Unveiling the Trading Secrets of MEME Whales: High-Frequency Strategies and Covert Manipulation Powering outsized Profits

The trading strategies employed by these leading players not only highlight the diversity of MEME coin trading, but also shed light on the hidden complexities and potential pitfalls within this high-risk space.

This analysis explores several key aspects: token purchase preferences, maximum single-trade profit, largest single-trade loss, trading frequency, position sizing, and entry timing.

Cupsey: Hunting for Gems with High-Frequency Sniping

Cupsey (suqh5sHtr8HyJ7q8scBimULPkPpA557prMG47xCHQfK, Twitter: @Cupseyy) ranks first on the OKX Wallet Leaderboard for the past three months, with profits of approximately $5.14 million and a win rate of 67.7%. Cupsey's Twitter following has also reached 137,400.

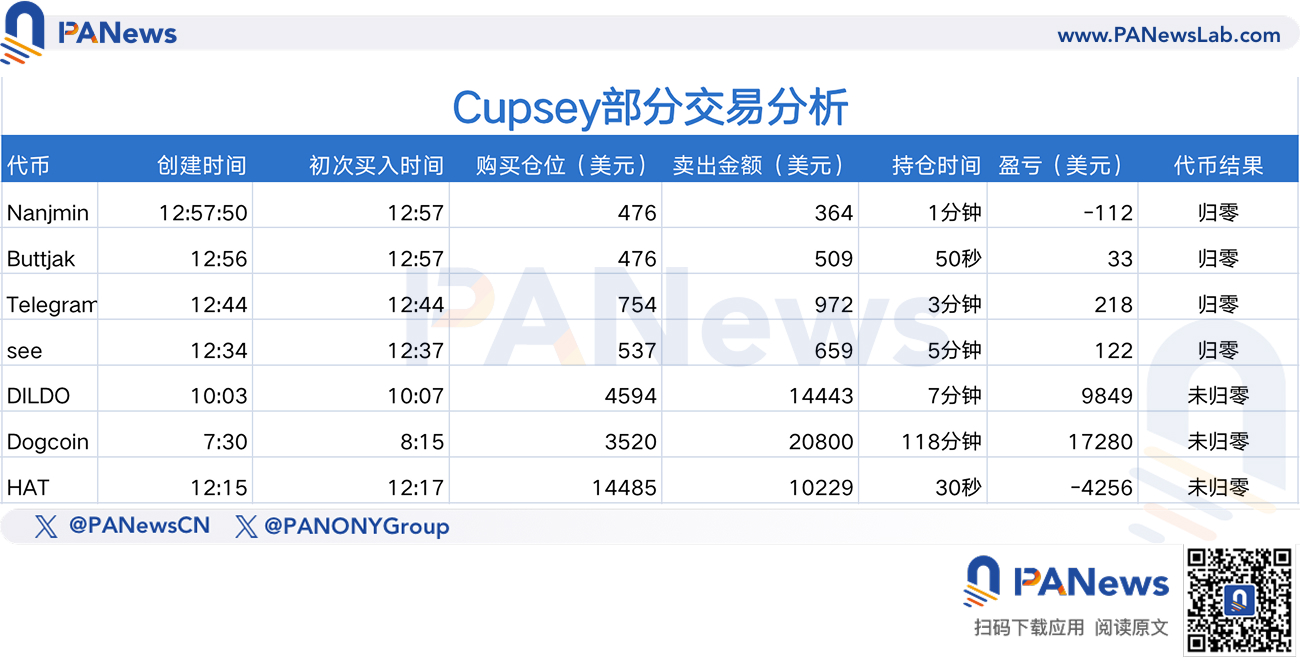

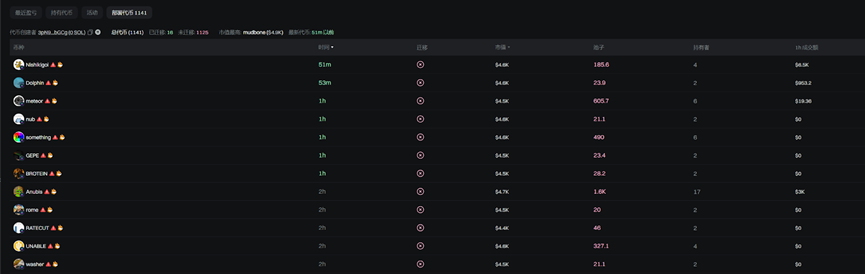

PANews analysis reveals that Cupsey’s trading strategy revolves around high-frequency sniping—investing a set portion of funds into tokens the moment they launch, then exiting the position within one minute or even just seconds. Given the staggering 95,000 trades in 30 days, analyzing Cupsey’s entire trading approach in detail is not feasible. Instead, PANews focused on several of Cupsey’s recent random trades, as well as the most profitable and the largest losing trade.

In terms of trading frequency, Cupsey averages about 910 trades per day over the past week. Analyzing recent trades shows a clear tendency to buy tokens with similar capital allocations—typically around 3 SOL—within minutes of new tokens listing or opening. Initial sell-offs typically occur within seconds to a few minutes. If certain criteria are met, Cupsey will “chase” by adding an additional $30 per trade, usually up to 10 additional times. Cupsey’s profit targets remain modest, ranging from several dozen to about $200 per trade. Clearly, Cupsey’s logic is not driven by a fixed profit/loss ratio, but rather by real-time market moves and swift exits. Most tokens he trades go to zero within minutes—sometimes so quickly that even he cannot avoid losses. Judging by his execution speed, Cupsey almost certainly leverages a proprietary trading API for maximal efficiency and to avoid being frontrun.

