Stablecoins are all the rage, but can Bitcoin still fulfill its “payment dream”?

With the GENIUS Act solidifying the status of stablecoins backed by U.S. Treasuries, Bitcoin’s decentralized network positions it as the leading blockchain for global adoption—especially as the world contends with declining demand for U.S. bonds in an increasingly multipolar environment.

As the era transitions from a U.S.-led unipolar order to a multipolar regime driven by BRICS nations, the dollar faces historic pressure from falling bond demand and rising debt costs. The GENIUS Act, enacted in July 2025, represents a bold U.S. strategy: formal legal recognition of stablecoins backed by U.S. Treasuries, thereby unlocking vast international demand for American bonds.

The blockchains supporting these stablecoins will shape the global economy for generations. Bitcoin’s unmatched decentralization, the privacy features of the Lightning Network, and formidable security make it the optimal foundation to drive the digital dollar revolution—ensuring minimal conversion costs as fiat currencies inevitably weaken. This article examines why the dollar must—and will—be digitized via blockchain, and why Bitcoin must serve as its operational rail for the U.S. economy’s soft landing as its global dominance recedes.

The End of the Unipolar World

The world is moving from a unipolar order—where the U.S. could dictate markets and global conflicts—to a multipolar system that allows Eastern alliances to organize independently of U.S. foreign policy. The BRICS bloc, comprised of Brazil, Russia, China, and India, epitomizes this shift. The rise of BRICS is driving a major geopolitical realignment, directly challenging the dollar’s dominance.

Several seemingly isolated events signal this restructuring, such as the U.S.-Saudi military alliance. The U.S. no longer defends the petrodollar pact, which once mandated Saudi oil sales exclusively in dollars in exchange for American military protection. Once central to dollar demand and U.S. economic clout since the 1970s, the petrodollar mechanism has unraveled in recent years—at least since the Ukraine war began—with Saudi Arabia now accepting other currencies for oil trade.

Weakness in the U.S. Bond Market

Another critical data point in this geopolitical transformation is the mounting weakness in the U.S. bond market, as skepticism grows about the government’s long-term creditworthiness. Some fear domestic instability; others question if the government can adapt to high-tech disruption and the BRICS ascent.

Elon Musk is reportedly among the doubters. Recently, he spent months collaborating with the Trump administration to overhaul the federal government and national finances via the Office of Government Efficiency, only to abruptly exit politics in May.

At a recent summit, Musk surprised the public, stating, “I haven’t been to Washington since May. The government is basically beyond repair. I admire David Sacks’ noble efforts… but in the end, if you look at our national debt… if AI and robotics can’t solve our debt problem, we’re finished.”

If even Musk can’t save the U.S. government from financial calamity, who can?

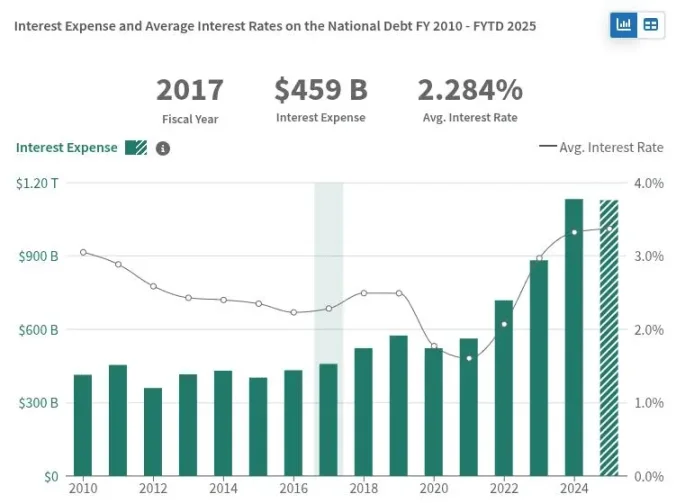

This uncertainty is reflected in weak demand for long-term U.S. bonds, forcing the Treasury to raise rates to attract investors. The 30-year Treasury yield now stands at 4.75%—a 17-year high. According to Reuters, demand at long-bond auctions like the 30-year Treasury has dropped, with 2025 turnout described as “disappointing.”

This weakening demand for long-term U.S. bonds has profound economic consequences. The Treasury must offer higher yields, raising the government’s interest payments—which now approach $1 trillion annually, exceeding the nation’s military budget.

