Choosing Between Prediction Markets and Meme Coins

In a recent post I asked which one offers trader more opportunities between trading memes on pumpfun and speculating on prediction markets, especially when starting with a modest capital of say $100.

It’s like pitting a chess game against a casino slot machine in my opinion; both can pay off big, but one rewards strategy while the other thrives on chaos and luck.

But let’s break it down, focusing on viability, risks, returns, edge and how your starting stack matters.

The Mechanics of the Markets

- Prediction Markets

Prediction Markets are well structured Forecasting tools; The top platforms like @ Kalshi and @ Polymarket allow users to trade on the outcome of specific, verifiable events, such as election results, economic data releases, or specific price movements.

The price of a contract on a prediction market reflects the market’s perceived probability of an event occurring. For example, a contract trading at $0.80 suggests an 80% chance of a “Yes” outcome.

Also, these markets are often celebrated for their “wisdom of crowds” effect, where the collective knowledge of participants aggregates to provide surprisingly accurate forecasts, which is impossible to replicate in the memecoin space.

The value of a prediction market contract is tied to a verifiable, real-world event. This foundation provides a degree of legitimacy and is a core differentiator from meme coins.

- Meme Coin Trading on Pumpfun

Pumpfun allows for near-instant creation and trading of new tokens on a bonding curve, which drives up the price as more people buy. This frictionless entry attracts a high volume of new, untested meme projects.

The lifecycle of memes on Pumpfun often follows a predictable, though chaotic, pattern. After reaching a certain market capitalization, the coin is deployed to a DEX like @ RaydiumProtoco, often fueling an initial “pump” phase

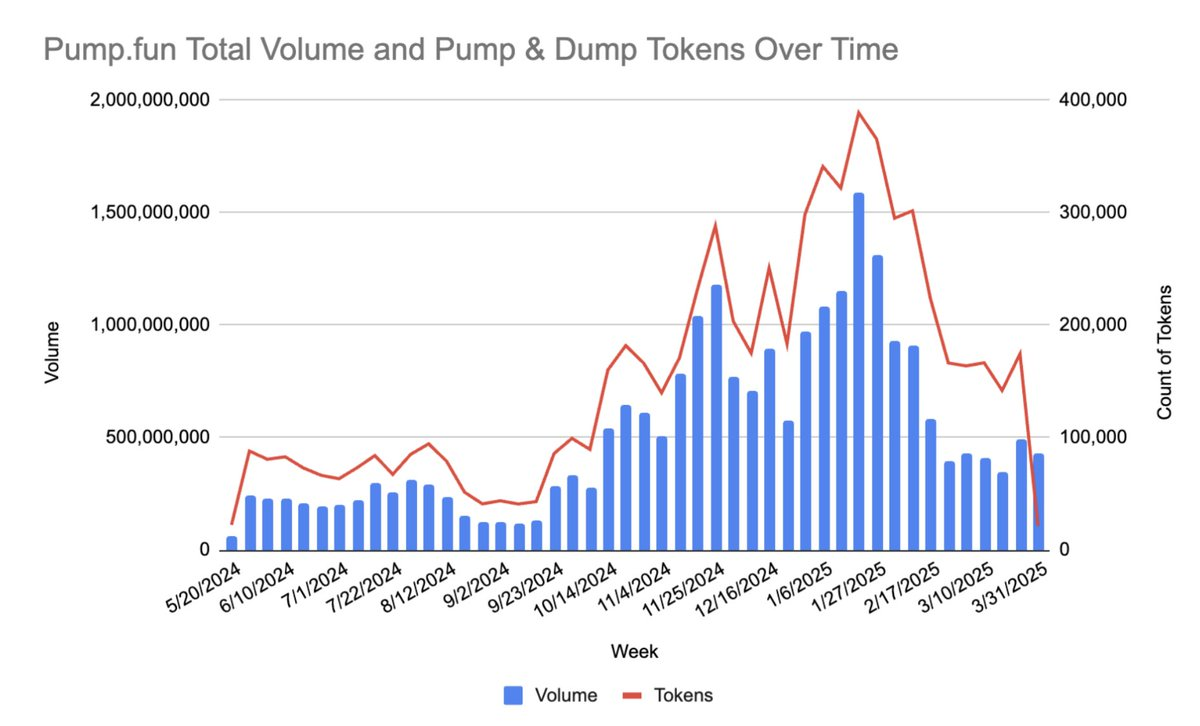

In fact, data from May 2025 indicates that the majority of tokens fail after the initial launch.

A report from @ Solidus_Labs revealed that a staggering 98.6% of the 7 million tokens launched on Pumpfun were identified as “rug pulls” or manipulative schemes.

Accessibility

Both scenes are very accessible for a tiny bit of money, there is literally no gatekeeping here.

A capital as little as $10 can get you in on Polymarket, letting you snag small sized positions in event bets like elections or crypto prices.

With $50–$100, you could diversify across 5–10 outcomes, using a better strategy to size bets optimally.

Pumpfun has an even cheaper entry, creating a meme coin costs ~0.02 SOL (about $3–$4 at current prices), and buying into one starts at whatever crumbs you have in your Solana wallet.

Initial trades often happen at a smaller market cap like ~$4k , so $50-$100 can buy you a meaningful slice early.