On-chain data shows Cupsey’s most profitable trade was with a token called Dogcoin. This time, he deviated from his usual approach by entering more than 40 minutes after launch and starting with an initial investment of over $2,000, quickly adding to the position with multiple additional buys. He closed the position in less than two hours. He then repeatedly bought and sold the same token, ultimately netting about $17,000 in profit.

For his largest loss, Cupsey traded the HAT token using his typical sniping strategy—buying within two minutes of launch and selling after 30 seconds. This time, the initial investment was unusually large at over $2,300. The first sell incurred a $300 loss. Cupsey remained confident and increased his position size, losing another $3,000 just a minute later.

This sequence illustrates that even elite MEME traders can fall victim to emotional heavy-position trading. Overall, Cupsey relies primarily on two strategies: the first is to snipe new launches for quick, small profits—which requires split-second judgment and ultra-fast execution, often requiring sophisticated automated tools.

The second strategy is more deliberate: identifying promising tokens early, investing thousands of dollars, and exiting in phases. In both strategies, Cupsey generally avoids holding positions overnight or chasing outsized returns. His approach exemplifies how professional MEME traders build profits through technical prowess and distinctive trading logic—turning small wins into substantial gains.

gake: Master of Value Discovery and Swing Trading

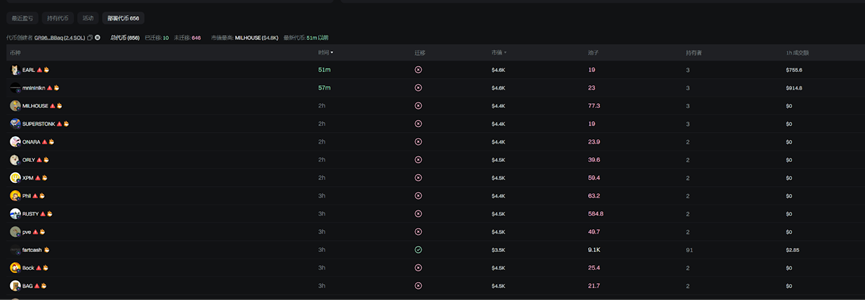

gake (DNfuF1L62WWyW3pNakVkyGGFzVVhj4Yr52jSmdTyeBHm, Twitter: @Ga__ke, aka dnf), holds second place. gake’s trading style stands in stark contrast to Cupsey’s. Over the past three months, gake earned about $2.48 million with a win rate near 42%, and usually makes several thousand to over $10,000 per profitable trade. gake’s trade frequency is much lower than Cupsey’s, with 2,141 trades in three months—about 23 trades per day.

gake typically targets tokens with market caps above $100,000 and is not fixated on buying at launch. Occasionally, gake buys shortly after a token’s launch, but this seems to be about accumulating cheaper tokens—not exiting sooner than the crowd.

gake’s primary focus is on tokens less likely to go to zero quickly and with strong potential to trend on social media. Typically, this means tokens tied to AI, Elon Musk, or established MEME culture communities. Based on observations, most tokens that gake buys have market caps exceeding $1 million.

