If Polymarket Doesn’t Launch a Token, What Else Can Prediction Markets Speculate On?

With Trump projected to return to the White House, prediction markets are entering an unprecedented mainstream surge. The latest major news: Polymarket, the world’s largest prediction market, has received a multi-million-dollar investment from Donald Trump Jr.’s venture capital fund. Not only did the president’s son participate through 1789 Capital, but he’s also joining Polymarket’s advisory board.

This funding suggests Polymarket may be more likely to pursue an IPO than launch a native token. 1789 Capital, which also backs high-profile firms like Anduril and SpaceX, reportedly began engaging with Polymarket CEO Shayne Coplan 18 months ago. However, Polymarket established clear regulatory compliance in the U.S. market before finalizing the investment.

Another key observation: most prediction market projects still haven’t issued tokens, leaving secondary market investors with limited options. Even industry leader Polymarket’s most direct investment target is UMA, the optimistic oracle protocol supporting its platform.

Given this context, BlockBeats has spotlighted six leading projects in the prediction market sector. They range from Flipr—delivering 100x returns in just two months and integrating trading natively into social media—to infrastructure providers UMA and Azuro, and new protocols using AI to power fully autonomous trading decisions. Each project offers unique technical approaches, business models, and user experiences. Important note: This article is for industry analysis and informational purposes only and should not be considered investment advice.

Flipr: Social Prediction Market With 100x Growth in 2 Months

Flipr positions itself as the “social layer” of prediction markets, its hallmark innovation embedding prediction trading directly into X (Twitter). Users can place bets without ever leaving their social feed.

Users simply tag @fliprbot in a tweet, specify the direction and amount, and the bot instantly parses and executes the trade. The completed order is automatically posted as a quote tweet, placing bets on Polymarket and Kalshi, and allowing one-click copying, counter-betting, or sharing by others. This transforms prediction market platforms from isolated websites into viral, social experiences—every trade becomes shareable content, lowering user acquisition costs. Flipr also offers up to 5x leverage, stop-loss/take-profit features, and advanced order types.

On team and fundraising, as of August 2025, Flipr operates anonymously, with no team member details or equity rounds publicly announced.

