How does centralized capital exert control over decentralized markets?

Chapter 1: Disguised Power—The Paradox of Technological Decentralization and Power Centralization

The core innovation of modern Perp DEX platforms centers on smart contract execution, on-chain transparency, and user self-custody. While these technical strengths create a robust "decentralized" defense, they often mask a deeper concentration of power.

1.1 The Power Concentration Trap: Hidden Monopolies in Economic Models and Governance Structures

Despite claims of community governance, token allocation cements a centralized power structure from the outset. The majority of governance tokens are held by founding teams, early investors, and VCs, reducing so-called "democratic governance" to a performance for a select few major stakeholders.

Even more critically, liquidity is the lifeblood of Perp DEX platforms, yet it is heavily monopolized by professional market makers and institutional LPs. Regular users find it nearly impossible to compete in the "Matthew Effect" of fee sharing and governance rewards, while high proposal costs further exclude smaller investors from governance, rendering the notion of democracy largely illusory.

Chapter 2: The Invisible Hand—Market Manipulation Through Four Mechanisms

Centralized capital does not directly attack technical architecture; instead, it achieves deep control over markets and users by establishing structurally unequal mechanisms.

2.1 Monopoly: Capital-Driven Oligopoly Market Structure

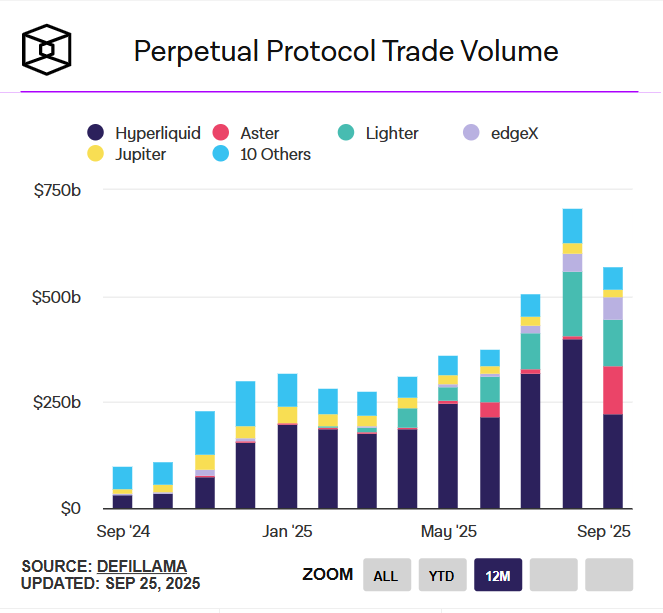

By 2025, the Perp DEX market demonstrates striking concentration: the top four platforms (Hyperliquid, Aster, Lighter, edgeX) collectively control as much as 84.1% of total market share.

This extreme concentration is not a product of natural market selection, but rather the outcome of capital-driven screening and favoritism. For example, Aster secured nearly 10% market share shortly after its TGE, with its "parachute success" underscoring how background and capital far outweigh technological innovation. Major platforms leverage their scale to attract more fees and resources, creating a positive feedback loop and nearly insurmountable liquidity barriers. In a tightening funding environment, this oligopoly becomes even more entrenched, leaving new projects with little room for survival.

source: theblock

2.2 Intervention: Double Standards in Governance and Interest Alignment

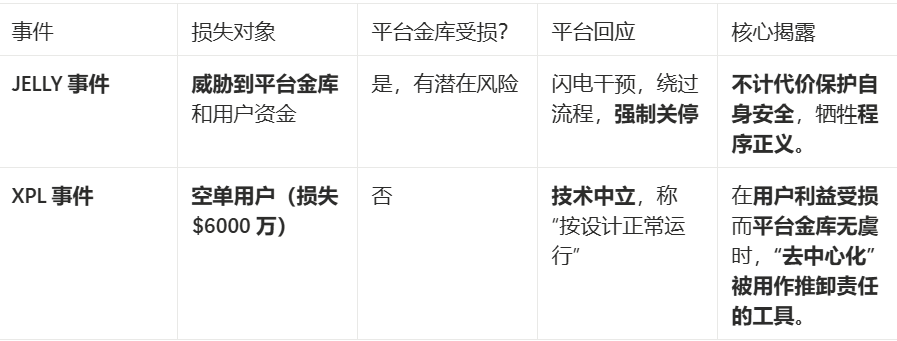

The most severe manifestation of centralized governance is selective intervention. Two classic cases from Hyperliquid clearly reveal how procedural justice collapses when platform interests are at stake.