On entry timing, gake waits for price bottoms or uses positive catalysts to buy into breakouts. After entry, a small portion of the principal is quickly recovered, while the remainder is left to run. When a token gains momentum, gake will trade it multiple times during its cycle, similar to trading altcoins.

Overall, gake is a true “diamond hands” trader with a distinct eye for value—specializing in identifying promising narratives and MEME themes, and allocating significant capital after thorough assessment.

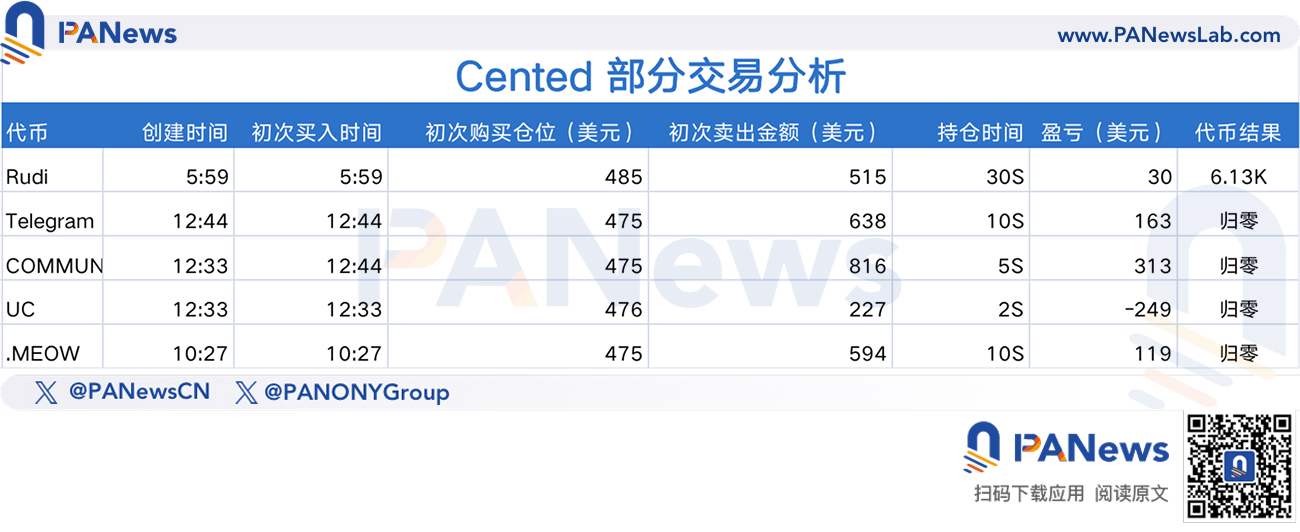

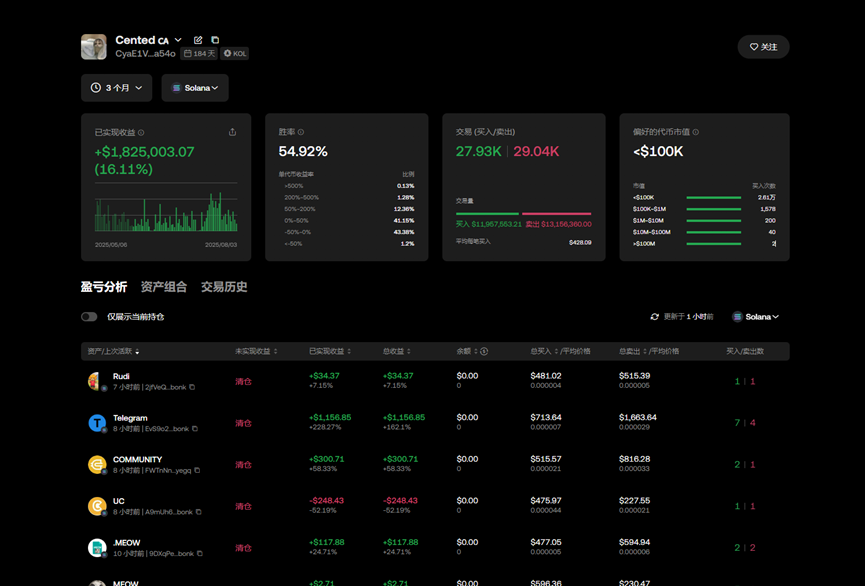

Cented: “Smart Money” Traps and Warning Signs of Manipulation

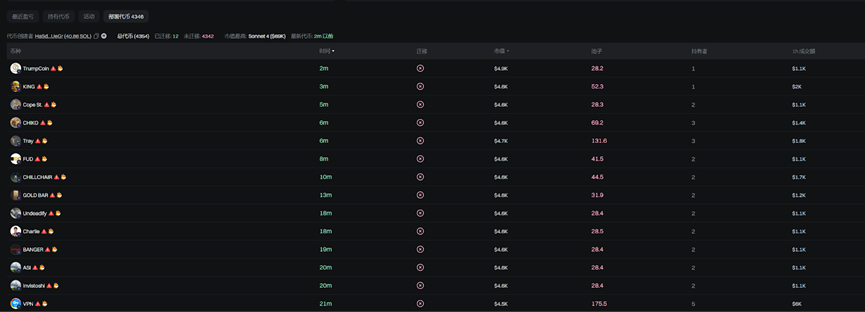

Cented (CyaE1VxvBrahnPWkqm5VsdCvyS2QmNht2UFrKJHga54o), ranked third, reported $1.82 million in profits over the past three months. Cented’s approach closely resembles Cupsey’s, with similar investment sizes and even overlapping token selections. However, Cented trades are pure high-frequency, launch-sniping bot activity with even shorter holding periods—typically wrapping up in just a few or several dozen seconds, almost always buying within seconds of launch. This account is clearly bot-driven.

However, despite Cented’s reported $1.82 million in profits, these figures may be misleading. Cented only buys brand-new tokens at launch, and unless outside buyers participate, these tokens rarely rise or yield real profits. Yet, over half of Cented’s tokens appear profitable—an anomaly in MEME token trading. PANews suspects that Cented is one of several coordinated addresses, with most gains resulting from artificial price action between affiliated wallets—essentially wash trading. The intention appears to be showcasing Cented as “smart money.” This lures others to engage in copy trading and become easy targets for the group’s schemes.

