How to do a good research?

As an investor, the best way to lose your money is following others advice without knowing anything about the project. I’ve been there before so i’m sharing my experience here on how I research a project.

If you’re new to crypto and need some good experience this article is for you

1. Define the narrative

Narrative is one of the most important thing in crypto because market follow its movement, if you want to invest in a project start to learm]n the narrative behind it. If it’s still on some outdated narrative such as metaverse or GameFi, the project likely NGMI.

I always check the project narrative on platforms like @ CoinMarketCap or @ coingecko

- Go to:https://coinmarketcap.com/cryptocurrency-category/

- Put the project name.

- Scroll down to the “Tags” section.

Now that you know the project’s narrative start looking the leader of that sector see if it has been making any recent moves by volume and check whether your project you’re investing has a chance to compete with it. Believe me you should buy something that is either a competitor or a beta player of the leader.

People always chasing that after the main one run.

Choose narratives that are trending like AI, prediction markets, InfoFi or whatever is hot a you check at the time, it’s the best way to make profit.

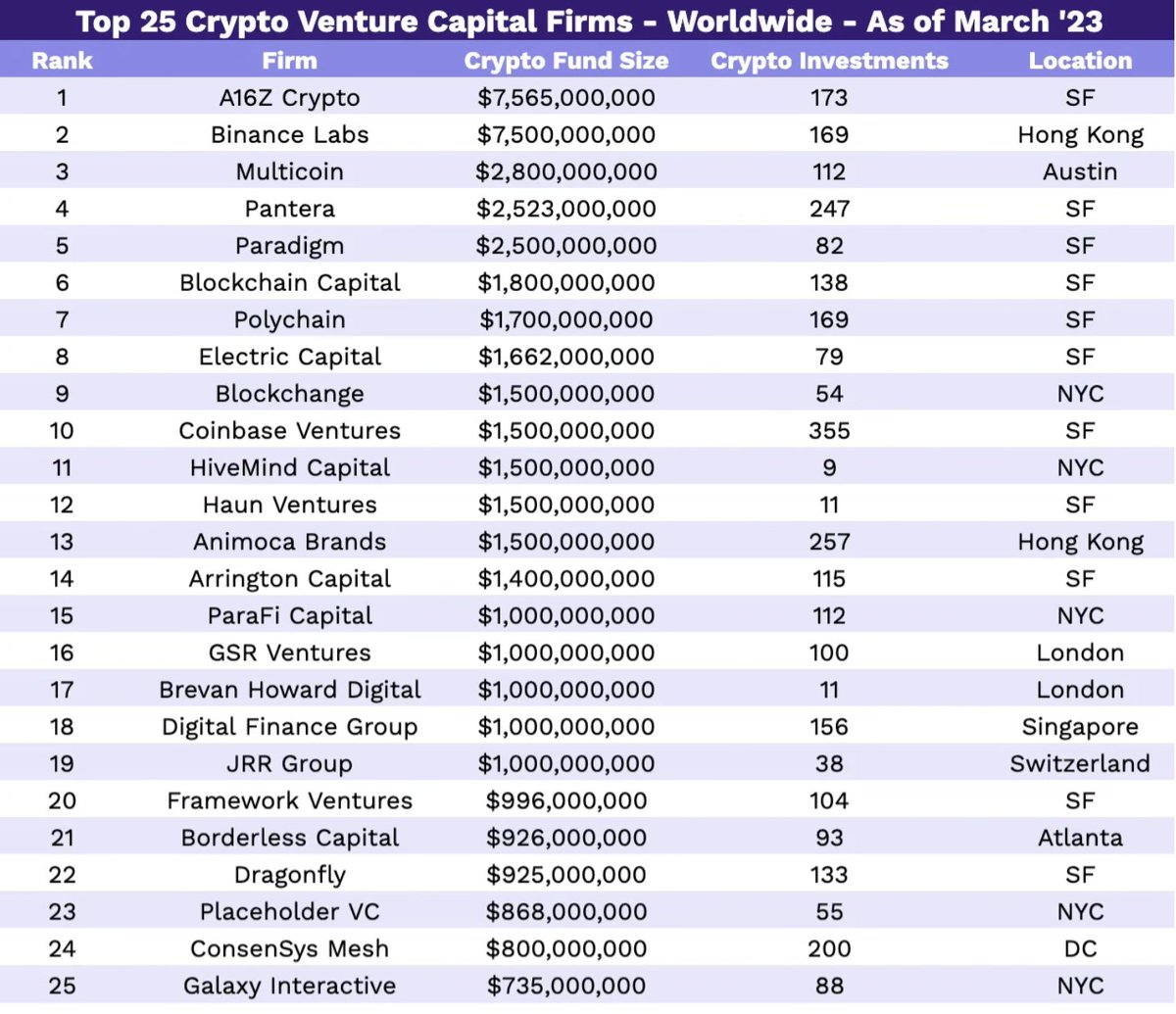

2. Backer

People may dislike of the term VCs these day and prefer self fund project but believe me, if the project you’re research doesn’t have the best product or team and isn’t a leader in any narrative. They need a backer to push them forward.

The site I use most to check a project’s backers is CryptoFundraising, it shows everything from backers and team to social and the project’s site and it’s totally free.

- Go to:https://crypto-fundraising.info/

- Search for your project

- Check raised fund and VCs tier

I’ve noticed that projects with less funding, somewhere around 2-3 VCs are usually do better than those with 20+ VCs, Think of it like a cake shared by many people which the team can’t make their own decisions without getting approval from all those VCs.

VC tiers are also very important here. There are some VCs I always love to choose

- Coinbase VC

- AI16z

- Polychain

- Paradigm

- GSR

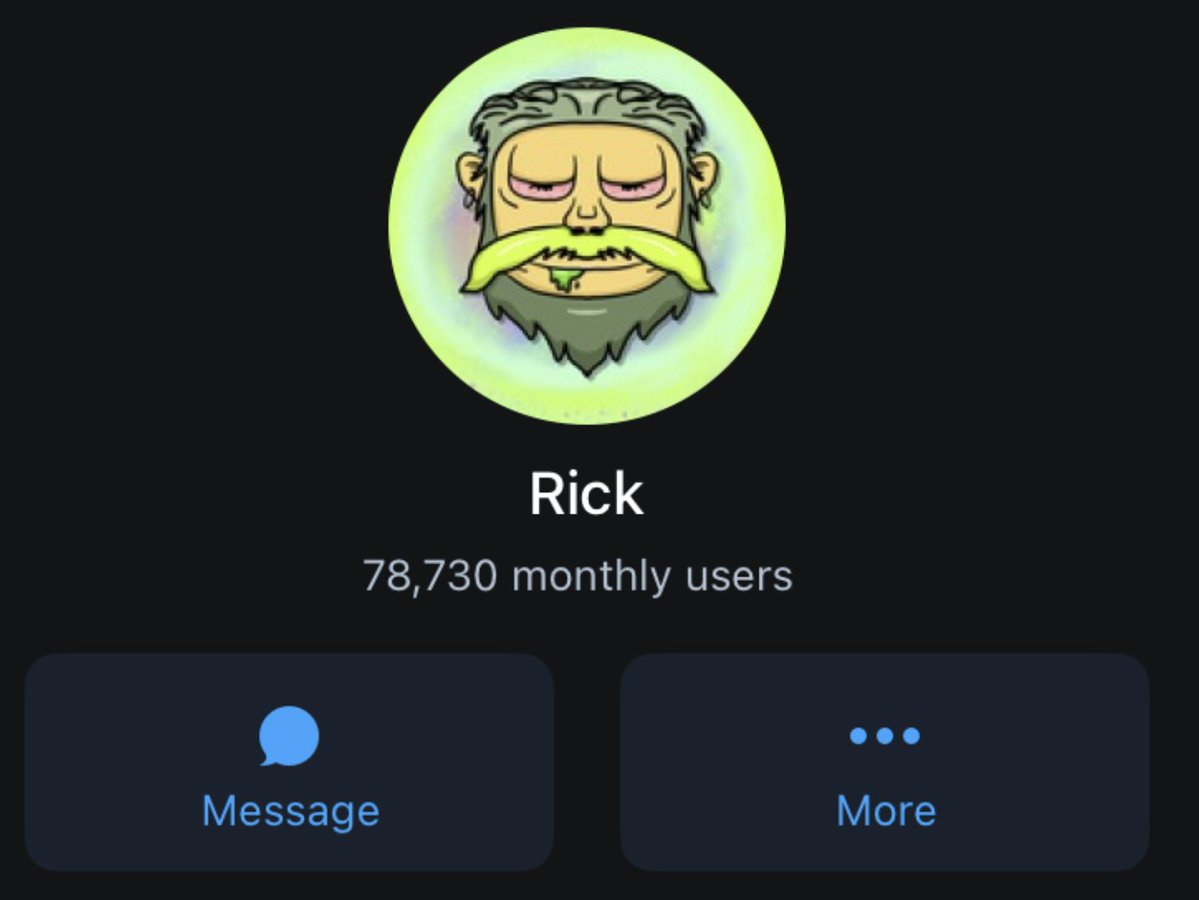

3. Check the social

This also very important if the project locked the comment or change the handle stay away from them, to check the previous handle you can use the rick bot on telegram

- Log on to your telegram

- Message Rickburpbot

- Use this command: /twit the project handle

Mutual followers should also be considered. If the project is followed by more than 20 notable people it’s usually a good sign.

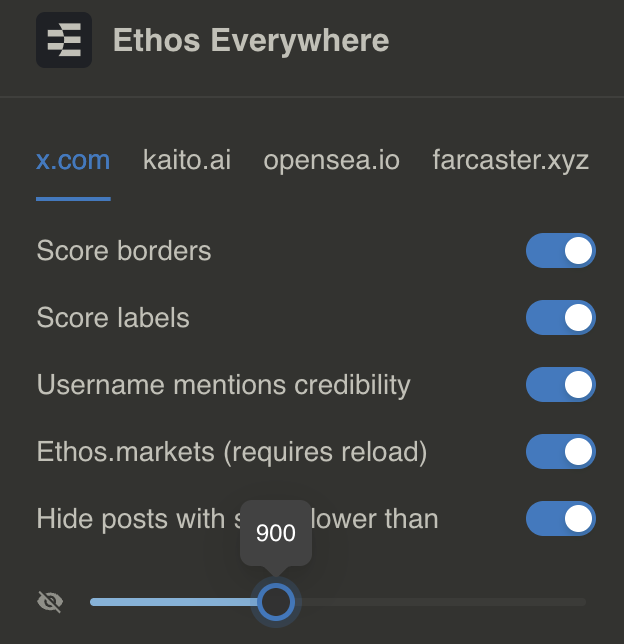

For checking legit of a project you can also use @ ethos_network, it’s a great tool but for new projects, it may only show a 950 score without any review.

- Go to:https://app.ethos.network/

- Get the chrome extension

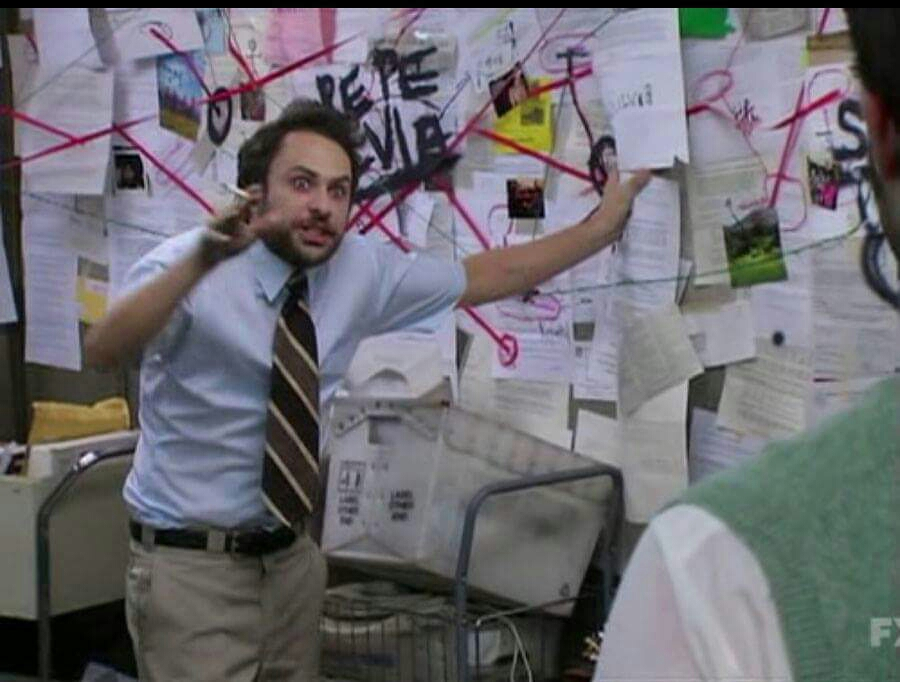

- Setting like this above so if the project get some bad review it won’t even show on your X

- You can use the extension without the ethos invite for free

4. Deep dive

Founders

I always prefer projects with the founder is active daily on CT engaging with the community. A good founder is the one believes in their project and willing to admit their mistakes.

Avoid undoxxed or crash out founders who claim community is everything but act superior and detached.

The founder actions often lead to their project direction after it launch.

Product

Accessible my top priority. Only simple, user friendly products can bring real adoption from users and make revenue.

Nobody cares about quantum blockchain try to solve world hunger if it’s hard to use.

Tokenomics

For projects already have tokens, it’s a big red flag if they allocate tokens to unrelated groups without any support their project like Binance Alpha just to seeking for a short term hype.

This action usually leads to a fail TGE followed by disaster price chart. Tokenomics doesn’t need to allocate everything to the community but it must have a clear and transparent unlock schedule for every stakeholder, including the team.

Transparency is always the must thing by team.

You can check the tokenomics and unlock by @ Dropstab_com

- Go to:https://dropstab.com/vesting

- Search for the project

- Check how the token price went in the last unlock of the project you research

Disclaimer:

- This article is reprinted from [0xleegenz]. All copyrights belong to the original author [0xleegenz]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?