The platform does not merely choose whether to intervene, but exercises centralized authority selectively to safeguard its own interests. User losses amounting to tens of millions of dollars are dismissed as "market risk," while potential platform losses prompt emergency interventions that undermine decentralization principles.

JELLY Incident—Rapid Intervention: When the JELLY token suffered significant price manipulation, directly threatening platform liquidity and user vault funds, Hyperliquid responded with remarkable speed. Validator nodes quickly reached emergency consensus, bypassed all standard governance processes, initiated an on-chain vote, and forcibly closed profitable orders, directly shutting down the manipulating accounts. The platform explained that this was a necessary action to protect user vault funds, and the entire process showcased extraordinary execution efficiency.

XPL Incident—Apathetic Response: In stark contrast, when manipulators orchestrated a short squeeze in the XPL market, profiting over $46 million and causing short position users to lose approximately $60 million (far exceeding the $11 million loss in the JELLY incident), Hyperliquid's response was entirely different.

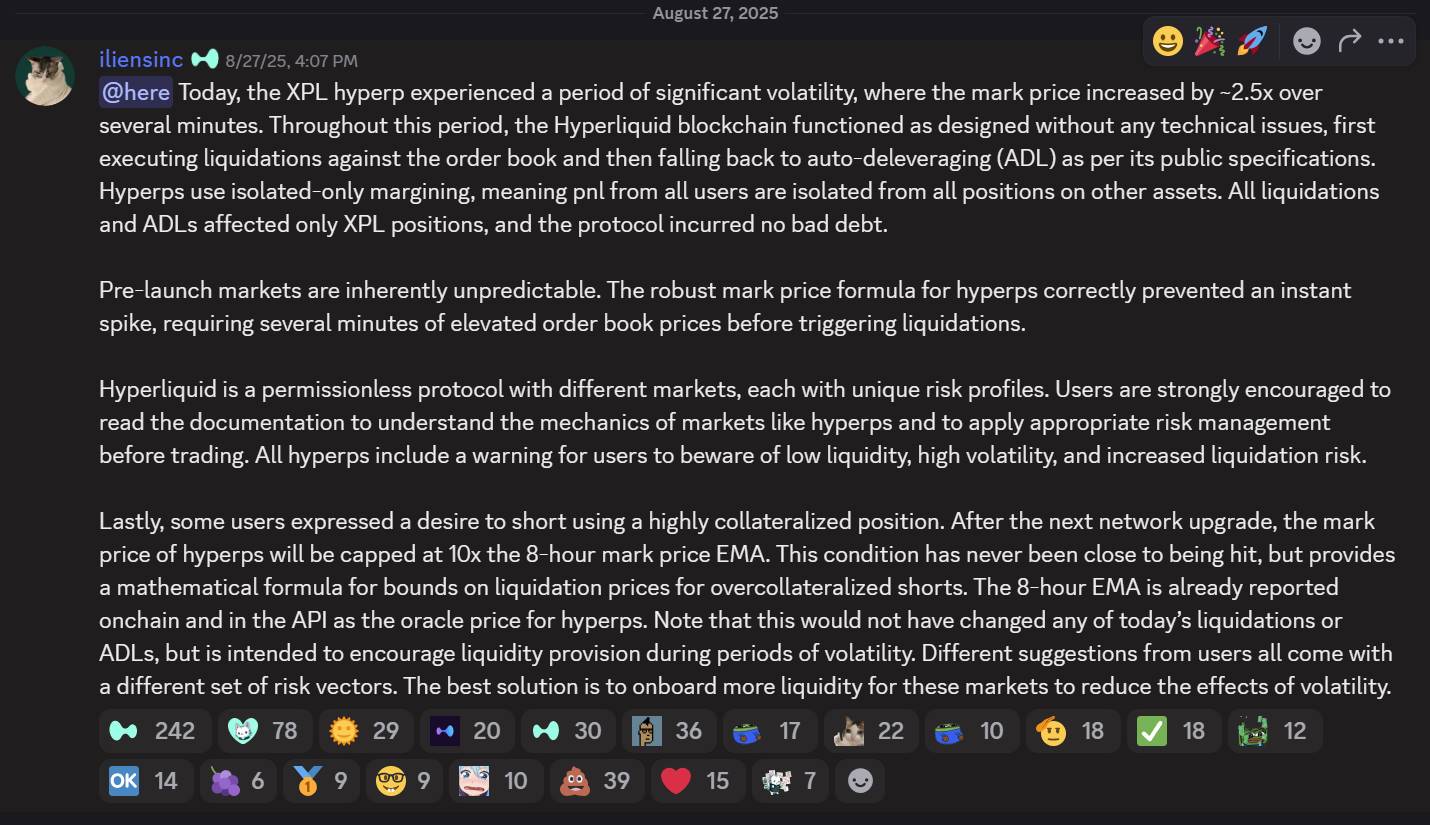

source: hyperliquid discord

The platform responded on its official Discord: "The XPL market experienced extreme volatility, but the Hyperliquid blockchain operated as designed, with no technical issues. Liquidation and auto-deleveraging mechanisms functioned according to the public protocol, and since the platform uses a fully isolated margin system, this event only affected XPL positions, with no bad debt incurred by the protocol."

In this capital-driven feast, manipulators skillfully exploited Hyperliquid's structural vulnerabilities:

- First, on-chain transparency allowed them to precisely calculate required capital and expected outcomes;

- Second, the isolated oracle system meant XPL on Hyperliquid used an independent price feed, allowing manipulators to control prices within this "fortress" without external exchange price pressure;

- Third, they chose an unlisted "paper contract" token, avoiding spot settlement constraints;

- Fourth, they targeted the weakest liquidity periods.

Double Standard Logic: This starkly different treatment exposes a clear formula: the JELLY incident threatened the platform vault, triggering intervention; the XPL incident harmed only users while the platform vault remained unaffected, so it was ignored. Protecting platform funds is always the top priority, while decentralization principles are mere window dressing unless core interests are at risk. User losses of $60 million are dismissed as "market risk," but potential platform losses prompt emergency rescues at the expense of decentralization.

