Individuals profiting discreetly from arbitrage opportunities on Polymarket

After raising $2 billion, Polymarket is now valued at $9 billion, making it one of the largest funding rounds in the crypto space in recent years.

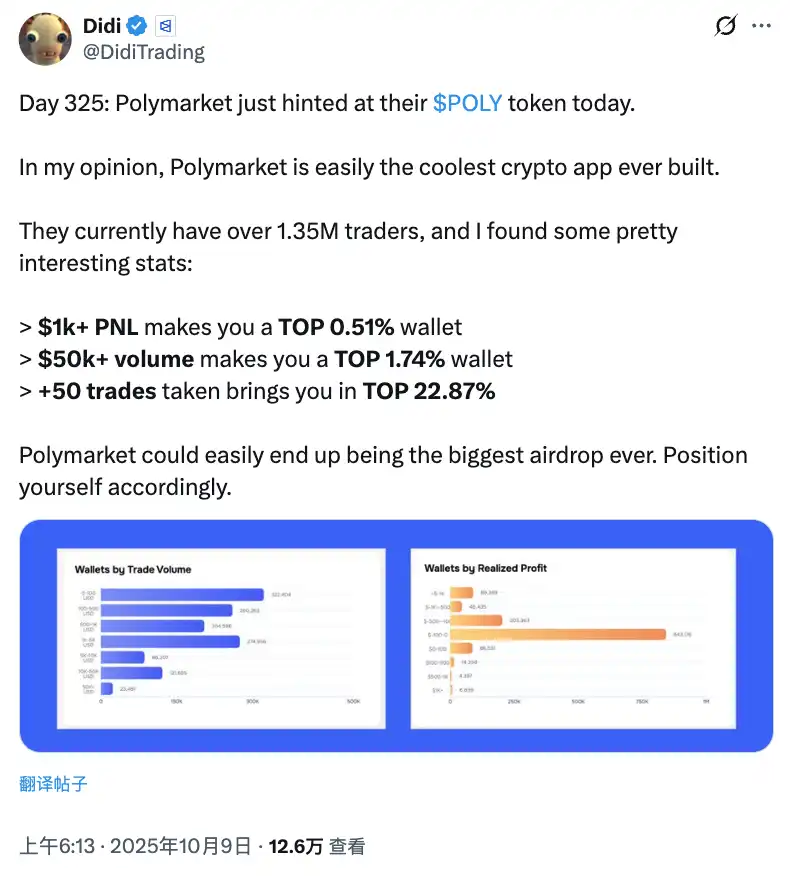

With rumors of IPOs, IDOs, and airdrops swirling, let’s examine some intriguing statistics: Achieve a PNL above $1,000, and you’re in the top 0.51% of wallets; surpass $50,000 in trading volume, and you rank among the top 1.74% of whales; complete more than 50 trades, and you outperform 77% of users.

These figures reveal that, in Polymarket’s fertile landscape, only a handful of participants have consistently cultivated and reaped meaningful returns over the past few years.

ICE’s strategic investment has triggered rapid growth in Polymarket’s liquidity, user base, and market depth. More capital brings more trading opportunities; increased retail participation leads to greater market imbalances; and a broader range of markets opens up new arbitrage possibilities.

For those who know how to profit on Polymarket, this is a golden era. While most view Polymarket as a casino, savvy capital treats it as an arbitrage engine. In the following analysis, BlockBeats interviewed three experienced Polymarket users to break down their profit strategies.

Tail-End Trading Emerges as a New Wealth Strategy

"On Polymarket, about 90% of large trades over $10,000 are executed at prices above 0.95," veteran trader Fish stated directly.

This prediction market has seen “tail-end trading” become a widespread strategy.

The approach is straightforward: When an event’s outcome is nearly locked in and the market price surges above 0.95—sometimes close to 0.99—you buy at that price, then patiently wait for the official settlement to capture the final few points of guaranteed yield.

The essence of tail-end trading is simple: trading time for certainty.

If an event is already decided—such as a concluded election or finished sports match—but the market hasn’t settled, prices often hover just below 1. By entering at this point, in theory, you simply wait for settlement to lock in those final fractional gains.

