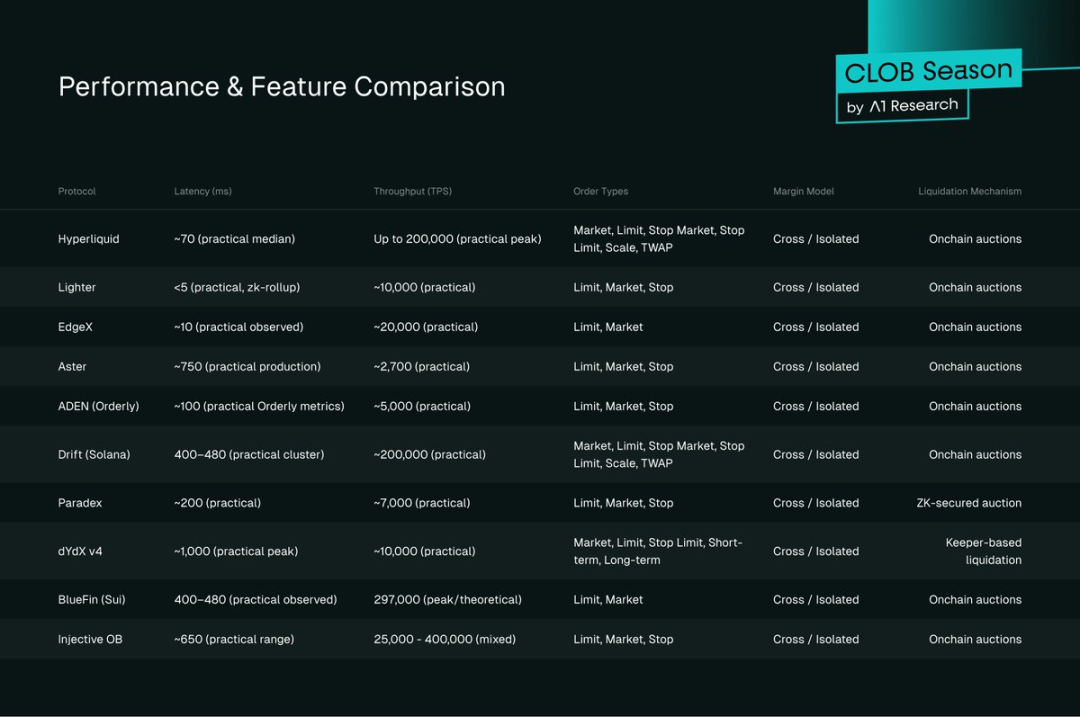

Performance & Features

Figure 6: Performance and feature comparison

Latency Benchmarks

Architectural latency highlights:

- Lighter (ZK Layer2): 5ms (Layer3 ZK Rollup)

- EdgeX (StarkEx): 10ms (hybrid matching)

- Hyperliquid (Layer1): 70ms (HyperBFT, zero gas)

- Drift (Solana): 400–480ms

- dYdX v4 (Cosmos): 1,000ms

- Paradex (CairoVM): 200ms

- Bullet: ~1ms (testnet)

- Monaco:

Throughput

Theoretical throughput varies:

- Hyperliquid: 200,000 TPS

- BlueFin: 297,000 TPS

- Injective: 25,000–400,000 TPS

- Lighter: 10,000 TPS

- Paradex: 7,000 TPS

- Bullet: 7,840,000 TPS (testnet)

- Monaco: 12,500 TPS (testnet)

Order Types & Features

Order type breadth tracks protocol maturity:

- Full-featured: Hyperliquid (market, limit, stop-market, stop-limit, ladder, TWAP)

- Standard: Most support market, limit, stop

- Basic: Launch-phase protocols offer market/limit only

Margin & Cross-Margin

Cross-margin is standard; Hyperliquid, Drift, and ADEN stand out:

- Hyperliquid: Fixed margin rates for consistent leverage management.

- Drift: Solana-powered multi-asset, multi-position cross-margin for complex strategies.

- ADEN: LayerZero cross-chain messaging for unified margin management across multiple chains.

Liquidation Mechanisms

Three main types:

- On-chain auctions (Hyperliquid, EdgeX, Aster, ADEN, Drift, BlueFin, Injective): decentralized, competitive pricing but reliant on active bidders.

- Leeper bots (dYdX v4): fast, predictable, but some centralization risk.

- ZK proof validation (Paradex): high throughput, low cost, but complex architecture.

- ZK proof-verified on-chain auction (Lighter): transparent, fair, CEX-like speed, but high technical complexity.