2.3 Structure: Protocol-Level Privileges and Liquidity Monopoly

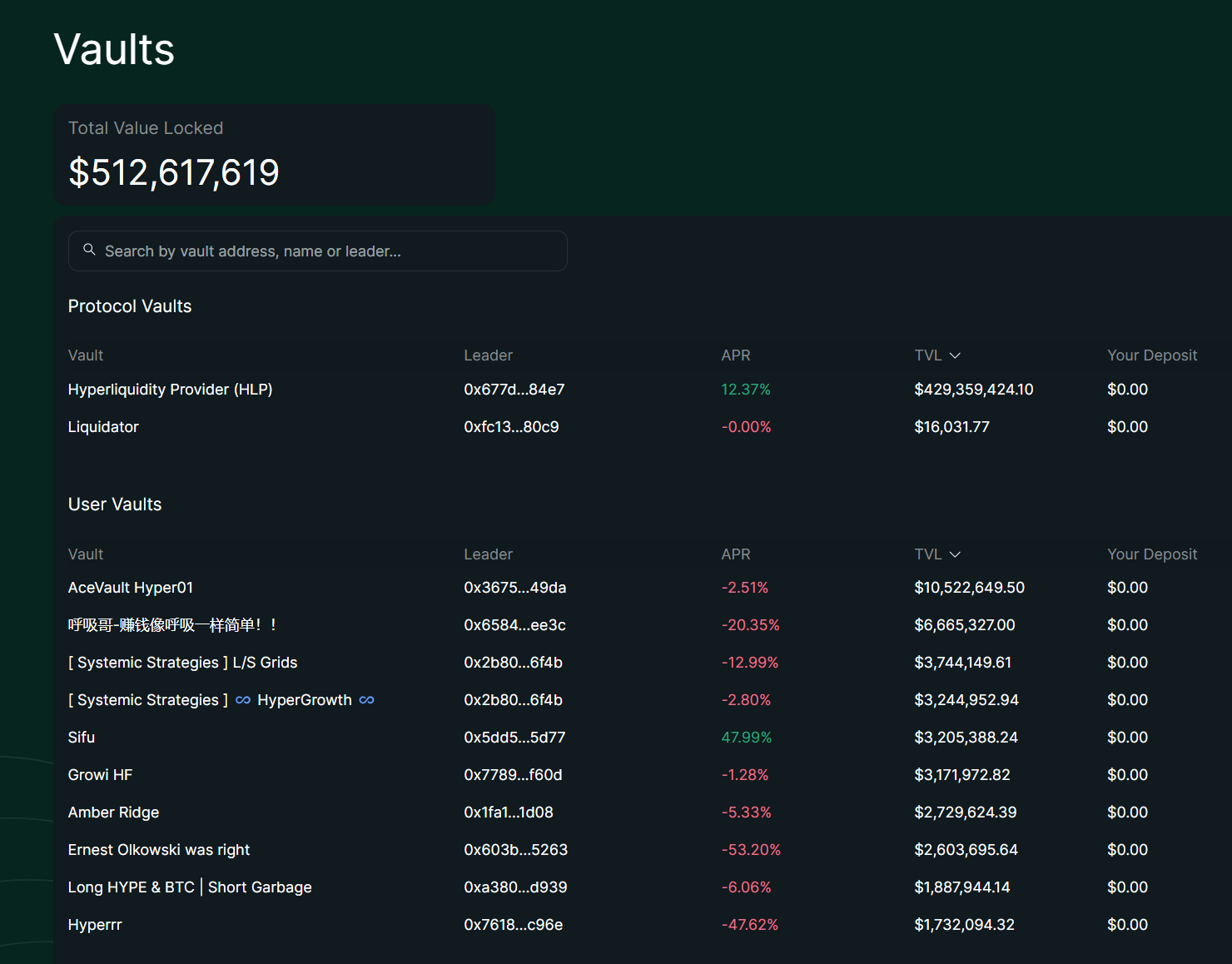

source: hyperliquid

According to the latest data, Hyperliquid's total TVL reached $512 million, with the protocol vault HLP accounting for $429 million—84% of the total. HLP has become the protocol's "shadow central bank" or "privileged class." By contrast, all User Vaults combined hold about $83 million, distributed across hundreds of independent vaults.

Deep Dive: HLP System Advantages

- Monopoly on Liquidation Handling: HLP enjoys exclusive liquidation rights. When leveraged positions are liquidated and the order book cannot fully match, HLP absorbs the remaining positions at roughly 2x leverage and gradually unwinds them via market-making strategies. This prevents platform-wide cascading liquidations and distributes liquidation profits directly to HLP holders. User Vaults, in contrast, cannot participate in backstop liquidations and are limited to custom trading strategies.

- Structural Fee-Sharing Advantage: HLP takes a fixed 45% cut of platform trading fees, providing stable, volume-correlated passive income. In H1 2025, HLP captured a major share of platform revenue through this mechanism, while User Vaults depend solely on Leader strategy performance, with no fixed share rights.

- Collective Risk Buffer: HLP pools over $400 million in collective capital, with off-chain strategy optimization further reducing volatility. HLP's volatility is significantly lower than BTC's 45%, maintaining relative stability in both bull and bear markets, with an annualized yield of about 51%. User Vaults are more vulnerable to single-strategy failures.

