Gate Earn Launches NODE 30-Day Fixed Income: 200% APY, Limited Subscription

NODE 30-Day Fixed-Term Simple Earn Now Available

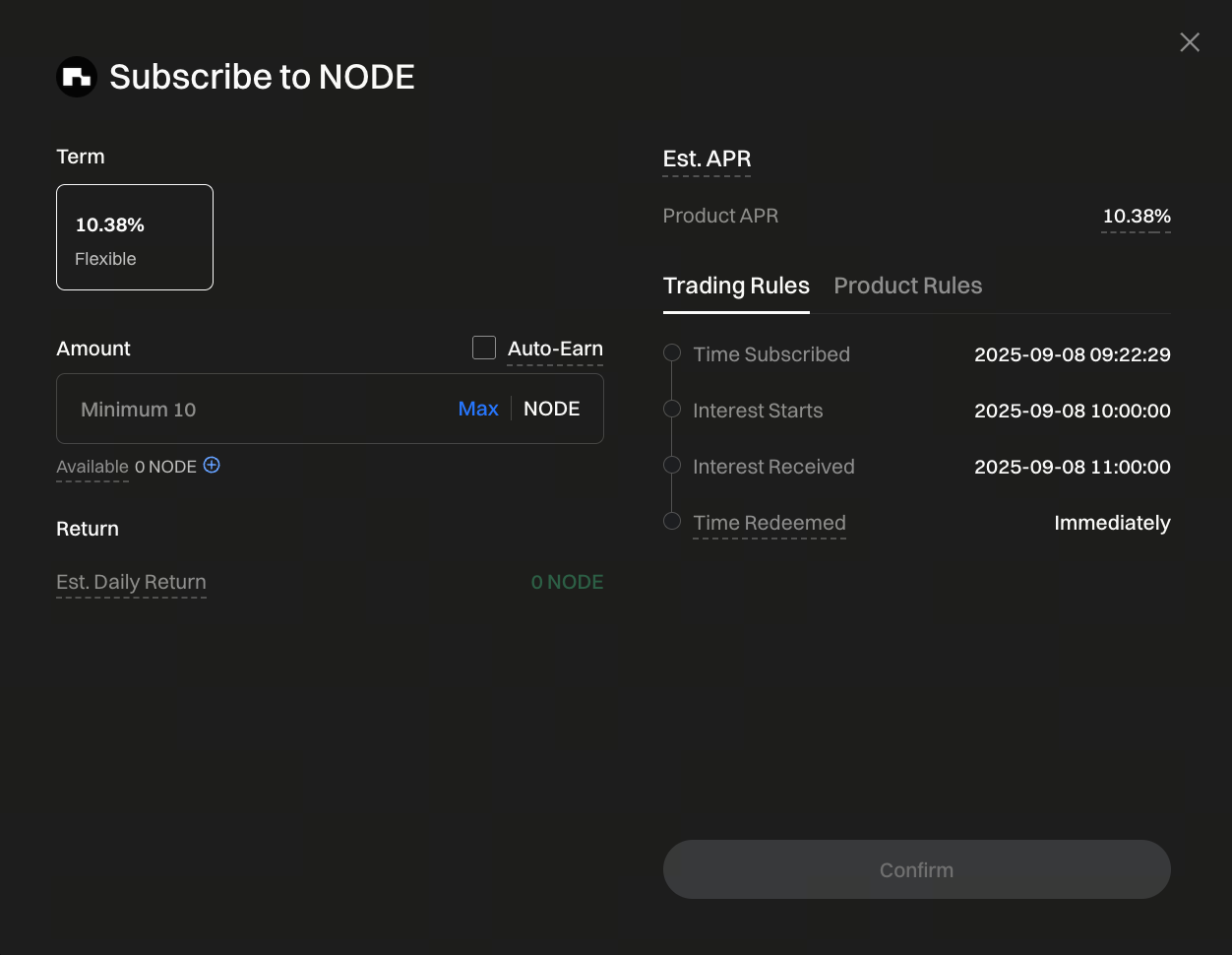

Image: https://www.gate.com/simple-earn?asset=NODE&product_id=96&product_type_tag=1

After consistently introducing high-yield investment products, Gate Simple Earn has launched a new option—NODE 30-Day Fixed-Term Simple Earn. This offering features an annualized yield of up to 200%, representing one of the most compelling short-term investment opportunities in today’s market.

This product has a 30-day lock-up period with a total quota of just 3.7 million NODE, issued on a first-come, first-served basis. Compared with shorter 7-day or 14-day terms, the 30-day duration is better suited for investors who plan their finances and can accommodate a short- to medium-term lock-up.

Yield and Subscription Details

Key product details include:

- Investment term: 30 days

- Annualized yield: 200%

- Interest distribution: Paid out in NODE tokens; viewable under [Financial Records] - [Fixed-Term] - [Interest Income]

- Quota: 3.7 million NODE, available until fully subscribed

Please note: As interest is paid in NODE rather than stablecoins, actual returns are subject to price fluctuations of NODE. Investors must be aware of heightened market uncertainty, even though the potential yield is high.

In-Depth Overview of the NodeOps Project

The NODE token is backed by NodeOps Network—a decentralized infrastructure platform focused on large-scale verifiable computation. Its core strengths include:

- Compute orchestration: Enables efficient GPU/CPU coordination and RPC-as-a-service, making it easier for developers to access computational resources

- Template marketplace: Similar to Vercel in Web2, provides ready-to-use deployment tools and lowers the barrier to entry for Web3 development

- Multi-chain compatibility: Currently supports rapid app deployment across 60+ blockchains

Key growth milestones:

- NodeOps has raised $5 million from leading investors including L1D, BFF, Finality Capital, and Polygon co-founder Sandeep Nailwal

- The platform serves over 700,000 users with more than $150 million in assets under management

- It connects 89,000 machines and 24,000 vendors, with total revenues exceeding $4.1 million

- In the DePIN (Decentralized Physical Infrastructure Network) sector, NodeOps’ revenue growth rate consistently ranks among the top five

These achievements highlight NodeOps’ solid market foundation and growth prospects. The expanding use cases and ecosystem of the NODE token further enhance the appeal of its Simple Earn products.

Who Should Consider Participating

Given its yield structure and the project’s background, this NODE Simple Earn product is best suited for:

- Investors bullish on infrastructure: NodeOps targets the DePIN and Web3 infrastructure sectors, both of which have promising growth potential

- Users with moderate risk tolerance: A 200% annualized yield is highly attractive, but token price volatility should not be overlooked

- Investors with flexible capital planning: The 30-day lock-up fits short- to medium-term financial arrangements without affecting daily liquidity

Risk Disclosure and Rational Investment Advice

While a 200% annualized yield is certainly attractive, investors should approach with caution:

- Price volatility risk: With interest paid in NODE, any decline in token price can erode actual returns

- Lock-up risk: Funds cannot be withdrawn before the 30-day term ends, limiting liquidity

- Market risk: The crypto market is subject to regulatory, market, and liquidity fluctuations, resulting in significant short-term volatility

We recommend that investors:

- Diversify allocations; avoid concentrating a large portion of assets in a single product

- Invest only idle funds to ensure sufficient liquidity

- Thoroughly research the fundamentals and future outlook of NODE before participating, and avoid pursuing high returns without due diligence

Conclusion

Gate Simple Earn’s NODE 30-Day Fixed-Term product, backed by a 200% annualized yield and the strong credentials of the NodeOps project, is emerging as a prominent investment option in the current market. For those optimistic about the Web3 infrastructure sector and willing to take on some risk, this is a notable short-term opportunity. Investors should always prioritize prudent judgment and effective risk management.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

What is N2: An AI-Driven Layer 2 Solution

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

Understand Baby doge coin in one article