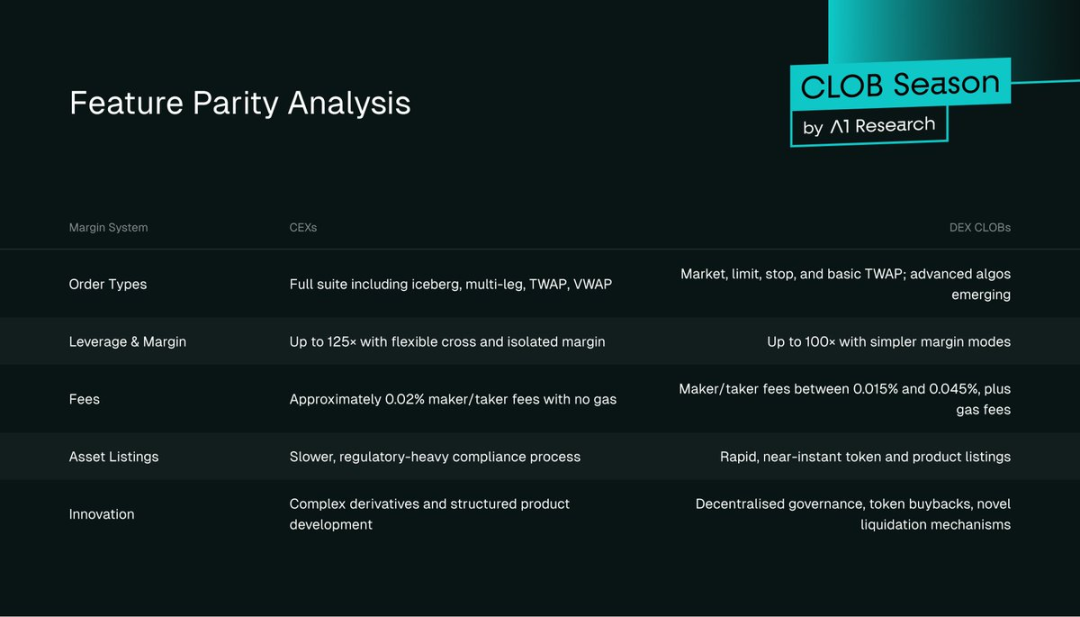

CEX vs. DEX CLOB

CEXs still dominate spot and derivatives volumes, but DEXs are gaining ground, reshaping competition.

Figure 7: DEX vs. CEX futures volume share, Source: The Block

DEX futures share climbed from under 2% (2022) to 8% (September 2025 UTC), with 2024–2025 as peak growth. CLOB DEXs account for 92.04% of on-chain Perp volume ($607 billion), with platforms like Hyperliquid and Lighter delivering sub-second finality and CEX-grade quality.

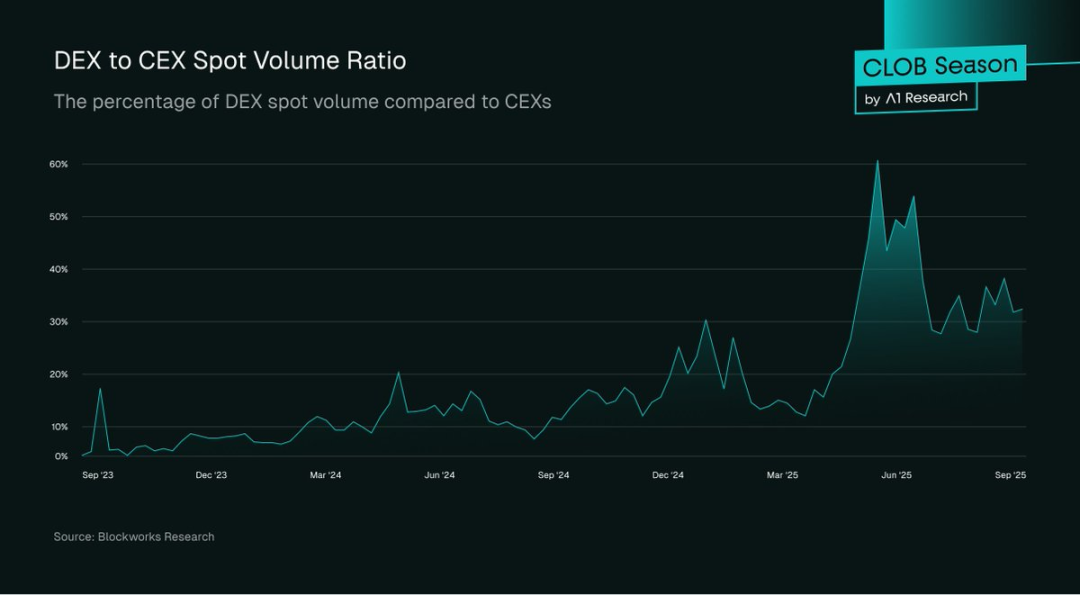

Figure 8: DEX vs. CEX spot volume share, Source: Blockworks Research

DEX spot volume can reach 30–60% of CEXs in active periods, often spiking during market stress (e.g., CEX withdrawal limits), as retail users migrate to DEXs for transparency—shown in the aftermath of events like FTX.