If the U.S. can’t find enough buyers for future debt, it may struggle to meet immediate obligations and rely on the Federal Reserve to buy its bonds—expanding the Fed’s balance sheet and money supply. This complex dynamic almost certainly leads to dollar inflation, further weakening the U.S. economy.

How Sanctions Disrupted the Bond Market

The U.S. bond market took another hit in 2022, when the government weaponized its bond market against Russia following the Ukraine invasion. The U.S. froze Russia’s offshore Treasury reserves—funds earmarked for servicing sovereign debt to Western investors—and reportedly blocked Russia from repaying foreign bondholders.

A U.S. Treasury spokesperson confirmed at the time that these payments were no longer allowed.

“Today is Russia’s deadline to make another debt payment,” she said.

“Effective immediately, the Treasury will not permit any dollar debt payments from Russian government accounts at U.S. financial institutions. Russia must choose to exhaust its remaining dollar reserves or find new revenue sources—or default.”

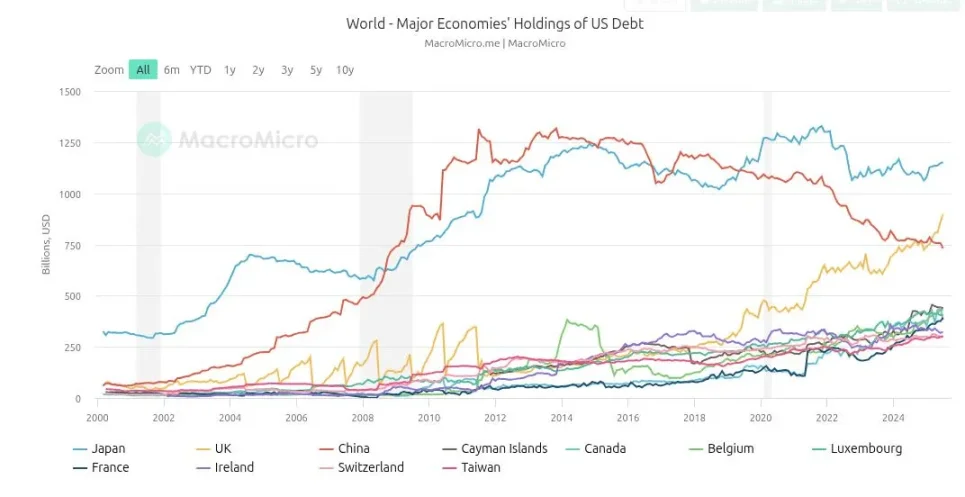

By leveraging its sanctions machinery, the U.S. transformed the bond market into a weapon against Russia. But sanctions cut both ways: since then, foreign demand for U.S. bonds has softened as nations not aligned with U.S. policy diversify risk. China led this retreat, with holdings peaking at $1.25 trillion in 2013 and dropping sharply since the Ukraine war—now nearing $750 billion.

While these events showcased the power of sanctions, they also eroded confidence in the bond market. Not only were Russian payments blocked—hurting investors as collateral damage—but freezing sovereign reserves sent a clear message: defy U.S. policy, and your bond market access vanishes.

The Trump administration moved away from sanctions as its primary tool, recognizing their harm to U.S. finance, and pivoted to tariffs. Results have been mixed; while the administration touts record tax revenue and private-sector infrastructure investment, Eastern collaboration via BRICS has accelerated.

Stablecoin Strategy Manual

As China reduced its U.S. bond holdings over the past decade, a new major buyer emerged. Tether, a fintech pioneer dating back to Bitcoin’s early days, now holds $171 billion in Treasuries—nearly one-fourth of China’s holdings and more than most other nations.

Tether, issuer of the world’s leading stablecoin USDT, boasts a $171 billion circulating market cap and reported $1 billion profit for Q1 2025. Its model is elegantly simple: buy short-term Treasuries, issue USDT tokens backed 1:1, and collect interest from the U.S. government. With just 100 employees at the year’s start, Tether is considered one of the world’s most profitable companies per capita.

