Co-founder Accused of Market Manipulation: The Most Controversial DEX on Solana Is About to TGE

Meteora, the Solana DEX set to officially launch its MET token on June 23, unveiled its tokenomics during the recent holiday period and branded the initiative “Phoenix Rebirth.”

Under the MET tokenomics plan, allocations are as follows: 20% to Mercurial stakeholders, 15% to Meteora users via LP incentive programs, 2% to off-chain contributors who have supported Meteora’s development, 3% to the Launchpad and Launchpool ecosystem, 3% to Jupiter staking rewards, 3% to centralized exchanges and market makers, and 2% to M3M3 stakeholders. Additionally, 18% of MET will be allocated to the team, and 34% reserved for Meteora, with both unlocking linearly over six years.

In total, 48% of the tokens will be distributed and immediately unlocked at TGE. However, MET will not be granted to users through a standard airdrop. Instead, 10% of the tokens will be issued to users in the form of liquidity positions. Meteora states that this approach eliminates the need for the project to provide additional tokens for initial liquidity, while enabling users to earn fee revenue.

Few realize that Meteora’s journey has been marked by dramatic fluctuations—calling the project a true “Phoenix Rebirth” is fitting. To understand its story, and the roles of Mercurial and M3M3 in the token distribution plan, we have to start from the beginning.

From “Privileged Prodigy” to “Prisoner”

Meteora originated as Mercurial Finance in 2021, serving as a stablecoin asset management protocol within the Solana ecosystem. Notably, Mercurial’s founding team also created Jupiter, which now dominates the Solana DEX sector. Co-founder Ben Zhow comes from a product design background, having worked in user experience and product development at IDEO and AKQA, and later co-founded social apps Friended and WishWell. The other anonymous co-founder, “meow,” has advised multiple DeFi and wallet projects—Instadapp, Fluid, Kyber, Blockfolio—and was an early contributor to the decentralized domain protocol Handshake.

Mercurial’s core objective was to build a platform delivering low slippage for stablecoin trading and high returns for liquidity providers (LPs). To minimize slippage, Mercurial did not require LPs to supply liquidity in strict 1:1 token pair ratios. Instead, flexible configuration enabled LPs to arbitrage by adding single-sided liquidity after large trades, reducing future slippage. Mercurial also implemented a specialized price curve, concentrating liquidity within defined ranges—if a user’s trade exceeded the preset rate range, only minimal liquidity would be available.

Mercurial utilized a dynamic fee structure to enhance yields. When trading activity surged, fees increased to offset LP impermanent loss; when trading slowed, fees decreased to stimulate volume. Additionally, with DAO approval, Mercurial could deploy pool assets to external protocols (e.g., lending platforms) to further boost LP returns.

During the 2021 DeFi boom, protocols like Mercurial—aspiring to be Solana’s Curve—were highly sought after. Mercurial received early investments from Alameda Research, Solana Ecosystem Fund, OKEx (now OKX), and Huobi, and held an IEO on FTX. FTX founder Sam Bankman-Fried personally endorsed the project: “The team’s robust technical, research, and operational capabilities showcase Solana’s appeal. We look forward to collaborating with them to enhance Solana’s liquidity and usability.”

At its August 2021 peak, Mercurial’s TVL accounted for nearly 10% of Solana’s total TVL. Even at the end of 2021, as Solana TVL approached $10 billion, Mercurial still held over 2%, making it a significant DeFi infrastructure component.

The next chapter is familiar: in 2022’s bear market, Solana’s entire ecosystem cooled, hitting bottom after FTX’s collapse. Mercurial, closely linked to FTX, suffered heavy losses, with TVL dropping and remaining depressed. By October 2023, TVL fell below $10 million, less than 5% of its peak. Many similar projects have faded away, but Mercurial’s story continued.

