Pump.fun: The Tokenization Wave Has Now Reached Live Streaming

Live streaming has evolved content from mere entertainment into a high-leverage marketplace. While traditional jobs offer a fixed return per hour, live streaming multiplies each hour’s output by total viewers—a single streaming hour can yield thousands of viewer hours, creating valuable monetizable assets for advertisers, platforms, and creators. Yet, income distribution among creators remains deeply unequal.

On Twitch and YouTube, revenue is primarily generated through subscriptions and advertising. Layered revenue-sharing structures mean ordinary streamers receive just 50% of subscription income, while top creators earn more than tenfold that rate. New platforms like Kick have upended the status quo by letting streamers keep 95% of subscriptions, sparking “Kick vs Twitch” rivalry and leading to multi-million-dollar signing deals.

In this shifting landscape, Pump.fun—known for memecoin launches—entered the scene. By mid-2025, it quietly introduced live streaming and a dynamic fee model that directly links streamer income to native token performance.

This edition explores how Pump.fun’s creator capital market works, its pivotal role against Kick and Twitch, and the strategic reasoning behind tokenizing live streaming.

Stay on top of market developments

Current Landscape: Kick vs. Twitch

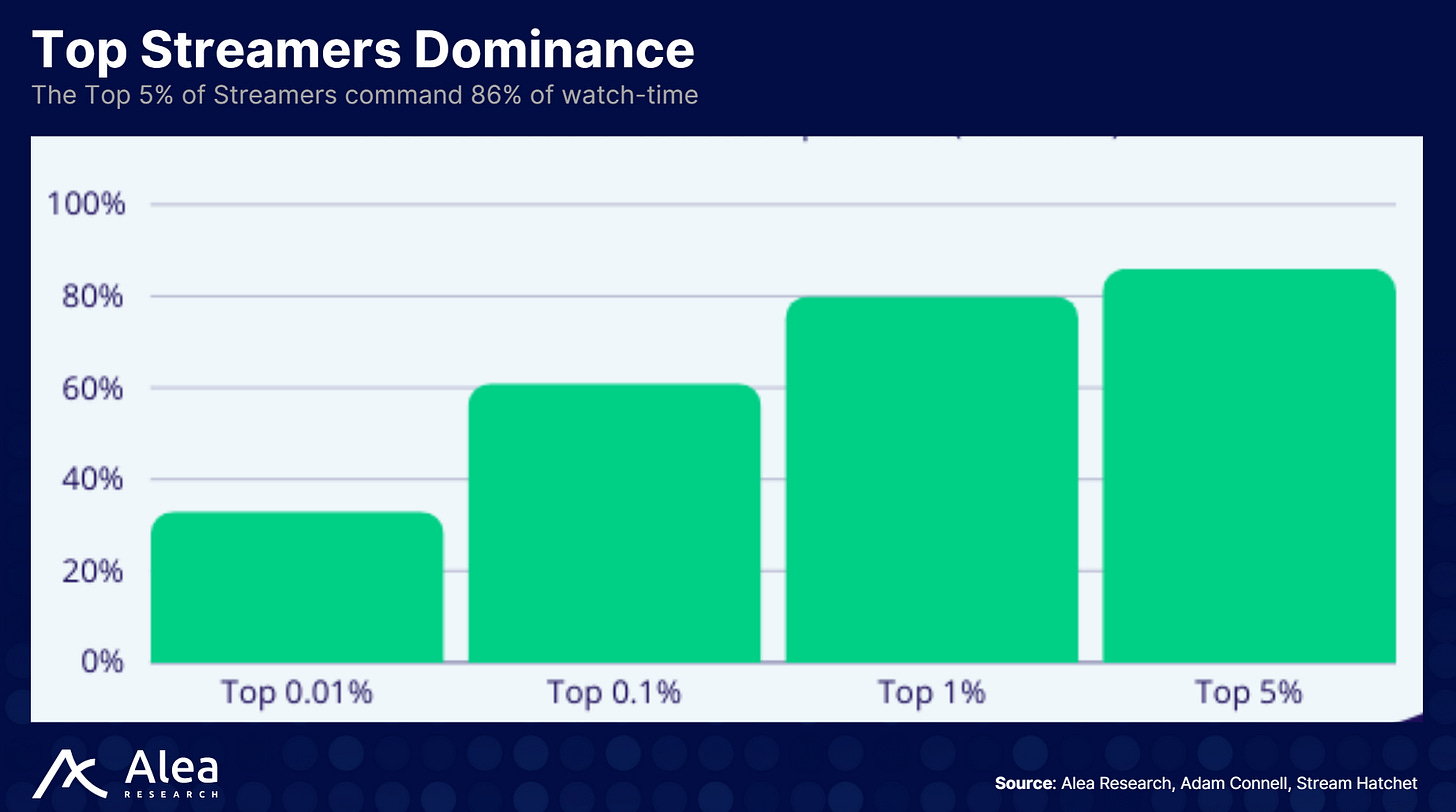

Twitch pioneered live streaming, averaging 1.5 billion viewer hours per month. Most streamers split subscription income 50/50 with Twitch, while ad revenue (via the Ads Incentive Program, or AIP) is split 55/45. Elite streamers in the Partner Plus program receive a more generous 70/30 subscription split. This creates a Pareto dynamic: top creators command 80% of total viewer hours and revenue, leaving smaller creators to compete for the remaining 20%.

