From AMM to CLOB: The $7 Trillion Race to Bring Nasdaq On-Chain

From AMM to CLOB: Bringing Nasdaq On-Chain in the $7 Trillion Race

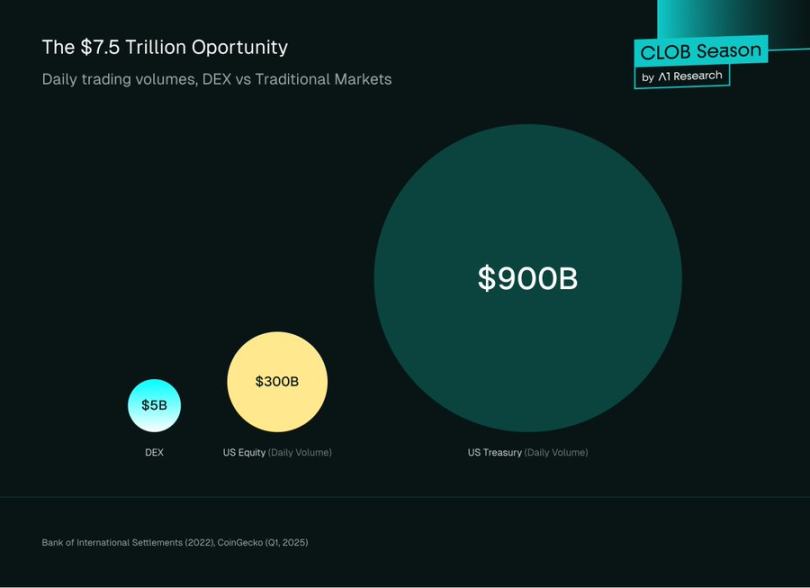

According to the Bank for International Settlements’ 2022 report, global exchange markets clear over $7.5 trillion in trading volume daily. Crypto represents less than 2% of this figure, and in Q1 2025, average daily crypto trading volume dropped to $1.46 billion. Spot DEXs process only about $500 million a day—a negligible blip in global finance.

If finance is moving on-chain, the key question isn’t timing—it’s whether the infrastructure is ready. Consider the scale: U.S. equities trade roughly $300 billion daily, while Treasuries see nearly $900 billion. For decades, professionals have built their strategies and entire operations around a single standard—the Central Limit Order Book (CLOB).

Now, compare this with DeFi. DeFi asks institutions to abandon that framework and trade against Automated Market Makers (AMMs)—mathematical curves, not order books. For firms managing billions, this is inefficient and unfamiliar.

The result? Most capital entering crypto sticks to centralized exchanges like Binance and Coinbase, whose infrastructure aligns with traditional finance. DeFi’s transparent, self-custodied markets are attractive, but their current operation is worlds apart from Wall Street.

The good news: things are changing. On-chain CLOBs represent DeFi’s maturity—blockchain infrastructure finally matches the sophistication of traditional markets.

Citadel Securities processes roughly 35% of U.S.-listed retail trades on its platform. Jane Street generated $2.05 billion in net trading revenue in 2024. Neither uses AMMs—they rely on CLOBs. Now, platforms like @HyperliquidX can process 200,000 orders per second, and millisecond latency on Ethereum L2s and Solana means infrastructure is ready for $7.5 trillion in daily volume.

This isn’t about replacing AMMs. AMMs remain vital for on-chain price discovery, especially for long-tail assets. The goal is to build a bridge—bringing Wall Street on-chain, enabling BlackRock to trade mainstream stocks and bonds directly on DeFi rails, making “decentralized finance” more than just a retail vision, and unlocking the full power of programmable, composable DeFi primitives.

Moving from AMM to on-chain CLOB is not just a technical upgrade—it’s DeFi’s growth story. Early on, blockchain limits made traditional order books impossible. AMMs offered an elegant workaround: trade against curves, not waiting for counterparties. They made DeFi possible. Now, as infrastructure matures and institutional demand rises, markets are returning to the scalable order book model.

This article explores both systems’ mechanisms, trade-offs, and why cutting-edge trading apps are leading the CLOB comeback. It’s not a rejection of DeFi innovation, but a natural evolution to institutional-grade systems.

Automated Market Makers: DeFi’s Zero-to-One Innovation

Ethereum faces major limitations: low throughput (about 15 transactions per second) and high, volatile gas fees. Replicating a traditional high-frequency CLOB requires constant order actions—computationally and economically impossible. AMMs solve these problems brilliantly.

