Inside Monad’s Market-Making Setup: Key Insights Hidden in Its 18-Page Sales Document

With the public sale of Monad (MON) tokens on Coinbase approaching, the project’s 18-page disclosure document is drawing significant attention from the market.

Prepared by MF Services (BVI), Ltd., a subsidiary of the Monad Foundation, the document provides a thorough overview of Monad. It covers the project’s architecture, funding details, token allocation, sale rules, market maker transparency, and security risks. This information equips investors with the key facts needed for informed decision-making and reflects the project’s commitment to openness.

Beyond widely cited data points such as “$2.5 billion FDV,” “$0.025 per token,” and “7.5% public sale allocation,” the document systematically discloses critical details including legal pricing, token release schedules, market making arrangements, and risk factors.

Notably, the document devotes substantial space to detailing multidimensional risks related to the token sale, Monad Foundation, MON tokens, the Monad project, and its underlying technology. Prospective MONAD investors are strongly encouraged to review the document carefully and make rational investment decisions.

Legal Structure

- The Monad Foundation will conduct the public sale on Coinbase through its subsidiary, MF Services (BVI) Ltd.

- MF Services (BVI) Ltd. is a wholly owned subsidiary of the Monad Foundation, registered in the British Virgin Islands, and serves as the seller for this offering.

- The Monad Foundation is the sole director of MF Services (BVI).

Core Development Entities and $262 Million Funding Details

- The main contributors to Monad are the Monad Foundation and Category Labs, Inc. (formerly Monad Labs, Inc.).

- The Monad Foundation, a Cayman Islands foundation company, supports the development, decentralization, security, and adoption of the Monad network through community engagement, business development, developer and user education, and marketing services. Category Labs, based in New York, provides core development for the Monad client.

- Monad was co-founded by James Hunsaker (CEO of Category Labs), Keone Hon, and Eunice Giarta. Hon and Giarta serve as co-GMs of the Monad Foundation.

- The Monad Foundation is overseen by a board of directors: Petrus Basson, Keone Hon, and Marc Piano.

- Funding timeline:

- Pre-Seed: $19.6 million raised from June to December 2022

- Seed: $22.6 million raised from January to March 2024

- Series A: $220.5 million raised from March to August 2024

- In 2024, the Monad Foundation received a $90 million grant from Category Labs to cover operating expenses for 2024–2026. This grant is included in the $262 million raised by Monad Labs across all rounds.

Key Sale Terms

- Token sale period: November 17, 2025, 14:00 UTC to November 23, 2025, 02:00 UTC

- Token allocation: Up to 750 million MON (7.5% of the initial total supply)

- Sale price: $0.025 per MON. If fully subscribed, the offering will raise $187.5 million.

- Minimum investment: $100; maximum: $100,000 (Coinbase One members may have higher limits per platform policy)

- FDV: $2.5 billion

- Bottom-up oversubscription allocation: To ensure broad participation and prevent concentration among large buyers, the document details a “bottom-up fill” mechanism. If the sale is oversubscribed, this approach aims for wide distribution and limits large allocations.

- Example: For a 1,000-token sale, three users (small/medium/large) request 100/500/1,000 tokens. In the first round, each gets 100 (leaving 700 tokens; small buyer fully satisfied). In the second round, the remaining 700 are split evenly between medium and large buyers (350 each). Final distribution: small = 100, medium = 450, large = 450.

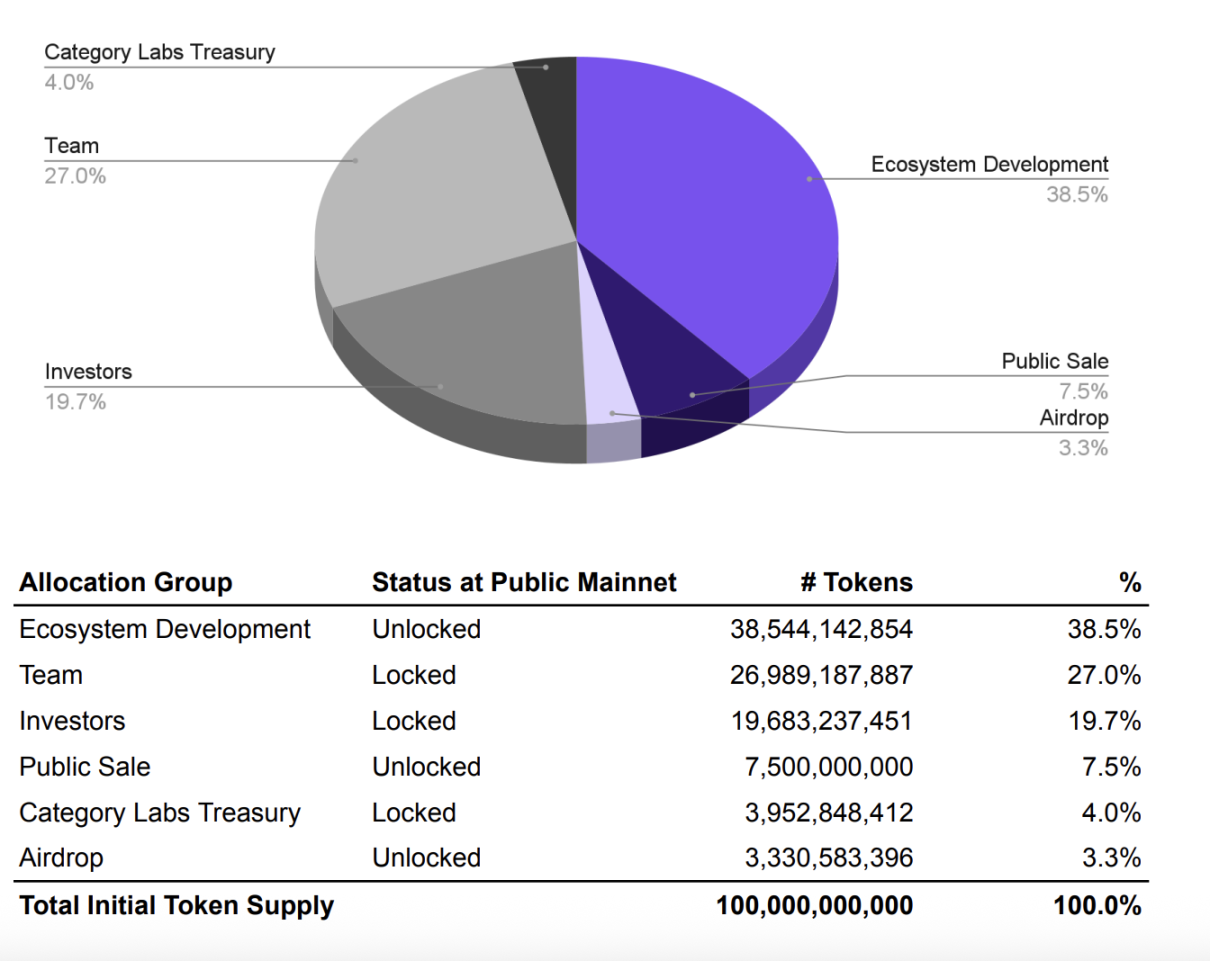

Token Allocation and Release

The MON tokenomics model is shown below:

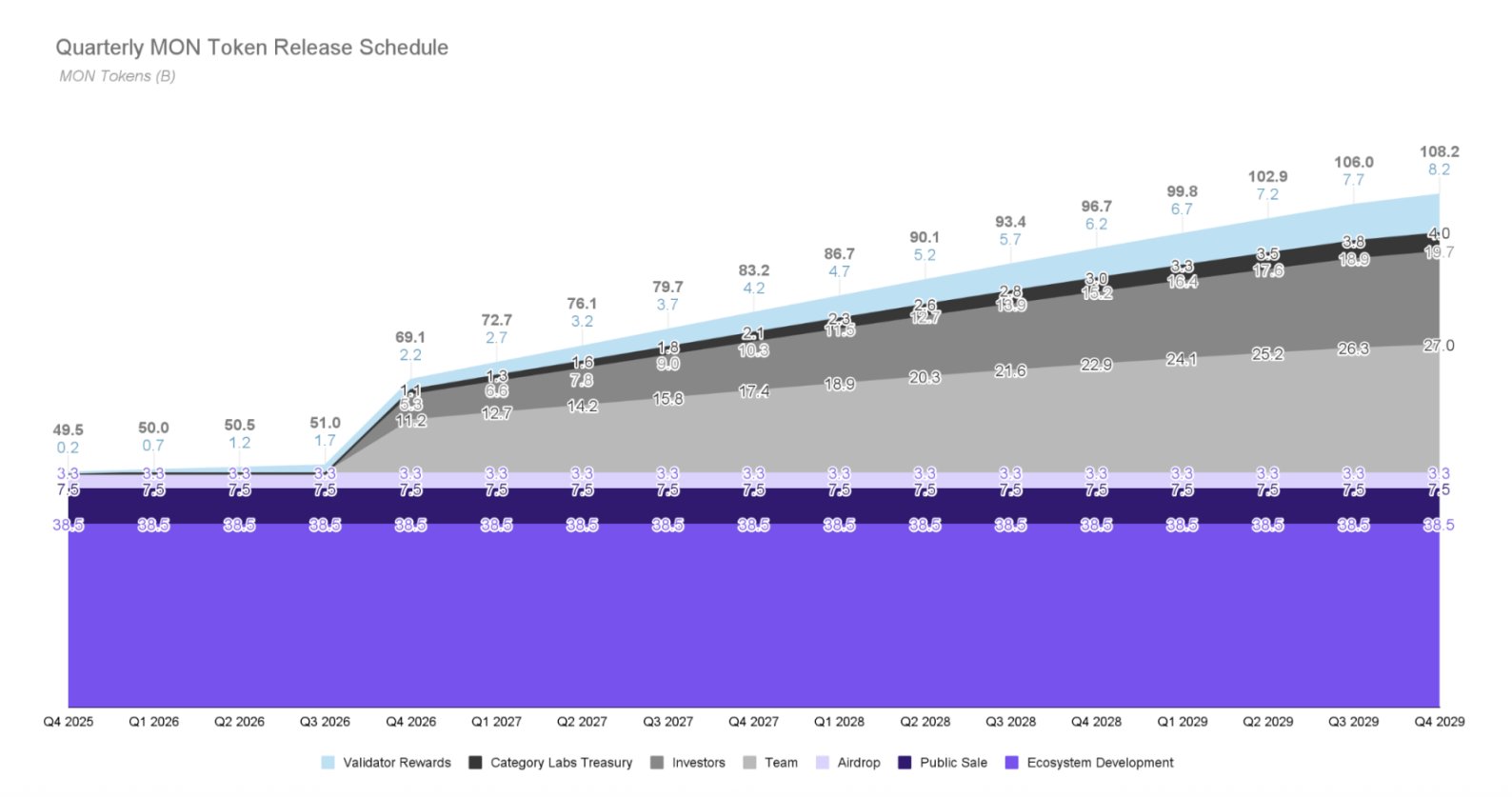

The chart below outlines the anticipated release schedule:

At mainnet launch, approximately 4.94 billion MON tokens (49.4%) will be unlocked. Of those, around 1.08 billion MON (10.8% of initial supply) will enter circulation via public sale and airdrop, while about 3.85 billion MON (38.5%) will be allocated for ecosystem development. These tokens, though unlocked, remain under Monad Foundation management and will be deployed for grants or incentives over several years and delegated per the Foundation’s validator program.

All tokens allocated to investors, team members, and the Category Labs treasury will be locked at mainnet launch and follow a clear vesting schedule. These tokens will remain locked for at least one year, with all initially locked tokens expected to be fully unlocked by the fourth anniversary of mainnet launch (Q4 2029). Locked tokens cannot be staked.

Importantly, the document indicates that the Monad Foundation may continue airdrops after launch to incentivize exploration and adoption of applications and protocols within the Monad ecosystem.

Future Supply: 2% Annual Inflation + Fee Burn Deflation

- Inflation: Each block mints 25 MON as validator/staker rewards, resulting in annual inflation of roughly 200 million MON (2% of initial supply). This incentivizes participation and supports network security.

- Deflation: All base transaction fees are burned, reducing circulating supply and offsetting some inflationary pressure.