"A lot of retail traders can’t wait for settlement," Fish told BlockBeats. "They want to cash out quickly and jump to the next trade, so they’ll sell at 0.997 to 0.999, which creates arbitrage opportunities for whales. Each trade may only net 0.1%, but with enough capital and frequency, these small gains add up."

However, as with any investment, tail-end trading is not a risk-free “set-and-forget” strategy.

"The biggest threat to this approach," Fish explained, "isn’t market volatility—it’s black swan events and whale manipulation."

Black swan risk is a constant concern for tail-end traders. A black swan event is a seemingly certain outcome that unexpectedly reverses. For example, a finished match might be ruled invalid, or a settled political event could be overturned by scandal. If these rare events occur, your 0.99-priced positions can become worthless instantly.

"Most black swan reversals are orchestrated by whales," Fish continued. "A typical tactic is to crash the price from near 0.99 to 0.9 with a large trade, sparking panic. They then spread rumors in comments and on social media to amplify retail fear; as retail traders panic-sell, whales buy back at lower prices. After settlement, whales pocket both the price spread and profits retail traders should have earned."

This is the full cycle of whale-driven manipulation.

Luke (@DeFiGuyLuke), another veteran, highlighted a unique aspect of this dynamic: "Polymarket’s comment sections are especially engaging. You rarely see this in other platforms."

Users post extensive evidence and opinions, and many know how to coordinate sentiment. This makes Polymarket especially prone to opinion manipulation.

This observation inspired Luke’s startup: "I noticed Twitter content is mostly noise and rarely genuine. People don’t talk much. But on Polymarket, even small bettors write long, detailed comments."

"This content is fascinating, so I realized Polymarket’s comment sections are uniquely readable." Based on this, Luke developed Buzzing—a platform where anyone can create markets on any topic. After placing bets, users comment, and those comments form a feed that helps distribute market information.

Given the risk of black swan manipulation in tail-end trading, is the strategy still viable?

"It is, but risk control and position management are crucial. For instance, I never commit more than 10% of my capital to any single market," Fish added. "Never go all-in, even if a bet seems 99.9% certain. Focus on markets about to settle (within a few hours) and priced above 0.997 to minimize black swan exposure."

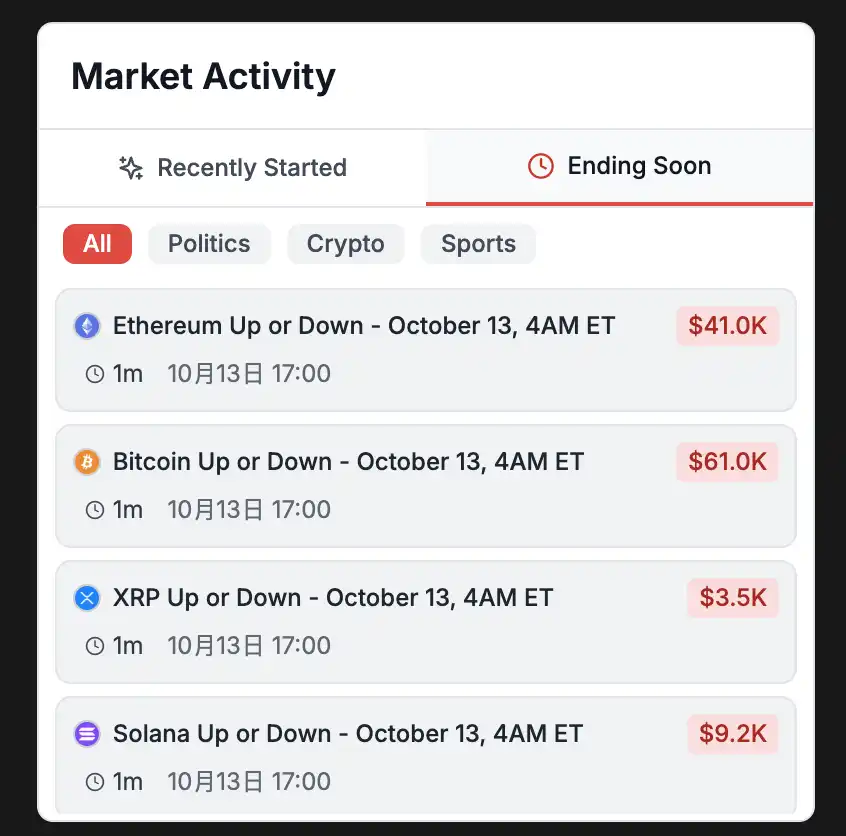

Markets near settlement as shown on polymarketanalytics

Arbitrage Opportunities: Sums Below 100%

On Polymarket, one address turned $10,000 into $100,000 over six months, taking part in more than 10,000 markets.

The strategy wasn’t gambling or insider trading, but a technical arbitrage: finding multi-option markets where the sum of all option prices is below 100%.

The logic is elegantly simple: In a winner-take-all market, if the total price of all options is less than $1, buy one share of each. Upon settlement, one option pays $1, and the difference between cost and return is your risk-free profit.

Here’s a concrete example: Consider a market on the "Fed decision in July?" with four options:

Rate cut by 50bps+: $0.001 (0.1%);

Rate cut by 25bps+: $0.008 (0.8%);

No change: $0.985 (98.5%);

Rate hike by 25bps+: $0.001 (0.1%)

Add them up: $0.001 + $0.008 + $0.985 + $0.001 = $0.995. Buy one share of each for $0.995; after settlement, one wins and pays $1. Profit: $0.005, or 0.5% yield.

"Don't underestimate 0.5%—$10,000 earns $50 per trade. Execute dozens daily for impressive annual returns, and it’s risk-free as long as the market settles normally," Fish said.

Why does this opportunity exist?

Each option in multi-choice markets has an independent order book. Most of the time, the total probability equals or exceeds 1 (market makers profit from the spread). But when retail traders trade a single option, only its price moves, leading to brief imbalances where the sum drops below 1.

This window may last only seconds. For arbitrageurs running bots, it’s a golden opportunity.

"Our bot monitors all multi-option order books 24/7," Fish explained. "When the sum drops below 1, it buys all options instantly to lock in profit. With a robust bot, you can track thousands of markets simultaneously."

"It’s similar to MEV atomic arbitrage in crypto," Fish added. "You exploit short-lived imbalances with speed and tech, then let the market rebalance."

Unfortunately, this edge is now dominated by a few bots. In practice, risk-free arbitrage has become a contest between professional systems.

"Competition will only get fiercer," Fish said. "It’ll depend on whose servers are closest to Polygon nodes, whose code executes fastest, and who can submit and confirm transactions first."

At Its Core, This Is Market Making

By now, most readers have noticed: the arbitrage strategies above are essentially market making.

Market makers deposit USDC into pools, effectively posting simultaneous Yes and No orders, providing counterparty for all trades. USDC is split into contract shares based on the current Yes/No ratio. For example, at 50:50 pricing, 100 USDC is split into 50 Yes + 50 No. As markets fluctuate, your inventory diverges from the ideal ratio. Skilled market makers actively rebalance and arbitrage to optimize yield.

Thus, arbitrage bots act as market makers—constantly rebalancing markets and deepening liquidity. This benefits Polymarket’s ecosystem, so the platform charges no fees and rewards makers.

"Polymarket is very friendly to market makers," Fish said.

"Data shows market makers on Polymarket earned at least $20 million in the past year," Luke told BlockBeats two months ago. "Updated figures will be even higher."

"The earnings model: A stable expectation is 0.2% of volume," Luke explained.

Provide liquidity to a market with $1 million monthly volume, and your expected profit is $2,000.

This yield may seem modest, but it’s stable—unlike speculative trading. Scale up to 10 markets ($20,000) or 100 markets ($200,000). Add LP rewards and annualized returns, and actual yields rise. "But the primary income is still the spread and Polymarket’s maker rewards."

Interestingly, while arbitrage is dominated by bots, market making is less competitive.

"Token trading is fiercely competitive, driving hardware upgrades. But Polymarket’s competition focuses more on strategy than speed," Luke noted.

For technologists with sufficient capital, market making remains an undervalued opportunity. As Polymarket’s $9 billion valuation drives liquidity growth, market making profits will expand. Now is still a good time to enter.

2028 U.S. Election Arbitrage

During interviews with BlockBeats, Luke and Tim discussed market making opportunities—especially in Polymarket’s 2028 U.S. presidential election market offering 4% APY.

With three years until the election, Polymarket is already attracting early liquidity with a 4% annual yield.

"Many see 4% APY as low for crypto—AAVE and similar platforms offer more,"

"But Polymarket is competing with Kalshi," Luke explained. "Kalshi has long offered Treasury yields on account balances—a standard feature in traditional finance. For example, Interactive Brokers pays interest even if you don’t buy bonds or stocks."

"As a Web2 platform, Kalshi can implement this easily. Polymarket couldn’t, since assets are protocol-locked. That’s why Polymarket lagged on this feature."

This gap is wider in long-term markets like the 2028 election. "Locking up funds for three years with no yield is painful. To close the gap, Polymarket subsidizes the 4% annual reward," Luke said.

"But market makers aren’t targeting the 4% APY—it’s mainly for regular users." This subsidy lowers trading costs, benefiting frequent traders who are cost-sensitive.

Tim’s research shows greater arbitrage potential for market makers than the headline 4% rate.

"Polymarket’s reward structure is often overlooked—each option offers an extra $300 daily LP reward," Tim explained. In addition to 4% annualized yield, market makers earn additional incentives by providing liquidity and maintaining market depth.

Tim calculated: If the "2028 President" market has 10 leading options, each with $300 daily LP rewards, that's a $3,000 daily pool. Holding 10% of liquidity nets $300 a day, or $109,500 annually.

"And that’s just LP rewards. Add market making spreads and compounding the 4% annualized yield, and total returns can easily exceed 10%, even 20%,"

"Is the 2028 election market making strategy worth it? If you have technical expertise, capital, and patience, it’s a significantly undervalued opportunity. But honestly, it’s not for everyone."

Tim continued: "It suits prudent players with tens of thousands of dollars; those with programming skills who can build automated market making systems; long-term investors focused on steady returns; and those who understand U.S. politics and can assess market sentiment.

It’s not for small bankrolls (a few thousand dollars); those seeking quick gains or unwilling to wait four years; total novices without insight into market dynamics or U.S. politics; or anyone needing immediate liquidity."

News Trading on Polymarket

Luke and his team uncovered a counterintuitive trend while analyzing Polymarket’s data.

"It’s commonly said Polymarket users are smart and prescient, predicting outcomes before events finish," Luke observed. "But in reality, the opposite is true."

"Most Polymarket users are 'dumb money,' pretty inexperienced," Luke laughed. "They often misjudge events. Only after news breaks do many rush in to arbitrage and push prices to their expected levels. Before news drops, users are frequently wrong."

"Data shows user betting and price feedback on Polymarket lag actual events. Often, the real outcome occurs, but bets are off, prompting sharp reversals," Luke explained.

Luke cited an example: "The papal election—an American was elected Pope. Before the Vatican announced it, the American candidate’s odds were tiny. When the Vatican made it official, the price spiked."

"So you see, users often bet incorrectly," Luke concluded. "If you can tap into instant news and act quickly, front-running the market is lucrative. This strategy is viable."

But it’s technically demanding.

"It requires strong development skills," Luke admitted. "You need real-time news feeds, similar to MEV. You must reliably parse news, implement advanced NLP, and execute trades rapidly. But there are clear opportunities."

On Polymarket’s $9 billion battleground, all sorts of profit strategies exist, but most successful players treat it as an arbitrage engine—not a casino.

Our interviews reveal Polymarket’s arbitrage ecosystem is maturing rapidly, and the window for newcomers is narrowing. But regular players still have opportunities.

Return to the opening stats: A PNL above $1,000 puts you in the top 0.51%; trading volume above $50,000 places you in the top 1.74%; and over 50 trades beats 77% of users.

So even starting active trading now, when airdrops arrive, Polymarket—the largest crypto fundraising project in years—could still deliver a major surprise for regular users.

Statement:

- This article is reprinted from [BlockBeats]. Copyright belongs to the original author [Jaleel加六]. If you have any concerns regarding reproduction, please contact the Gate Learn team for prompt resolution according to established procedures.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Unless specifically referencing Gate, do not copy, distribute, or plagiarize the translated content.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?