Pivot to DEX, Meteoric Rise with TRUMP

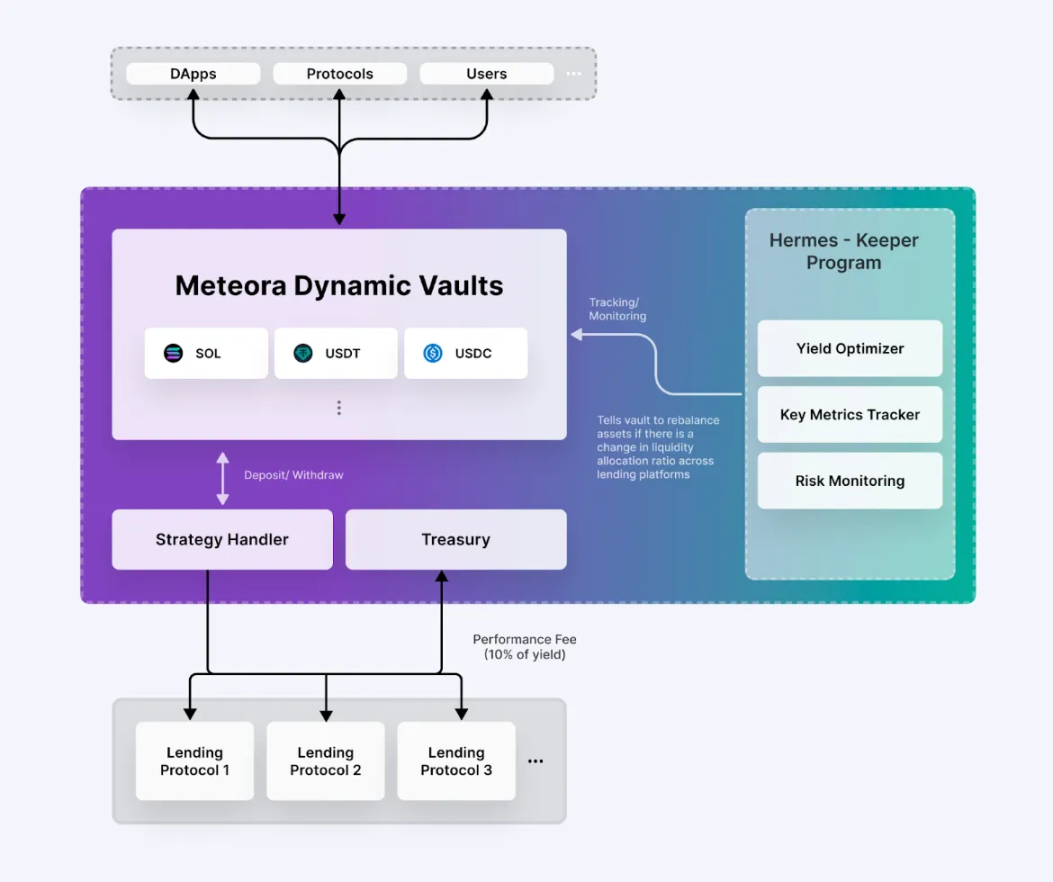

On December 27, 2022, Mercurial announced the Meteora initiative via Medium, detailing the launch of Dynamic Vaults and AMM, introduction of a new token replacing MER, and a full rebrand to Meteora.org.

At this stage, Mercurial focused on Dynamic Vaults, aiming to make Meteora Solana’s yield layer. The vision was a platform comprising Dynamic Vaults, AMM pools, and “guardians”—entities monitoring and rebalancing vault assets across lending protocols every few minutes, delivering optimal returns for LPs.

Meteora’s new platform launched in February 2023, yet, as noted, TVL hit a low in October. The rebrand alone did not reverse the downturn. After ten months of stagnation, a turning point arrived at year-end 2023.

In early December, Meteora announced a liquidity incentive program launching January 1, 2024, allocating 10% of the new token to liquidity providers. Incentives now covered both stablecoin and non-stablecoin pools, signaling Meteora’s strategic pivot to DEX. TVL surged from under $20 million before December to over $50 million.

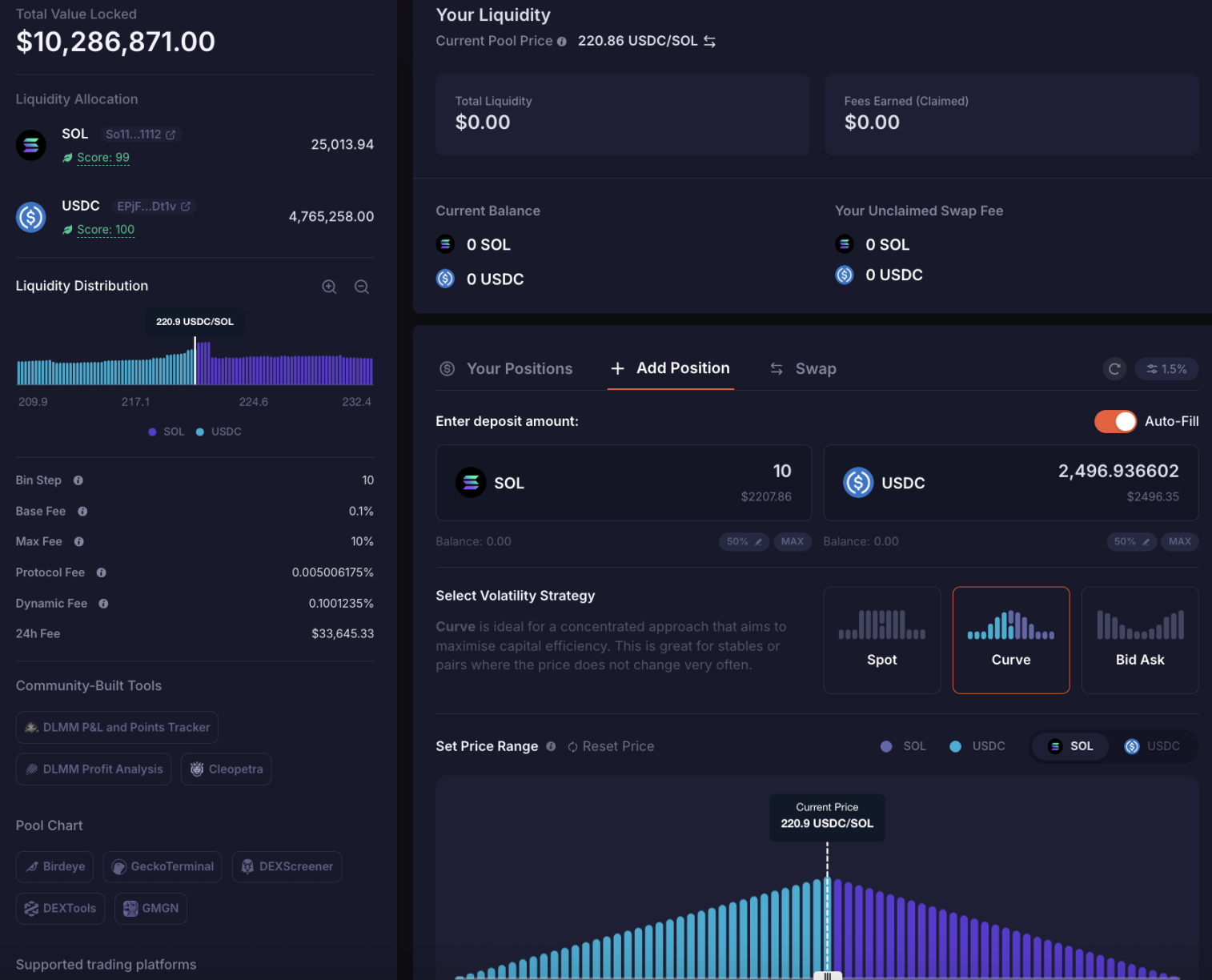

Simultaneously, Meteora introduced a new AMM model, DLMM (Dynamic Liquidity Market Maker), inspired by Trader Joe. Rather than continuous liquidity, DLMM segments liquidity into discrete “Bins,” each representing a fixed price. As long as a Bin retains liquidity, trades execute at that price with zero slippage.

For example, if SOL is priced at $200 and Meteora offers two SOL/USDC Bins at $200 and $201 USDC, then if the SOL market price rises to $201 but the $200 USDC Bin retains 10 SOL in liquidity, users can purchase up to 10 SOL at $200 USDC. Only when total purchases exceed 10 SOL does liquidity shift to the $201 USDC Bin.

Liquidity can be added via Spot, Curve, or Bid Ask modes. Spot and Curve distribute liquidity evenly—Spot uses linear averaging, Curve uses curve-based averaging. Bid Ask allows for single-sided liquidity, such as adding only SOL or only USDC to the SOL/USDC pool.

Despite introducing new mechanics, Meteora retained its original AMM+ yield aggregator as DAMM v1. The vault, which had dwindled to just a few million dollars, has rebounded to over $90 million in TVL. Meteora also launched DAMM v2, a separate, highly customizable AMM offering native liquidity mining, single-sided liquidity, and other early-stage value discovery tools for new projects. These flexible liquidity solutions have made Meteora the preferred choice for many projects seeking initial liquidity, referenced in the 3% token allocation to the Launchpad and Launchpool ecosystem.

This multi-pronged approach stabilized Meteora’s position in Solana DEX competition. TVL fluctuated between $200 million and $300 million, while trading volume and market share continued to climb. A year after its pivot, in January 2025, the TRUMP token’s debut supercharged Meteora’s growth.

The TRUMP team selected Jupiter, Meteora, and Moonshot as launch partners. On January 17 (evening) and January 18 (morning), TRUMP’s team established initial liquidity on Meteora, sparking several days of intense trading. According to DefiLlama, Meteora’s single-day trading volume on January 18 hit $7.6 billion, accounting for 20% of Solana’s $37.945 billion total DEX volume that day. By January 20, Meteora’s TVL reached $1.688 billion—14.7% of Solana’s TVL, up from less than $470 million just three days before.

This breakthrough made Meteora a leading name in the market. With Jupiter maintaining its lead as Solana’s aggregator and expanding its moat, Meteora has become a true competitor to Raydium and Orca, earning tens of millions in fees from TRUMP. Both projects achieved major recognition and financial success.

Market Manipulation Scandal and Co-Founder’s Exit

The TRUMP-driven financial boom triggered a wave of celebrity-themed meme tokens, including MELANIA (issued in Trump’s wife’s name) and LIBRA (promoted by Argentina’s President Milei). Unlike TRUMP’s financial impact, these tokens surged briefly before tanking, causing major losses for investors. After LIBRA’s collapse, Milei denied involvement, stating he only shared information. This exposed LIBRA’s true creator—Hayden Davis and his firm Kelsier Ventures.

DefiTuna founder Moty later disclosed that Meteora and Kelsier Ventures orchestrated the launch and price manipulation of numerous meme tokens, not just MELANIA and LIBRA. Kelsier, via the meme token Launchpad M3M3 (which Meteora claims is community-driven), profited by manipulating token prices, netting over $200 million.

Meteora co-founder Ben clarified that his only involvement with Kelsier Ventures was asking them to issue a token during M3M3’s launch to help test the platform. Ben said Kelsier seemed “trustworthy,” so he recommended them to the MELANIA team. For MELANIA and LIBRA, Meteora and Ben claim to have provided only technical support, not price manipulation.

The day after Ben’s statement, Moty released a video that essentially confirmed Meteora and Kelsier’s collusion in manipulating meme token prices, leading to Ben’s resignation under pressure. Meteora’s other co-founder, meow, posted on X expressing faith in the team’s integrity and announced hiring Fenwick & West to investigate and issue a report. The market was skeptical, since Fenwick & West were FTX’s former general counsel and had been sued for allegedly assisting FTX fraud.

Ben also revealed that Kelsier independently launched the M3M3 token during platform testing. Meteora subsequently redesigned the tokenomics and funded the so-called community to continue operating M3M3. Still, the M3M3 token saw a brief rally followed by decline. In April, law firms Burwick Law and Hoppin Grinsell LPP assisted affected investors in filing a class-action suit against Meteora and its founders, alleging manipulation of M3M3’s token launch and pricing led to $69 million in losses.

Back in March, Burwick Law had accused Meteora and Kelsier Ventures of participating in LIBRA’s launch and causing substantial investor losses, resulting in litigation. Both cases remain pending.

Many believe TRUMP’s launch marked the end of the meme token craze on Solana, but in reality, the scandals around Meteora are what cooled the market and made investors more wary. Meme token trading on Solana remains active, but is far less frenzied than before.

MET—Nearly Two Years Late

The plan to issue a new token was first announced in December 2023, when Mercurial revealed its rebranding plans to Meteora. Over almost two years, Meteora has repeatedly stated that a token launch was imminent, but it never materialized—until now, when the long-delayed token finally appears to have arrived.

This delay is understandable. Early in its transition, Meteora focused on scaling and strengthening its position, and a premature token launch might have backfired. Meteora also needed to consider early Mercurial token holders, liquidity incentive participants, new users post-TRUMP, and those who suffered major losses from M3M3. The method and amount of distribution for each group required careful deliberation.

Now, it seems Meteora has found a solution for its token, but the controversies persist. For the team, the token launch may only mark the beginning of a new chapter.

Statement:

- This article is reprinted from [Foresight News]. Copyright belongs to the original author [Eric, Foresight News]. For questions about this reprint, please contact the Gate Learn team, who will address concerns promptly in accordance with established procedures.

- Disclaimer: The views and opinions expressed herein are solely those of the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team. Do not copy, distribute, or plagiarize translated content without crediting Gate.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?