ZBT vs BCH: A Comparative Analysis of Two Emerging Cryptocurrencies

Introduction: ZBT vs BCH Investment Comparison

In the cryptocurrency market, the comparison between ZEROBASE vs BitcoinCash has always been an unavoidable topic for investors. The two not only have significant differences in market cap ranking, application scenarios, and price performance, but also represent different cryptocurrency positioning.

ZEROBASE (ZBT): Since its launch in 2025, it has gained market recognition for its decentralized cryptographic infrastructure network.

BitcoinCash (BCH): Since its inception in 2017, it has been hailed as a Bitcoin fork focused on on-chain scaling, and is one of the cryptocurrencies with the highest global transaction volume and market capitalization.

This article will comprehensively analyze the investment value comparison between ZBT vs BCH, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, and attempt to answer the question investors care about most:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

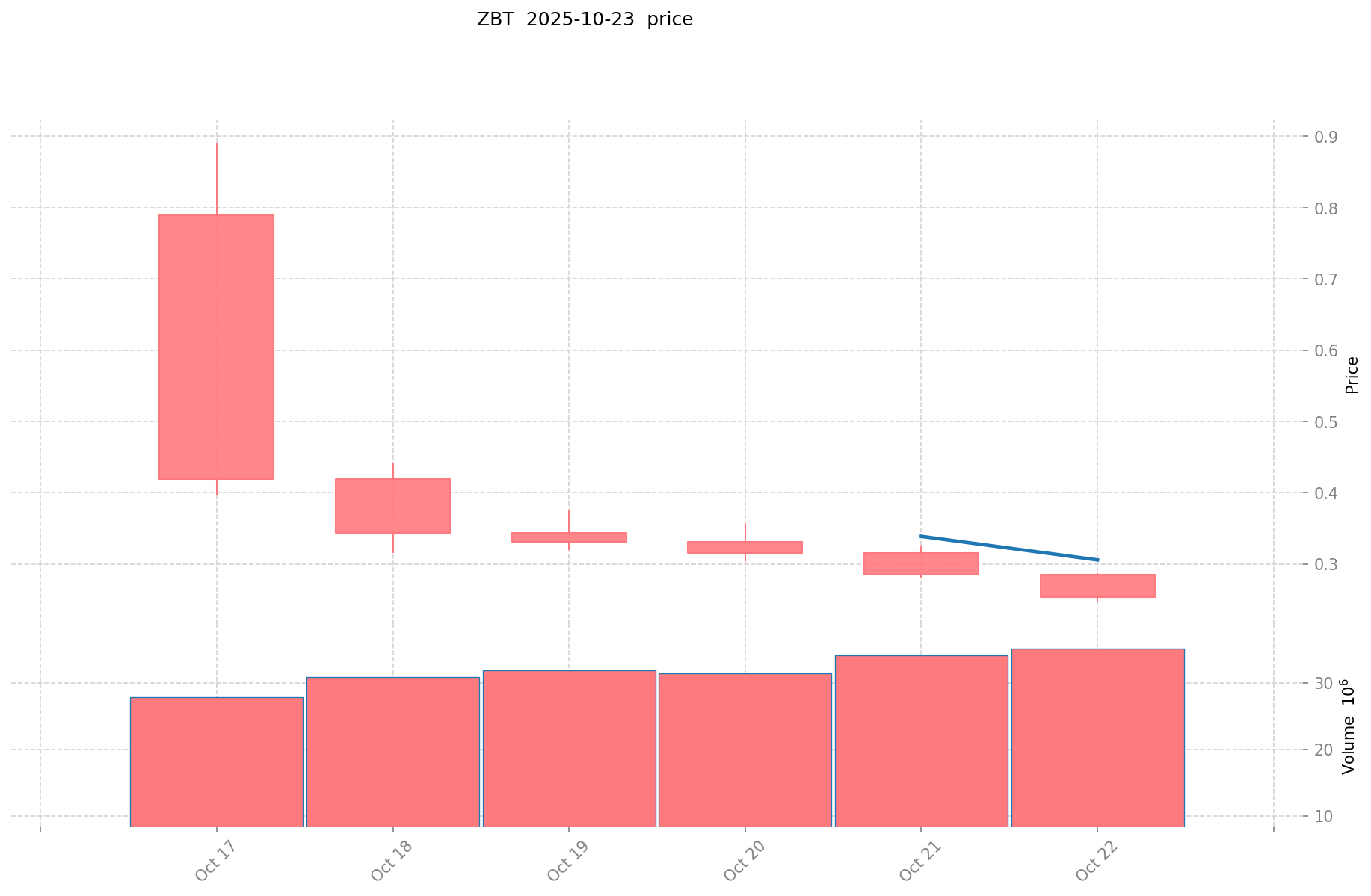

ZEROBASE (ZBT) and Bitcoin Cash (BCH) Historical Price Trends

- 2025: ZBT launched recently, with limited historical data available.

- 2017: BCH was created through a Bitcoin hard fork, initially trading around $555.89.

- Comparative analysis: In the current market cycle, ZBT reached an all-time high of $0.88999 on October 17, 2025, and has since dropped to its current price. BCH, on the other hand, has experienced multiple market cycles since its inception, with an all-time high of $3,785.82 in December 2017.

Current Market Situation (2025-10-23)

- ZBT current price: $0.25211

- BCH current price: $474.77

- 24-hour trading volume: $9,137,830 (ZBT) vs $2,785,101 (BCH)

- Market Sentiment Index (Fear & Greed Index): 25 (Extreme Fear)

Click to view real-time prices:

- Check ZBT current price Market Price

- Check BCH current price Market Price

II. Core Factors Affecting ZBT vs BCH Investment Value

Supply Mechanisms Comparison (Tokenomics)

- BCH: Supply mechanism follows Bitcoin's model with a maximum cap of 21 million coins

- ZBT: Recently launched token with exchange-supported distribution

- 📌 Historical pattern: BCH's fixed supply model aims to create scarcity value similar to Bitcoin

Institutional Adoption and Market Applications

- Institutional holdings: Limited information on institutional preference between these assets

- Enterprise adoption: BCH offers advantages in cross-border payments due to lower transaction fees compared to Bitcoin

- Regulatory attitudes: Varies by jurisdiction, with BCH generally following similar regulatory frameworks as Bitcoin

Technical Development and Ecosystem Building

- BCH technical upgrades: Focuses on scalability and low transaction fees, with larger block sizes than Bitcoin

- ZBT technical development: Relies on exchange support and early adopter advantages

- Ecosystem comparison: BCH has a more established ecosystem for payments, while ZBT is in earlier stages of ecosystem development

Macroeconomic Factors and Market Cycles

- Performance in inflationary environments: BCH designed with similar store-of-value properties to Bitcoin

- Macroeconomic monetary policy: Both assets likely affected by broader crypto market sentiment and liquidity conditions

- Geopolitical factors: BCH's lower fees may provide advantages for cross-border transactions in certain scenarios

III. 2025-2030 Price Prediction: ZBT vs BCH

Short-term Prediction (2025)

- ZBT: Conservative $0.2180 - $0.2506 | Optimistic $0.2506 - $0.3484

- BCH: Conservative $430.64 - $473.24 | Optimistic $473.24 - $700.39

Mid-term Prediction (2027)

- ZBT may enter a growth phase, with estimated prices $0.2554 - $0.3644

- BCH may enter a bullish market, with estimated prices $481.19 - $854.11

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- ZBT: Base scenario $0.5009 - $0.7264 | Optimistic scenario $0.7264+

- BCH: Base scenario $883.87 - $1255.10 | Optimistic scenario $1255.10+

Disclaimer

ZBT:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.3484035 | 0.25065 | 0.2180655 | 0 |

| 2026 | 0.32348889 | 0.29952675 | 0.2665788075 | 18 |

| 2027 | 0.3644641494 | 0.31150782 | 0.2554364124 | 23 |

| 2028 | 0.483319958121 | 0.3379859847 | 0.175752712044 | 34 |

| 2029 | 0.59134027883112 | 0.4106529714105 | 0.299776669129665 | 62 |

| 2030 | 0.726445106425174 | 0.50099662512081 | 0.485966726367185 | 98 |

BCH:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 700.3952 | 473.24 | 430.6484 | 0 |

| 2026 | 616.15848 | 586.8176 | 422.508672 | 23 |

| 2027 | 854.1130168 | 601.48804 | 481.190432 | 26 |

| 2028 | 924.306671068 | 727.8005284 | 531.294385732 | 53 |

| 2029 | 941.70110369676 | 826.053599734 | 586.49805581114 | 73 |

| 2030 | 1255.1058394358396 | 883.87735171538 | 565.6815050978432 | 86 |

IV. Investment Strategy Comparison: ZBT vs BCH

Long-term vs Short-term Investment Strategies

- ZBT: Suitable for investors focused on emerging ecosystems and potential growth

- BCH: Suitable for investors seeking established networks with payment use cases

Risk Management and Asset Allocation

- Conservative investors: ZBT: 10% vs BCH: 90%

- Aggressive investors: ZBT: 30% vs BCH: 70%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risks

- ZBT: Higher volatility due to recent launch and lower liquidity

- BCH: Susceptible to broader cryptocurrency market trends and Bitcoin price movements

Technical Risks

- ZBT: Scalability, network stability

- BCH: Hash rate concentration, potential security vulnerabilities

Regulatory Risks

- Global regulatory policies may impact both assets differently, with BCH potentially facing more scrutiny due to its longer history and wider adoption

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- ZBT advantages: New project with potential for growth, exchange-supported distribution

- BCH advantages: Established network, lower transaction fees, broader adoption for payments

✅ Investment Advice:

- New investors: Consider a small allocation to BCH for exposure to an established cryptocurrency

- Experienced investors: Diversify between BCH and ZBT, with a larger allocation to BCH

- Institutional investors: Focus on BCH for its more established market presence and liquidity

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

FAQ

Q1: What are the main differences between ZBT and BCH? A: ZBT is a recently launched token with exchange-supported distribution, while BCH is a Bitcoin fork focused on on-chain scaling since 2017. BCH has a more established ecosystem for payments and a fixed supply cap of 21 million coins, whereas ZBT is in earlier stages of ecosystem development.

Q2: Which cryptocurrency has shown better price performance? A: BCH has a longer price history, reaching an all-time high of $3,785.82 in December 2017. ZBT, being newer, reached an all-time high of $0.88999 on October 17, 2025. However, past performance doesn't guarantee future results.

Q3: How do the supply mechanisms of ZBT and BCH compare? A: BCH follows Bitcoin's model with a maximum supply cap of 21 million coins, aiming to create scarcity value. ZBT's supply mechanism is based on exchange-supported distribution, as it's a recently launched token.

Q4: What are the key factors affecting the investment value of ZBT and BCH? A: Key factors include supply mechanisms, institutional adoption, technical development, ecosystem building, and macroeconomic factors such as inflation and monetary policy.

Q5: What are the predicted price ranges for ZBT and BCH in 2030? A: For ZBT, the base scenario predicts $0.5009 - $0.7264, with an optimistic scenario of $0.7264+. For BCH, the base scenario predicts $883.87 - $1255.10, with an optimistic scenario of $1255.10+.

Q6: How should investors allocate their portfolio between ZBT and BCH? A: Conservative investors might consider allocating 10% to ZBT and 90% to BCH, while aggressive investors might allocate 30% to ZBT and 70% to BCH. However, individual circumstances and risk tolerance should guide investment decisions.

Q7: What are the main risks associated with investing in ZBT and BCH? A: Both face market risks related to cryptocurrency volatility. ZBT may have higher volatility due to its recent launch and lower liquidity. BCH faces potential regulatory scrutiny due to its wider adoption. Technical risks include scalability for ZBT and hash rate concentration for BCH.

Share

Content