StableChain Deep Dive: Vision, Architecture, and the USDT-Native Payment Ecosystem

Project Background and Market Landscape

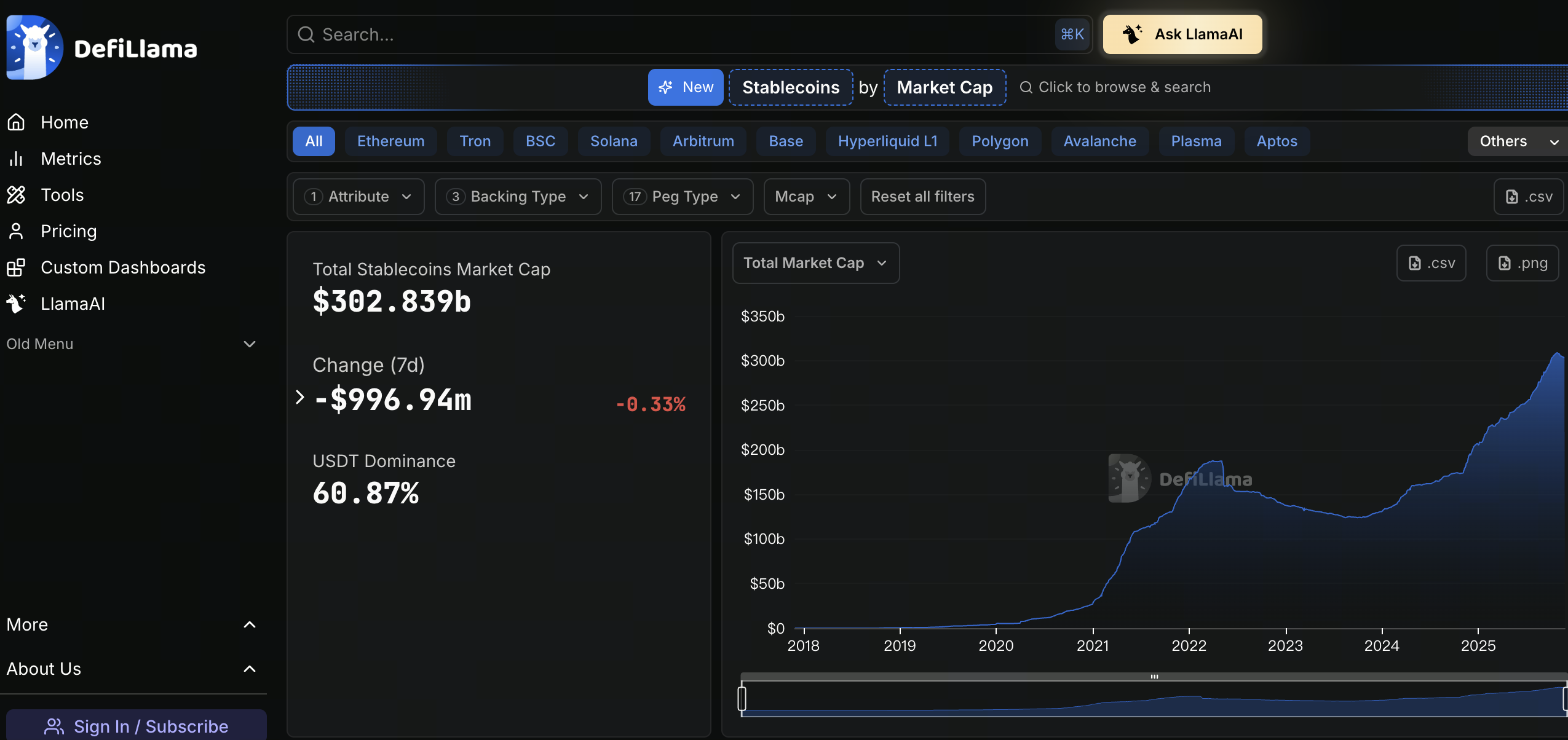

Score: https://defillama.com/stablecoins

As digital currencies and stablecoins have evolved, stablecoins have become a core asset class within the crypto financial ecosystem. Dollar-pegged stablecoins such as USDT and USDC now exceed $100 billion in circulation, with the market expected to surpass $300 billion for the first time in 2025—a year-over-year increase of more than $100 billion. Stablecoins not only play a key role in settlement for trading, but are also increasingly integrated into cross-border payments, on-chain finance, and enterprise treasury management. However, mainstream stablecoins currently rely on public blockchains like Ethereum, Tron, and Solana, which were not specifically designed for stablecoin usage and suffer from significant performance and cost limitations: for example, Ethereum faces high transaction fees during congestion; Tron offers low fees but raises concerns about centralization and security; Solana delivers high speed but has experienced occasional outages. These issues result in unpredictable costs for small payments, require users to hold volatile tokens for gas fees, and create fragmented cross-chain experiences.

