Equity Perps: Tall Orders and Slow Beginnings

Key Insights

- Equity perps remain a high-upside but unproven category, with limited traction onchain due to audience mismatch, weak demand, and more popular alternatives such as 0DTE options.

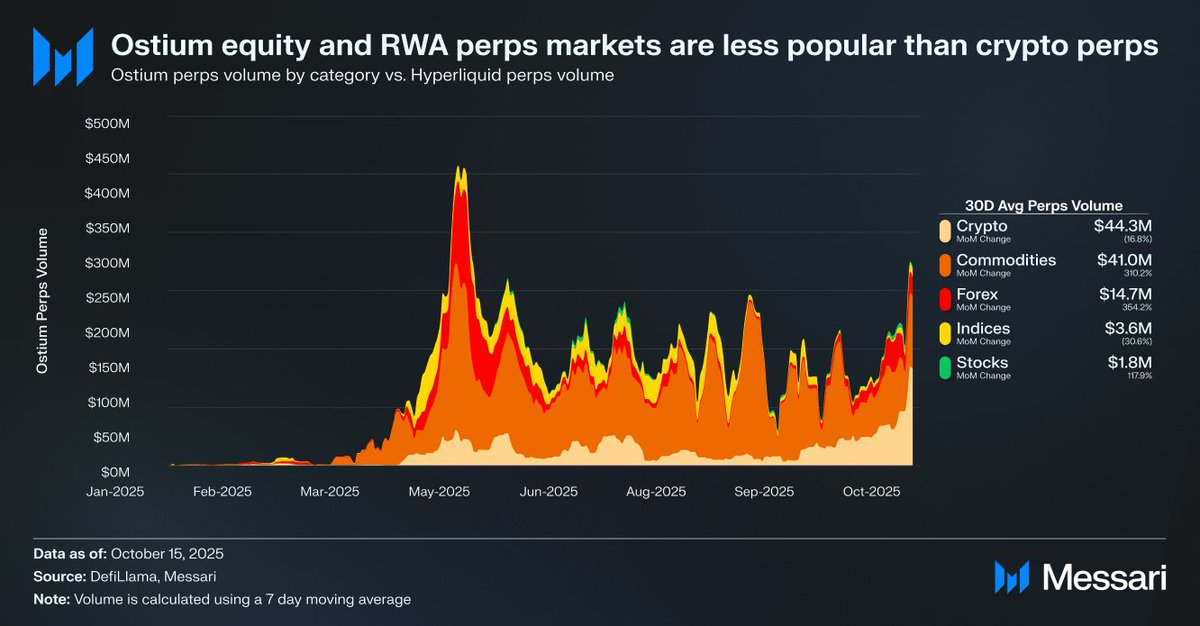

- Platforms like Ostium average just $1.8 million in daily stock perp volume versus $44.3 million in crypto perps, indicating weak traction.

- This may suggest latent demand due to infrastructure and regulatory limits. Hyperliquid’s recent HIP-3 upgrade is the best opportunity for equity perps to catch traction, although adoption will likely be gradual.

Source: Messari (@ 0xCryptoSam)

Equity perpetuals have been speculated as the inevitable next frontier for onchain markets, yet there is currently little data to support this in the near term. Ostium, a popular perp DEX for RWAs, does an average of $1.8 million daily perp volume for stocks compared to $44.3 million in crypto perpetuals volume, suggesting weak demand.

The adoption gap stems from an audience mismatch. Onchain traders show little interest in equities, while offchain traders on platforms like Robinhood can access stocks and options but not perpetuals. International investors without access to U.S. equities could be a logical target group. Still, they may prefer owning the underlying asset for shareholder rights and to avoid funding fees and liquidation risk.

Equities also face fewer interoperability challenges than tokens, which benefit from the convenience of synthetic wrappers. For the average investor, nearly every stock in global markets is abstracted away into individual tickers surfaced via a search bar. So, while perps add a permissionless, censorship-resistant element to stocks, the average equity investor is either unaware or doesn’t seem to care.

https://www.fow.com/insights/analysis-cboe-points-to-retail-flow-as-zero-day-options-grow

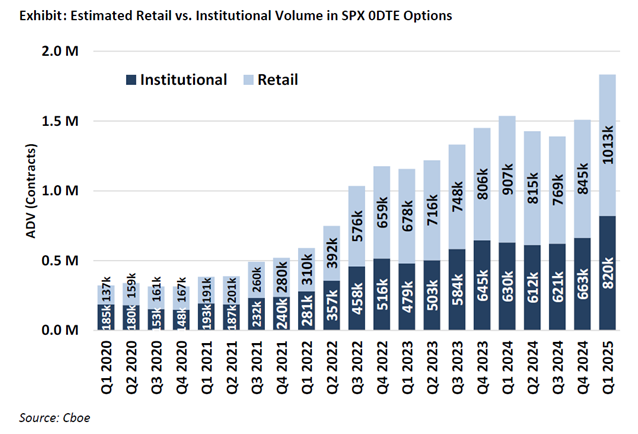

The most plausible equity perps user is retail options traders (who drive%20according%20to%20estimates%20published%20last%20week%20by%20Cboe%20Market%20Intelligence.) 50-60% of 0DTE trading on Robinhood). However, traditional exchanges that rely on banking services won’t adopt equity perps until there’s legal clarity. The CFTC has perps for BTC and ETH, but both have been declared not securities. Although perps are more intuitive than options, since the road to retail adoption is tethered to legal clarity, adoption may take more time than expected.

Source: @ Kaleb0x

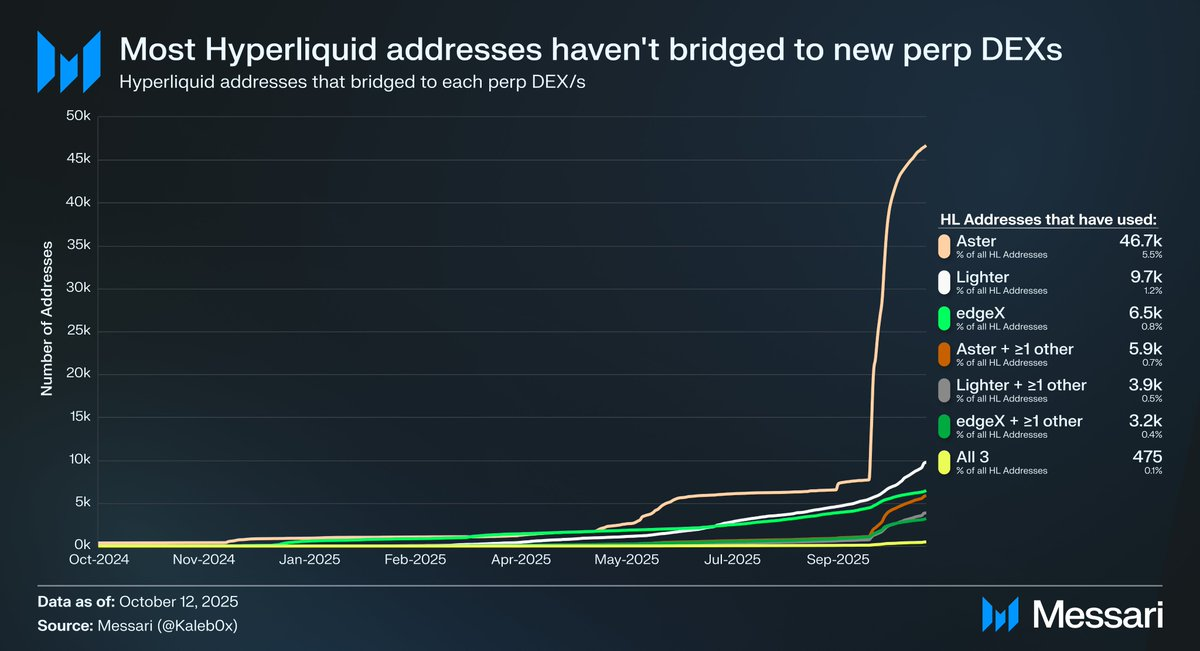

Let’s consider what equity perps could look like with HIP-3 on Hyperliquid, which introduced permissionless perps markets. Less than 10% of Hyperliquid addresses have bridged to Aster, Lighter, and edgeX, and even fewer to multiple perp DEXs, suggesting Hyperliquid capital is sticky, and thus higher quality. There are two ways to interpret this data regarding the future of equity perps:

- Hyperliquid users are loyal to Hyperliquid and are more likely to choose Hyperliquid over another perp DEX regardless of other asset listings or features.

- Hyperliquid users are satisfied with the current perp market offerings.

I believe the answer is a bit of both. Given that Hyperliquid users did not move capital en masse when tempted with incentives, they are likely loyal to Hyperliquid. But given that most of the volume and open interest on Hyperliquid, like other perp DEXs, is concentrated in majors, it’s difficult to say whether Hyperliquid users care about market diversity and if equity perps matter to the average Hyperliquid user (and more importantly, Hyperliquid whales who hold 70% of open interest on Hyperliquid). Many of these traders may also maintain accounts with traditional exchanges and brokers, which limits the total addressable market for equity perps on Hyperliquid. Additionally, this may not create new open interest/volume for Hyperliquid; it may just vamp existing flow on Hyperliquid.

While Ostium ($22 billion annual perp volume) and equity token wrappers like xStocks ($279 million in spot volume) have yet to experience breakout adoption, this may reflect infrastructure limits rather than a lack of underlying demand. This pattern mirrors early perps growth. GMX proved there was demand for onchain perps, but that infrastructure wasn’t capable of supporting sustained volume. Hyerliquid solved this bottleneck and unlocked latent demand. By the same logic, equity perpetuals could find their first scalable product–market fit on Hyperliquid once HIP-3 delivers the necessary performance and liquidity. Current data cannot confirm this outcome, but the precedent is compelling and worth monitoring.

The long-term upside for equity perps relative to 0DTE options remains clear. Projects like Trade[XYZ] could exploit regulatory arbitrage and build early user bases before traditional exchanges enter the space. Still, the true challenge is attracting offchain retail traders, which has historically been difficult for crypto applications.

To read my full thesis and how equity perps will tie into HIP-3’s year one revenue projections, check out the new @ MessariCrypto report:

https://messari.io/report/attached-at-the-hip-3

Disclaimer:

- This article is reprinted from [0xCryptoSam]. All copyrights belong to the original author [0xCryptoSam]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?