CLOB DEXs hold just 12.4% of on-chain spot ($26.4 billion), while AMMs reach $212 billion—reflecting differences in user preference, UI friction, and onboarding complexity.

CLOB DEXs excel in Perp trading ($607 billion), but spot is a much larger market, representing a major growth opportunity yet to be fully realized.

User Experience

CEXs lead in UI fluidity, sub-second execution, and advanced order types. But CLOB DEXs—especially Hyperliquid—have narrowed the gap, with latency under one second and broad order type support. Gas fees, wallet friction, and limited order types still constrain mass adoption.

Regulation

CEXs benefit from mature frameworks (US SEC, UK FCA), but many operate offshore. CLOB DEXs offer permissionless, borderless access with self-custody and no KYC, but face legal uncertainty amid evolving regulation (EU MiCA, US SEC guidance). Institutions must balance trust and regulatory clarity with access and flexibility.

Trust Models

CEXs require trust in custodian solvency and insurance; DEXs depend on smart contract security, oracle accuracy, and governance—risk profiles vary with audit and governance quality.

Feature Parity

Figure 9: Feature parity table

Spot Challenges

CLOBs lead Perp contracts (92.63%), but hold just 12.4% of spot—exposing architecture challenges against AMM liquidity.

Why do AMMs lead in spot?

- Liquidity bootstrapping: Active order book pools require more capital and expertise than passive AMM LPs.

- UX friction: Order placement is more complex than simple swaps, with added gas costs.

- Fragmentation: Lack of shared books splits liquidity.

- Market makers focus on major pairs, leaving long-tail assets thinly traded.

This creates a self-reinforcing cycle, as retail users default to AMMs for ease, while market makers focus on derivatives.