Score: https://www.stable.xyz/

Purpose-built stablecoin blockchains have emerged to address these challenges. By making stablecoins the native currency of the network, transaction fees and settlements are denominated in stablecoins (e.g., USDT), ensuring predictable costs and real-time settlement. These specialized chains are optimized at the protocol level for performance, scalability, and compliance, providing more efficient infrastructure for payment use cases. Within this context, StableChain (“Stable” or “StableChain”) was created as the first Layer 1 blockchain natively centered on USDT, elevating stablecoin payment infrastructure to new heights. The timing of StableChain’s launch is also significant: the passage of the U.S. GENIUS Act in 2025 has established a clear regulatory framework for stablecoin payments, accelerating the move toward compliance and creating favorable conditions for projects like StableChain.

StableChain Vision and Strategic Positioning

Developed by the Stable team, StableChain positions itself as an enterprise-grade USDT payment blockchain dedicated to unlocking the immense potential of USDT and other stablecoins while addressing the shortcomings of traditional payment systems. Its core vision is to enable “USDT to circulate on-chain as freely as cash,” establishing a global network for instant, efficient, low-cost stablecoin payments. StableChain uses USDT as both its native fuel and accounting unit, eliminating user reliance on volatile tokens and dramatically streamlining payment processes.

Strategic goals include:

- Driving Mass Adoption of USDT: Stable aims to promote global circulation and usage of USDT, making it the anchor of digital payment infrastructure. The team believes traditional payment rails are in urgent need of modernization, and that StableChain’s native USDT currency can deliver “instant, efficient” payment experiences that directly address existing system flaws.

- Enterprise-Grade Payment Infrastructure: StableChain is tailored for businesses and institutions, offering dedicated block space, batch transaction processing, and privacy protection features to meet the predictability and reliability requirements of large payments and financial settlements. The team envisions StableChain as a financial and payment backbone—a crypto-native alternative to SWIFT—while ensuring compliance and security.

- Building a Stablecoin Ecosystem Network: Beyond solving stablecoin payment use cases, Stable plans to build a comprehensive “Stable ecosystem network.” As previously outlined, Stable has a three-phase development roadmap: Phase 1 delivers native USDT gas with sub-second confirmation; Phase 2 introduces a USDT aggregator and enterprise-dedicated block space; Phase 3 enhances performance and releases developer tools. Through this staged technical evolution, Stable seeks to attract developers and users to build a robust ecosystem of payment and financial applications.

Core Product Mechanisms

StableChain’s architecture revolves around USDT as its standard and introduces several innovative mechanisms to improve payment efficiency and user experience:

- Native USDT Gas Mechanism: StableChain makes USDT the native gas token, with transaction fees settled directly in USDT. Users only need to hold USDT—no additional crypto tokens required—to pay on-chain transaction fees. This eliminates the need for holding or swapping volatile tokens just for gas payments. Whether peer-to-peer transfers, QR code payments, or merchant settlements, all fees can be precisely paid in stablecoins, significantly lowering both costs and entry barriers.

- Account Abstraction & Gasless Payments: Adopting an EIP-7702-like account abstraction design, every user wallet becomes a programmable smart contract account. The network integrates Bundler and Paymaster systems: when users initiate a USDT transaction, fees are automatically deducted from their USDT balance—no manual gas token management required. Under this mechanism, simple USDT transfers have transparent costs; users only see their USDT balance change without a separate gas deduction line item. This “gasless” payment approach makes micropayments and daily small transactions economically viable, bringing on-chain payments closer to the seamlessness of real-world cash.

- Dual-Token Architecture (USDT0 & GasUSDT): StableChain introduces two internal forms of USDT: USDT0 (the user-facing token) and GasUSDT (the protocol’s internal fuel). USDT0 is the standard ERC-20 balance visible to users; GasUSDT is used by the protocol for fee payments. The two are always pegged 1:1; users only need to hold USDT0, while the network automatically converts USDT0 to GasUSDT via account abstraction. This is similar to Ethereum’s ETH/wETH relationship: users interact with a single token while the underlying protocol manages conversions—unifying fee payments with transaction currency.

- Bundler & Batch Transaction Processing: StableChain uses bundling and parallel execution for transaction handling. Dedicated Bundler nodes aggregate multiple user transactions into large batches for parallel computation. For mass USDT transfers, StableChain features an internal USDT Transfer Aggregator that combines thousands of transfers into batch operations using MapReduce-style parallel processing. The aggregator first computes net changes across all transfers, then writes results on-chain in a single operation—dramatically increasing throughput and reducing block space consumption. With batch processing, StableChain supports high-volume daily payments while maintaining low latency and low fees.