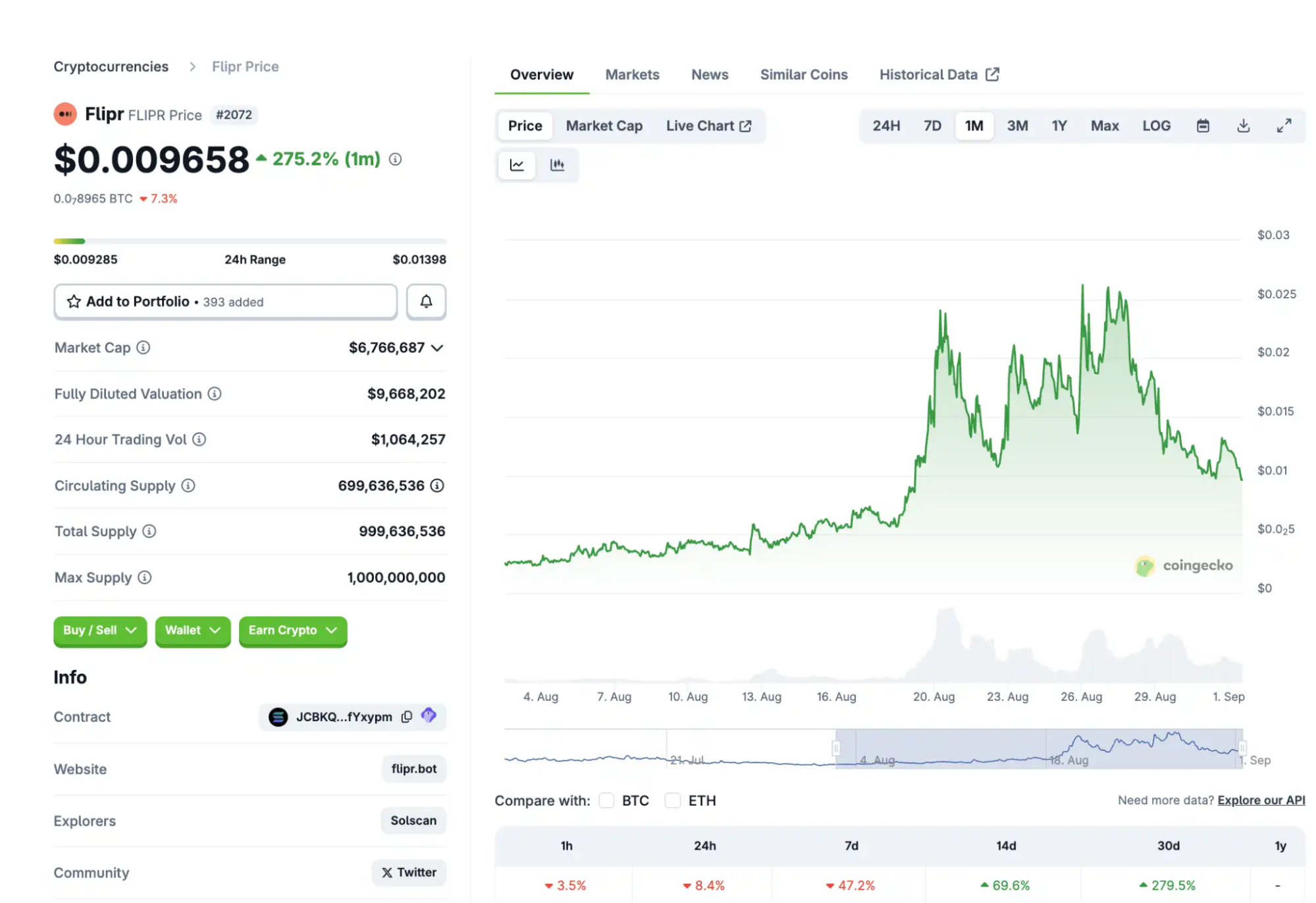

Token economics data from CoinGecko report that as of September 1, 2025, $FLIPR traded at $0.009951 with a market cap of approximately $6.96 million. In just two months, the token rocketed from under $2 million to a peak of $21 million—a 100x move, indicating significant momentum. However, after reaching an all-time high of $0.02804 on August 25, the price has dropped 64.5% from the peak, reflecting a substantial correction.

UMA: Infrastructure Leader for Prediction Markets

UMA is a cornerstone of prediction market infrastructure, powering protocols like Polymarket and Across with dispute resolution.

UMA (Universal Market Access) is an “optimistic oracle” protocol whose key innovation is a dual-layer structure—Optimistic Oracle and Data Verification Mechanism (DVM). As outlined in official documentation, UMA’s process is “assume correct, dispute if needed”: anyone can make an on-chain assertion of external truth and post collateral, and if no dispute occurs during the active window, it stands as valid. This allows most settlements without voting, with near-instant speed and minimal on-chain cost. Disputes are settled via UMA token holders voting off-chain, typically completed within 48-96 hours.

Funding statistics from RootData show UMA has raised a cumulative $6.6 million since 2018, primarily at the seed stage. The December 2018 seed round brought in $4 million led by Placeholder, with Coinbase Ventures, Dragonfly, Blockchain Capital, Bain Capital Ventures, and others joining. In July 2021, UMA innovated a $2.6 million Range Token financing, improving DAO treasury liquidity without selling pressure, with Amber Group, Wintermute, and BitDAO participating. By comparison, UMA’s more modest funding underscores the team’s commitment to product-led growth over capital-fueled expansion.

To secure its network, UMA uses a staking model: stakers lock UMA in the DVM 2.0 contract to vote on oracle disputes, earning roughly 30% annualized yield plus redistributed penalties from inaccurate votes. On August 12, UMA activated the “Managed Optimistic Oracle V2” for Polymarket, restricting market proposal rights to white-listed members.

Following Binance’s addition of a UMA trading pair on August 26, market liquidity is expected to improve further. Longer-term, UMA’s prospects depend on balancing decentralization with mitigation of token holder capture risk.

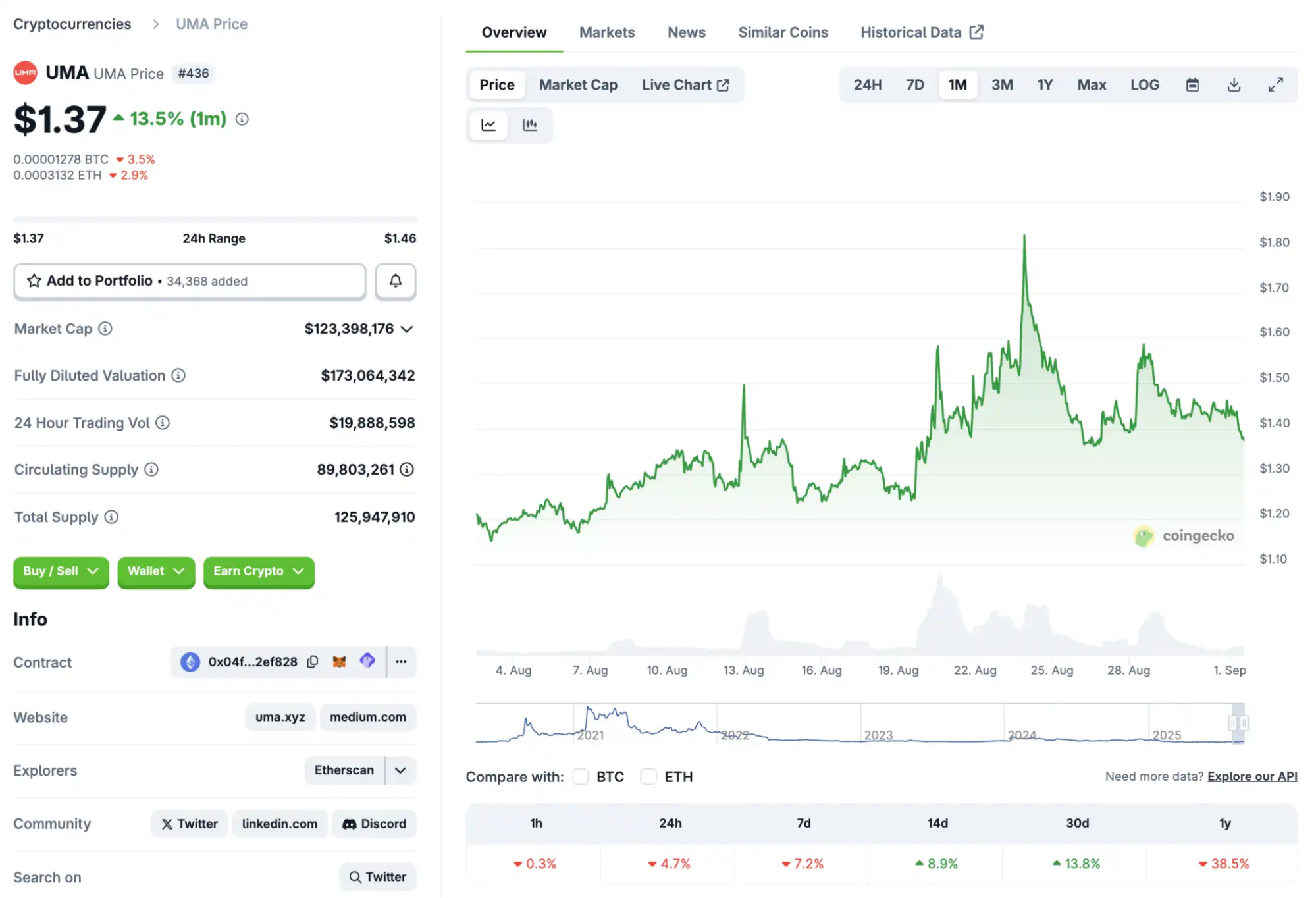

As of September 1, 2025, $UMA was priced at $1.38, with a market cap around $123.8 million. The token rose 8.9% over 14 days and 13.8% in 30 days, reflecting robust short-term performance. UMA’s all-time high was $41.56 on February 4, 2021; current prices are 96.7% below the peak, with recent stability.

Augur: Decentralized Prediction Market Pioneer

Augur is Ethereum’s first open-source, decentralized prediction market protocol and a recognized trailblazer in the sector.

In November last year, Vitalik Buterin referenced Augur in his article on prediction markets: “Back in 2015, I was a frequent user and supporter of Augur (my name is even cited in its Wikipedia entry). I won $58,000 betting in the 2020 U.S. election.”

The Augur protocol relies on REP token holders to crowdsource outcome reporting for real-world events, penalizing inaccurate reporters while rewarding those aligned with consensus through a share of platform fees. Its unique “fork to prevent consensus failure” mechanism allows REP holders to migrate to a new parallel universe if disputes are irresolvable, raising the cost of attacking the oracle—a safeguard that serves as an alternative to UMA’s mechanism.

Augur’s founding team includes three technologists with deep finance backgrounds. Forbes notes co-founder Joey Krug is currently Pantera Capital’s co-Chief Investment Officer, with a prediction market interest stemming from developing horse racing analytics spreadsheets. He designed Augur’s game theory framework and led Ethereum’s first-ever ICO. Co-founders Jeremy Gardner and Jack Peterson are also active in blockchain, with advisors including Vitalik Buterin and Intrade founder Ron Bernstein.

Augur’s ICO ran from August to October 2015, selling 8.8 million REP tokens at $0.602 each for a total raise of about $5.3 million, with investors including Pantera Capital, Multicoin Capital, and 1confirmation.

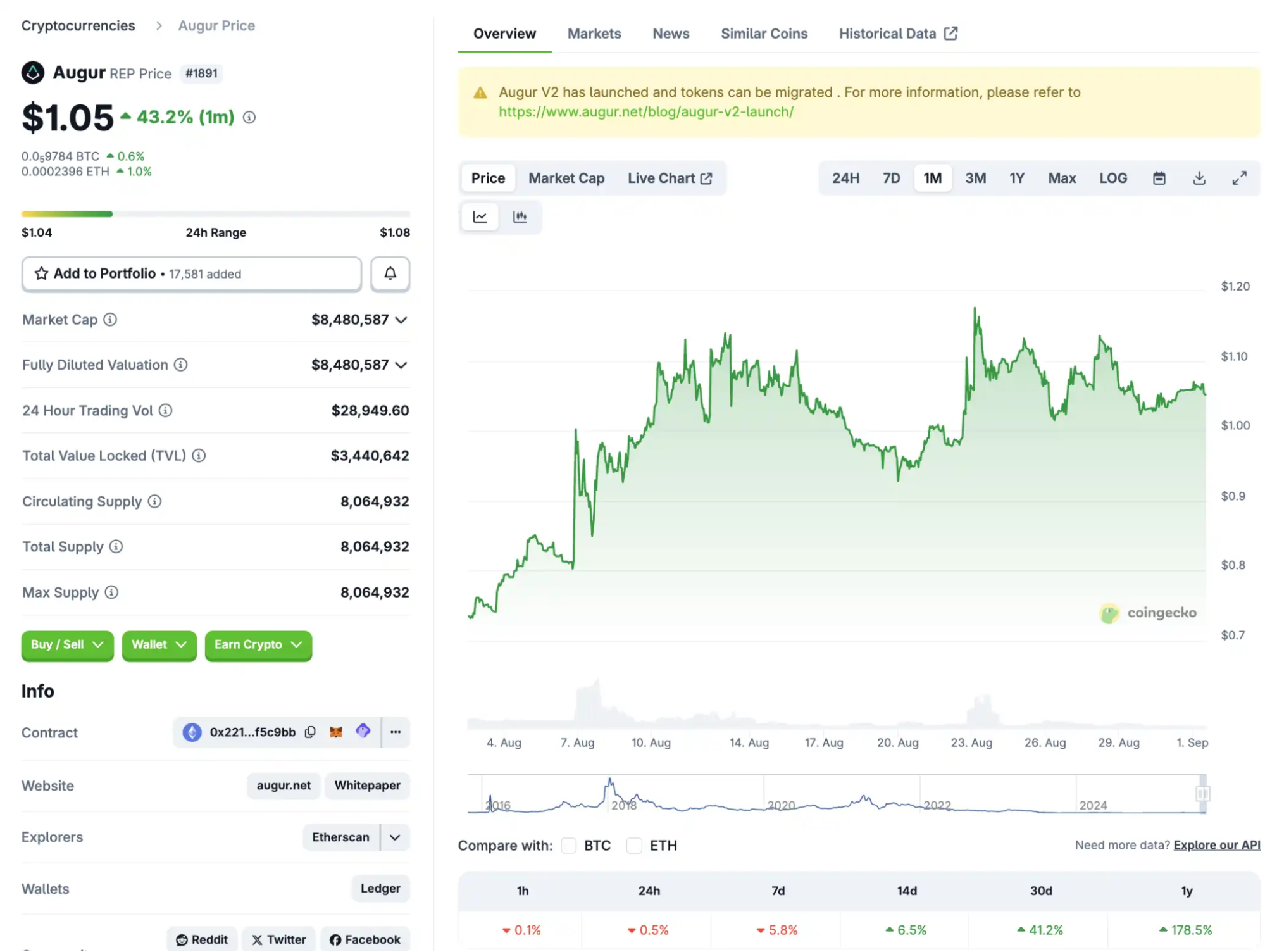

Currently, $Augur is experiencing a community-driven resurgence, pursuing liquidity incentives and new research but still struggling with liquidity compared to earlier platforms. As of September 1, 2025, REP was priced at $1.05, with a total supply of roughly 8.06 million (fully unlocked), for a market cap of $8.5 million. Thirty-day returns are 41.2%, annual returns 178%.

Azuro: Team With Deep Roots in the Traditional Gambling Sector

Azuro is an open white-label infrastructure protocol that lets anyone launch on-chain sports and event prediction apps in minutes. Per official technical docs, Azuro’s prediction market stack uses three plug-and-play modules: a shared liquidity pool (apps join a shared fund, pay fees, and LPs earn yield while sharing in trading results), a data provider/oracle layer (approved parties create “condition” markets with enhanced capital/collateral), and frontend hooks (ready-made React components for launching branded sports betting or prediction games without backend development). This makes Azuro a solution for sports betting—frontend apps retain their own UI/UX, pay a share of betting profits to the protocol, and avoid licensing and pool requirements.

Azuro’s technical edge is its LiquidityTree virtual AMM and shared singleton LP architecture, managing odds, liquidity, oracle feeds, and settlements so frontend apps don’t need custom engines. As of August 2025, the website reports Azuro powers over 30 live apps, with $530 million in cumulative betting volume and 31,000 unique wallets. Compared to legacy sportsbooks, Azuro’s permissionless liquidity and transparent on-chain settlements offer developers competitive fixed odds and easier access. The protocol runs on Polygon, Base, Chiliz, and Gnosis, with Polygon dominant—highlighting Azuro’s traction and strategic status in that ecosystem.

The founders bring traditional gambling expertise: CEO Paruyr Shahbazyan founded Bookmaker Ratings and has over a decade in iGaming. Financing totals $11 million across three rounds, with backers like Gnosis, Flow Ventures, Arrington XRP, AllianceDAO, Delphi Digital, and Fenbushi.

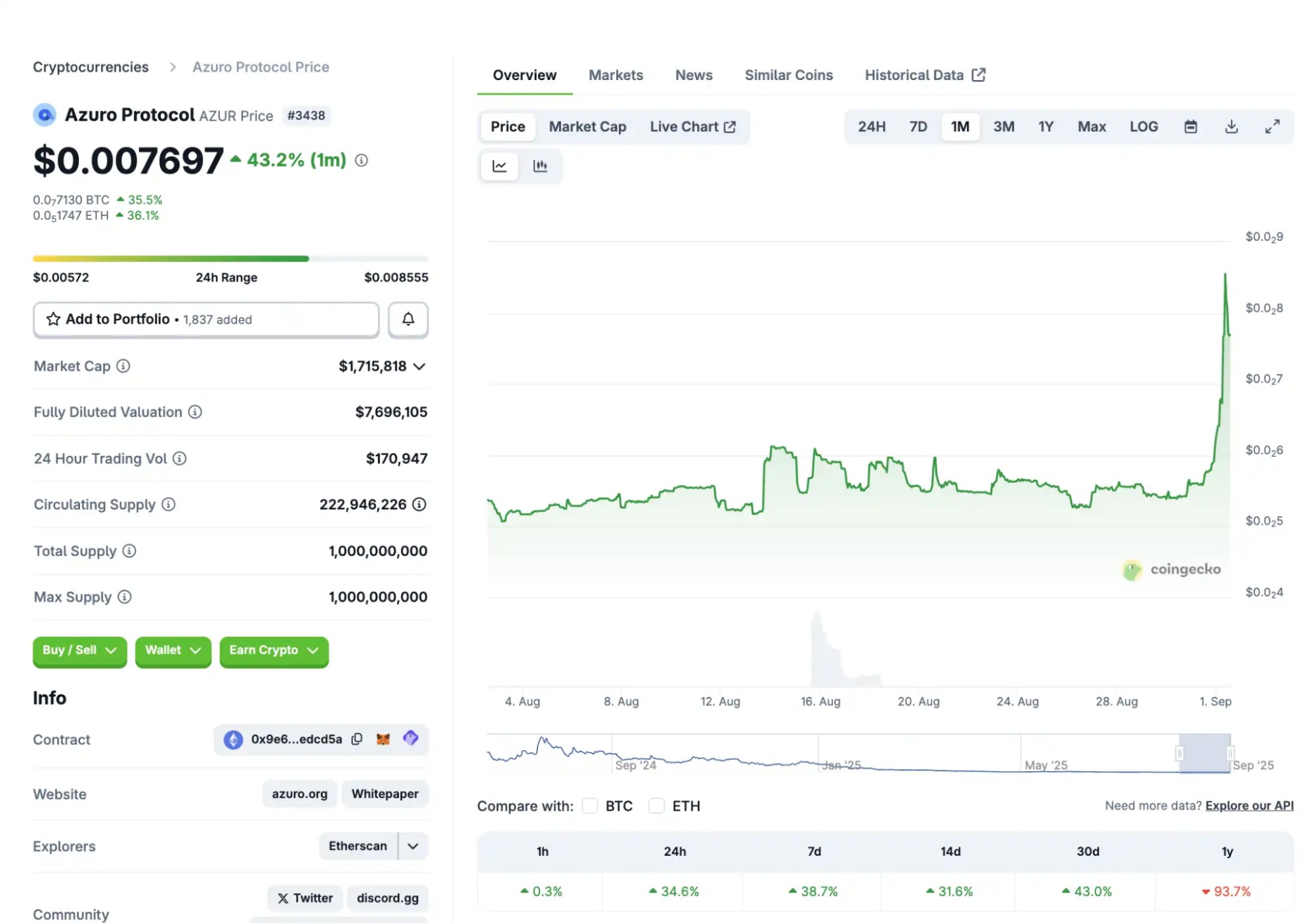

As of September 1, 2025, $AZUR has a 1 billion token supply, with 222.95 million (22%) circulating. Its price is $0.007894, market cap $1.81 million. The token peaked at $0.2396 on July 20, 2024, now down 96.6% from its high—but with a 41.5% surge in the past 24 hours and 41.8% over 7 days, it’s showing notable momentum.

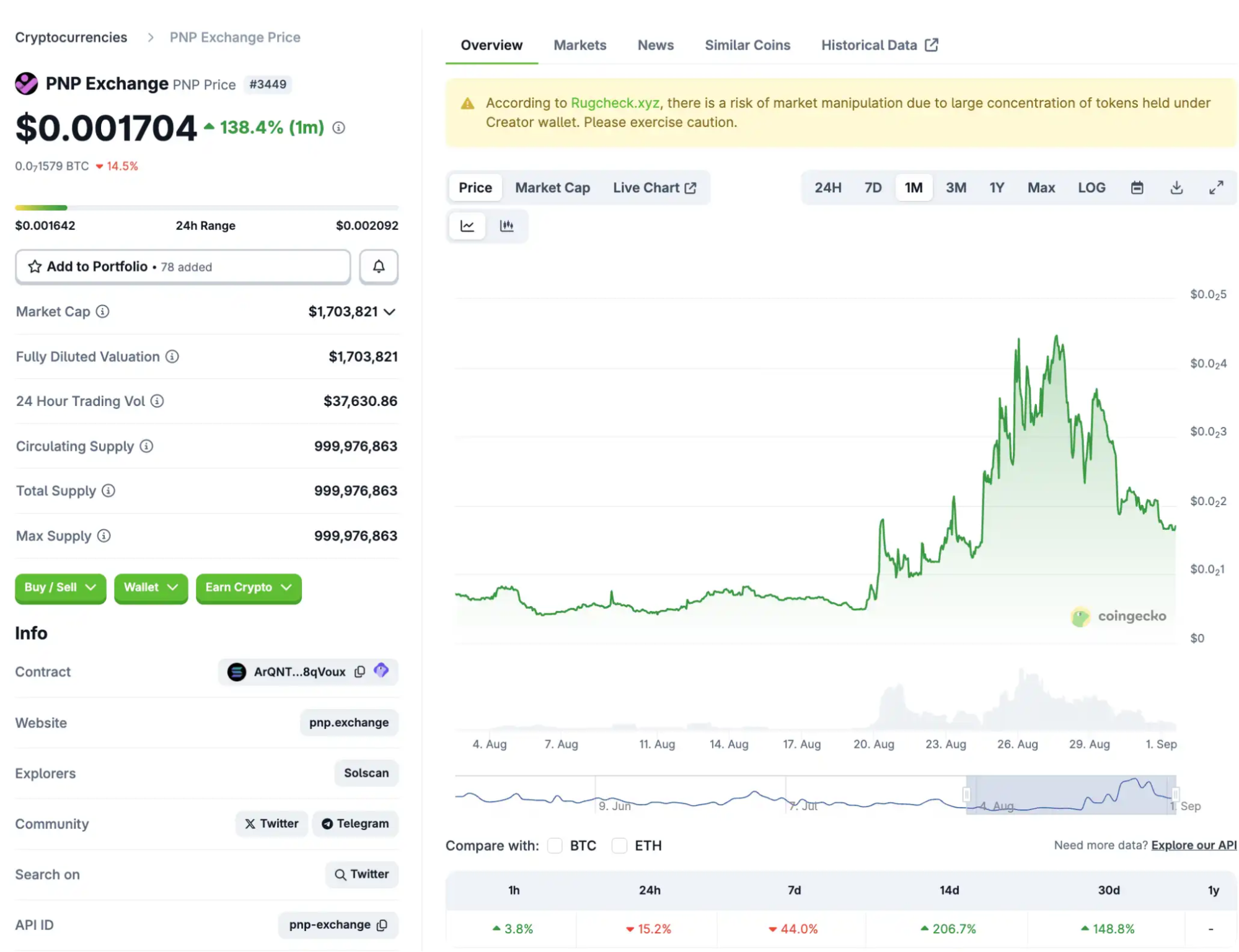

PNP Exchange: Permissionless Prediction DEX on Solana

PNP Exchange is a permissionless prediction market DEX built on Solana. Any user can create yes/no markets on any topic and earn 50% of trading fees from a unified curve pool. The platform features automated curve pricing for instant settlements on-chain, and notably, integrates an LLM oracle system. By combining consensus from Perplexity, Grok, and on-chain data, PNP automatically resolves market outcomes—already settling its first token market with zero manual intervention.

The protocol’s new “Coin MCP” module highlights its fast technical development: users can create prediction markets tied to any token’s price, liquidity, or market cap, with 1-hour settlement periods. According to the founder’s August 28 social media post, a coming SDK will let AI agents create and trade markets programmatically, while gas fees are set to drop 90% in the next 2–3 days. PNP’s “Pump.fun-style” approach eliminates token listing barriers, setting it apart from Kalshi and Polymarket and making it a meme-based, user-generated prediction trading hub.

The $PNP token is fully circulating, with about 965 million total supply. As of September 1, 2025, Birdeye shows $PNP trading at $0.001665, market cap $1.6 million. Thirty-day returns surged 148.8%, and 24-hour trading volume hit $176,000—all on Meteora DEX.

Hedgemony: Autonomous AI-Driven Trading Strategies

Hedgemony is a “fully autonomous AI trading algorithm” designed for real-time prediction trading based on global news and political sentiment. DexScreener indicates its algorithm scrapes some 2,500 real-time news and political sources per second—including Trump’s X posts, Bloomberg, Reuters, and state news feeds.

Hedgemony’s transformer-based language model identifies directional bias in global headlines with millisecond latency, executing high-frequency, leveraged futures trades up to 60 seconds before public dissemination.

Another innovation: Hedgemony’s “intent-based execution layer,” where its AI agent assembles swap routing, dollar-cost averaging, yield delegation, and narrative-driven portfolio strategies based on user prompts. Currently in MVP phase on Arbitrum, Hedgemony will expand to Base, HyperEVM, and Monad networks.

Funding-wise, Hedgemony has completed a seed round extension, claiming a $1 billion valuation (undisclosed amount raised). This valuation has not been independently verified by media or on-chain stakeholders, and investors should approach such claims with caution—especially for projects still at an early stage.

Tokenomics: $HEDGEMONY has 1 billion tokens supplied and circulating. As of September 1, 2025, price is $0.005306, market cap $5.3 million; fully diluted market cap equals current market cap. The token jumped 64% in 7 days, indicating strong short-term activity.

On-chain, there are 557 wallet holders, liquidity pool funds total $371,000, with 251 trades in the past 24 hours and 78 unique trading addresses. The top 10 holdings comprise 66.57% of supply—largest holder alone controls about 50%—highlighting significant concentration risk. The project remains in a very early, speculative phase with a high risk-reward profile.

Disclaimer:

- This article is republished from [BlockBeats], copyright remains with the original author [律动小工]. If you object to this republication, please contact the Gate Learn team, who will address the issue through the review process.

- Disclaimer: The opinions and views expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions are translated by the Gate Learn team. Unless Gate is cited, translated articles may not be duplicated, distributed, or plagiarized.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?