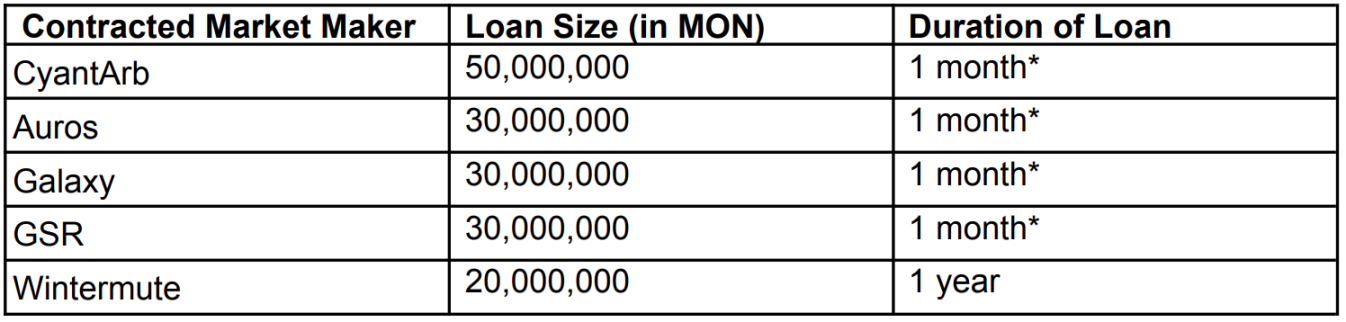

Monad Market Making and Liquidity Arrangements

To ensure strong liquidity after listing and maintain transparency, MF Services (BVI) Ltd. has disclosed its market maker partnerships and liquidity support plans.

MF Services (BVI) Ltd. has signed loan agreements with CyantArb, Auros, Galaxy, GSR, and Wintermute, lending 160 million MON tokens in total. The terms for CyantArb, Auros, Galaxy, and GSR are one month (renewable monthly), while Wintermute’s term is one year. Coinwatch, a third-party monitor, oversees token usage to ensure funds are dedicated to market liquidity and not misused.

Additionally, MF Services (BVI) may allocate up to 0.2% of the initial MON supply as initial liquidity for DEX pools.

Assessment of Monad’s Market Making Strategy

Transparency

In Web3, transparency and sound structure in market making are central concerns. Many traditional projects face trust issues due to undisclosed market maker details. Monad’s transparency in its Coinbase ICO disclosures breaks with industry norms.

Third-party monitoring by Coinwatch maximizes assurance that loaned tokens are used for market making, underscoring the project’s commitment to compliance.

Cautious Structure

The four market makers have one-month loans with monthly renewal; only Wintermute commits for a full year. This structure signals Monad’s careful approach:

- Flexibility: Short-term contracts enable adjustments based on market performance. Underperforming market makers can be rotated out monthly.

- Risk mitigation: Wintermute’s one-year commitment provides a stable, long-term liquidity base.

This mix ensures initial liquidity without overreliance on a single entity or excessive long-term obligations.

Prudent Scale

Relative to the 10 billion total supply, the 160 million MON loaned for market making represents just 0.16%—a notably conservative allocation. This may reflect:

- Avoiding excessive market intervention

- Controlling token dilution

- Market-driven strategy: Preferring organic trading activity over artificial price support

The Foundation may also deploy up to 0.2% (200 million MON) for initial DEX liquidity, reinforcing this prudent stance.

Potential Risks

The 18-page Monad sale document indicates the project has chosen a highly conservative balance between initial price discovery and long-term decentralization.

At a pre-listing price of $0.0517, these loans have a combined value of just $8.27 million. Compared to the 2–3% quotas seen in other projects, this may be insufficient to support liquidity under heavy selling pressure.

Furthermore, the Foundation’s initial DEX liquidity allocation is capped at 0.2% (200 million MON) and described as “possible,” not guaranteed. This amount can prevent a complete liquidity crunch at launch, but is unlikely to sustain deep liquidity. The official documentation also highlights risks regarding DEX and CEX liquidity, effectively serving as an early disclaimer.

For investors, this means MON could see significant price volatility post-launch if organic trading activity and natural buy-side support are lacking. When investing, it is wise to assess not only fundamentals and long-term prospects but also early market liquidity and price discovery mechanisms.

Disclaimer:

- This article is republished from [Foresight News]. Copyright remains with the original author [KarenZ, Foresight News]. For any concerns regarding republishing, please contact the Gate Learn team for prompt resolution per relevant policies.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by Gate Learn and may not be copied, distributed, or plagiarized without proper reference to Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?