First sale of coins, delisting, coin stocks are no longer the Pixiu of cryptocurrency

If MicroStrategy ignited the last Bitcoin bull run, Altcoin MicroStrategy is undeniably the engine fueling this cycle. Ethereum treasury companies such as SBET and BMNR have persistently bought ETH, pushing its price from $1,800 in early May up to $4,700—a surge of over 160%—and establishing themselves as new leaders in shaping market sentiment. At the same time, major altcoins like SOL, BNB, and HYPE have followed their lead. A new wave of companies has emerged, each making treasury accumulation a central part of their narrative, further amplifying bullish expectations across the market.

Yet, as this approach spreads, risk signals are surfacing. Recently, BNB treasury company WINT faced delisting risk, while HYPE treasury company LGHL became embroiled in a token-selling controversy, casting doubt on the long-term sustainability of treasury strategies. This concentrated buying model presents hidden risks that investors should watch out for as they chase high yields. This article takes a closer look.

Corporate Showdown: Capital Backs Only a Few Winners

The competition among treasury companies is a fierce, winner-takes-all competition.

Windtree Therapeutics (WINT) announced plans for a BNB strategic reserve in July. However, with weak fundamentals and a prolonged downturn in its share price, WINT received a Nasdaq delisting notice on August 19. Following the news, WINT shares plunged 77.21% in one day, now trading at just $0.13—a staggering 91.7% drop from $1.58 after the announcement. For a small, clinical-stage biopharma company with widening quarterly losses and no commercial products, delisting almost guarantees complete market marginalization.

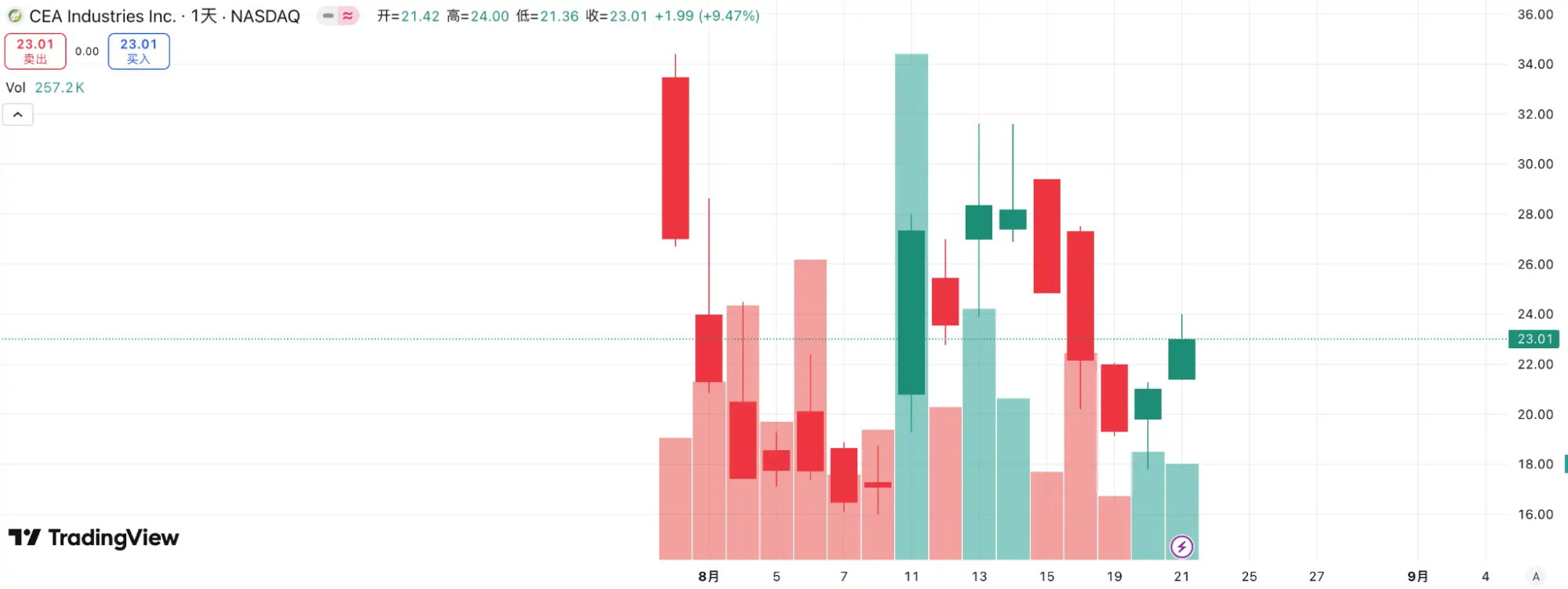

By contrast, BNB Network Company (BNC, formerly CEA Industries) has rapidly gained prominence. With backing from YZi Labs, BNC closed a $500 million private placement between late July and early August. CZ was directly involved, and more than 140 institutional investors participated—including industry leaders like Pantera Capital, Arrington Capital, and GSR. The company recruited former Galaxy Digital co-founder David Namdar as CEO and tapped Russell Read, the former Chief Investment Officer of CalPERS, to oversee investment decisions—transforming BNC overnight from a traditional small-cap into the official BNB treasury company.

