test-002-How do centralized capital entities exert control over decentralized markets in Web3?

Chapter 1: Disguised Power—The Paradox of Technological Decentralization and Power Centralization

The core innovation of modern Perp DEXs lies in smart contract execution, on-chain transparency, and user self-custody. While these technological strengths form the defensive shield of "decentralization," they often mask a deeper concentration of power.

1.1 The Power Concentration Trap: Implicit Monopoly in Economic Models and Governance Structures

Although projects claim to be community-governed, the initial allocation of tokens determines a centralized power structure from the start. Most governance tokens are concentrated in the hands of founding teams, early investors, and venture capitalists, reducing so-called "democratic governance" to a showcase for a handful of major stakeholders.

More critically, liquidity is the lifeblood of Perp DEXs, yet it remains highly monopolized by professional market makers and institutional LPs. Ordinary users struggle to compete in the "Matthew effect" of fee sharing and governance rewards, and the high cost of submitting proposals further excludes small investors from governance, making true democracy little more than an illusion.

Chapter 2: The Invisible Hand—Market Manipulation via Four Mechanisms

Centralized capital rarely attacks technical architecture directly. Instead, it achieves deep market and user control by establishing structurally unequal mechanisms.

2.1 Monopoly: Capital-Driven Oligopolistic Market Structure

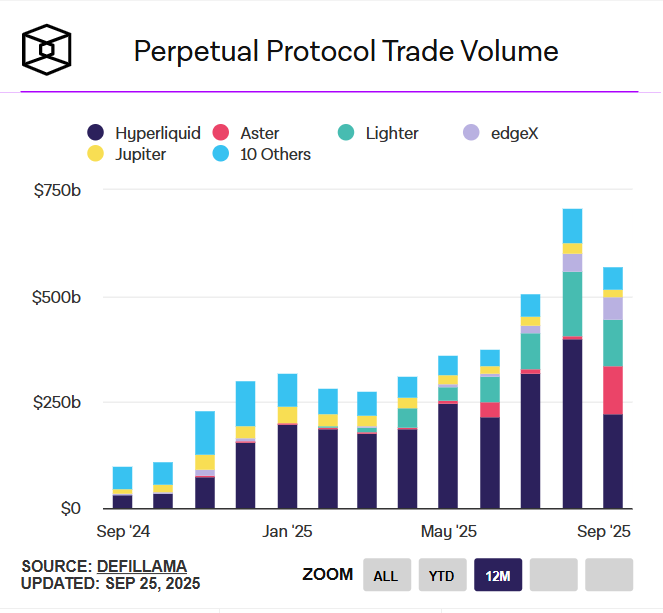

By 2025, the Perp DEX market is astonishingly concentrated: the top four platforms—Hyperliquid, Aster, Lighter, and edgeX—collectively control 84.1% of market share.

This extreme concentration is not the result of natural market selection, but of capital-driven filtering and favoritism. For example, Aster captured nearly 10% of market share shortly after its TGE—a "parachute success" that proves capital and connections matter far more than technological innovation. Major platforms leverage scale to attract more fees and resources, creating a positive feedback loop and nearly insurmountable liquidity barriers. In today's tightening funding environment, this oligopoly is becoming even more entrenched, leaving new projects with virtually no room to survive.