Systemic Constraints on User Vaults

- Information Access Disadvantage: User Vault Leaders have limited market data access and cannot prioritize order flow or microstructure data like HLP. HLP's protocol-level integration enables real-time data feeds, while User Vaults rely on on-chain queries, making them prone to latency.

- Execution Efficiency Gap: In Hyperliquid's sub-second environment, User Vaults face significant latency, especially in high-frequency trading or arbitrage. While Leaders can make off-chain adjustments, on-chain execution requirements limit response speed, making it easier to miss opportunities compared to HLP's infrastructure priority.

- Profit Pressure from Cost Structure: Leaders charge a 10–20% management/performance fee, directly impacting depositor returns. This increases operational strain, especially in volatile markets, while HLP has no such fees and shares collective PnL only.

- Strategy Limitations from Transparency: On-chain execution requires all positions and trades to be public, enhancing auditability but limiting strategy flexibility and confidentiality. HLP's "transparent opacity" (off-chain strategies + on-chain positions) better balances both needs.

These systemic advantages make HLP the platform's "default market maker," accounting for 84% of TVL. User Vault constraints result in most 30-day PnLs being negative (from -2.51% to -53.20%), with TVL representing just 16% of the total. This structural gap is evident not only in performance but also in the implicit inequality between protocol-level and user-level participants.

2.4 Infiltration: The "Rebranding" Game of CEX Capital and Ecosystem Capture

Binance Empire's Expanding Reach

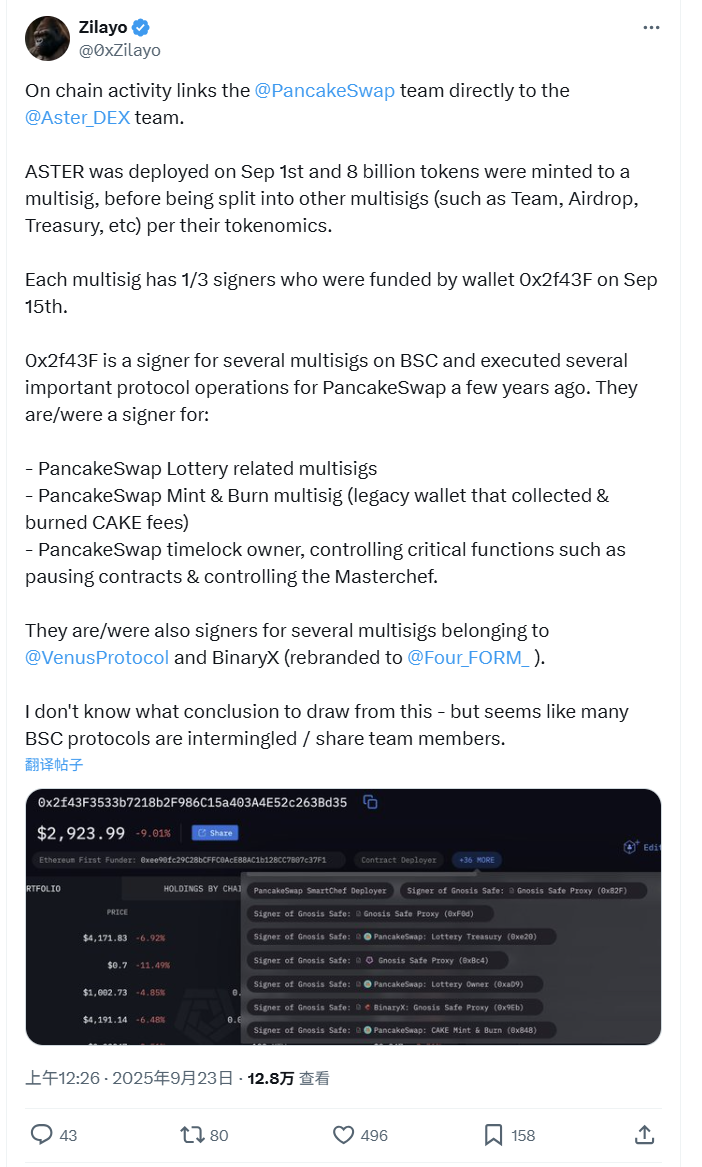

source: @ 0xZilayo & @ awesomeHunter_z X

On-chain investigations by @ 0xZilayo and @ awesomeHunter_z reveal:

The recent surge of Aster and PancakeSwap is driven by the same operating team.