The capital markets have spoken: WINT has fallen out of favor, while BNC has become the new standard-bearer. BNC’s share price rose 9.47% yesterday to $23.01, reinforcing its dominance among BNB treasury firms. This is more than a contest of company fundamentals: it is a market vote on who best commands the narrative and integrates resources.

Further Reading: First BNB Reserve Company WINT Delisted—Has the HODL Strategy Failed?

The Ethereum treasury company sector is equally competitive. SBET, led by Joseph Lubin, was the first public company to launch the ETH MicroStrategy idea, quickly catalyzing intense FOMO in its early days due to its head start and Lubin’s role as an ETH spokesperson. SBET’s share price soared from $3 to over $120, setting the benchmark for altcoin treasury models.

But BMNR’s rise soon changed the landscape. As a later entrant, BMNR surpassed SBET in both buying power and scale of funds, and publicly declared its commitment to holding 5% of all ETH, immediately lifting market expectations. Crucially, BMNR won open backing from Wall Street veterans like Tom Lee and Cathie Wood. This propelled BMNR into a dominant position among institutions and media outlets. While SBET boasted Joseph Lubin as a Web3 pioneer, it lagged behind BMNR in terms of influence and authority backed by old money.

The divergence is clear in their stock prices: during August, SBET rallied from $17 to a peak of $25—about a 50% gain—while BMNR surged from $30 to $70, over 130%, significantly outperforming its rival. As BMNR continues to earn support from major capital and opinion leaders, a distinct shift is emerging among ETH treasury companies.

The bigger message: the treasury company space is now a market that favors the strong. As institutional investors and top-tier funds enter, resources are concentrating in a handful of firms with genuine capital integration, compelling narratives, and robust governance. Small players have little chance of survival; even touting the treasury narrative won’t protect them from scrutiny over performance and capital strength. In the end, only a select few with the capacity to marshal capital and shape market sentiment will endure, while bubbles and copycats are quickly eliminated.

Hidden Risks of Selling: Strategic Reserves Are Not Forever

If Michael Saylor’s faith-powered commitment underpinned Bitcoin’s rally, the treasury bull in altcoins is far more pragmatic. Saylor has always emphatically stated that MicroStrategy will never sell its Bitcoin, fueling ongoing demand and confidence for BTC through repeated financing rounds. Yet, rumors persist about whether MicroStrategy will ever sell. In contrast, altcoin treasury companies, while copying this playbook, have never promised not to sell, creating deeper unease about their stability.

Recently, HYPE treasury company Lion Group Holding Ltd. reportedly sold $500,000 worth of HYPE tokens. Just a month earlier, the company had announced a $600 million fundraising round to launch its HYPE treasury strategy, aiming to make $HYPE a core reserve asset while also building a Layer-1 blockchain treasury with allocations in $SOL, $SUI, and more. Lion Group had even committed to increasing these holdings over time. This latest token sale, however, has investors questioning their asset allocation logic: is this a tactical diversification, or just a defensive reaction to recent market downturns? While the $500,000 sale is tiny compared with the $600 million raised, it serves as a warning to market participants.

Such examples are not unique. Meitu spent about $100 million acquiring BTC and ETH, then cashed out nearly $180 million when BTC topped $100,000 at the end of 2024, netting approximately $79.63 million in profit. Although Meitu doesn’t follow a treasury strategy, its actions show that strategic reserves can turn into profit-taking tools once prices climb high enough.

So far, the market hasn’t seen a mass sell-off by treasury companies, but the risk is real. Whether motivated by profits or market fear, treasury companies could become sources of selling pressure. Lion Group’s reduction is a microcosm of these concerns: as one of the first adopters of a HYPE treasury strategy, its liquidation signals that if the treasury cohort ever sells together, panic could trigger a market collapse and end the bull run as quickly as it began.

The mNAV Flywheel: Unlimited Ammo or Double-Edged Sword?