source: theblock

2.2 Intervention: Double Standards in Governance and Interest Trade-offs

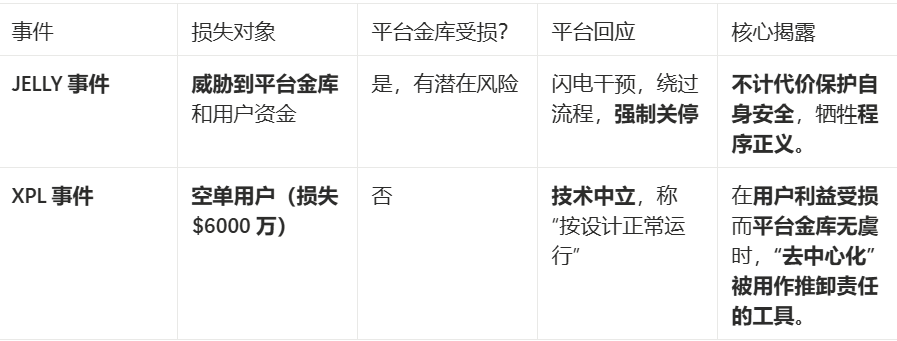

The most striking manifestation of centralized governance is selective intervention. Two classic Hyperliquid cases clearly illustrate how procedural justice collapses when platform interests are at stake.

The platform doesn’t decide whether to intervene, but rather when to exercise centralized authority to protect its own interests. Tens of millions in user losses are dismissed as "market risk," while potential platform losses trigger emergency measures that override decentralization principles.

JELLY Incident—Rapid Intervention: When the JELLY token experienced severe price manipulation, threatening platform liquidity and user vault funds, Hyperliquid responded at lightning speed. Validator nodes quickly reached emergency consensus, bypassed all normal governance, initiated an on-chain vote, and forcibly closed profitable orders, directly shutting down manipulative accounts. The platform claimed this was a necessary action to protect user vaults, demonstrating exceptional execution efficiency.

XPL Incident—Indifferent Response: In sharp contrast, when manipulators orchestrated a short squeeze in the XPL market, earning over $46 million and causing $60 million in losses to short position users (far exceeding the $11 million loss in the JELLY case), Hyperliquid’s response was entirely different.