Core controlling wallet: 0x2f43F3533b7218b2F986C15a403A4E52c263Bd35

Scope of control:

- Aster Treasury multisig: 0xEf0791f8dF081c7e6374EE6e9F4c3aBA7C1b1852

- PancakeSwap: direct involvement in CAKE token mint/burn

- Venus Protocol: BSC lending protocol multisig controller

- Aster governance: token deployment, airdrops, team wallets, and other core operations

This is no longer mere "association," but different projects run by the same team.

This also explains CZ's recent public support for Aster: it's not just investment endorsement, but direct promotion of his own product. In essence, Aster is a Binance-affiliated internal project, and CZ's tweets are a "left hand to right hand" marketing maneuver.

Personnel Network: Binance Executive Project Assignments

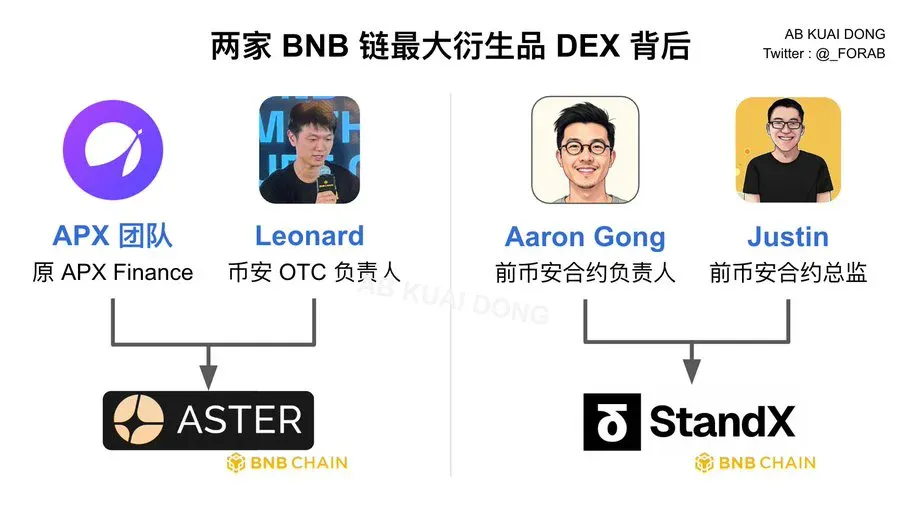

source: @ _FORAB X

Aster team:

- APX team: core members from former APX Finance

- Leonard: Binance OTC head, responsible for block trades and institutional clients

StandX team:

- Aaron Gong: former Binance contracts head

- Justin: former Binance contracts director

Dual Monopoly—Precision Design:

- Product differentiation: Aster focuses on cross-chain diversity, StandX specializes in BNB ecosystem depth

- Risk diversification: different legal entities and technical architectures reduce regulatory risk