- Dedicated Enterprise Block Space: StableChain provides institutional users with reserved block space. During network congestion, validators allocate capacity for critical transactions to ensure priority handling of essential payments and settlements. Validators always reserve part of each new block for high-priority USDT transactions—ensuring that even during peak periods, enterprise-level transactions are predictably included. This mechanism enables businesses to confidently conduct payroll, supply chain settlements, and other key operations without worrying about fee volatility or delays.

- Privacy-Protected Transactions: Addressing institutional privacy needs, StableChain plans to implement Confidential Transfers using zero-knowledge proofs to encrypt transaction amounts while publicly revealing only counterparties’ identities. This allows businesses to conceal sensitive payment amounts while enabling regulatory audits for transparency. This feature balances commercial privacy with compliance—offering secure on-chain payment solutions for large transactions and institutional settlements.

Technical Architecture Overview

Score: https://www.rootdata.com/Projects/detail/Stable?k=MTg0Mzk%3D

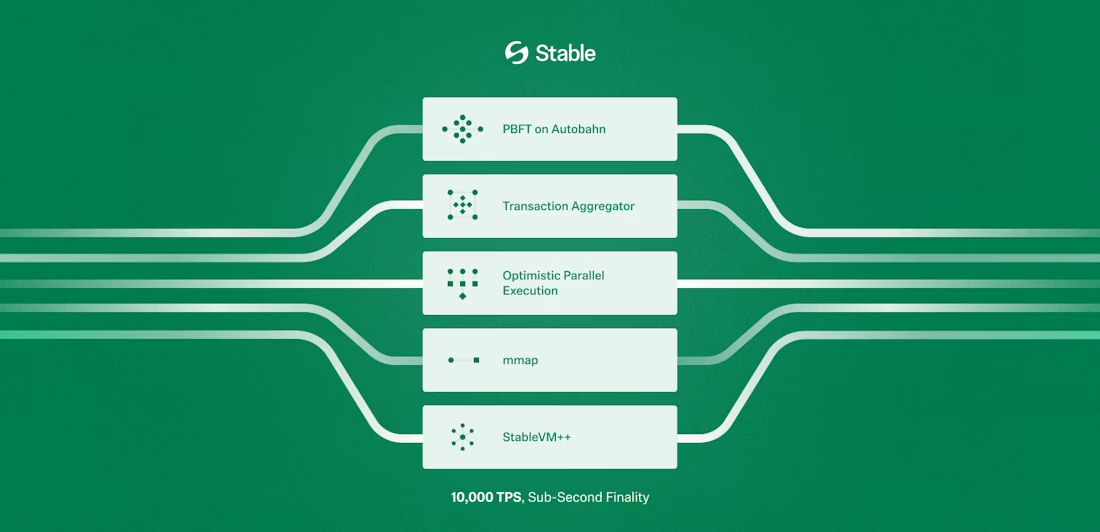

StableChain’s technical framework is optimized specifically for stablecoin payments across consensus layer, execution environment, storage layer, cross-chain interoperability, and more:

- Consensus Mechanism: StableBFT (Based on CometBFT): StableChain employs a custom StableBFT consensus protocol—a delegated Proof-of-Stake (dPoS) system built atop an improved version of CometBFT (formerly Tendermint). StableBFT maintains Byzantine Fault Tolerance (BFT) security while introducing multi-proposer mode (per project docs) to overcome single-leader bottlenecks and boost throughput—enabling ultra-high TPS and sub-second confirmation times. Under test conditions, StableBFT achieves up to 200,000 TPS via parallel transaction channels (“Autobahn” design) while maintaining security; actual mainnet performance remains to be validated but targets thousands of payments per second.

- EVM-Compatible Execution Environment (StableVM++): Fully compatible with Ethereum’s EVM, StableChain lets developers deploy existing Ethereum smart contracts and use familiar tooling. For enhanced stablecoin operations, StableChain layers additional features atop EVM (“StableVM++”), such as built-in precompiles for aggregated USDT transfers and ledger queries. Official docs highlight optimized transaction execution and state storage for lower latency and higher throughput—all while maintaining EVM compatibility.

- StableDB: High-Performance State Storage: To avoid disk I/O bottlenecks typical of legacy chains, StableChain introduces StableDB—a storage system that first commits recent state changes to memory (MemDB), then asynchronously writes them to disk (VersionDB) via background threads. DualDB structure ensures fast access to recent states with efficient management of historical data—greatly boosting on-chain throughput under heavy load while keeping latency low.

- Cross-Chain Interoperability & Bridging: Using LayerZero and similar technologies, StableChain achieves seamless inter-chain connectivity. According to public project info, USDT0 utilizes the OFT (Omnichain Fungible Token) standard for cross-chain operations—allowing users to bridge assets from other chains (Ethereum, BSC, etc.) into StableChain with one click via LayerZero gateways for deep liquidity access. In future plans, native bridge services will connect StableChain’s ecosystem with Bitcoin, Ethereum, and other major networks—building a unified stablecoin settlement network.