And there is no formal minimum beyond network fees, making it perfect for degen plays.

Risk, Reward, and Reality

Prediction Markets are known for quantifiable risk; The risks are explicit and tied to the outcome of the event. While a trader can lose their entire investment on a single contract, the odds and event criteria are clear from the start.

There is also a huge potential for high returns for well-researched predictions. While they are less sensational than meme coin gains, the returns are often more sustainable and based on informed decision-making.

One of the most common risks that can arise is from traders misjudging probabilities or from illiquid markets, but total ruin is manageable and rare if you bet small fractions of your portfolio.

For most traders, a diversified prediction market portfolio offers a more structured way to engage in high-risk trading with more predictable outcomes.

Here is a very good article from @ Predictifybot on how to diversify your prediction market portfolio

Lastly, the presence of regulators like the U.S. CFTC (which regulates Kalshi) adds a layer of oversight and protection for participants, mitigating some risks associated with fraud and manipulation.

The memecoin ecosystem on the other hand is rife with scams, manipulation, and volatile, unpredictable price swings. A project can rug pull, where developers drain liquidity, leaving investors with worthless tokens.

Value is based on hype and social sentiment rather than any fundamental utility, making it highly susceptible to social media trends and “insider” trading.

And the promise of massive, life-changing returns attracts many, but the reality is that such successes are rare. Most participants either lose money or gain very little.

What can you do with $100?

Using a small capital, such as $100, effectively in prediction markets and on Pumpfun requires highly specialized, and fundamentally different, strategies.

I believe the best strategy when it comes to prediction markets is to find events with mispriced odds due to information asymmetry although this is almost impossible to apply to Pumpfun memes.

Prediction markets: Capitalizing on information asymmetry

With only $100, you cannot influence a prediction market, so your strategy must be to act like a savvy analyst. Your edge comes from finding information that the market has collectively overlooked.

How it works

- Identify information gaps: The market’s odds are based on the aggregate information of all traders. A low-volume market,, may not have enough participants to be truly efficient. This is where a small-capital trader can find an edge.

- Leverage overlooked expertise: If you have specialized knowledge that few people in the market possess, you can act on that information. This could be anything from a niche understanding of a local election, a specific technological development, an obscure legal case, or outcome of a game.

Monitor low-liquidity markets: Larger, more liquid markets tend to be more efficient, but with a small capital, you can focus on smaller, less-traded markets where the odds might not reflect all available information yet

You should know that as a small-capital trader you are an information arbitrageur, all you want to do is seeking out the inefficiencies that are created by incomplete information.

Pumpfun: All about survival

The concept of information asymmetry on Pumpfun is completely different and significantly more difficult to exploit. It is less about rational odds and more about inside information.

How it works

Inside information is key: Information asymmetry on Pumpfun is mostly a disadvantage for the average trader. The creators of the meme coins possess complete information, and there are many tools available for “insiders” to manipulate trading.

- Social and emotional leverage: The most powerful “information” in this market is the potential for a coin to go viral. The founders have control over this initial marketing push, often relying on influencers and social media tactics to create FOMO.

Info Asymmetry: There is an edge here. If you’re plugged into Solana meme communities or catch a coin pre-pump. But asymmetries are fleeting, pumps last minutes to hours, and 97% of traders don’t clear $1k.

Unlike prediction markets, there’s no truemprobability…. just crowd FOMO.

The strategy is quite simple; Get lucky or get out! With only $100, your memecoin strategy involves:

Be first: DYOR and quickly get in on new coins hoping to be part of the initial momentum.

Use pro tools: Many traders use bots to spot new listings and market activity for a few seconds of lead time.

Manage risk by being paranoid: Constantly watch the chart for signs of a “dev dump” and be ready to sell immediately

With Pumpfun, your $100 is not being used to exploit an information gap; it is being thrown into a market where information is weaponized against you by more powerful players.

Your success is less about analysis and more about luck, timing, and avoiding being the victim of manipulative schemes

Final Thoughts

Ultimately, the choice between prediction markets and meme coin trading on Pumpfun boils down to a trader’s risk appetite.

While both offer the potential for high returns, they do so through fundamentally different mechanisms.

Prediction markets, with their verifiable outcomes and potential regulatory oversight, offer a more structured and information-based approach to high-stakes speculation.

Trading meme coins is more akin to gambling in a high-risk, unregulated casino, profits possible and can be huge but the risk of loss is astronomical due to scams and extreme volatility.

Here is a good post from @ tradefoxintern on why prediction markets will replace memecoins;

So for those who prefer a calculated, research-driven approach, prediction markets are the clear choice.

For those seeking a chance at massive, lottery-like returns and are comfortable navigating through thousands of scams, Pumpfun remains an option.

And that is a wrap!

Disclaimer:

- This article is reprinted from [baheet_]. All copyrights belong to the original author [baheet_]. If there are objections to this reprint, please contact the Gate Learn team, and they will handle it promptly.

- Liability Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute any investment advice.

- Translations of the article into other languages are done by the Gate Learn team. Unless mentioned, copying, distributing, or plagiarizing the translated articles is prohibited.

Related Articles

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Solana Need L2s And Appchains?

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What is Tronscan and How Can You Use it in 2025?