PANews randomly checked several tokens traded by Cented. In every case, the creators were addresses dedicated to launching this type of “scam coin.” This evidence indicates that Cented is either part of the group or specializes in trading these low-quality tokens. Regardless, following Cented is not a prudent move for investors.

Therefore, investors should carefully examine “smart money” addresses and avoid following them without due diligence. When conducting MEME token research, it is important to remain vigilant and analyze whether apparent profits align with genuine market trends. Otherwise, you may become a victim of a rug-pull scheme.

In summary, the trading behavior of these top players illustrates that real success isn’t about a single stroke of luck, but rather stems from unique trading logic, robust tech infrastructure, and disciplined risk management. For retail investors, blindly engaging in copy trading is no substitute for understanding the rationale and risks behind these strategies. Before diving into this fast-paced pursuit of profits, independent thinking and sound judgment may be the most valuable smart money tactics of all.

Disclaimer:

- This article is reprinted from [PANews], with all rights reserved to the original author [Frank, PANews]. For any reprint concerns, please contact the Gate Learn Team, and the team will address it promptly in accordance with relevant procedures.

- Disclaimer: The views and opinions expressed herein are those of the author alone and do not constitute investment advice of any kind.

- Other language versions are provided by the Gate Learn Team. Unless specifically noted as originating from Gate, translated articles may not be copied, distributed, or reproduced without permission.

Related Articles

Top 10 Meme Coin Trading Platforms

Review of the Top Ten Meme Bots

What's Behind Solana's Biggest Meme Launch Platform Pump.fun?

Introduction to Raydium

NFTs and Memecoins in Last vs Current Bull Markets