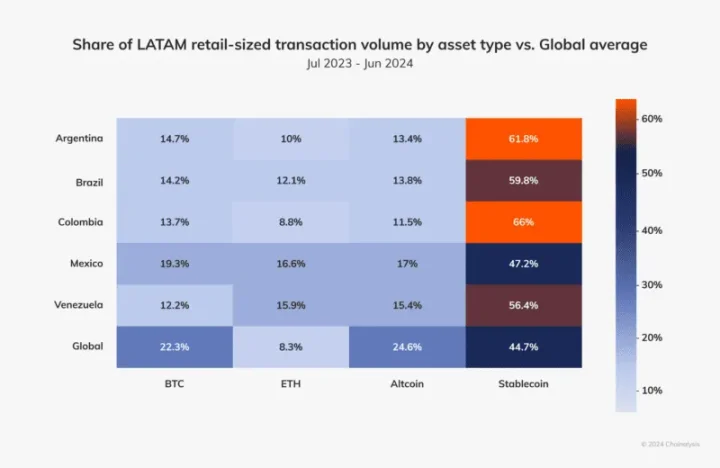

Circle, issuer of USDC—the second-largest stablecoin—holds nearly $50 billion in short-term Treasuries. Stablecoins are now used globally, especially in Latin America and developing countries, as alternatives to local fiat currencies suffering from inflation and capital controls far worse than the dollar.

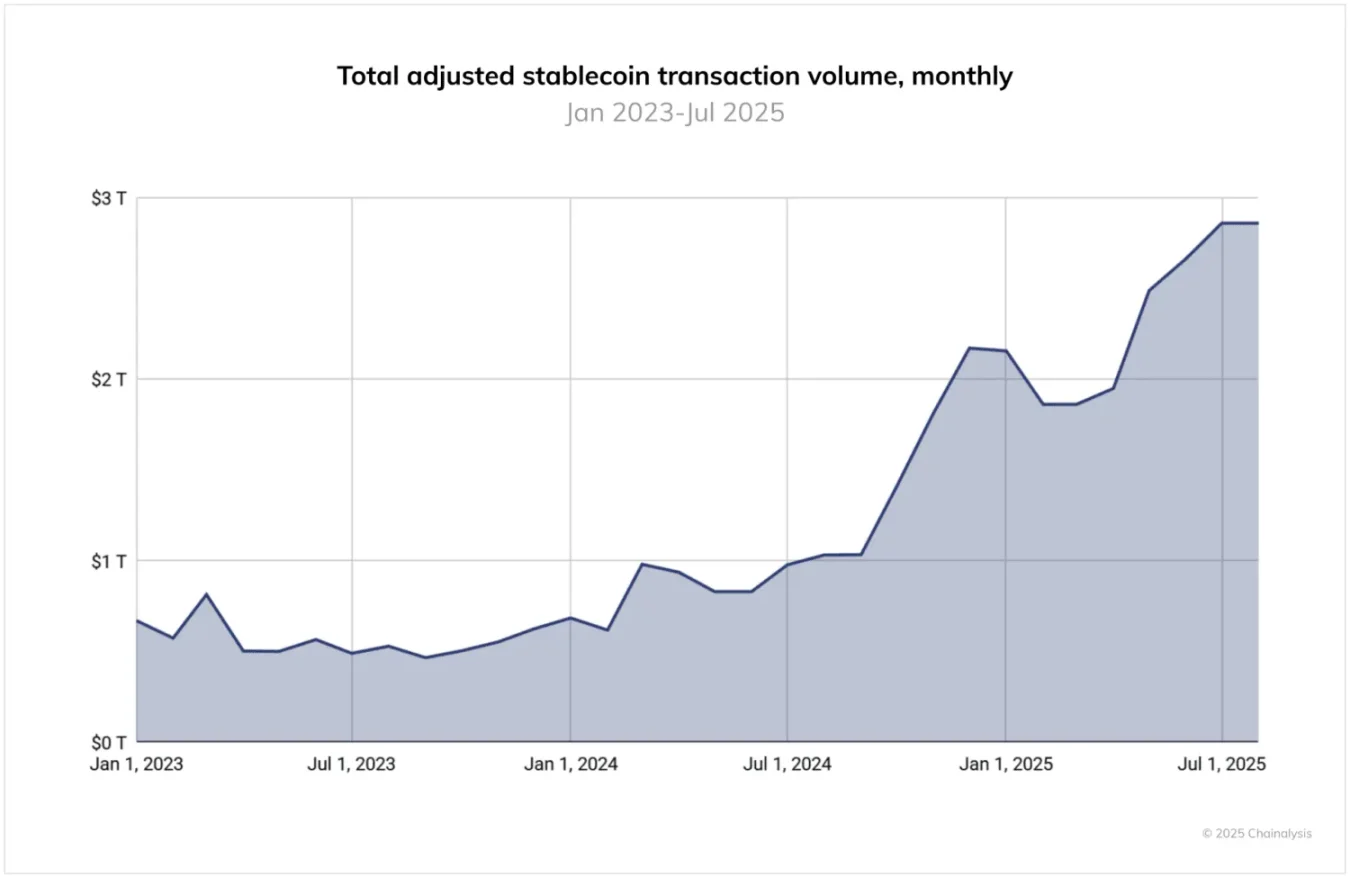

Stablecoin transaction volumes are no longer niche or experimental—they have hit trillions of dollars. A Chainalysis 2025 report notes: “Between June 2024 and June 2025, USDT processed over $1 trillion monthly, peaking at $1.14 trillion in January 2025. USDC volumes ranged from $1.24 trillion to $3.29 trillion monthly. These figures highlight Tether and USDC’s ongoing centrality in crypto infrastructure, especially for cross-border payments and institutional activity.”

For instance, a 2024 Chainalysis report focused on Latin America shows the region accounted for 9.1% of total crypto inflows between 2023 and 2024, with annual usage growth of 40–100%—over half of which is stablecoins. This underscores the developing world’s strong demand for alternative currencies.

The U.S. needs new buyers for its bonds, and this demand comes in the form of dollar demand—since most people globally are stuck with far weaker fiat currencies. If the world shifts to a geopolitical structure where the dollar must compete on equal terms with other fiats, it may still prove the best of the bunch. Despite its flaws, the U.S. remains a superpower with tremendous wealth, human capital, and economic potential—especially compared to many smaller economies and their questionable pesos.

Latin America has demonstrated strong appetite for dollars, but supply is constrained as local governments resist traditional banking channels. In many countries outside the U.S., dollar-denominated accounts are hard to obtain. Local banks are tightly regulated and answer to governments who have a vested interest in defending their own peso. After all, the U.S. isn’t the only government skilled at printing money and protecting its currency.

Stablecoins solve both problems: they generate demand for Treasuries and deliver dollar-denominated value to anyone, anywhere.

Stablecoins leverage the censorship-resistant attributes of their underlying blockchains—features local banks simply cannot match. By promoting stablecoins, the U.S. can access untapped international markets, expand its user base, and export dollar inflation to countries with no direct influence on U.S. politics—a longstanding American tradition. Strategically, this is ideal for the dollar and a natural extension of decades-old policy, now built atop new financial technologies.

U.S. policymakers recognize this opportunity. As Chainalysis notes: “The stablecoin regulatory landscape has changed dramatically in the past 12 months. While the GENIUS Act has yet to take effect, its passage has spurred intense institutional interest.”

Why Stablecoins Should Eclipse Bitcoin

The most effective way for Bitcoin to help developing countries escape weak fiat currencies is for the dollar to use Bitcoin as its settlement layer. Every dollar stablecoin wallet should also be a Bitcoin wallet.

Critics of the Bitcoin-dollar strategy argue that it betrays Bitcoin’s libertarian roots—Bitcoin was meant to replace the dollar, not enhance or modernize it. But this objection is largely U.S.-centric. It’s easy to criticize the dollar if your income and bank account are in dollars, or if you experience only 2–8% annual inflation. For many outside the U.S., 2–8% inflation would be a blessing.

Much of the world suffers under fiat currencies far worse than the dollar, with inflation ranging from low double digits to triple digits. That’s why stablecoins have achieved mass adoption in the developing world. These regions must first abandon their sinking ships; once aboard a stable vessel, upgrading to Bitcoin becomes possible.

Unfortunately, while most stablecoins were initially built on Bitcoin, today they do not run on Bitcoin—creating friction and risk for users. The majority of stablecoin transactions now take place on the Tron blockchain, a centralized network controlled by Justin Sun and easily targeted by governments hostile to dollar stablecoins.

Most blockchains supporting stablecoins are fully transparent: public addresses are easily traced, often linked to user data by exchanges, and accessible to local governments. This exposes users to significant risk and provides leverage for foreign actors to hinder dollar stablecoin adoption.

Bitcoin avoids these infrastructure risks. Unlike Ethereum, Tron, and Solana, Bitcoin is highly decentralized—with tens of thousands of nodes globally and a resilient peer-to-peer system for relaying transactions. Its proof-of-work consensus provides separation of powers not found in proof-of-stake chains. For example, Michael Saylor, despite holding 3% of all Bitcoin, has no direct voting power over the network’s consensus—unlike Vitalik with Ethereum or Justin Sun with Tron.