- zk Privacy Technology: As noted above, StableChain supports zero-knowledge proof encryption for confidential transfers—not just hiding transaction amounts but also enabling private payments or on-chain KYC verification scenarios. Optional zk modules provide regulator-friendly compliance while offering enhanced security for institutional users.

- Infrastructure Layer (RPC/Node Architecture): StableChain prioritizes high availability at the node/API layer—drawing from other high-performance chains’ experience by potentially adopting decoupled node architecture (consensus/execution separated from RPC services), load balancing, and auto-scaling to prevent RPC bottlenecks. Both official docs and community discussions stress scalable/highly available RPC design—anticipating distributed gateways and lightweight verification models as further optimizations.

StableChain’s “dual-token” design is purpose-built for USDT payments: users hold USDT0 for daily transactions while GasUSDT serves as network fuel. The protocol automatically converts USDT0 to GasUSDT via account abstraction—no manual action required. With LayerZero-based OFT support for cross-chain liquidity, users can transfer USDT across different blockchains seamlessly—eliminating traditional bridging hassles.

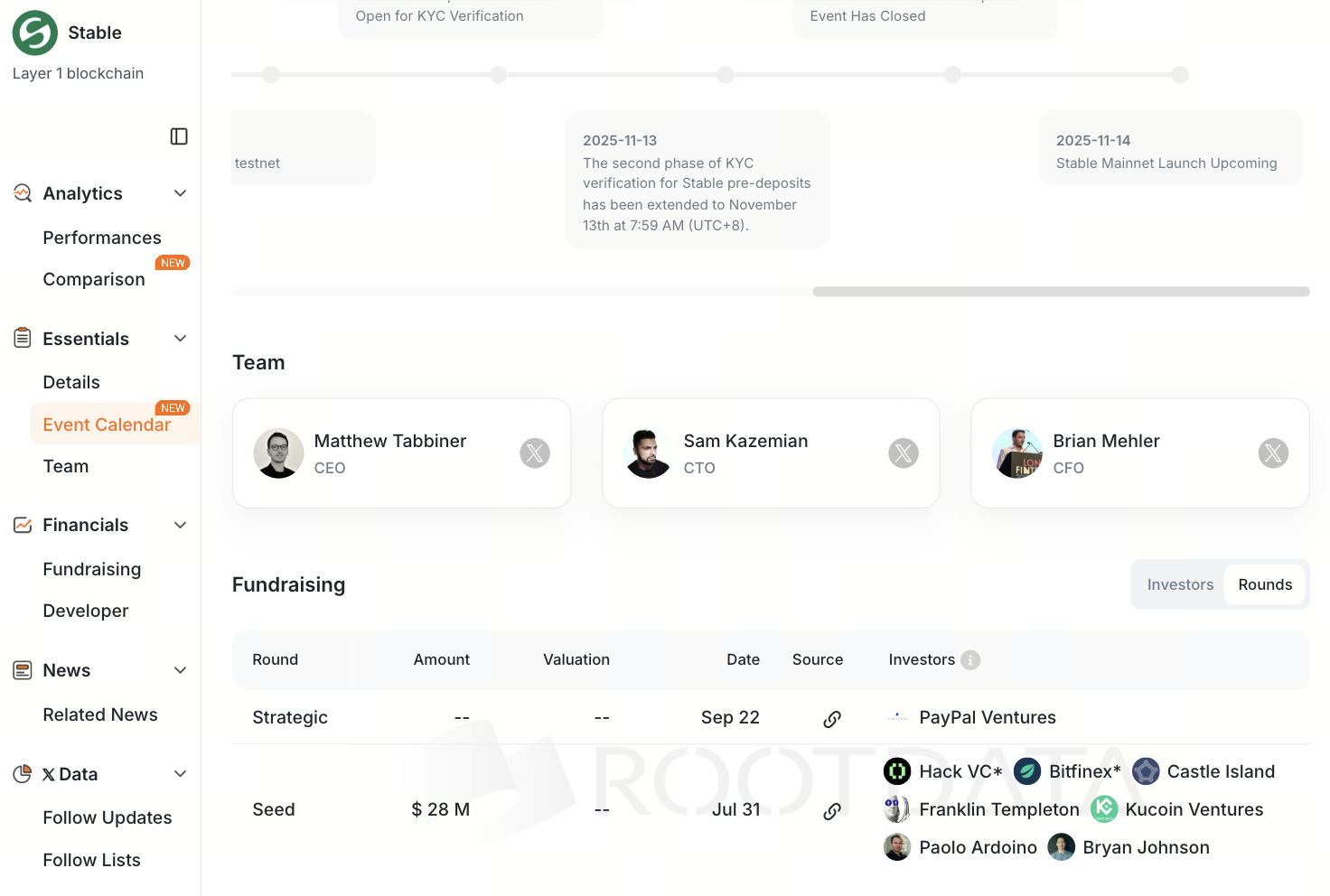

Team Background & Fundraising History

The founding team behind StableChain (Stable) brings deep blockchain and financial expertise; CEO & co-founder Joshua Harding has repeatedly articulated his vision for upgrading payment infrastructure. The project boasts heavyweight investors and advisors—including Paolo Ardoino (CTO of Tether/Bitfinex; key architect behind USDT), Braintree founder Bryan Johnson, former Anchorage CEO Nathan McCauley, among others. In July 2025, Stable completed a $28 million seed round led by Bitfinex and Hack VC; other investors include Franklin Templeton, Castle Island Ventures, eGirl Capital, Bybit-Mirana, Susquehanna International Group (SIG), Nascent, Blue Pool Capital, BTSE, KuCoin Ventures, etc. Bitfinex played an important role during early incubation stages as well. The scale of funding and caliber of backers highlight industry recognition of Stable’s vision.

Funds raised are primarily allocated toward building network infrastructure, expanding tech/operations teams, and promoting global USDT adoption. As stated at the official launch: “This funding will be used to build out Stable’s network infrastructure, grow our team, and boost global circulation/application of USDT.” The Tether team also strongly supports this mission; Paolo Ardoino noted that U.S. attitudes toward digital assets have fundamentally shifted—and that the Stable team “fully understands and is equipped to bring USDT mainstream.” Overall, both team pedigree and investor backing provide crucial credibility and resources for the project.

Ecosystem Development & Real-World Use Cases

StableChain’s ecosystem development is progressing steadily across personal payments, enterprise settlements, DeFi integration, and more:

- Stable Pay Wallet: Stable has launched its first official wallet app—“Stable Pay”—as the ecosystem entry point. Focused on seamless payment experiences as a non-custodial wallet, it supports email/social account registration with no mnemonic required. Stable Pay delivers instant settlement and gas-free transfers; users’ USDT payments are completed in seconds with no visible transaction fees. By September 2025 at KBW Expo pre-registration opening, over 100k users had signed up—demonstrating strong global demand for stablecoin payments. Future plans include adding enterprise tools, yield strategies, expanded token support—to provide an all-in-one stablecoin payment platform for individuals/businesses.

- Institutional Payments & Settlement: Thanks to dedicated block space/batch processing mechanisms, StableChain offers special support for enterprises/larger payments—enabling cross-border remittance, payroll distribution, supply chain settlement with near-instant predictable service. On-chain privacy features protect sensitive corporate flows; some institutions may migrate assets/settlements onto StableChain for efficiency/cost advantages. The official statement noted 100k+ pre-registrations at KBW Expo with near-instant settlement support.

- DeFi & Cross-Chain Collaboration: As a fully EVM-compatible network, DeFi projects can integrate into the ecosystem—decentralized exchanges offering instant swaps/lending for USDT leveraging efficient trade aggregation/order matching within chain. Plans include bridges with other DeFi networks (Ethereum/Tron/etc.) for two-way asset movement; using USDT0/LayerZero technology allows seamless transfers between StableChain/external chains—further enhancing liquidity. Additional ecosystem infrastructure like stablecoin payment gateways/clearing providers will further enrich use cases.

- Wallets & Custody Solutions: In addition to the official Stable Pay wallet, StableChain encourages third-party wallet integration of native USDT payments; more mobile/web wallets supporting social login/fiat onramps are expected soon—increasing user reach. While running its own chain, custody solutions (mnemonic vaults/custody signing services) will resemble those of traditional crypto wallets—allowing enterprise clients compliant third-party custody options.

- Cross-Chain Asset Interoperability: Native cross-chain hubs are planned—enabling direct connections with Ethereum/Bitcoin etc., allowing assets like USDT to move seamlessly across chains. This gives users optimal routing choices across networks while cementing StableChain’s role as a stablecoin cross-chain financial hub. Currently interoperable via LayerZero bridges—with more official bridges/compliant solutions expected.

Through these measures, StableChain builds a stablecoin-centric payment network: end-users enjoy simple wallets/near-zero cost payments; merchants/institutions get predictable secure settlements; developers benefit from EVM compatibility/specialized payment toolchains lowering development barriers. In this ecosystem, USDT evolves from trading pair/collateral asset into a high-frequency on-chain medium of exchange.

