Beginner’s Guide: What Is YieldBasis (YB) and How to Earn BTC Yield with Zero Risk

What is YieldBasis?

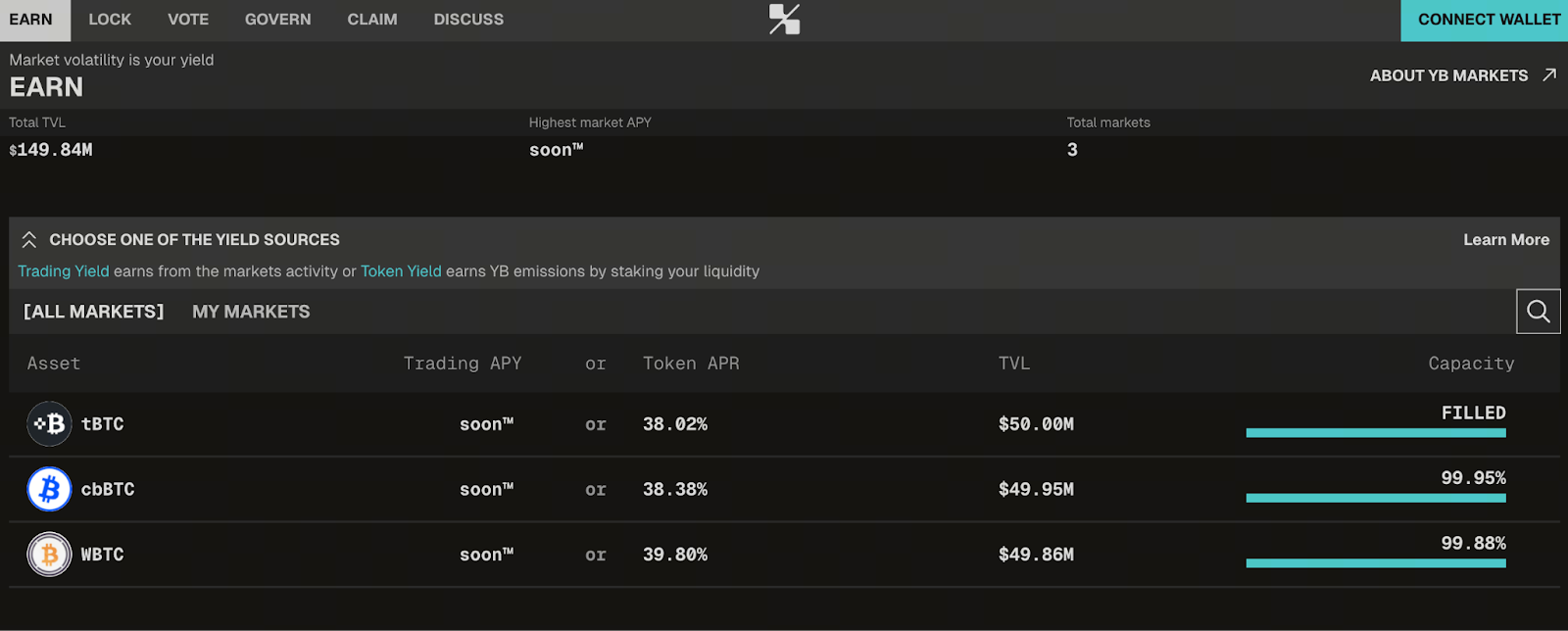

Image: https://yieldbasis.com/earn

YieldBasis (YB) is an innovative project built on the DeFi protocol Curve and lending mechanisms. It is designed to let users provide BTC liquidity while avoiding impermanent loss common in traditional AMM models.

In this system, users deposit BTC into the protocol, which then automatically borrows stablecoins (such as crvUSD) to form a liquidity pool, maintaining a 2x leveraged structure. This approach enables a no-loss holding yield model—users maintain a 1:1 BTC peg for their assets and earn trading fees and YB rewards.

Why does traditional liquidity mining incur impermanent loss?

In traditional AMM models such as Uniswap and Curve, when asset prices fluctuate, liquidity providers (LPs) are forced to rebalance between two assets. This causes them to sell low during price increases and buy high during declines. While LPs do earn trading fees, their overall returns are often lower than simply holding BTC—this is known as impermanent loss (IL). YieldBasis is specifically designed to tackle this persistent challenge, nearly eliminating IL risk through its leverage and rebalancing mechanisms.

YieldBasis Core Mechanism: Dual Leverage and Automated Rebalancing

YieldBasis innovates with its leveraged liquidity model. When a user deposits BTC, the protocol automatically borrows an equivalent amount of stablecoins (crvUSD), and both are added to the BTC/crvUSD pool, generating LP tokens. The protocol maintains a fixed 2x leverage ratio, and its automated rebalancing mechanism keeps the portfolio close to the target structure. If BTC price swings cause leverage to deviate, the system incentivizes arbitrageurs. They restore the ratio in a single transaction.

This mechanism keeps user asset performance in sync with BTC, delivering a theoretical zero impermanent loss.

User Participation Process

YieldBasis is highly accessible for beginners:

- Deposit BTC: Add BTC to the protocol and receive an equal amount of ybBTC from the system.

- Earn Yield: Holding ybBTC automatically accrues Curve pool trading fees; staking ybBTC also earns YB rewards.

- Withdraw Anytime: Burn ybBTC to redeem your initial BTC deposit and yield; the system automatically repays loans and removes LP positions.

The process is fully automated with no complicated steps required.

Latest Updates and Market News

- YB Price Performance: As of mid-October, YieldBasis (YB) trades at approximately $0.70, up nearly 9% in 24 hours. Trade YB/USDT here: https://www.gate.com/trade/YB_USDT

- Project Progress: Curve DAO has approved a multi-million crvUSD credit line for YieldBasis, supporting the expansion of its BTC-stablecoin liquidity market.

- Launch Update: YieldBasis launched trading on October 15, 2025, and quickly attracted attention as one of the most popular tokens in airdrop campaigns on select platforms.

- Community Buzz: Core Curve members launched YieldBasis, which is recognized as a major breakthrough for next-generation DeFi yield mechanisms.

Risk Disclosure and Target Audience

Risk Disclosure:

- Extreme market conditions may disrupt the rebalancing mechanism, triggering liquidation risk.

- Smart contract vulnerabilities or leverage mechanism failures can result in potential losses.

- New tokens are typically highly volatile at launch, posing significant short-term speculation risk.

Target Audience:

- Long-term BTC holders seeking additional DeFi yield.

- Investors with a basic understanding of crypto and a tolerance for volatility.

- Early adopters interested in new DeFi yield models and innovative projects.

Summary

YieldBasis transforms BTC into a yield-bearing asset. Its dual leverage and rebalancing mechanisms address the key challenges of traditional liquidity mining, enabling users to benefit from BTC’s appreciation potential while consistently earning fees and token rewards. For newcomers, it offers an excellent gateway to DeFi. Risk and position management is essential.

Related Articles

2025 BTC Price Prediction: BTC Trend Forecast Based on Technical and Macroeconomic Data

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025

Pi Coin Transaction Guide: How to Transfer to Gate.com

How to Use a Crypto Whale Tracker: Top Tool Recommendation for 2025 to Follow Whale Moves

What is N2: An AI-Driven Layer 2 Solution