- Market coverage: whichever succeeds, Binance is the ultimate beneficiary

Other CEXs' Strategic Deployments

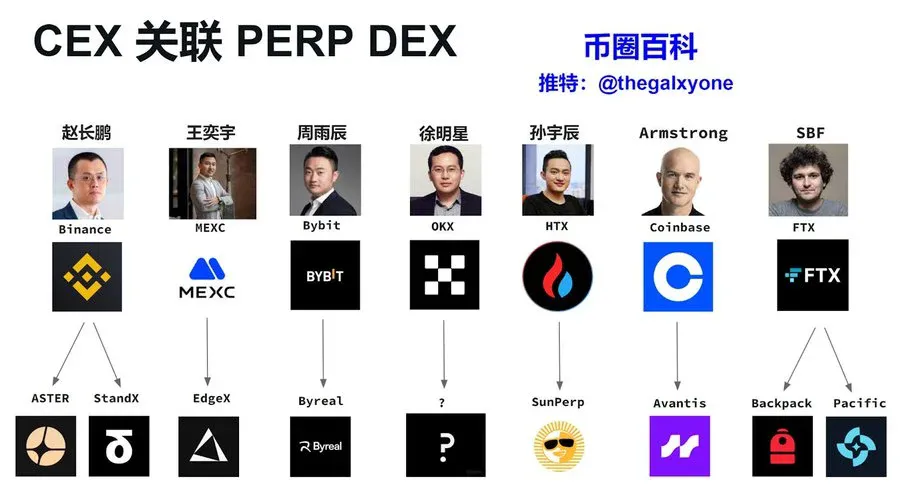

source: X Crypto Encyclopedia @ thegalxyone

Perp DEX deployment strategies by major CEXs:

- MEXC → EdgeX: Under Wang Yiyu, MEXC is known as the "king of small-cap tokens." EdgeX focuses on ZK-Rollup perpetual DEX, aligning with MEXC's flexible listing strategy. EDGEX is a startup by former executives, with both sides maintaining close ties.

- Bybit → Byreal: Bybit, a derivatives trading leader, launched Byreal to leverage its perpetual contract expertise, using "decentralization" as regulatory cover.

- HTX → SunPerp: Justin Sun's HTX (formerly Huobi) expands via the TRON ecosystem. SunPerp leverages TRON's low-cost advantage, reflecting Sun's "ecosystem closed loop" strategy.

- Coinbase → Avantis: Under Armstrong, Coinbase represents the US compliance route. Avantis focuses on RWA perpetual contracts, aligns with US regulatory requirements, and achieves tech-compliance balance via the Base chain.

- FTX → Backpack & Pacific: Despite SBF's downfall, FTX's technical DNA persists. Former FTX teams have branched into multiple projects, with Backpack and Pacific likely inheriting some FTX tech assets.

CEX Motives for Perp DEX Expansion

- CEX Strategic Map: From Binance's investments in Aster and StandX, to MEXC's incubation of EdgeX, and Coinbase's deployment of Avantis, all CEXs share core motives: regulatory risk mitigation (via "decentralization" branding), defending market share, and capturing the next wave of DeFi innovation.

- Harsh Reality: CEXs leverage shared technical resources, unified market-making networks, and cross-platform user migration to move users from CEXs to affiliated Perp DEXs, keeping them within the same capital-controlled ecosystem. The so-called "decentralization" revolution may simply be a "capital rebranding" exercise by traditional centralized powers.

Chapter 3: The End of the Ideological Debate

"Technological decentralization, power centralization" has become the new industry norm for Perp DEX platforms.

While top platforms adhere to DeFi principles in their technical architecture, in practice they are deeply controlled by CEX capital and a handful of oligarchs. The decentralization narrative is used as a tool to achieve both operational efficiency and regulatory avoidance.

The key to winning in the Perp DEX sector is no longer ideological purity, but the ability to balance decentralized infrastructure with centralized operational efficiency to deliver a user experience rivaling that of CEXs. For mainstream users, trading speed, capital efficiency, and seamless execution now outweigh the pursuit of pure decentralization ideals.

As a result, future competition will revolve around who can build sustainable value capture mechanisms while continuing to execute efficient centralized capital strategies under the guise of "decentralization."

Statement:

- This article is reprinted from [TechFlow], with copyright belonging to the original author [WolfDAO]. If you have any objections to this reprint, please contact the Gate Learn team, and we will address your concerns promptly in accordance with relevant procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Without explicit mention of Gate, copying, distributing, or plagiarizing the translated content is strictly prohibited.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape