Did Ethena Really Depeg?

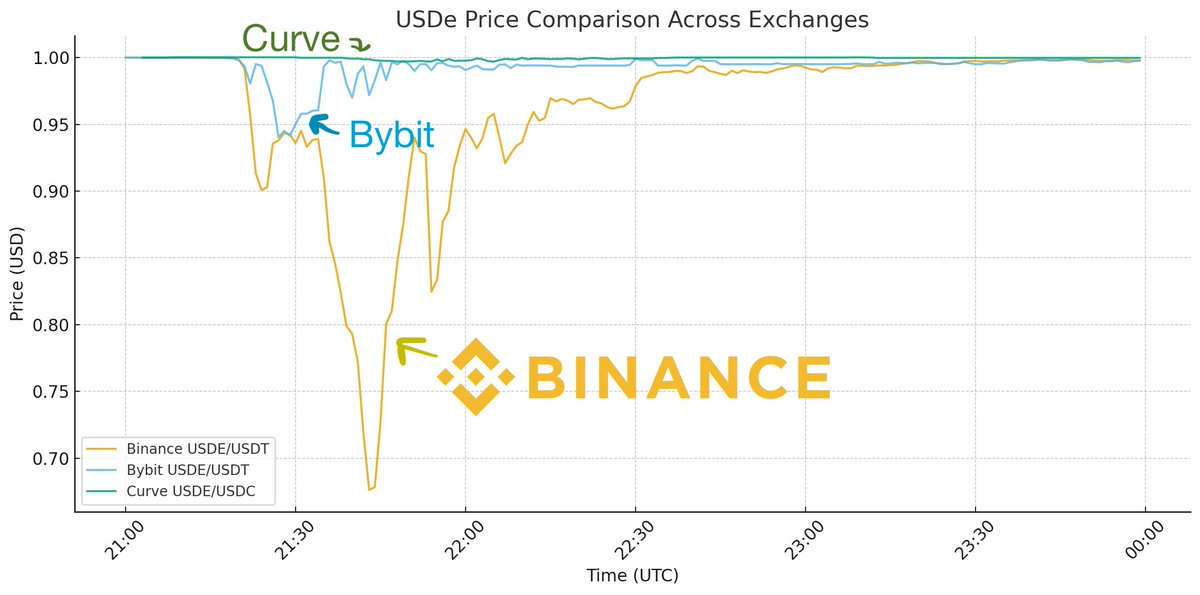

I’ve seen a lot of chatter about the Ethena depeg during the market mayhem this weekend. The story is that USDe briefly depegged to ~68c before recovering. Here’s the Binance chart everyone is quoting:

But digging into the data and talking to a bunch of folks over last couple days, it’s now clear this story is not correct. USDe did not depeg.

First thing to understand about USDe: its most liquid venue is actually not on exchanges, it’s on Curve. There’s hundreds of millions of dollars of standing liquidity on Curve, while only tens of millions on any given exchange, including Binance.

So if you just look at that chart of USDe on Binance, it looks like USDe depegged. But if you superimpose the other liquid venues for USDe, you get a different picture:

We see here that while USDe wicked down on every CEX, it did not do so uniformly. Bybit briefly hit $0.95 then quickly recovered, yet Binance depegged a crazy amount and took forever to regain the peg. Curve meanwhile dipped a mere 0.3%. What explains this difference?

Remember, every single exchange was under immense load on that day—it was the single largest liquidation event in crypto history. Binance was extremely unstable during this period, causing MMs to be unable to shift inventory because APIs were failing and withdrawals and deposits were bricked. Nobody was able to step in and arb.

It’s like a fire broke out on Binance, but all of the roads were blocked and firefighters couldn’t make their way in. This caused a wildfire to break out on Binance, but pretty much everywhere else, that fire was immediately put out by bridging liquidity. (As Guy shows in his post, USDC also depegged a few cents temporarily on Binance due to the same general instability issues—liquidity just couldn’t get ferried in, but this wasn’t a depeg event for USDC either.)

So OK. Unsurprising that while there’s API instability, prices on exchanges are wildly different because nobody can get inventory in. But why did it decline so much deeper on Binance than on Bybit?

The answer is twofold—first, Binance did not have any primary dealer relationship with Ethena to be able to directly mint and redeem on-platform (Bybit and other exchanges have this integrated) which allows MMs to stay on-platform and still perform peg arbitrage. This is huge, as otherwise an MM has to take their money out of Binance, go do the Ethena peg arb, and then bring back their inventory. Nobody was doing that in a moment of crisis when APIs were failing (plus so many other coins were cratering).

Second, Binance had their oracle poorly implemented and started liquidating positions they shouldn’t have—good liquidation mechanisms don’t trigger on flash crashes. If you are not the primary venue for an asset (which Binance is not for USDe) then you should look at the price on the primary venue. If you are only looking at your own order book, you will liquidate too aggressively. This caused Binance to start liquidating USDe as though it was worth $0.80 or whatever, which caused a cascade. This is a big part of the reason why Binance is refunding people who were liquidated on USDe (other exchanges AFAIK are not doing so)—they messed up by only looking at their own price instead of the true external price.

So this was a Binance-specific flash crash, which better market structure could’ve prevented. USDe on its primary venue, Curve, was actually trading at a tight peg the entire day. This is really different from what you’d describe as a depeg.

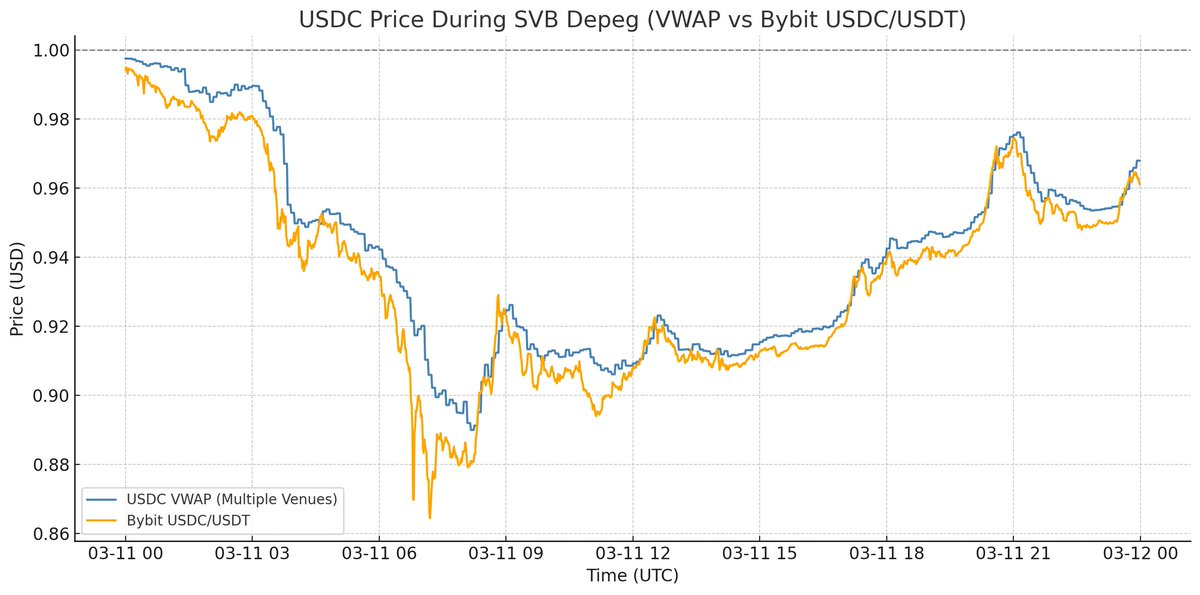

If you remember USDC in 2023 during the banking crisis, this is what an actual depeg looks like:

During the banking crisis, USDC traded down on every single venue. There was no place where you could buy USDC for $1. Redemptions were literally halted, so $0.87 was the true price. That’s what a depeg means.

This instead was a Binance-specific dislocation. It’s a big lesson for market infra, but critical to understand the nuance here if you are trying to draw inferences about USDe’s mechanism from this weekend.

USDe was fully collateralized and worth $1 on its primary venue through the entire episode and actually increased its backing collateral over the weekend due to the price action. That said, this kind of market instability is ultimately good because it exposes lessons for the whole industry. Guy’s post below lays out how any exchange, including Binance, can avoid this kind of issue in the future.

TL;DR: USDe did not depeg, Binance did.

Disclaimer:

- This article is reprinted from [hosseeb]. All copyrights belong to the original author [hosseeb]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?