Grayscale, Once a Fierce SEC Challenger, Is Now Heading to the NYSE

On November 13 (Beijing time), Grayscale filed for an IPO with the New York Stock Exchange, aiming to list on the U.S. market through Grayscale Investment, Inc. Morgan Stanley, BofA Securities, Jefferies, and Cantor are the lead underwriters for this IPO.

Grayscale’s listing uses an Up-C structure, meaning Grayscale Operating, LLC—the company’s operating and controlling entity—is not the listed entity. Instead, the newly formed Grayscale Investment, Inc. is going public, acquiring a portion of LLC’s interests to enable public trading. Company founders and early stakeholders can convert their LLC interests into shares of the listed entity, benefiting from capital gains tax treatment and owing only personal income tax. In contrast, IPO investors are subject to corporate taxes on company profits and personal income tax on dividends.

Beyond tax advantages for early stakeholders, this structure also allows for continued absolute control after going public via AB share classes. The S-1 filing shows Grayscale is wholly owned by parent company DCG. Grayscale has stated that even after the IPO, DCG will retain decision-making authority over major matters by holding 100% of the higher-voting Class B shares. All IPO proceeds will be used to acquire interests from the LLC.

Grayscale is a familiar name, known for pioneering Bitcoin and Ethereum investment products and, after protracted battles with the SEC, converting its Bitcoin and Ethereum trusts into spot ETFs. Its Digital Large Cap Fund has had an “S&P 500 for crypto” effect. During the last bull market, every adjustment to the Large Cap Fund drove significant short-term price swings for tokens being added or removed.

The S-1 filing reports that as of September 30 (local time), Grayscale managed $35 billion in assets, ranking first globally in crypto asset management. The firm offers more than 40 digital asset investment products covering over 45 cryptocurrencies. Of the $35 billion AUM, $33.9 billion comes from ETPs and ETFs (mainly Bitcoin, Ethereum, and Solana-related products), while $1.1 billion is in private funds (primarily altcoin investments).