The treasury company funding flywheel is built around the market net asset value (mNAV) mechanism—a reflexive loop that seemingly gives treasury companies unlimited ammo in bull markets. mNAV represents the ratio of a company’s market value (P) to its net asset value (NAV) per share. For treasury companies, NAV is their digital asset holdings.

When the share price P exceeds NAV per share (that is, mNAV > 1), the company can keep raising capital and reinvesting in digital assets. Each successive offering increases holdings per share and book value, building confidence in the company narrative and driving the share price even higher. This creates a self-reinforcing cycle: higher mNAV → more fundraising → more crypto purchases → higher per-share holdings → stronger market confidence → even higher prices. MicroStrategy has used this mechanism for years to finance Bitcoin acquisitions without severe dilution.

But mNAV cuts both ways. A premium may reflect real confidence—or mere speculative excess. If mNAV drops to or below 1, the narrative flips from accretive to dilutive. Should token prices also fall, the cycle reverses, inflicting simultaneous declines in market value and confidence. Treasury company financing depends on the mNAV premium; if mNAV stays below 1 for long, fundraising dries up, and struggling smaller companies may see their business models collapse overnight. In theory, when mNAV < 1, selling assets to buy back shares is logical to restore balance—but it’s not automatic, and a discount can also signal undervaluation.

During the 2022 bear market, even with MicroStrategy’s mNAV briefly below 1, the company refused to sell Bitcoin—opting for debt restructuring and holding firm. This stubbornness reflected Saylor’s vision of BTC as a permanent reserve asset. Most altcoin treasury companies, however, lack strong business foundations and turned to buy-the-coin strategies to survive, not out of conviction. If the market worsens, these firms are more likely to sell assets to stem losses or lock in profits, sparking the risk of a cascade.

How to Guard Against DAT Treasury Model Risks?

Prioritize Companies with Core BTC Holdings

The current treasury model is often an imitation of MicroStrategy, and Bitcoin remains the industry bedrock. As the only widely accepted decentralized digital gold, Bitcoin’s consensus on value is unmatched. Both traditional financial giants and crypto-native institutions remain underexposed to BTC relative to their long-term goals. For investors, companies with core Bitcoin treasuries are generally more stable and command higher long-term confidence premiums than firms merely copying the altcoin treasury approach.

Track Rivalries and Focus on Leaders

The competitive landscape in capital markets is brutal. In treasury strategy—driven by narrative—markets usually know only the leader. The WINT vs. BNC case proves that once capital and institutional support center on one player, rivals are rapidly sidelined. Investors should focus on the leader effect: front-runners attract more institutional money, media narratives, and market trust, while others often get left behind.

For retail investors uncertain about picking specific stocks, directly investing in the token itself is often simpler and more effective. In fact, despite intense company-level rivalry, both ETH and BNB have made new all-time highs without being impacted.

Evaluate Company Fundamentals

A key weakness of the DAT Treasury Model is that many treasury companies are shells—with stalled business lines, weak profitability, and a reliance on crypto speculation for survival. This approach may look reasonable in a bull market, but if market sentiment turns, the lack of cash flow means they can quickly succumb. When selecting targets, investors should consider:

Cash flow: Does the company generate sustainable operating income?

Entry price: Is the average cost basis resilient enough to weather downturns?

Exposure: Is the proportion of digital assets relative to net assets excessive?

Use of funds: Is new capital primarily for crypto purchases, or for real business expansion?

Debt management: Can the company maintain stability if convertible debt matures or the share price comes under pressure?

Companies lacking sustainable earning power may thrive in a bull cycle, but as liquidity recedes, their risk tolerance collapses. They’re often the first casualties in a panic-driven downturn.

Conclusion

Treasury strategies have been the driving force behind this bull market, with new capital flows fueling a relentless rally led by ETH and altcoins. But the more infinite ammo a model appears to offer, the more vigilant investors need to be about bubbles and hidden risks. History shows that while liquidity and narrative can ignite markets, they cannot replace genuine value. Investors should remain optimistic about the current trend, but also uphold a cool head and exercise caution. Only with rationality amidst the frenzy can one stand strong when the next bubble bursts.

Disclaimer:

- This article is republished from BlockBeats and is the copyright of the original author kkk. If you have any objections to this republication, please contact the Gate Learn team and they will process your request as quickly as possible following their procedures.

- Disclaimer: The views and opinions expressed in this article are those of the author alone and do not constitute any investment advice.

- Other language versions of this article are translated by the Gate Learn team. Without explicit mention of Gate, copying, distribution, or plagiarism of translated articles is strictly prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?