Bitcoin’s Lightning Network enables instant, secure transactions while preserving privacy: Lightning payments are off-chain and leave no public record, giving users confidentiality when sending funds. This narrows the pool of privacy threats from anyone watching the blockchain to only a handful of companies—even in the worst case.

Users can also run their own local Lightning nodes, controlling privacy and security—features absent from most blockchains currently used for stablecoin transactions.

Compliance policies and even sanctions remain applicable to dollar stablecoins, with governance anchored in Washington and enforcement via analytics and smart contracts. Fundamentally, the dollar cannot be decentralized; it was built to be centralized. Yet, if most stablecoin value moves through Lightning, user privacy will be preserved—protecting developing-world users from organized crime or even hostile local governments.

In the end, users care most about transaction fees and transfer costs—hence Tron’s dominance. But as USDT launches on Lightning, this could change rapidly. In a Bitcoin-dollar world, the Bitcoin network will serve as the transactional rail for dollars, while the dollar remains the primary unit of account for the foreseeable future.

Can Bitcoin Withstand the Pressure?

Some critics worry the Bitcoin-dollar strategy could compromise Bitcoin itself. They question whether placing the dollar atop Bitcoin will distort the network’s foundation. The most obvious way for a superpower like the U.S. to manipulate Bitcoin would be to impose sanctions compliance at the proof-of-work level.

However, as previously noted, the sanctions regime has peaked and given way to a new era of tariffs—focusing on regulating goods flows rather than capital flows. This post-Trump, post-Ukraine shift in American foreign policy actually eases pressure on Bitcoin.

As Western institutions like BlackRock—and even the U.S. government—embrace Bitcoin as a long-term strategy, or as Trump calls it, “strategic Bitcoin reserves,” they become invested in the network’s future. Attacking Bitcoin’s censorship resistance would undermine their own holdings and stifle the network’s potential to deliver stablecoins to the developing world.

In a Bitcoin-dollar order, Bitcoin’s most notable compromise is yielding its role as the unit of account. For many Bitcoin enthusiasts, this is unwelcome news. The unit of account is the ultimate goal of hyperbitcoinization, and some users already operate in this paradigm, making economic decisions based on their satoshi balances. Still, for those who understand Bitcoin as the soundest money ever, nothing can take that away. In fact, the Bitcoin-dollar strategy will reinforce Bitcoin’s reputation as a store of value and medium of exchange.

After 16 years of striving to make Bitcoin the universal unit of account like the dollar, some now see that, in the medium term, the dollar and stablecoins will likely fulfill that role. Bitcoin payments will persist—businesses championed by Bitcoiners will continue to grow and should keep accepting Bitcoin to build reserves—but for the coming decades, stablecoins and dollar-denominated value will likely dominate crypto trade.

Nothing Can Stop This Momentum

As the world adapts to the rise of Eastern powers and a multipolar order, the U.S. may have to make tough, pivotal choices to avoid enduring financial crisis. In theory, America could cut spending, pivot, and modernize to become more efficient and competitive in the 21st century. The Trump administration is making such efforts—through tariffs and other measures to reshore manufacturing and nurture domestic talent.

While a handful of miracles—such as sci-fi automation or the Bitcoin-dollar strategy—could resolve America’s fiscal challenges, even putting the dollar on the blockchain won’t alter its ultimate fate: to become a collector’s relic, a museum artifact, a rediscovered token of a bygone empire.

The dollar’s centralized design and reliance on U.S. politics ultimately seal its fate as a currency. But realistically, its demise may not be seen for 10, 50, or 100 years. When that moment finally arrives, if history repeats itself, Bitcoin should be there as the operational rail—ready to pick up the pieces and fulfill the prophecy of hyperbitcoinization.

Statement:

- This article is reprinted from [Foresight News], copyright held by the original author [Juan Galt]. If you have concerns about this reprint, please contact the Gate Learn team for prompt handling via the relevant procedure.

- Disclaimer: The views and opinions presented in this article are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Unless Gate is cited, translated articles may not be copied, distributed, or plagiarized.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

What is Stablecoin?

Top 15 Stablecoins

A Complete Overview of Stablecoin Yield Strategies

Stripe’s $1.1 Billion Acquisition of Bridge.xyz: The Strategic Reasoning Behind the Industry’s Biggest Deal.