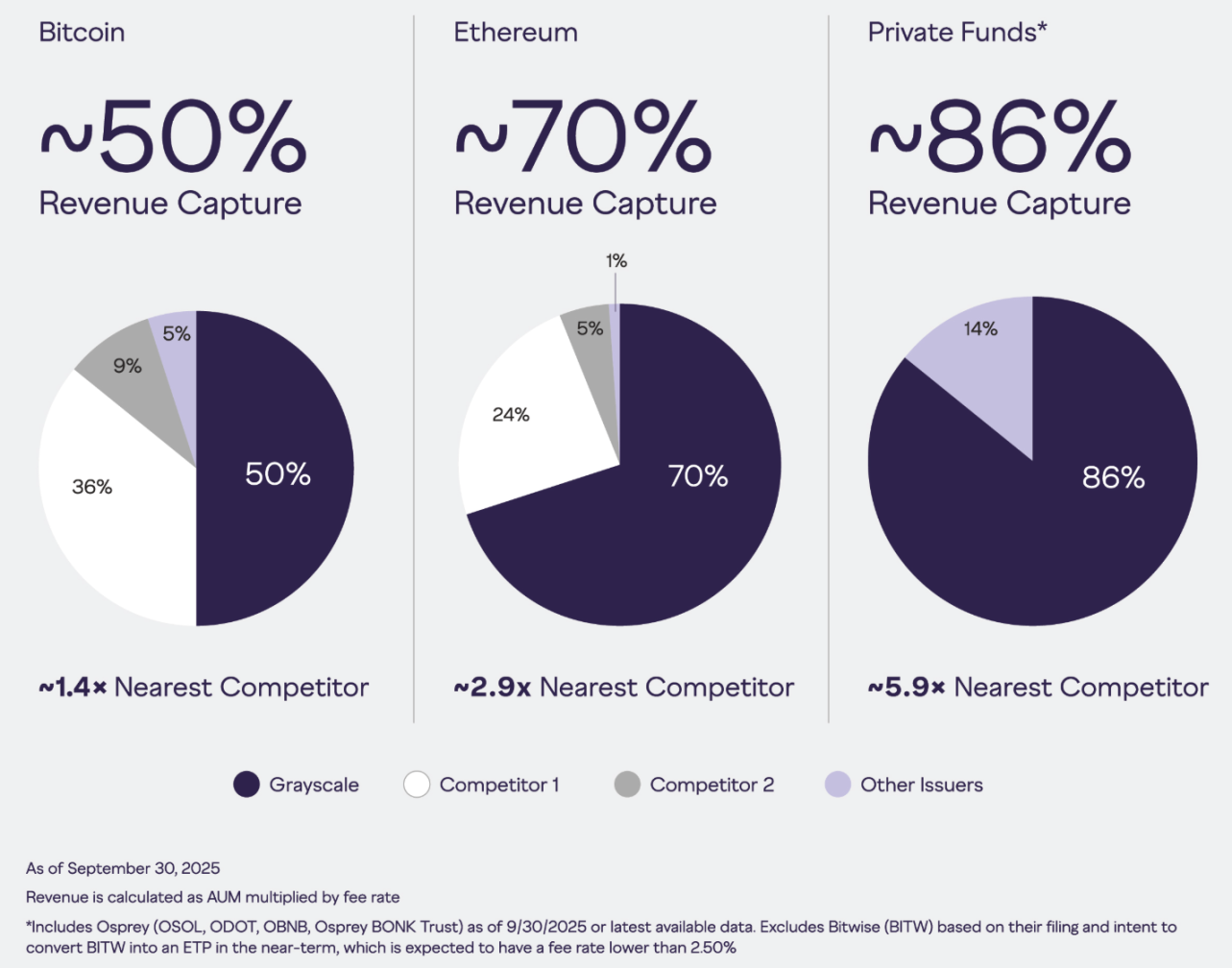

In terms of revenue, Grayscale’s flagship products outperform key competitors, largely due to previously accumulated AUM in closed-end trusts and management fees above industry averages.

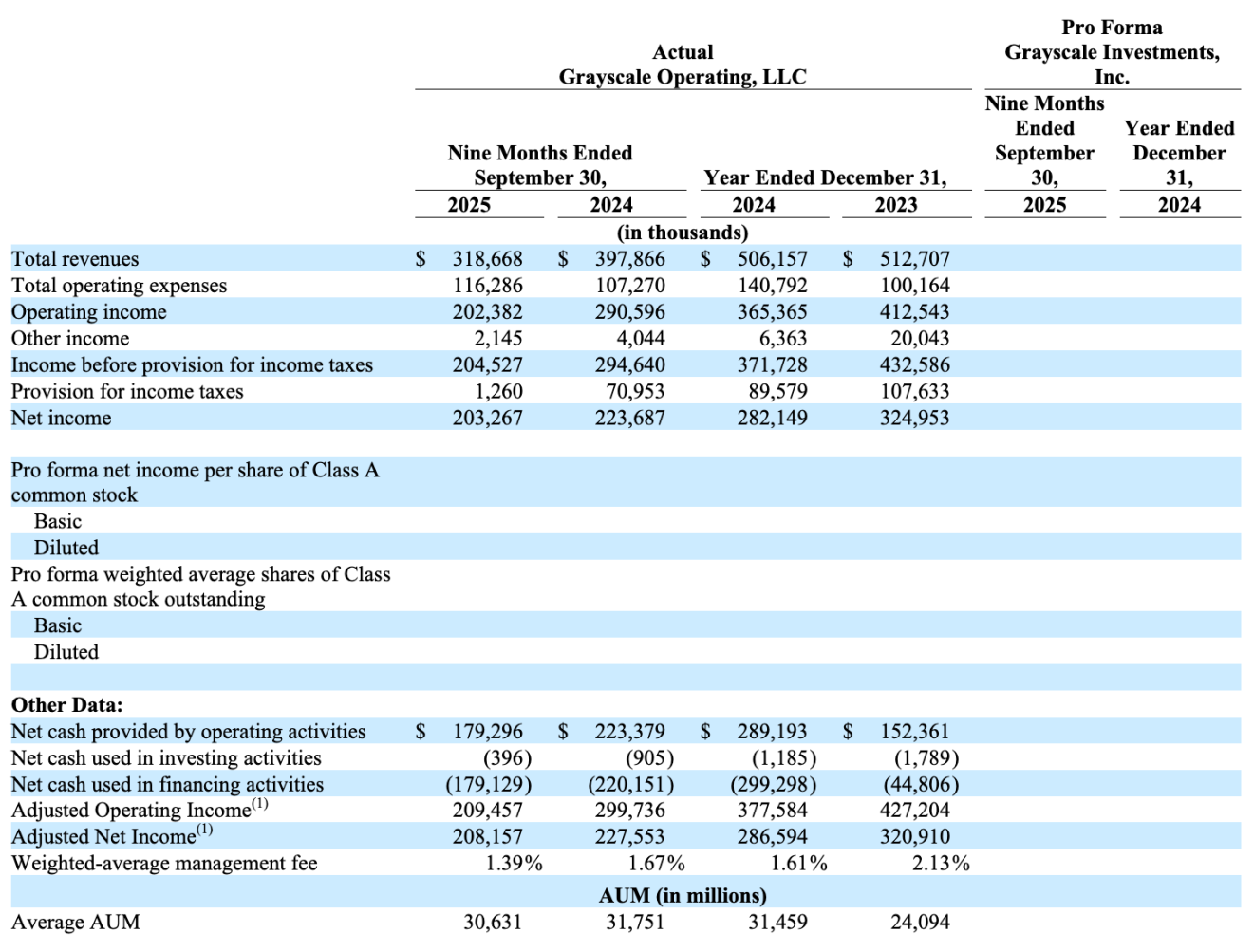

Financially, for the nine months ended September 30, 2025, Grayscale generated about $319 million in operating revenue, a 20% year-over-year decline. Operating expenses were $116 million, up 8.4%. Operating profit was $202 million, down 30.4% year-over-year. Net profit, after other income and tax provisions, was approximately $203 million, a 9.1% decrease year-over-year. Average AUM data suggests AUM may have declined compared to last year.

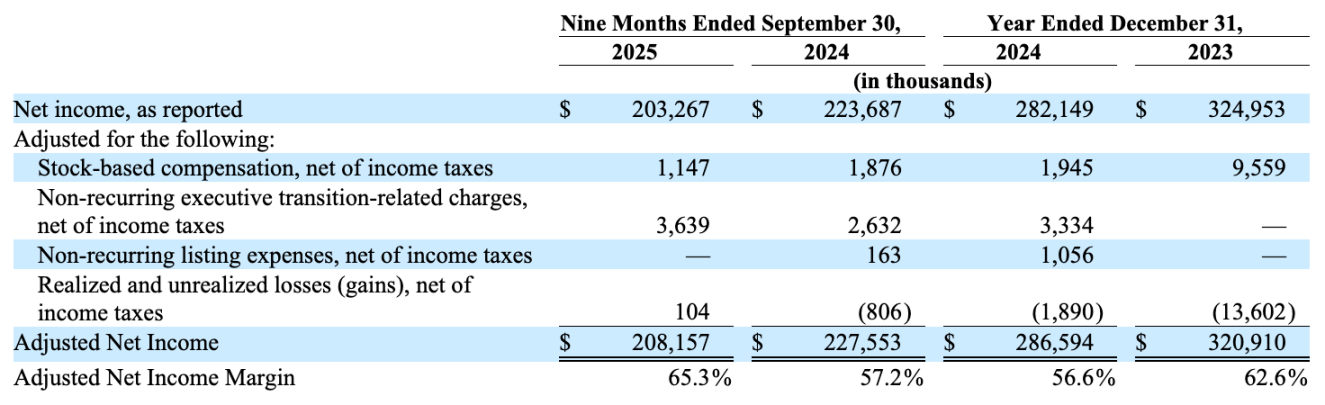

Excluding nonrecurring items, adjusted net profit for the period was around $208 million, with a net profit margin of 65.3%. While adjusted net profit fell 8.5% year-over-year, the margin improved from 57.2% a year ago.

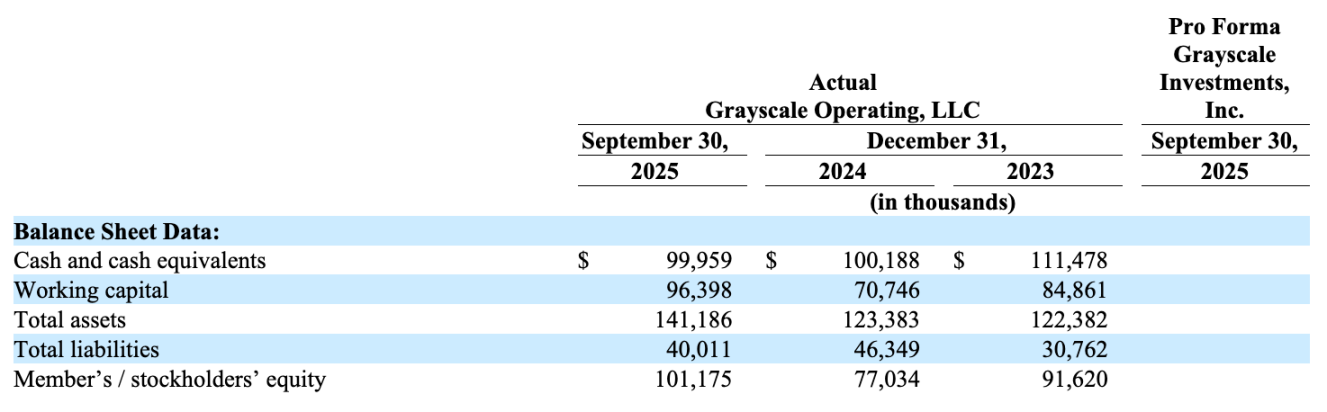

Grayscale’s leverage ratio is currently healthy. Despite declines in revenue and profit, the company’s asset value has grown, liabilities have dropped, and profit margins have improved—all indicating steady operational improvement.

The S-1 filing also details Grayscale’s growth plans: expanding its private fund offerings (including more altcoin-focused private investment products); launching actively managed investment products to complement passive funds like ETFs and ETPs; and pursuing active investments in its own funds, cryptocurrencies, or other assets.

On the distribution front, Grayscale reports it has completed due diligence with three brokerages that collectively manage $14.2 trillion in assets. This month, the company launched Bitcoin and Ethereum mini ETFs on the platform of a major independent broker-dealer with more than 17,500 financial advisors and over $1 trillion in advisory and brokerage assets. In August, Grayscale partnered with iCapital Network—a consortium of 6,700 advisory firms. Under the agreement, Grayscale will provide digital asset investment channels to network firms through its active management strategies.

Overall, Grayscale’s disclosures position it as a stable asset manager, with management fees from investment products as its main source of revenue and limited room for upside surprises. However, with precedents from traditional asset management IPOs, market cap and P/E projections for Grayscale are relatively trackable, making it a more predictable investment target.

Statement:

- This article is republished from [Foresight News]. Copyright belongs to the original author [Eric, Foresight News]. If you have any objections to this republication, please contact the Gate Learn team, and we will address them promptly according to our established procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Do not copy, distribute, or plagiarize the translated article without proper attribution to Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?