For example, Twitch’s leading streamer Kai Cenat holds more active subscriptions and earns more revenue than streamers ranked 2nd to 10th combined.

Kick debuted in 2022, backed by Stake.com, a betting platform. Kick challenged Twitch by allowing streamers to retain 95% of subscriptions and hosting content such as gambling that Twitch restricts. Kick also signed blockbuster deals with Twitch’s top talent, including a reported $100 million, two-year non-exclusive contract for xQc, and a $30–40 million deal with Amouranth.

Following these announcements, Kick gained over one million users. These moves highlight how streaming platforms invest heavily to capture attention, though most revenue still comes from subscriptions, ads, and donations.

The Attention Economy & Pareto Effect

A frequent misconception is that more streamers dilute rewards and viewer time, making live streaming a zero-sum game. In reality, viewer attention follows a Pareto distribution—viral creators command most of the audience, while the majority fight for exposure. When top personalities like Kai Cenat or iShowSpeed go live, they expand the total audience and draw millions of new fans who may never have used the platform before.

This dynamic explains why Kick invests massive signing bonuses: bringing in attention capital grows the ecosystem, not just reallocates viewers from existing streamers.

On Pump.fun, established Twitch streamers—such as “League of Legends” star BunnyFuFuu—have already made the move.

Pump.fun seeks to harness fan spending power through tokenization. Dedicated fans typically budget for monthly donations; buying a streamer’s token transforms that spending into a tradable asset. Token holders are motivated to promote their favorite streamer (boosting prices); if a creator goes viral, early backers share in the upside. In effect, streamer tokens turn donations into equity, aligning fan rewards with creator success and reducing the sense of dilution when newcomers join.

Entering the Creator Capital Marketplace

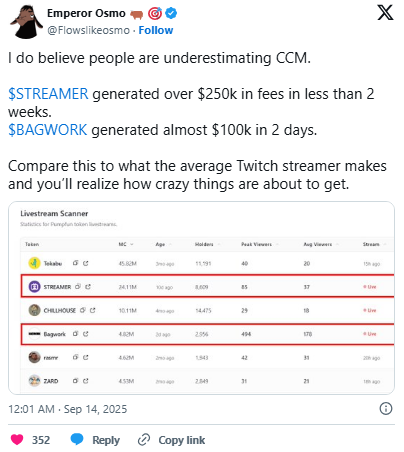

Pump.fun’s streaming model introduces a fundamentally new economic structure: streamer tokens. Instead of simply tipping or subscribing, audiences buy tokens tied to individual streamers. Token prices fluctuate with supply and demand, allowing fans to speculate on creator popularity much like investors.

Streamers earn transaction fees on each token trade—up to 0.95% for smaller projects like Project Ascend—which decrease to 0.05% as market cap grows.

Pump.fun has reopened streaming to select users and tightened moderation to prohibit violence and animal abuse. The core innovation is a tokenized feedback loop—a direct link between fan engagement and creator revenue.

Pump.fun’s Tokenized Streaming Model

Project Ascend shifted Pump.fun’s fixed 0.05% creator fee to a variable model: tokens below $300,000 market cap incur a 0.95% fee, while those topping $20 million pay just 0.05%. This lets smaller creators earn nearly 1% per trade. Blockworks reports this update restored Pump.fun’s market share, generating over $834 million in total revenue, with a $492 million annualized run rate and daily buybacks above $68 million.

After suspending streaming due to harmful conduct, Pump.fun reinstated the feature for 5% of users, implementing stricter standards banning violence, animal abuse, and hate speech. While some NSFW content is expected, the platform aims to combine safety with edgy entertainment—a balance crucial for mainstream user adoption and positive first impressions.

Viewers can buy and sell streamer tokens without permission or centralized liquidity control. The ability to take long or short positions deepens the market and reflects community sentiment through price signals. Tokens pegged to creator performance motivate streamers to maintain consistent schedules and strengthen community ties.

Why Choose Pump.fun Over Twitch or Kick?

- Economic incentives: Unlike Twitch or Kick, where fan donations or subscriptions offer no financial return, Pump.fun turns donations into assets. If streamer popularity rises, token values may appreciate, offering speculative returns to early supporters.

- Creator income grows with success: Streamer earnings are no longer tied to static subscription rates. They profit from token trading volume and benefit from network effects as participation grows. Pump.fun’s variable fee model means smaller creators can earn up to 19 times more per transaction than under legacy flat fees.

- Community ownership: Streamers and viewers share financial upside, fostering more collaborative content—joint projects, or community-driven decisions about future streams.

Conclusion

Pump.fun is betting that tokenized streamer fan communities can unlock a broader attention and donation market by sharing rewards with fans. Its ability to replicate Kick’s early success depends on attracting top talent, enforcing robust content moderation, and scaling its dynamic fee infrastructure.

If the experiment works, it may set a new standard for the creator economy—blending live streaming, trading, and speculation into one marketplace.

Disclaimer:

- This article is republished from [TechFlow] and all rights belong to the original author [Alea Research]. For any concerns about republication, please contact the Gate Learn team for prompt resolution.

- Disclaimer: The views expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions are translated by Gate Learn and may not be reproduced, shared, or plagiarized without credit to Gate.

Related Articles

Top 10 Meme Coin Trading Platforms

Review of the Top Ten Meme Bots

What's Behind Solana's Biggest Meme Launch Platform Pump.fun?

Introduction to Raydium

NFTs and Memecoins in Last vs Current Bull Markets