Wall Street’s Strategy: What Does $500 Million Get You in Ripple?

Most notably, this round of funding has attracted major investors: Wall Street’s Fortress Investment Group and Citadel Securities are leading, alongside renowned institutions including Pantera Capital, Galaxy Digital, Brevan Howard, and Marshall Wace.

For those familiar with Ripple, this marks a genuine turnaround—is this really the same Ripple that was bogged down in SEC lawsuits and previously regarded as a “zombie company”?

From “Master Storyteller” to “Compliance Epicenter”

Ripple, founded in 2012, is one of the crypto industry’s oldest projects. Its core technology, the XRP Ledger, is a decentralized ledger specifically designed for cross-border payments. Building on this, Ripple developed payment and settlement systems, and its token, XRP, became a global sensation in 2017–2018, reaching the third-highest market capitalization behind Bitcoin and Ethereum.

But as token prices collapsed and “inflated” partnerships came to light, Ripple’s “bank-grade partnerships” narrative began to unravel.

During this period, Forbes published an exposé alleging Ripple’s core business model could be a “pump-and-dump” scheme: Ripple uses its massive XRP holdings to purchase partnerships, creating a façade of success, and employs vague statements to skirt regulation. The ultimate objective is not technological innovation, but to inflate the value of freely acquired tokens through marketing and hype, enabling insiders to profit by cashing out.

Regulators took decisive action in December 2020.

The SEC charged Ripple with “unregistered securities sales,” alleging it illegally raised over $1.3 billion via XRP.

This was one of the most consequential regulatory battles in crypto history.

The lawsuit’s fallout was severe: Coinbase, Kraken, and other major exchanges quickly delisted XRP; long-term partner MoneyGram ended its relationship; XRP’s price plunged over 60% in the following month. Ripple's business suffered, placing it on regulatory watchlists.

Strategic Transformation

This protracted legal struggle cost Ripple nearly $200 million, but delivered crucial breathing room and favorable court decisions, buying time for a strategic pivot.

In 2024, Ripple launched RLUSD, a dollar-pegged stablecoin focused on regulatory compliance and institutional payments and settlements. Unlike USDT and USDC, RLUSD isn’t designed as an exchange-backed stablecoin, but targets traditional credit card and cross-border clearing systems.

By 2025, Ripple announced partnerships with Mastercard, WebBank, and Gemini, enabling RLUSD for real-time credit card settlements—the first on-chain stablecoin to enter card payment networks worldwide.

This breakthrough opens enterprise channels for stablecoin adoption and clears the path for Ripple’s integration with mainstream finance.

To build a comprehensive on-chain financial stack, Ripple executed targeted acquisitions from 2023 to 2025:

- Metaco acquisition: Secured institutional-grade digital asset custody technology, establishing a foundation for large financial institution services.

- Rail acquisition: Acquired stablecoin issuance and management systems, speeding RLUSD’s rollout.

- Hidden Road acquisition: Added institutional credit networks and cross-border settlement capabilities to complete the infrastructure.

Through these deals, Ripple’s capabilities have evolved from simple cross-border payments to a full-stack financial infrastructure: stablecoin issuance, institutional custody, and cross-chain settlement.

The Truth Behind the $40 Billion Valuation

At first glance, Ripple’s transformation seems expansive.

However, experienced capital market participants have a different perspective.

To understand the real rationale behind this funding, it’s essential to recognize Ripple’s nature: it’s a massive digital asset treasury.

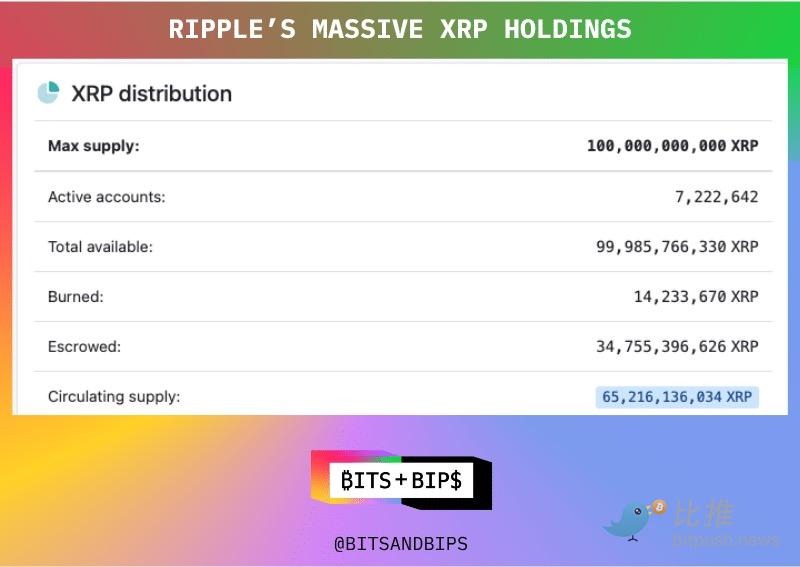

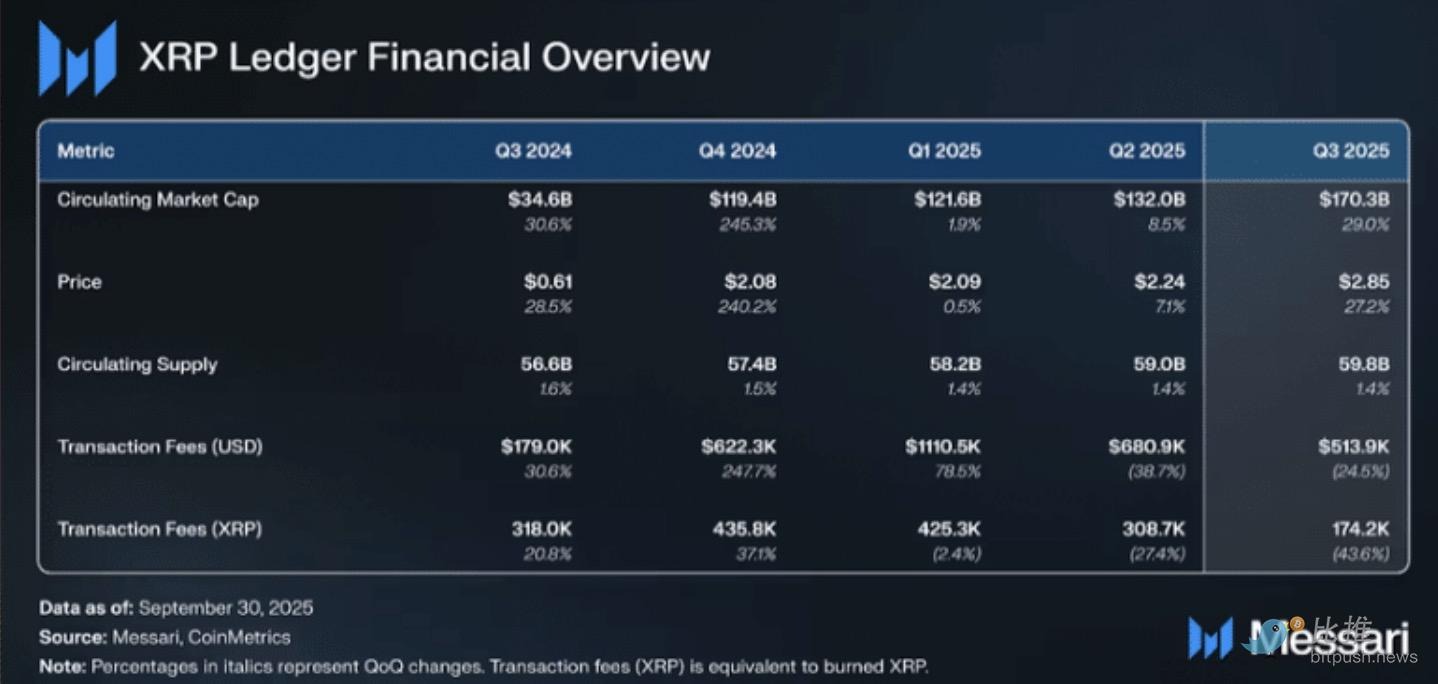

At XRP’s genesis, 80 billion of the 100 billion tokens were placed in Ripple’s custody. Today, Ripple still holds 34.76 billion XRP, with a nominal market value exceeding $80 billion—twice its valuation from this round.

Multiple venture capitalists confirm the $500 million deal was closely tied to purchasing Ripple’s XRP reserves, likely at prices well below spot.

From an investment standpoint, investors are buying assets at a 0.5x market capitalization to net asset value ratio. Even with a 50% liquidity haircut on XRP holdings, the asset value still matches the company’s valuation.

An insider told Unchained, “Even if Ripple can’t build the business, they can just buy another company outright.”

One venture capitalist remarked, “This company’s value is purely its XRP holdings. No one uses their technology; there’s zero traction in the network or blockchain ecosystem.”

Community members have echoed, “Ripple’s equity itself likely isn’t worth much—certainly not $40 billion.”

A participant noted the rationale as follows: “Payments are currently experiencing strong growth. Investors need to bet on multiple horses in the race.”

Ripple is just one of those horses—maybe not the most technically advanced, but with large reserves of XRP.

For Ripple, this is a win-win:

- Anchoring valuation: Officially setting the $40 billion private market valuation, giving early investors a benchmark for exit pricing.

- Avoiding sell pressure: Using capital to acquire companies rather than dumping XRP on the market, reducing price impact.

Ripple co-founder Chris Larsen’s personal wealth has climbed to approximately $15 billion.

From this angle, Ripple’s story is a classic financial saga—about assets, valuation, and liquidity management.

From the SEC’s defendant’s bench to Wall Street boardrooms, Ripple’s journey is a microcosm of crypto’s shift from idealism to pragmatism. If Ripple once epitomized “narrative economics,” today it demonstrates how, as the tide recedes, projects rely on core capital strength for a stable outcome.

Statement:

- This article is reproduced from [BitpushNews]. Copyright belongs to the original author, [Seed.eth]. For reprint concerns, please contact the Gate Learn team, who will handle requests promptly according to established procedures.

- Disclaimer: The views and opinions expressed are those of the author and do not constitute investment advice.

- Other language versions were translated by the Gate Learn team. Without explicit reference to Gate, translated articles may not be copied, distributed, or plagiarized.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?