What Is Liquid Staking? — The “Liquidity Revolution” in Crypto Asset Staking

What Is Liquid Staking?

Staking means you lock your crypto assets on a blockchain network to help maintain the network and earn rewards. Traditionally, your assets are locked up for a set period and can’t be accessed. With liquid staking, you can earn rewards on staked crypto assets while keeping them liquid. In short, your assets are staked and accessible at the same time.

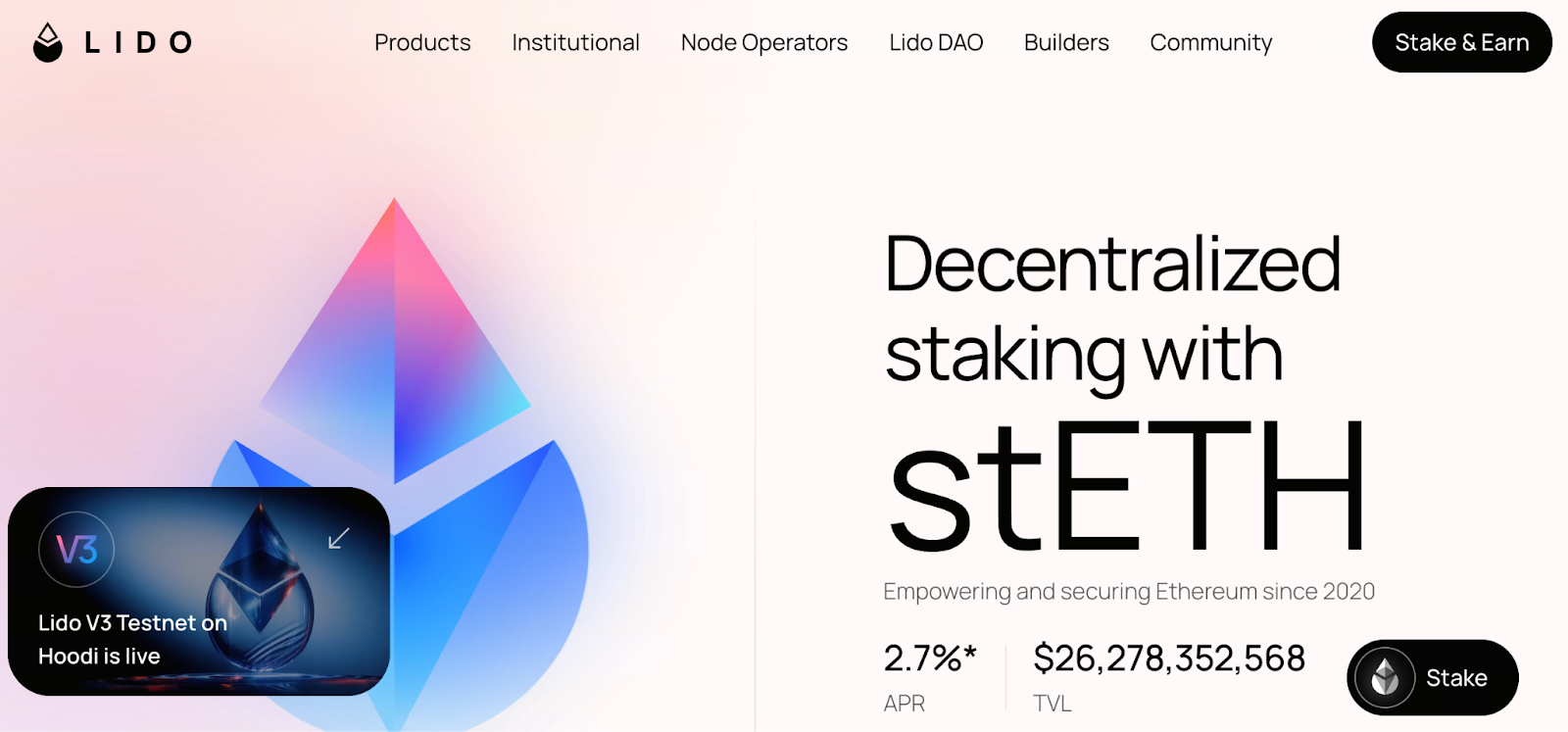

With liquid staking, you receive tokens from protocols that represent your staked assets—commonly called liquid staking tokens (LSTs), such as stETH or wstETH in the Ethereum ecosystem. You can use these tokens for decentralized trading, lending, or other DeFi applications.

How Liquid Staking Works

Here’s how it typically works:

- You deposit tokens (for example, ETH) into a liquid staking protocol or service provider.

- The protocol stakes those tokens and locks them, then mints an equivalent amount of liquid staking tokens (LSTs) for you.

- Holding LSTs lets you keep using your assets in the DeFi ecosystem, even after staking.

- If you want to exit staking or redeem your assets, you return the LSTs to the protocol and get back your original assets plus any rewards, according to the protocol’s rules.

With liquid staking, you earn yield on locked assets and keep the flexibility of liquidity.

Key Benefits of Liquid Staking

- Get both liquidity and yield. You earn staking rewards and still have access to your assets, so you don’t sacrifice flexibility during lock-up periods.

- Boost your capital efficiency. If you want to engage in DeFi, lending, trading, or other on-chain activities, LSTs keep your assets working for you.

- Lower opportunity cost. Unlike traditional staking, liquid staking helps you avoid missed opportunities due to market volatility.

- Broader acceptance. With increased regulatory clarity, liquid staking is more likely to attract institutional and retail investors.

Risks and Limitations of Liquid Staking

- Protocol and smart contract risk. Liquid staking relies on smart contracts or service providers. Vulnerabilities or security breaches could result in asset loss.

- LST market risk. While LSTs represent staked assets, their value can be affected by market supply and demand, liquidity, and investor confidence.

- Redemption and lock-up rules. Each protocol has its own redemption requirements, which may include delays or restrictions.

- Network and governance risk. Major changes to the underlying blockchain—such as upgrades, forks, or regulatory shifts—can impact staking rewards or asset security.

Current Market Landscape and Emerging Trends

- By mid-2025, global liquid staking total value locked (TVL) is projected to reach an all-time high of roughly $86 billion, marking a 48% increase since the start of the year.

- Lido and similar protocols continue to dominate the liquid staking market, holding a significant share of TVL.

- Regulatory developments are promising. In August 2025, the U.S. Securities and Exchange Commission (SEC) clarified that, with proper structural design, liquid staking protocols and their liquid staking tokens (LSTs) generally do not constitute securities. This reduces legal uncertainty.

- Greater regulatory clarity has boosted market confidence, attracting more institutional investors and paving the way for future capital inflows and product innovation.

Advice for Retail Investors and Crypto Enthusiasts

If you’re interested in blockchain and DeFi, and want your assets to earn yield while staying flexible, liquid staking is worth exploring. Before you start, consider these tips:

- Review the protocol’s redemption mechanisms, security features, and audit status.

- Diversify your risk. Don’t stake all your assets in a single protocol.

- Choose reputable, well-audited, and established protocols.

- Keep an eye on LST market liquidity and possible volatility.

- If you’re a long-term holder, try allocating some assets to liquid staking and keep others liquid to balance yield and flexibility.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.com

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution