The Next Milestone for RWA: Is Nasdaq Really Considering Tokenized Stocks?

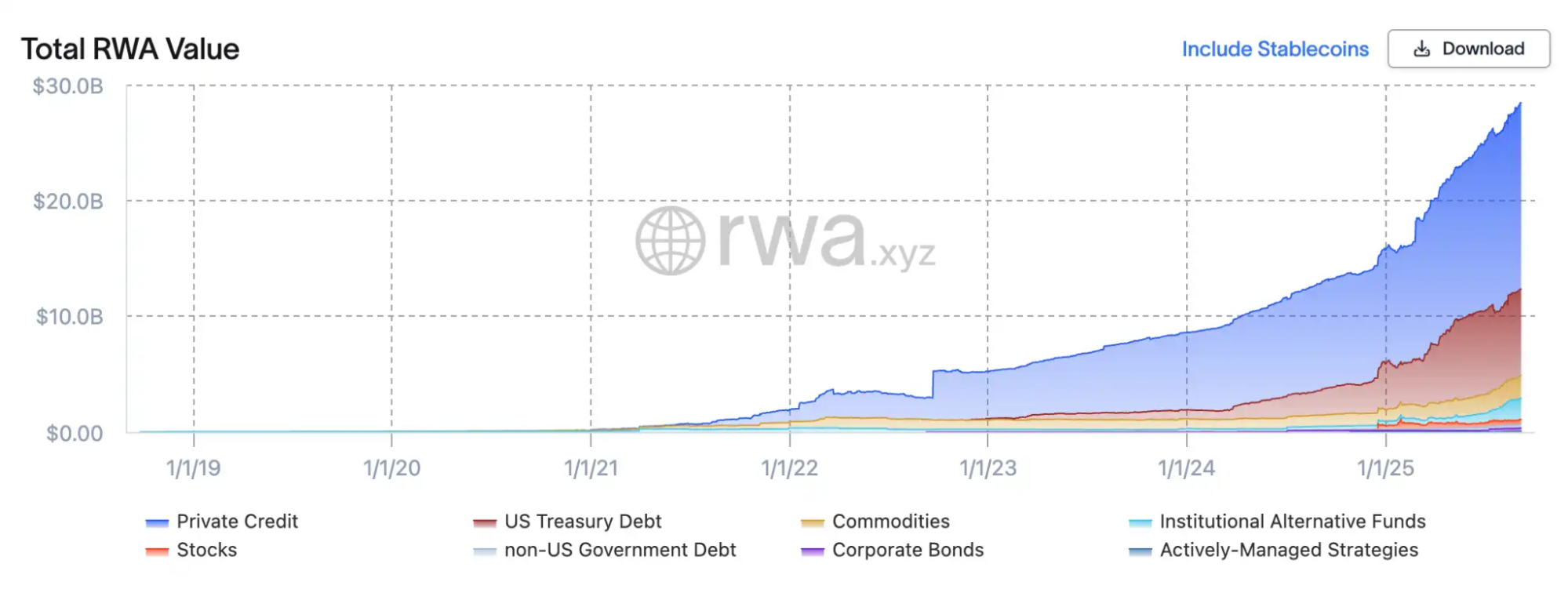

Within just two years, the tokenized securities market has experienced explosive growth. According to RWA.xyz, the current total market capitalization of tokenized RWAs (real-world assets) now exceeds $2.8 billion, with on-chain stocks reaching $420 million. At the beginning of 2024, this figure was under $5 million, marking an 80-fold increase in less than two years.

Corporations entering the space and ramping up their efforts fuel this surge: Robinhood launched tokenized private equity products covering high-profile assets such as SpaceX and OpenAI; Kraken’s affiliate XStocks rolled out tokenized versions of over 50 U.S. stocks and ETFs; Ondo’s “Wall Street 2.0” brought more than 100 U.S. stocks and ETFs on-chain via Ethereum; Galaxy Digital became the first to put its own Nasdaq-listed shares on a blockchain; and SBI Holdings, in partnership with Startale, established an on-chain trading platform in Japan. Both crypto-native players and established financial institutions are vying for early leadership in the race to tokenize equities.

This movement not only pits crypto against traditional finance, it also has the potential to revolutionize how exchanges operate. On September 8, Nasdaq—the world’s second-largest exchange—proactively submitted a proposal to the U.S. Securities and Exchange Commission (SEC), officially embracing tokenized stocks and seeking to shift the transformation from niche experimentation to the heart of Wall Street.

A New Wrapper for Old Infrastructure: The Mechanics of Tokenized Stocks

Tokenized stocks are not a brand-new asset class conjured out of thin air. Rather, they repackage traditional equity in a new format. The crux of the innovation is integrating blockchain’s ledger and settlement capabilities with existing financial infrastructure. In Nasdaq’s SEC rule proposal, this mechanism is spelled out clearly: going forward, investors can select a “tokenized settlement” option when placing orders. Trade matching will continue in the same order book, with no special priority for tokenized trades. The real transformation occurs after the trade: Nasdaq will transmit the settlement instructions to the Depository Trust Company (DTC), which will move traditional shares into a dedicated account, issue equivalent tokens on the blockchain, and distribute them to broker wallets. The trading process is identical for both tokenized and traditional stocks; blockchain mapping only occurs at the settlement layer.

Tokenized stocks remain part of the National Market System (NMS) and are subject to standard regulation and transparency requirements: trades count toward the National Best Bid and Offer (NBBO), ownership and voting rights are the same as conventional shares, and surveillance is jointly conducted by Nasdaq and FINRA. In practical terms, tokenization is not a parallel system—it’s an upgrade to market infrastructure. “We’re not looking to replace the current framework; we’re providing a more efficient and transparent technological alternative,” said Chuck Mack, Senior Vice President for North American Markets at Nasdaq. “Tokenized securities are the same asset expressed in a new digital format on the blockchain.” This approach lets markets leverage both established structures and clearing systems, while using blockchain as the next-generation custody and settlement solution.

From a macro perspective, tokenization appeals precisely because it addresses core pain points in capital markets. The first is settlement efficiency—today’s system involves T+1 or longer for stock delivery, whereas on-chain settlement can be nearly instantaneous, reducing counterparty risk. The second is trading hours and accessibility—traditional exchanges operate on set schedules and cross-border investing requires multiple intermediaries, but tokenized stocks can theoretically trade 24/7 and reach global investors directly through blockchain wallets. The last factor is programmability: proxy voting, dividend distributions, and even corporate governance could be automated and rendered transparent through smart contracts.

Looking ahead, Nasdaq positions tokenization as the next evolutionary step in capital markets infrastructure. If all goes according to plan, once the DTC upgrades are complete, on-chain settlement could launch as soon as Q3 2026, enabling tokenized stocks to operate in parallel with traditional ones in regulated U.S. markets. Nasdaq clearly rejects workarounds or exemptions, prioritizing investor protection and preventing liquidity fragmentation.

Different Approaches Among Industry Players

xStocks: Compliant Custody Meets DeFi Composability

xStocks, backed by Backed Finance, leverages Swiss and Liechtenstein DLT legislation to form an SPV that holds actual stocks and issues blockchain tokens at a 1:1 ratio. Legally, these tokens are senior asset-backed debt certificates, backed by custodians and real-time reserve proof. The issuance and trading layers operate independently, allowing tokens to circulate on centralized exchanges like Kraken and Bybit, and within Solana DeFi protocols such as Jupiter and Kamino. The key advantage is transparency and cross-market composability, though liquidity is still limited and the market size hasn’t caught up with off-chain solutions.

Robinhood: Licensed Broker’s On-Chain Closed Loop

Robinhood pursues a fundamentally different strategy. Through its Lithuanian subsidiary’s MiFID II license, Robinhood procures and custodies U.S. stocks, ETFs, and private equity under regulatory compliance, then issues corresponding tokens on Arbitrum. All token transactions occur exclusively within Robinhood’s proprietary app in a closed loop, ensuring that the on-chain quantity always reflects the custodial holdings in real time. This offers regulatory clarity and consistent user experience, even supporting fractional dividends and on-chain settlement. However, tokens are nearly non-transferrable and lack open liquidity. For Robinhood, tokenization is a tool to expand its financial ecosystem, not just a market innovation.

Galaxy: Public Company’s Native On-Chain Shares

Unlike the previous two models, Galaxy Digital directly migrated its Nasdaq-listed stock on-chain. Partnering with SEC-registered transfer agent Superstate, shareholders can convert GLXY common shares into tokenized shares on Solana, one-to-one, via regulatory processes. Rather than synthetic tokens or derivative contracts, these tokens represent genuine shares with full legal rights to voting and dividends. Galaxy’s pilot is the first to ensure tokens and shares are legally equivalent, paving the way for a true on-chain equity marketplace. Liquidity remains nascent and is limited to peer-to-peer (P2P) transfer among registered users; full secondary market access awaits further regulatory progress.

Ondo: Creating Wall Street 2.0

Founded by former Goldman Sachs executives, Ondo Finance follows an “institutional packaging plus open distribution” model. Its newly launched Ondo Global Markets platform has brought over 100 U.S. stocks and ETFs to Ethereum, giving non-U.S. investors legitimate access to on-chain investing. Ondo acquires and holds actual stocks via licensed brokers, issuing tokens at a 1:1 ratio to ensure each token carries full economic rights including dividends and corporate actions. Ondo stands out for its scale and transparency, offering daily proof of reserves, bankruptcy isolation, and third-party custody, along with cross-chain compatibility and DeFi composability. Investors can access major stocks like Apple and Tesla, use tokens as collateral for lending and automated strategies. Ondo is building a “global financial supermarket,” fusing Wall Street’s liquidity with blockchain transparency to truly create Wall Street 2.0.

Adoption or Risk? Wall Street’s On-Chain Test

Nasdaq’s formal SEC application for tokenized equity trading is seen as Wall Street’s “core trial” in digital transformation. The proposal’s key principle: tokenized stocks must have identical rights and protections as their underlying securities; trade matching stays within the current order book, while DTC issues and settles equivalent tokens on-chain. This shifts tokenization from the margins to a foundational role in the U.S. capital markets. In contrast to Robinhood or xStocks, which still rely on price mapping and contract certificates, Nasdaq’s method is all-encompassing—migrating all shareholder rights (votes, dividends, governance) onto the blockchain. Investors receive not just “shadows,” but fully empowered digital equities.

Nasdaq CEO Tal Cohen stated, “Blockchain technology offers unprecedented possibilities for shorter settlement cycles, modernized proxy voting, and automated corporate actions.” Nasdaq aims to upgrade market infrastructure with minimal regulatory friction, keeping investor protection and transparency at the core. Regulators see this as a positive step—better to integrate tokenization into regulated frameworks than to let it develop unchecked abroad or in gray markets.

Nonetheless, skepticism remains. JPMorgan notes tokenization of stocks and bonds “has not yet seen significant adoption outside of crypto-native firms,” urging caution on short-term hype. Citadel Securities warns that hasty regulatory moves without clear rules could trigger market risks. Globally, the World Federation of Exchanges (WFE) has reached out to regulators, concerned that tokenized shares may “imitate” real stock without adequate shareholder rights or legal protections, calling for stronger legal standards and custody frameworks. Although tokenization holds enormous promise, regulatory adaptation will require time.

Conclusion

Nasdaq’s proposal is both a technical update and a policy-level trial. If the SEC approves, it will be the first time blockchain technology anchors mainstream U.S. stock markets, potentially paving the way for round-the-clock trading, real-time settlement, and smart contract governance. Yet, before such changes materialize, the market will need to see: whether regulators offer clear structures, whether investors trust the new model, and whether tokenization can truly deliver value beyond traditional markets.

Statement:

- This article is reprinted from [BlockBeats]; copyright belongs to the original author [kkk]. For reprinting inquiries, please contact the Gate Learn team; your request will be addressed according to relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Other language versions are translated by the Gate Learn team. Unless Gate is specifically cited, do not copy, distribute, or plagiarize the translated content.

Related Articles

What is Plume Network

Reshaping Web3 Community Reward Models with RWA Yields

What Are Crypto Narratives? Top Narratives for 2025 (UPDATED)

ONDO, a Project Favored by BlackRock

Real World Assets - All assets will move on-chain