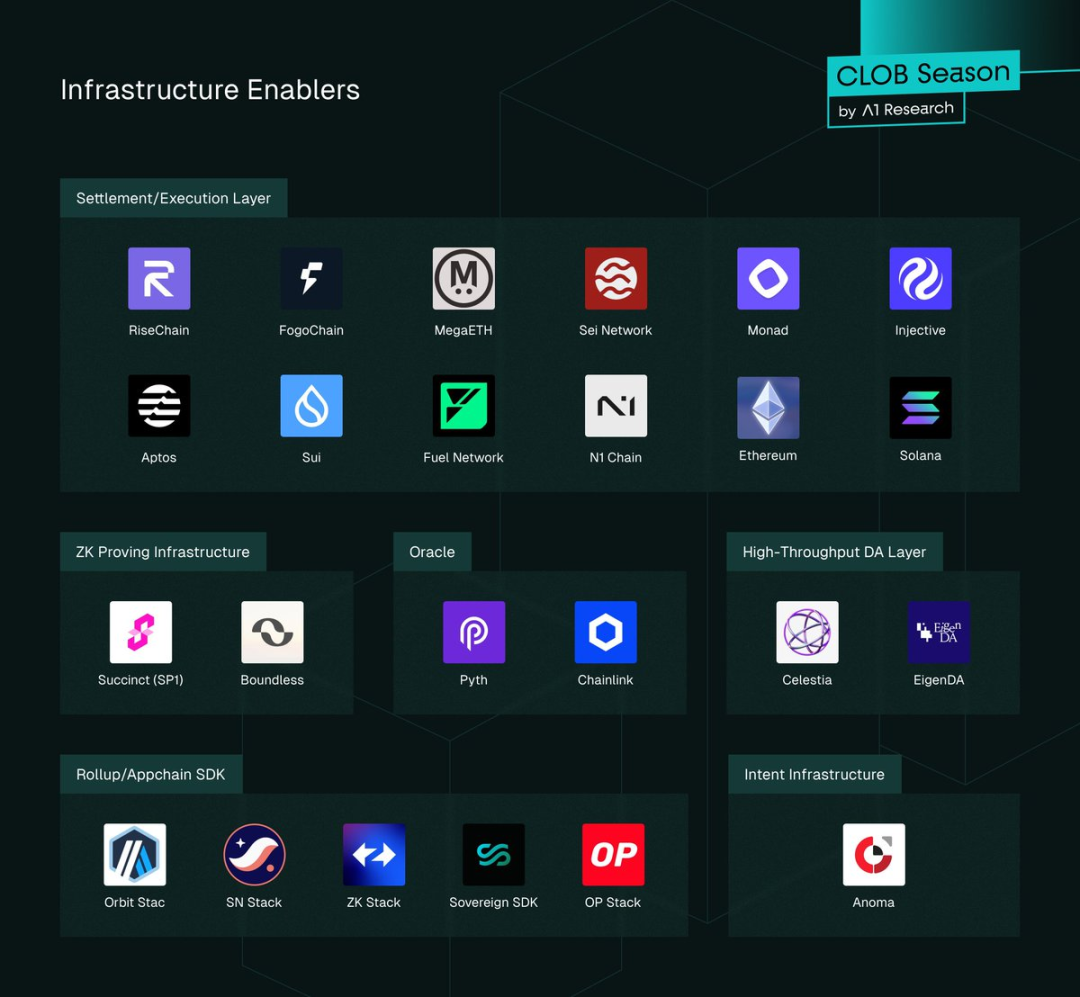

Ecosystem Map

Figure 10: CLOB infrastructure providers

Infrastructure Layers

DA (Data Availability) adoption among top CLOBs:

- Lighter: Ethereum DA

- ADEN: Orderly Network DA

- Others: Native base chain DA (Hyperliquid/Layer1, Drift/Solana, Aster/BNB Chain)

ZK infrastructure:

- Lighter: ZK Rollup Layer2, recursive SNARKs for batch proof validation.

- EdgeX: StarkEX ZK proofs for off-chain matching, balancing speed and security.

- Paradex: SN stack and Starknet SHARP, Cairo for zero-knowledge privacy and verifiability.

- Non-ZK: Hyperliquid (custom consensus), Drift (Solana native), ADEN (Orderly Network), dYdX v4 (Cosmos SDK), Aster (BNB Chain), BlueFin (Sui), Injective (Cosmos SDK).

Shared liquidity models:

- ADEN: Full shared liquidity via Orderly Network.

- Injective: Protocol-level shared book for ecosystem participants.

- BlueFin: Sui DeepBook protocol for native shared liquidity.

- Independent books: Hyperliquid, Lighter, EdgeX, Aster, Drift, Paradex, dYdX v4.

Oracles: Chainlink and Pyth for low-latency market data; most use PythLazer for sub-second price updates.

Cross-chain routing:

- IBC for dYdX v4 and Injective (Cosmos margin trading).

- LayerZero/Wormhole for EdgeX, ADEN (Orderly Network) asset/order routing.

- Hyperlane for Paradex and others for modular multi-chain messaging.

True atomic multi-platform settlement is still in development.

Appchains and Universal Integration:

Layer1 appchains: Hyperliquid (HyperBFT Layer1), Injective (Cosmos SDK Layer1) for performance/control.

Layer2/Layer3 appchains: Lighter (custom ZK Layer2), EdgeX (StarkEX Layer2) for efficient validation.

Universal Layer1: Sui (DeepBook), Sei (exchange-optimized), Monad (EVM parallel execution).

All aim for tight spreads and rapid finality. Future content will explore design trade-offs and high-performance CLOBs in composable environments.

Leaders, Laggards, Winners & Losers

Current Leaders

Hyperliquid’s custom Layer1 delivers sub-second order execution and deep books, translating technical edge into record volume and fees—no close competitors in 2025.

Emerging Winners

- EdgeX: StarkEX hybrid matching, fast trading and token listings.

- Lighter: Proprietary ZK L2, verifiable execution, zero-fee retail, sustained user and OI growth.

- Paradex: ZK L2 with diversified revenue (PFOF, deposit yield, vault fees, money market spreads).

- Aster: High fees but rapid growth from incentives, influencers, support from Binance’s CZ, and fast listings.

- Orderly Network: No-code Perpetual DEX launcher for ADEN, unified book for fast liquidity/user growth.

Key Players to Watch

- Bullet: Solana ZK rollup appchain, Hyperliquid-style order book for scalable, low-latency perps.

- Monaco: Sei-based permissionless, low-latency CLOB infra focused on composability and microsecond execution.

Strategic Laggards

- Legacy appchains (e.g., dYdX v4) face mounting challenges: $7.34 billion volume but just $221 million OI (1.22%), signaling weak institutional trust. Governance-driven listing slows expansion; high fee capture (1.28%) shows loyal user base, but sustainability is uncertain under zero-fee competition.