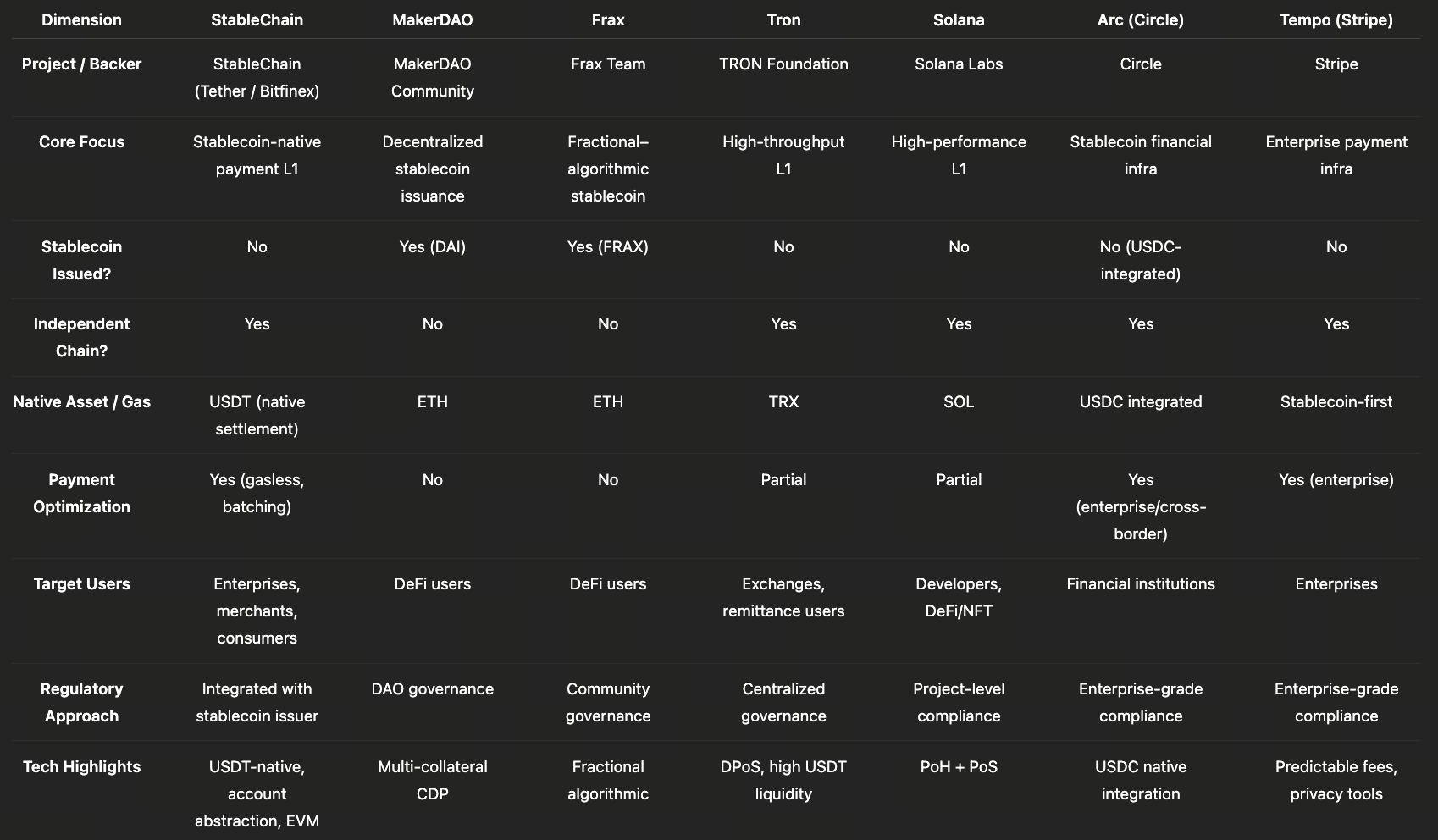

Comparison With Other Stablecoin Protocols/Payment Chains

StableChain’s positioning is distinct from current stablecoin ecosystems/competitors:

MakerDAO & Frax

MakerDAO’s DAI/Frax are algorithmic or overcollateralized protocols running on Ethereum/public chains—focused on innovative issuance/governance mechanisms; by contrast, StableChain focuses on stablecoin payment infrastructure itself. Unlike Maker/Frax protocols that issue new stablecoins or complex collateral algorithms, StableChain is an independent blockchain serving existing mainstream stablecoins (USDT), not issuing new coins or algorithms—making it more akin to a payment network than a stablecoin issuance protocol.

TRON & Solana

TRON currently hosts over 50% of all USDT supply with daily volumes reaching tens of billions; its low fees/high throughput make it popular but still require holding volatile TRX tokens for fees—and has faced criticism over security/decentralization concerns. Solana offers ultra-high throughput supporting various stablecoins but requires holding SOL for fees/can pose network stability challenges. In contrast, StableChain’s edge lies in using USDT itself as fuel—eliminating token conversion steps; plus it focuses on payment-specific design with parallel execution/batch processing/privacy features tailored for enterprises—optimizations general-purpose chains lack.