AMMs don’t match individual buyers and sellers. Instead, users trade with liquidity pools—reserves of assets. Prices are set by deterministic algorithms, not order books.

Constant Product Market Maker (CPMM)

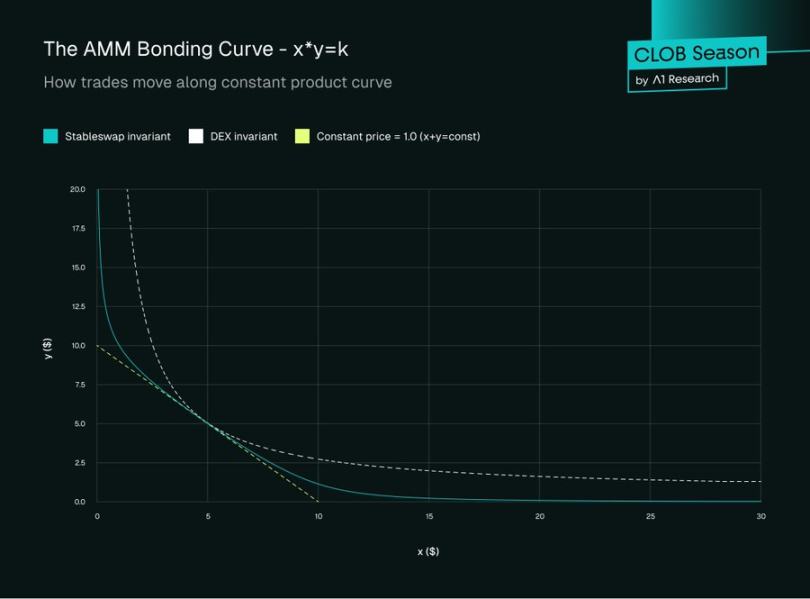

The most common AMM is the Constant Product Market Maker, pioneered by Uniswap. It’s based on a simple formula:

x × y = k

Where:

- x: amount of asset A in the pool

- y: amount of asset B in the pool

- k: the constant product, unchanged during each trade (ignoring fees)

In CPMMs, asset price = y / x, the ratio of reserves.

Trading Example

Let’s look at a real example to see how CPMM trades work, and why slippage matters.

Initial Pool State

Imagine an ETH/USDC pool:

- x = 1,000 ETH

- y = 4,500,000 USDC

- k = 4,500,000,000

Spot price before trading:

Price = y / x = 4,500 USDC per ETH

Trade Execution

Scenario: A trader swaps USDC for 10 ETH.

Removing 10 ETH, the formula says:

New ETH balance: 990 ETH

New USDC balance: 4,500,000,000 ÷ 990 = 4,545,454.55 USDC

Trader deposits:

USDC required = 4,545,454.55 - 4,500,000 = 45,454.55 USDC

Effective price = 45,454.55 ÷ 10 = 4,545.45 USDC per ETH

The trader pays 4,545.45 USDC per ETH—not the initial spot price of 4,500. That’s price impact.

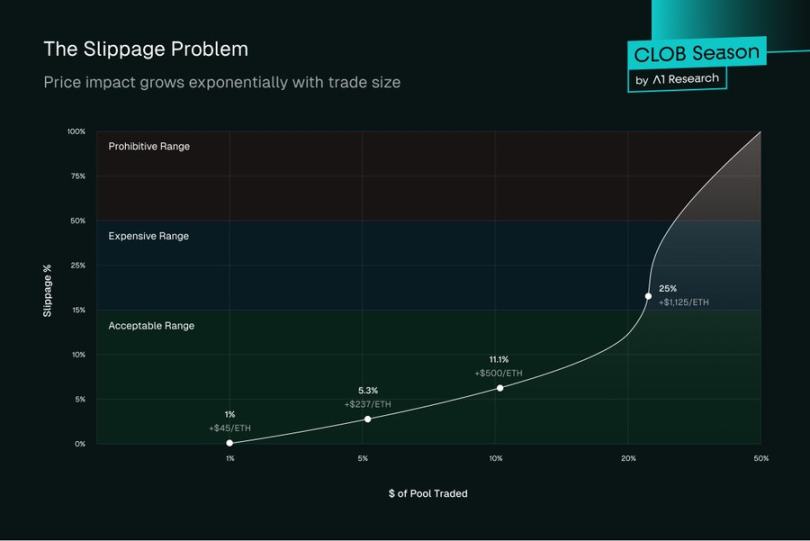

Understanding Slippage

Slippage is the percent difference between expected (spot) and executed price. Here:

Slippage = (4,545.45 - 4,500) ÷ 4,500 × 100% = 1.01%

1.01% may seem okay, but as trade size grows, CPMMs produce exponentially worse prices:

For 50 ETH:

- New ETH: 950

- New USDC: 4,736,842.11

- USDC required: 236,842.11

- Price per ETH: 4,736.84

- Slippage: 5.26%

For 100 ETH:

- New ETH: 900

- New USDC: 5,000,000

- USDC required: 500,000

- Price per ETH: 5,000

- Slippage: 11.11%

Price Impact Curve

Trade size and price impact follow a hyperbolic curve. As you trade a larger percent of pool liquidity:

- 1% of pool → ~1% slippage

- 5% of pool → ~5.3% slippage

- 10% of pool → ~11.1% slippage

Critical AMM Concepts and Challenges

Liquidity Providers: Anyone can supply assets (e.g., 1 ETH and 2,000 USDC) to become an LP. In return, they earn a share of pool trading fees.

Impermanent Loss: The most misunderstood LP risk is that AMM pools are isolated markets. Prices are set by the formula, not external sources. When asset prices change—say, ETH doubles on Coinbase—arbitrageurs trade with the pool until prices match the global market. This rebalancing extracts value from LPs: they end up with more depreciated assets and less of the appreciated ones. The loss is “impermanent” if prices revert, but often becomes real opportunity cost versus simply holding.

Capital Inefficiency: In CPMMs, liquidity is spread across an infinite price curve. Most capital sits idle—trades only happen near the market price. For stablecoins like USDC/DAI, providing liquidity at $0.10 or $10.00 is extremely inefficient.

Evolution: Concentrated Liquidity (Uniswap v3)

Uniswap v3 introduced concentrated liquidity. LPs can provide liquidity only within chosen price ranges.

For example, an LP might supply ETH/USDC liquidity only from $4,400–$4,800. This focuses capital where trading happens, earning more fees for the same investment. It creates deep liquidity positions resembling order book “limit orders”—the first bridge between AMM and CLOB.

Challenges of Concentrated Liquidity:

Amplified Impermanent Loss

As prices move outside the chosen range, losses are magnified. Narrow ranges earn more fees, but if prices drift, losses are larger. A position in a 1% range can lose 100% of one asset if price moves 1% in either direction.

Active Management Burden

Unlike v2’s “set and forget,” v3 requires constant monitoring and rebalancing. If ETH moves from $4,500 to $4,600, a $4,500-centered position becomes inactive and earns zero fees until manually adjusted—creating significant operational overhead.

Gas Cost Complexity

Frequent trades for rebalancing, adjustment, and fee collection mean high gas costs. During volatile periods, costs can exceed fee income, especially for small positions—posing a barrier for retail LPs.

Persistent MEV Vulnerability

MEV bots can exploit concentrated positions—sandwich attacks extract value just before big trades and withdraw liquidity immediately after, leaving LPs with losses.

Failed Price Discovery

The x*y=k formula, even concentrated, doesn’t reflect true market dynamics. There’s no sentiment, order flow, or price-time priority. Every trade moves price, creating artificial volatility.

Liquidity Fragmentation

LPs choosing different ranges fragment liquidity. A trader may find deep liquidity at $4,500 and poor execution at $4,550—quality varies unpredictably across price levels.

No Native Limit Orders

Concentrated positions resemble limit orders but aren’t true limit orders—liquidity is supplied both ways, may be partially filled repeatedly, and doesn’t guarantee execution at a set price.

Spot Success vs. Perpetuals’ Problems

AMMs have revolutionized spot trading (Uniswap has processed over $2 trillion), but they haven’t worked for perpetual futures. This reveals a key truth: different products need different infrastructure.

Spot markets are forgiving—traders swap ETH for USDC, accept slippage for instant execution, and settle trades immediately. AMMs excel here—their simplicity matches spot trading’s directness.

Perpetuals demand precise entry/exit prices, continuous funding rates, real-time liquidations, and leverage control. @GMX_IO and other AMM-based perpetuals struggle: oracles enable toxic flow, traders arbitrage oracle/market gaps, and LPs face asymmetric risk. AMM-based perpetuals have stop-loss and limit orders, but lack the granularity and price discovery of true order books.

The result: professionals stay on centralized exchanges. Uniswap took significant spot market share from Coinbase, but GMX and peers haven’t dented Binance’s dominance in perpetuals. Perpetual volume is 3–5x spot and remains CeFi territory.

This isn’t about execution failure—it’s architecture mismatch. Perpetuals originate from markets built around order books for price discovery and risk management. Forcing them into AMMs is like running an F1 car on square wheels—possible, but wildly inefficient.

The market is ready for solutions. Hyperliquid and new on-chain CLOBs deliver, recognizing that institutional flows demand institutional-grade infrastructure—not approximations, but real, on-chain order books with centralized-level performance.

Central Limit Order Book (CLOB): Precision and Efficiency

CLOB is the backbone of traditional finance, powering venues from NYSE to Coinbase—a transparent, efficient system matching buyers and sellers.

Core Mechanism

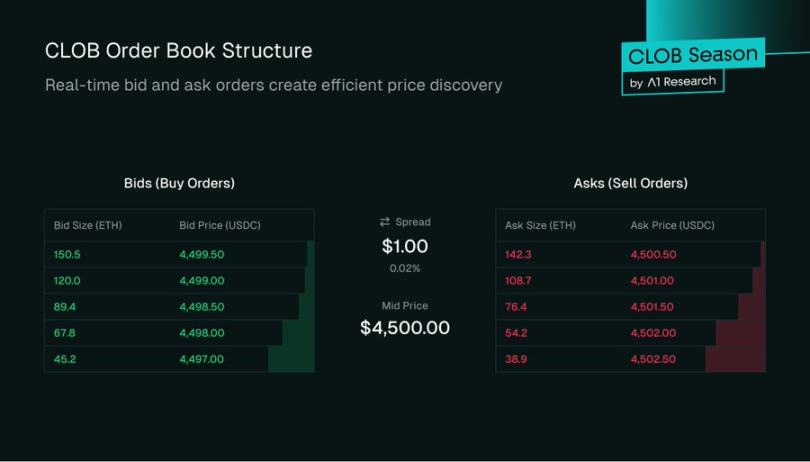

CLOB keeps two order lists per asset pair:

- Buy side: buy orders, highest to lowest price

- Sell side: sell orders, lowest to highest price

The highest bid and lowest ask difference is the spread. Depth at each price affects execution—100 ETH at $4,500 beats 10 ETH for large trades. Deeper liquidity means less slippage.

Order Types and Matching Engine

Users interact using:

Limit Orders: Buy/sell at a specific price or better. An ETH buy limit at $4,495 fills only if asks reach $4,495 or lower. Unfilled orders stay on the book, adding depth—how market makers supply liquidity.

Market Orders: Buy/sell immediately at the best available price. A market buy “walks the book,” consuming lowest asks until filled—guaranteed execution, not guaranteed price.

Stop Orders: Trigger only when price reaches the set level. A $4,400 stop sell executes if ETH drops to that price—helping manage downside risk.

The matching engine enforces price-time priority: better prices match first; otherwise, FIFO at each price. This ensures fairness and prevents queue jumping—unlike AMMs, where bigger trades extract more value.

Order Book Engine: Professional Market Makers

An order book is just intentions until liquidity arrives. AMMs rely on passive LP pools; CLOBs depend on specialist market makers—professional trading firms or liquidity funds.

Market makers’ job: always ready to buy and sell, posting simultaneous buy and sell orders—

- Ensuring liquidity: Retail traders always find orders to trade against.

- Reducing spreads: Competition narrows the bid-ask spread, signaling a healthy market and better prices for traders.

Profit comes from the spread: Buy 1 ETH at $1,999.50, sell at $2,000—earn $0.50 per round-trip. Total profit = spread × volume.

Not risk-free: Market makers face inventory risk. If ETH drops, their filled buys lose value. Accumulating 100 ETH at $4,500 and dropping to $4,400 means $10,000 in unrealized loss.

If ETH spikes, their sell orders may be filled below the prevailing market price.

To manage risk, market makers use algorithms, constantly adjusting quotes based on volatility, volume, and inventory. They hedge with perpetuals or options, aiming for delta neutrality. This is an active, data-driven process, unlike passive AMM LPs.

On-Chain Liquidity Fund Landscape

On-chain CLOBs attract professional liquidity funds and trading firms from traditional and centralized crypto markets. Firms like @wintermutet, @jump, and @GSR_io are now major DeFi liquidity providers.

They operate via API, running automated high-frequency strategies. To attract them, CLOBs offer:

Maker Rebates: Maker-taker fee models—takers pay, makers earn small rebates. At scale, rebates matter.

Liquidity Mining: Protocols reward market makers with native governance tokens for meeting targets like order depth, spread, and high uptime—bootstrapping new market liquidity.

On-chain operations bring new challenges:

- Gas Costs: Every order action is an on-chain transaction, costing gas. Low-fee L2s and high-throughput L1s are essential for profitability.

- Latency & MEV: Blockchain block times cause delays—e.g., Ethereum’s ~12s blocks mean orders are in-flight and can’t be changed for up to 12 seconds, versus microseconds in traditional finance.

During this time, markets can move. Orders are also visible in the mempool before confirmation, exposing them to MEV strategies like front-running. Mitigation includes order splitting, private mempools, or off-chain execution.

Why CLOB Is Returning: Technology Drivers

The biggest challenge for on-chain CLOBs was computation.

High-Throughput L1s: Chains like @solana, @SeiNetwork, @monad, @Aptos, and @SuiNetwork are built for speed and scale—making on-chain order books possible. These are general-purpose chains. Dedicated L1s like Hyperliquid’s HyperCore are optimized for trading performance.

Rollups: High-performance rollups like @megaethlabs, @fuel_network, and @rise_chain enable real-time trading on Ethereum via parallel processing. Specialized L2 app-chains (e.g., @hibachi_xyz on @celestia, @bulletxyz for Solana) are built to host matching engines.

These rely on scalable data availability layers like @eigen_da and Celestia for throughput, and ZK tech enables verifiable off-chain CLOBs with Ethereum-level security.

Projects like Hyperliquid, Bullet, and @dYdX are leading CLOB-based DEXs.

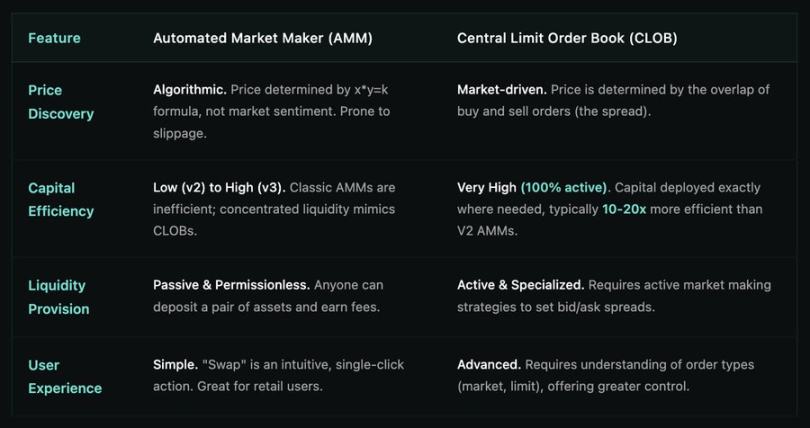

Part III: AMM vs. CLOB—A Direct Comparison

User Impact

Moving from AMM to CLOB isn’t just technical—it reshapes user experience:

Retail traders: Enjoy better prices, lower slippage, and familiar interfaces.

Institutions: Access professional-grade tools, order types, risk management, and deep liquidity on decentralized rails.

DeFi protocols: Unlock composable liquidity—capital is efficiently allocated and integrated ecosystem-wide.

As blockchains approach traditional financial performance, the gap between centralized and decentralized trading narrows—on-chain markets become truly competitive in global finance.

Conclusion: DeFi Trading Comes of Age

AMMs were DeFi’s zero-to-one breakthrough—solving cold start challenges when blockchains were slow and costly. They democratized market making and offered simple, unstoppable on-chain trading.

But as DeFi matures into a parallel system targeting institutional capital and professional traders, its infrastructure must evolve. CLOBs deliver unmatched capital efficiency, price precision, and granular strategy control for market makers.

AMMs will always matter for long-tail assets and simple swaps, but the future of high-volume, professional decentralized trading is CLOB-driven. The CLOB movement isn’t about replacing AMMs—it’s about building the next layer of advanced financial infrastructure on-chain.

Statement:

- This article is republished from [Foresight News]. Copyright belongs to original author [A1 Research]. For any republication concerns, please contact the Gate Learn team for prompt resolution.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice.

- Other language versions are translated by Gate Learn. Do not reproduce, distribute, or plagiarize translated content unless Gate is cited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?