- Undifferentiated platforms: BlueFin ($4.4 billion) and Injective ($3.05 billion) have solid infra but lack market moats. Neither has delivered mass adoption; as the market matures, they may find niches or face pressure from both top-scale and specialist rivals.

- Appchain issuance faces friction as general-purpose Layer1 blockchains improve; bridging increases onboarding steps, while native deployment avoids them. Sui, Solana, BNB Chain now rival in performance and liquidity, making appchain issuance harder to justify. Only real technical breakthroughs or mature cross-chain infra may reverse this trend.

Winning Strategies

- Tight bid-ask spreads, low/predictable latency

- Multi-frontend shared liquidity

- White-label liquidity solutions for rapid distribution

- Fair, risk-matched fee structures for market makers

- MEV-aware matching to limit predatory trading activity

Performance is key. Tight spreads and sub-second execution drive volume and retain market makers, as Hyperliquid demonstrates. Shared liquidity models (Injective, Sui) boost pricing efficiency versus isolated pools. White-label liquidity solutions (Orderly Network) let frontends focus on UX while centralizing backend matching. Zero-fee models, like Lighter, disrupt incumbents and drive rapid growth, but long-term sustainability depends on monetization. MEV mitigation (Injective batch auctions) reduces toxic flow but requires ongoing adjustment.

Unsuccessful Approaches & Risks

- Slow, costly Layer1 execution

- Complex onboarding vs. AMM simplicity

- Centralized sorters—trust/fraud risk

- Excessive rebates—manipulative liquidity

- Governance slows asset onboarding

- Liquidity concentration—systemic risk of outages

dYdX illustrates that trading migrates to faster, cheaper architectures. Most CLOBs lag AMM in onboarding; centralized sorters create single-point risks. Incentive design challenges include order cancellation abuse and speculation. Governance-driven asset launches are slower than AMM’s real-time listing, limiting long-tail diversity. Liquidity concentration magnifies systemic risk of outages; robust, multi-platform deep liquidity is needed.

Market Structure Outlook

- Consolidation to 3–5 liquidity hubs

- Integrated wallet/app liquidity

- Modular architectures—separated execution/settlement

- Mature Layer1 CLOB platforms

- Infra node compliance focus

- Hybrid order matching for speed/fairness

- Spot market expansion beyond 11% share

Consolidation favors leading DEXs, while specialists focus on privacy, niche assets, or compliance. Leadership depends on execution quality and the ability to attract/retain market makers via deep liquidity. Deeper liquidity pools attract market makers and drive further growth. Future liquidity acquisition will hinge on wallet/app integration. ZK infrastructure and DA solutions will enable modular designs, separating execution/settlement for speed, privacy, and resilience. General-purpose Layer1 blockchains (Monad, Sei, Aptos, Sui, MegaETH, Rise, Fogo) are emerging as top CLOB platforms. Compliance will focus on sorters/builders; hybrid permissioning and audit trails are likely. Order matching will blend continuous books with batch auctions or dual streams (e.g., Injective, dYdX v4). CLOBs will expand spot via shared liquidity infra, wallet integration, and gas-free trading. Spot market is two to four times the size of derivatives; capturing share could grow the addressable market from $26.4 billion to over $200 billion. On-chain CLOBs have huge potential to capture spot from AMMs via shared liquidity, wallet routing, Layer2 cost reduction, and blue-chip incentives. While AMMs dominate long-tail assets, CLOBs can boost revenue by growing major pairs.

Conclusion

Decentralized exchanges have entered a new era, with leading CLOB DEXs posting monthly volumes in the hundreds of billions and execution rivaling CEXs. Fierce competition is driving strategic decisions that will shape the sector’s future. Zero-fee models are resetting pricing, forcing incumbents to match or justify premiums. Architecture advantages are shifting as monolithic Layer1s offer comparable performance and composability. The spot market gap remains a key challenge. As liquidity concentrates, the market may consolidate to a handful of leaders, with distribution and retention now as critical as technical feasibility. This report sets benchmarks for tracking competition; future work will examine CLOB architecture, modular infrastructure economics, and spot expansion strategies.

Statement:

- This article is republished from ForesightNews and copyright belongs to A1 Research. Please contact the Gate Learn team for any concerns about republishing.

- Disclaimer: Views expressed are those of the author only and do not constitute investment advice.

- Other language versions are translated by Gate Learn. Do not reproduce, share, or plagiarize translated articles without proper citation to Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?