Plasma vs StableChain (Tether Dual Chain Strategy)

Tether has launched another USDT chain called Plasma—a high-performance/zero-fee transfer blockchain anchored periodically to Bitcoin network state. Plasma targets high-frequency trading/DeFi scenarios; whereas StableChain is designed for daily payments/settlement use cases. Plasma handles micropayments/off-chain anchoring; StableChain serves as the core settlement chain—complementary yet competing in merchant/cross-border/remittance niches with distinct roles.

Arc (Circle) & Tempo (Stripe)

Circle’s Arc chain (launched August 2025) is another Layer 1 purpose-built for stablecoins—using USDC as gas natively integrating multiple fiat-pegged coins (EURC etc.) with built-in FX engine targeting institutional/global settlement use cases. By contrast, StableChain focuses solely on USDT/dollar ecosystem; Stripe/Paradigm’s Tempo project is neutral infrastructure supporting multiple stablecoins/payments chain—with instant confirmations/no native token issuance planned. These emerging payment chains all occupy the stablecoin blockchain vertical—but each has unique features: Arc leverages deep Circle integration/multi-currency clearing; Tempo emphasizes native payments/multi-token support; while StableChain leverages USDT market share/Tether backing—focusing on low-barrier enterprise-grade dollar payments infrastructure.

Stablecoin Protocol Comparison Table

In summary, what fundamentally sets StableChain apart from legacy protocols/general-purpose blockchains is its bespoke focus—a public chain tailored exclusively for USDT where stablecoin payments are core design elements rather than secondary use cases within broader value networks. As ChainCatcher notes: single-token chains like Arc/Stable emphasize intra-chain payment efficiency while Arc aims at cross-chain clearing hubs; StableChain’s vision is to make USDT the “digital dollar” on-chain—building its competitive moat through infrastructure optimization.

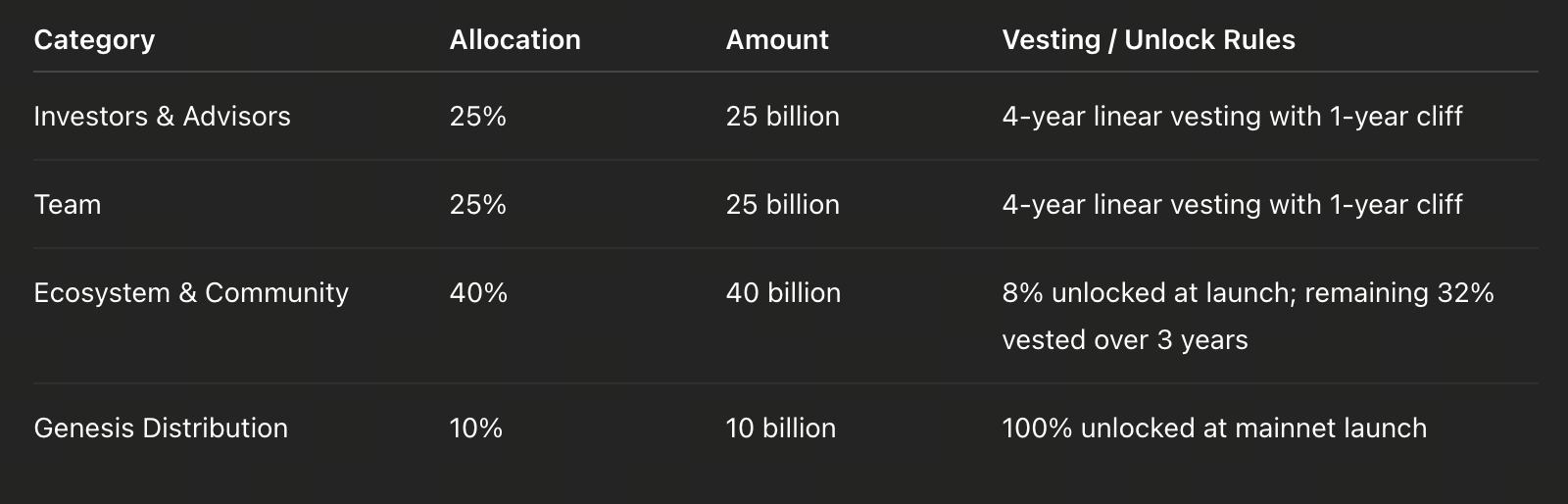

STABLE Tokenomics

STABLE Token Unlock Chart Source: https://docs.stable.xyz/en/introduction/tokenomics

STABLE is the native governance token of the Stable Network—issued under EVM standard on mainnet with a total supply of 100 billion tokens. As a “stablecoin-native chain,” most user operations (high-speed transfers/payments/settlements) require only USDT—with no need to hold STABLE tokens for day-to-day use. This design makes payments more Web2-like—lowering onboarding barriers while ensuring that stablecoin circulation isn’t affected by governance token price volatility.