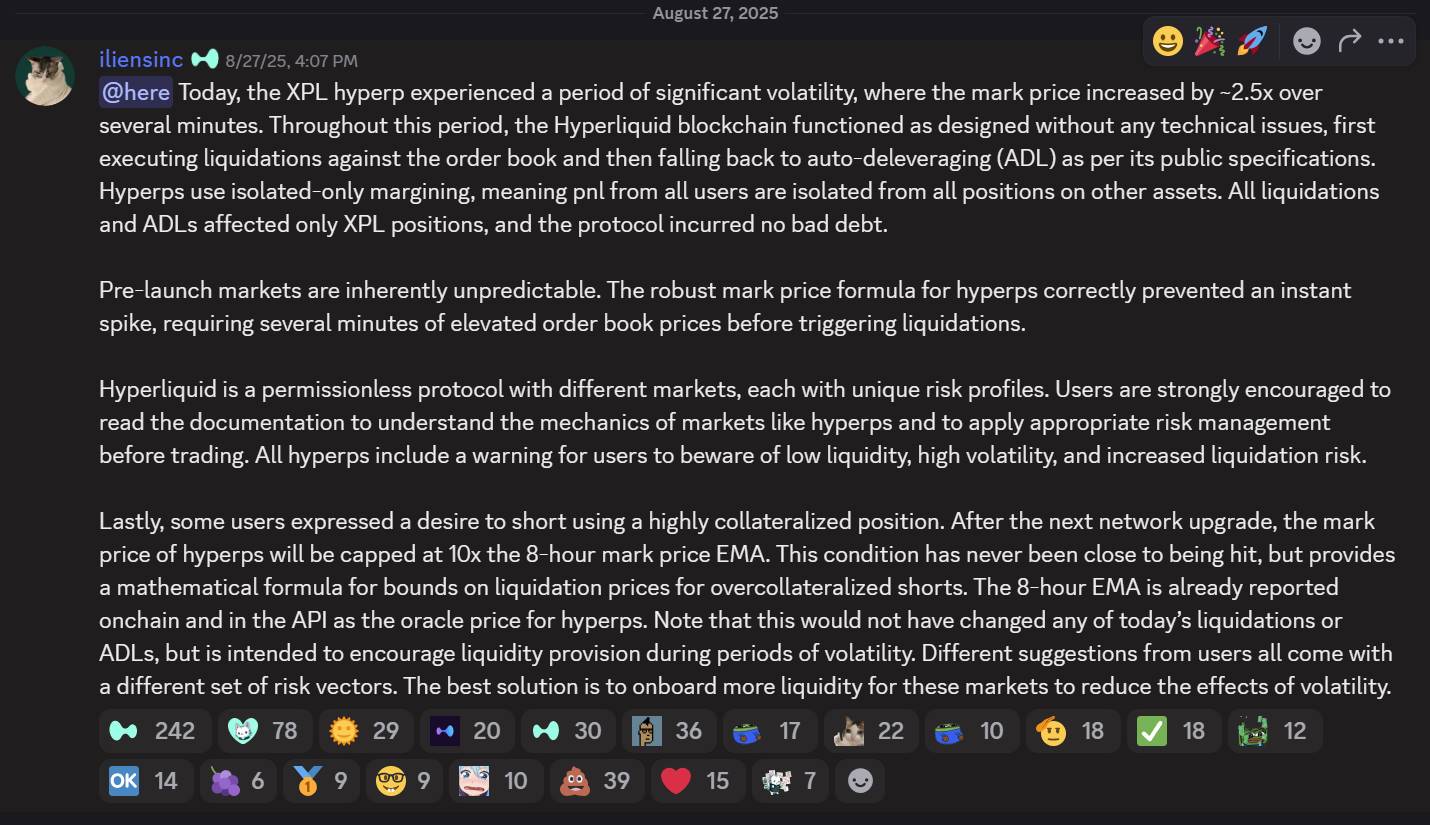

source: hyperliquid discord

On its official Discord, the platform stated: "The XPL market experienced extreme volatility, but the Hyperliquid blockchain operated as designed with no technical issues. Liquidation and auto-deleveraging mechanisms were executed according to the public protocol, and since the platform uses a fully isolated margin system, this incident only affected XPL positions, and the protocol incurred no bad debt."

In this capital-driven spectacle, manipulators exploited Hyperliquid’s structural vulnerabilities:

- On-chain transparency enabled precise calculations of required capital and expected outcomes;

- An isolated oracle system allowed XPL on Hyperliquid to use an independent price feed, letting manipulators move prices within this "walled garden" without external exchange pressures;

- They targeted an unlisted "paper contract" token, so there was no spot settlement pressure;

- They picked the weakest liquidity window for the attack.

Double Standard Logic: This disparate handling exposes a clear formula—when the JELLY incident threatened the platform vault, Hyperliquid intervened; when the XPL incident only hurt users and not the platform vault, it was ignored. Platform fund safety always comes first, and decentralization is only honored when it doesn’t threaten core interests. User losses of $60 million are dismissed as "market risk," while platform losses prompt urgent action, even at the expense of decentralization.

2.3 Structure: Protocol-Level Privileges and Liquidity Monopoly

source: hyperliquid

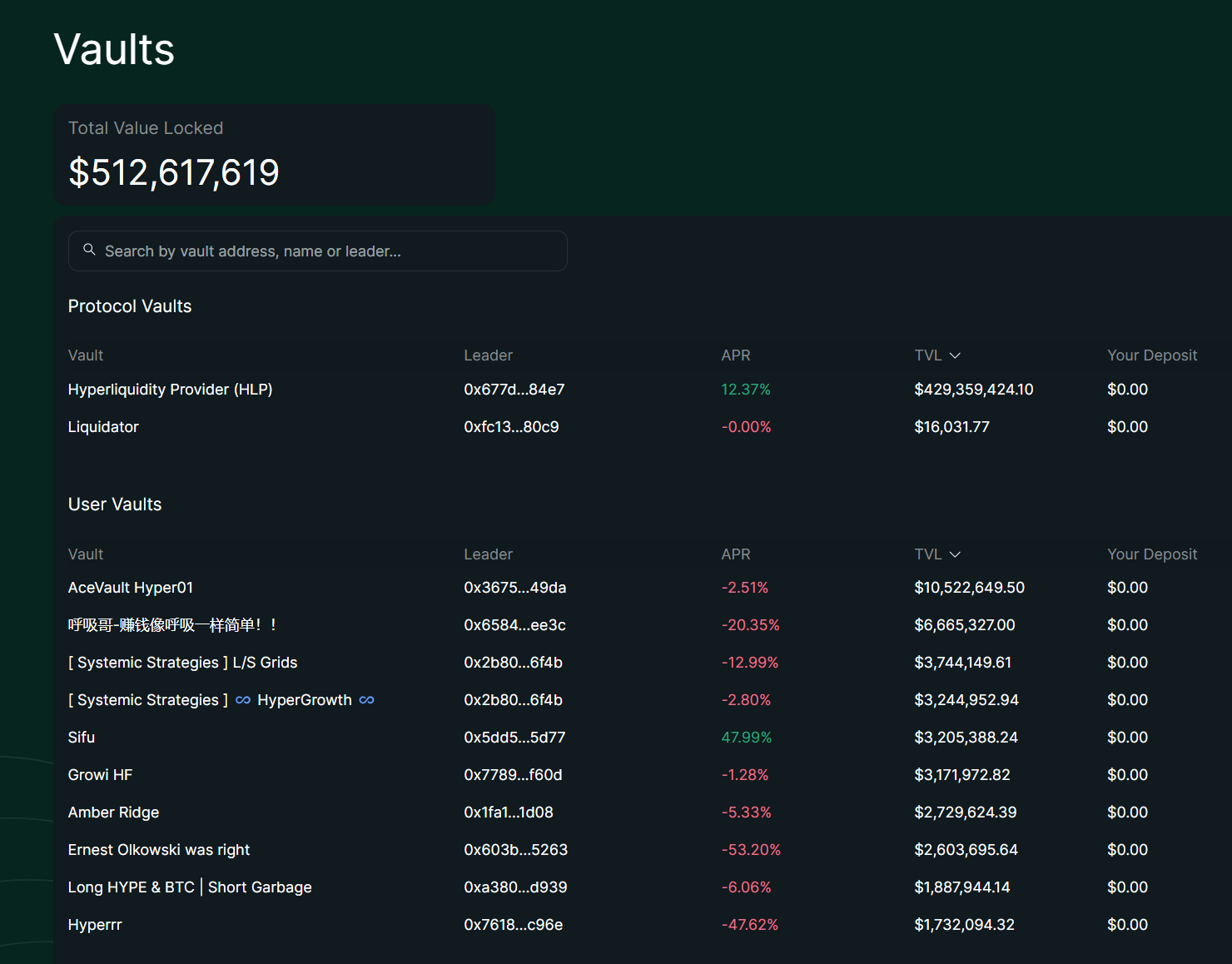

According to the latest data, Hyperliquid’s total TVL has reached $512 million, with its protocol vault (HLP) holding $429 million—84% of the total—making it a "shadow central bank" or privileged class. In contrast, all User Vaults combined hold only $83 million, spread across hundreds of independent vaults.

Deep Dive: HLP System Advantages

- Monopolistic Liquidation: HLP has exclusive liquidation rights. When leveraged positions are liquidated and the order book can’t fully absorb them, HLP takes on the remaining positions at roughly 2x leverage and unwinds them via market making. This prevents cascading liquidations and allocates profits directly to HLP holders. User Vaults cannot participate in backup liquidations and are limited to custom trading strategies.

- Structural Fee Advantage: HLP receives a fixed 45% of platform trading fees, providing stable, volume-correlated passive income. In the first half of 2025, HLP captured a major share of platform income, while User Vaults depend solely on leader strategy performance and have no fixed share.

- Collective Risk Buffer: HLP pools over $400 million to share risk, with off-chain strategy optimization further reducing volatility. HLP’s volatility is much lower than BTC’s 45%, maintaining relative stability in all markets, with an annualized return of about 51%. User Vaults are vulnerable to single-strategy failures.

Systemic Constraints on User Vaults

- Information Disadvantage: User Vault leaders have limited access to market data and cannot access order flow or microstructure info like HLP. HLP’s protocol-level integration allows real-time data feeds, while User Vaults rely on on-chain queries with higher latency.

- Execution Gap: In Hyperliquid’s sub-second environment, User Vaults suffer from latency, especially in high-frequency trading or arbitrage. Leaders can adjust off-chain, but on-chain execution slows response, while HLP’s infrastructure priority captures more opportunities.

- Cost Pressure: Leaders charge 10–20% management/performance fees, directly impacting depositor returns and increasing operational pressure, especially in volatile markets. HLP has no such fees—returns are shared collectively.

- Transparency Constraints: On-chain execution makes all positions and trades public, improving auditability but limiting strategy flexibility and confidentiality. HLP’s "transparent opacity" (off-chain strategy + on-chain positions) strikes a better balance.

These systemic advantages make HLP the platform’s "default market maker," with 84% of total TVL. User Vault constraints result in most 30-day PnLs being negative (from -2.51% to -53.20%), and only 16% of TVL. This structural gap is evident not only in returns but also in the implicit inequality between protocol-level and user-level participants.

2.4 Infiltration: The "Rebranding" Game of CEX Capital and Ecosystem Predation

Binance Empire’s Expanding Reach

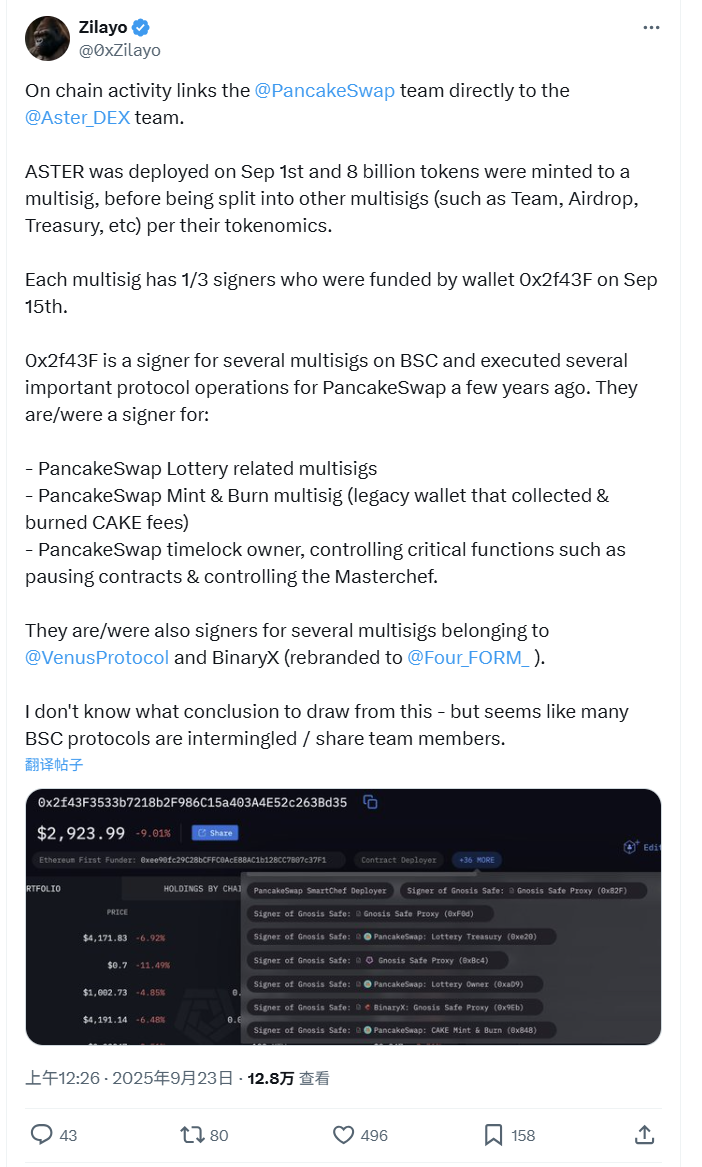

source: @ 0xZilayo & @ awesomeHunter_z X

On-chain investigators @0xZilayo and @awesomeHunter_z have revealed:

The recent surge of aster and pancakeSwap is driven by the same operating team.

Core control wallet: 0x2f43F3533b7218b2F986C15a403A4E52c263Bd35

Network of control:

- Aster Treasury multisig contract: 0xEf0791f8dF081c7e6374EE6e9F4c3aBA7C1b1852

- PancakeSwap: Directly involved in CAKE token mint/burn

- Venus Protocol: BSC lending protocol multisig wallet controller

- Aster governance: Core functions like token deployment, airdrops, and team wallets

This is not just an "association," but the same team running multiple projects.

This also explains why CZ has been actively promoting Aster: it’s not merely an investment endorsement, but internal product marketing. Aster is essentially a Binance-affiliated project, and CZ’s tweets are a "left hand to right hand" marketing play.

Personnel Network: Binance Executive Project Assignments

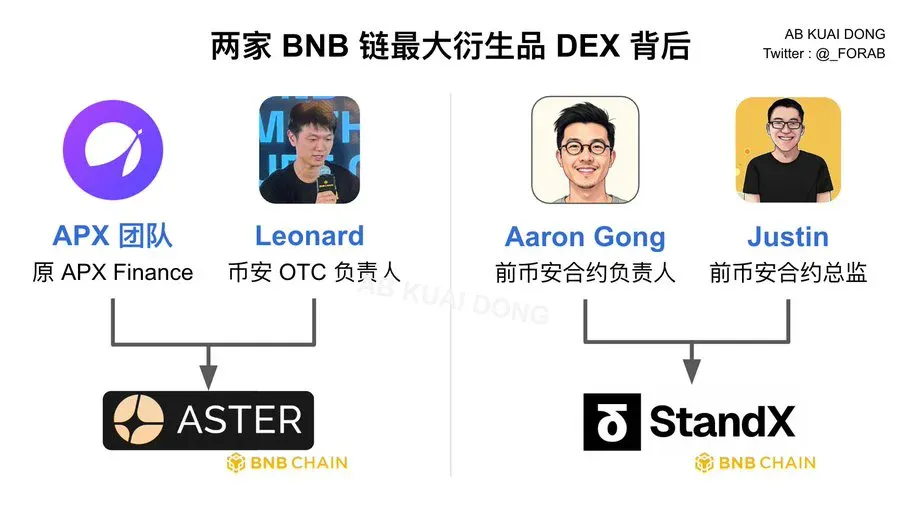

source: @ _FORAB X

Aster team:

- APX Team: Former APX Finance core members

- Leonard: Binance OTC head, responsible for block trades and institutional clients

StandX team:

- Aaron Gong: Former Binance derivatives head

- Justin: Former Binance derivatives director

Dual Monopoly Design:

- Product differentiation: Aster focuses on cross-chain diversity, StandX on BNB ecosystem

- Risk diversification: Different legal entities and architectures mitigate regulatory risk

- Market coverage: Regardless of which succeeds, Binance benefits

Other CEXs’ Strategic Moves

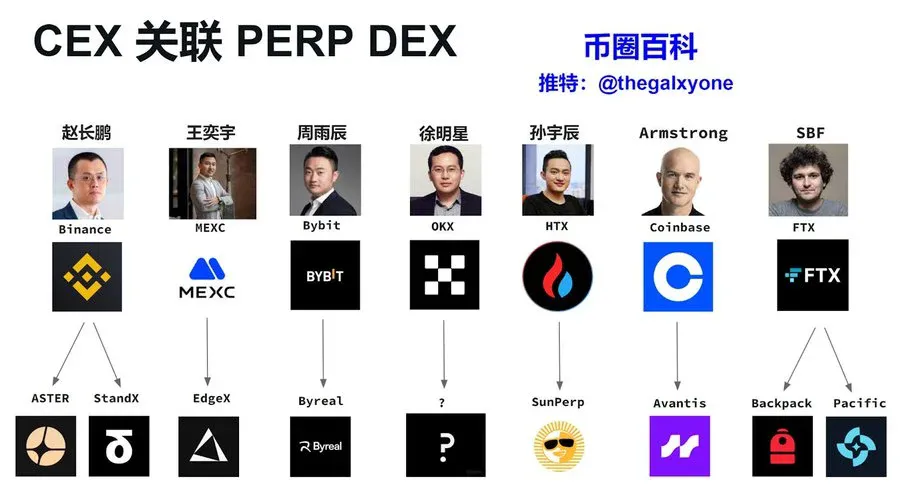

source: X Crypto Encyclopedia @thegalxyone

Perp DEX strategies of major CEXs:

- MEXC → EdgeX: Under Wang Yiyu, MEXC is known for small-cap listings. EdgeX focuses on ZK-Rollup perpetual DEX, echoing MEXC’s agile listing. EDGEX is a spin-off by former executives, with ongoing close ties.

- Bybit → Byreal: Bybit has deep derivatives experience; Byreal inherits Bybit’s perpetual contract technology, using "decentralization" as a regulatory shield.

- HTX → SunPerp: Justin Sun’s HTX (formerly Huobi) leverages the TRON ecosystem; SunPerp uses TRON’s low-cost advantage, reflecting Sun’s "ecosystem closed loop" strategy.

- Coinbase → Avantis: Led by Armstrong, Coinbase represents US compliance; Avantis focuses on RWA perpetuals, aligning with US regulations and leveraging the Base chain for tech-compliance balance.

- FTX → Backpack & Pacific: Despite SBF’s downfall, FTX’s technical DNA persists. Former team members have launched multiple projects, with Backpack and Pacific possibly inheriting FTX’s tech assets.

CEX Motivations for Perp DEX Expansion

- CEX Strategy Map: From Binance’s investments in Aster and StandX, to MEXC’s EdgeX incubation, and Coinbase’s Avantis deployment, all CEXs share core motives: regulatory hedging (via "decentralization"), defending market share, and capturing the next DeFi innovation wave.

- Harsh Reality: CEXs use shared tech, unified market-making, and cross-platform user migration to keep users within the same capital ecosystem. The "decentralization" revolution may simply be a "capital rebranding" exercise by traditional centralized players.

Chapter 3: Ending the Ideological Debate

"Technological decentralization, power centralization" is now the Perp DEX industry’s new normal.

Leading platforms may adhere to DeFi principles in technical architecture, but in practice, they are deeply controlled by CEX capital and a handful of oligarchs. The decentralization narrative is used as a tool to achieve both operational efficiency and regulatory avoidance.

The key to success in the Perp DEX sector is no longer ideological purity, but the ability to balance decentralized frameworks with centralized operational efficiency, delivering a user experience rivaling that of CEXs. For most users, trading speed, capital efficiency, and smooth execution now outweigh the pursuit of pure decentralization ideals.

As a result, future competition will center on who can build sustainable value capture mechanisms while executing efficient centralized capital strategies under the banner of "decentralization."

Statement:

- This article is republished from [TechFlow], with copyright belonging to the original author [WolfDAO]. For any concerns regarding this republication, please contact the Gate Learn team for prompt handling in accordance with relevant procedures.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Unless Gate is explicitly mentioned, do not copy, distribute, or plagiarize the translated content.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Top 10 NFT Data Platforms Overview

Sui: How are users leveraging its speed, security, & scalability?

7 Analysis Tools for Understanding NFTs