STABLE’s main utility centers around governance—including protocol management, validator elections, network parameter voting/ecosystem incentive decisions. Token holders participate directly in shaping network rules/development direction via on-chain governance mechanisms; STABLE also supports staking—delegators earn shares of network fee revenue (collected in USDT/gas fees then distributed per staking rules). Thus STABLE acts as the “coordination layer”—maintaining economic models/incentivizing validator stability/driving ecosystem growth.

Stable’s design philosophy separates “payment layer” from “governance layer”:

- Payments/settlements rely solely on USDT—for better usability/stability;

- STABLE covers governance/staking/ecosystem incentives/long-term coordination—to ensure sustainable network development.

This approach delivers high-throughput/high-reliability/low-barrier user experience at the payment layer while assigning governance tokens long-term value capture/network coordination roles—for a clear/structured token economy.

Challenges & Future Outlook

Despite numerous innovations/advantages, StableChain faces several challenges:

- Regulatory & Compliance Pressure: As tightly coupled to USDT—and with Tether subject to scrutiny across multiple jurisdictions—any sanctions/policy tightening against Tether could directly impact the ecosystem. With new regulations emerging (U.S. GENIUS Act/EU MiCA), compliance must be ensured including integration with banking oversight systems—balancing privacy/anonymity with transparency/KYC.

- Security & Stability: As a new chain not yet live on mainnet—performance/security remain unproven at scale; despite leveraging mature CometBFT/account abstraction techs—actual operations may face novel attacks/software bugs. The economic incentive/governance token plans remain undefined—which could affect long-term decentralization/ecosystem health; note some enterprise/base rollups launch without tokens—but if so long-term sustainability must be addressed.

- Competition & Market Adoption: With giants like Visa/PayPal moving into blockchain payments—and Arc/Tempo pushing new stablecoin chains—the competitive landscape intensifies; rapid developer/user traction plus rich application offerings are needed to stand out among many options. To date the ecosystem remains nascent—with no public usage data or major real-world deployments; while 100k+ pre-registration is promising—actual user retention/activity/ecosystem vitality remain to be seen.

- Technical Challenges & Roadmap Execution: Planned multi-phase roadmap (sub-second confirmation→parallel execution→extreme scaling) requires time/proof in practice; ongoing optimizations needed in parallel engines/sharding/cross-chain security etc.; future support for additional assets (USDC/fiat stables), privacy upgrades/protocol evolution also demand continuous advancement.

- Ecosystem Development & Tokenomics: Currently running without its own token—relying solely on USDT simplifies early stage operations but may limit future incentive models; governance/staking/incentive frameworks need exploration—including potential token launches or alternate reward mechanisms—to encourage validator/developer/user participation; partnerships with banks/payment gateways/merchants must also be fostered—to become part of mainstream financial infrastructure.

Looking ahead—if these challenges can be overcome—StableChain could become the foundational layer for global stablecoin payments; technically it offers high throughput/low latency/gas-free advantages supporting microtransactions/remittances/payroll at scale; from UX perspective social login/voucher payments/human-readable domains are under development per official roadmap (e.g., social login wallets). Broadly speaking—StableChain reflects the trend among stablecoin issuers seeking control over the payment value chain; if successfully integrated with legacy finance/payment systems—it could reshape cross-border settlement/digital payments infrastructure worldwide. Both technology/policy environments continue evolving—but StableChain’s goal remains clear: build a network where USDT (and other stables) circulate as freely as cash.

Conclusion

As the world’s first Layer 1 public blockchain natively powered by USDT—StableChain introduces a groundbreaking model for payment infrastructure. With its USDT-centric architecture/gasless transactions/account abstraction innovations—it deeply optimizes pain points around stablecoin payments. Using advanced technologies like StableBFT consensus/parallel execution engines/in-memory storage—it delivers unprecedented speed/cost efficiency at the network layer; meanwhile its ecosystem is rapidly expanding—from the launch of Stable Pay wallet to enterprise settlement solutions—increasing real-world application breadth.

Compared with protocols like MakerDAO/Frax—or general-purpose chains like Tron/Solana—StableChain stands out by focusing squarely on stablecoin payments/integrating USDT deeply throughout its design stack from top-down.

Despite facing regulatory/security/competitive headwinds—StableChain already enjoys backing from Tether/Bitfinex industry leaders—and has attracted significant market attention. Its vision is clear: make USDT the foundational currency for global value transfer—and make payments as simple/effective as cash.

In tomorrow’s financial ecosystem—from instant payrolls/cross-border remittances/to embedded finance/DeFi integrations—StableChain aims to provide unified/high-efficiency solutions for stablecoin payments.

The rise of dedicated stablecoin blockchains is rewriting the value chain of financial infrastructure—and StableChain is positioned at the forefront of this transformative era.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape