USDC nedir: Popüler dijital doların ne olduğunu ve kripto para ekosistemindeki rolünü anlamak

USD Coin'in Konumlandırılması ve Önemi

Centre Consortium, 2018 yılında USD Coin (USDC)'i piyasaya sürerek, sınır ötesi ödemelerde şeffaflık eksikliği ve verimsizlik gibi sorunları çözmeyi amaçladı.

Amerikan dolarına endeksli ve tam teminatlı bir stablecoin olan USDC, DeFi, ödeme sistemleri ve uluslararası transferler alanında merkezi bir öneme sahiptir.

2025 yılı itibarıyla USDC, piyasa değeri açısından dünyanın en büyük ilk 10 kripto parası arasında yer alıyor; piyasa değeri 72 milyar doların üzerinde ve birçok blockchain ağında yaygın olarak kullanılmaktadır.

Bu makalede, USDC'nin teknik altyapısı, piyasa performansı ve gelecekteki potansiyeli kapsamlı biçimde analiz edilmektedir.

Kökeni ve Tarihsel Gelişimi

Arka Plan

USD Coin, Centre Consortium tarafından 2018 yılında kripto para ekosisteminde şeffaf, düzenleyiciye uyumlu bir stablecoin ihtiyacına yanıt olarak geliştirildi.

Blockchain teknolojisinin yükseliş döneminde doğan USDC, blockchain üzerinde hızlı ve güvenli ödemeler için istikrarlı ve güvenilir bir dijital dolar sunmayı hedefledi.

USDC'nin piyasaya sürülmesi, Amerikan dolarının dijital ve güvenilir bir temsilini arayan şirketler ve bireyler için önemli fırsatlar sundu.

Önemli Dönüm Noktaları

- 2018: USDC Ethereum ağında başlatıldı; tam teminatlı stablecoin sunuldu.

- 2020: Algorand ve Stellar gibi diğer blockchainlere büyük ölçekli genişleme.

- 2021: Büyük kurumların benimsemesiyle piyasa değeri 25 milyar doların üstüne çıktı.

- 2023: USDC ekosistemi, 15'ten fazla blockchain ağında destek kapsamında genişletildi.

Centre Consortium ve destekçilerinin katkısıyla USDC, teknoloji, güvenlik ve gerçek dünya uygulamaları alanlarında gelişimini sürdürüyor.

USD Coin Nasıl Çalışır?

Merkeziyetsiz Kontrol

USDC, dünya genelindeki farklı merkeziyetsiz blockchain ağlarında çalışır. Tek bir banka veya hükümetin doğrudan yönetimi altında değildir.

Bu ağlar işlemlerin doğrulanması için birlikte çalışır. Şeffaflığı ve saldırılara karşı direnci garanti eder. Kullanıcılara daha fazla özerklik ve ağın bütünlüğünü sağlar.

Blockchain Temeli

USDC'nin blockchain altyapısı, her işlemin kaydedildiği kamuya açık, değiştirilemez bir dijital defterdir.

İşlemler bloklar halinde gruplandırılır ve kriptografik hashlerle birbirine bağlanarak güvenli bir zincir oluşturur.

Herkes bu kayıtları inceleyebilir; böylece aracıya ihtiyaç duymadan güven sağlanır.

USDC, performans ve birlikte çalışabilirlik açısından birden fazla blockchain teknolojisinden yararlanır.

Adaletin Sağlanması

USDC, altında yatan blockchain'e bağlı olarak Proof of Stake (PoS) ve Bizans Hata Toleransı (BFT) sistemler gibi farklı konsensüs mekanizmalarını kullanır; böylece işlemler doğrulanır ve çift harcama gibi dolandırıcılık önlenir.

Katılımcılar, ağ güvenliğini stake etme veya düğüm çalıştırarak sağlar ve ilgili blockchainin yerel tokenlarıyla ödüllendirilir.

USDC'nin yenilikçi yaklaşımı, çoklu ağlarda yüksek işlem hacmi ve enerji verimliliği avantajlarını da içerir.

Güvenli İşlemler

USDC, işlemleri korumak için açık anahtar kriptografisi kullanır:

- Özel anahtarlar (kişisel parolalar gibi) işlemlerin imzalanmasında kullanılır

- Açık anahtarlar (hesap numarası gibi) sahiplik doğrulamasında kullanılır

Bu mekanizma fonların güvenliğini sağlarken, işlemler anonim kalır.

Ek güvenlik önlemleri arasında USDC rezervlerinin düzenli olarak denetlenmesi ve regülasyon standartlarına uygunluk yer alır.

USDC'nin Piyasa Performansı

Dolaşım Durumu

10 Eylül 2025 itibarıyla USDC'nin dolaşımdaki arzı 72.519.639.195,77576 coin, toplam arzı ise 72.519.501.931,88579 coindir. USDC, dolar endeksine tam teminatlandırılmış modelle bağlanır.

Piyasaya yeni coinler dolar rezervleriyle desteklenen basım yoluyla girer; arz-talep dinamikleri doğrudan bu süreçten etkilenir.

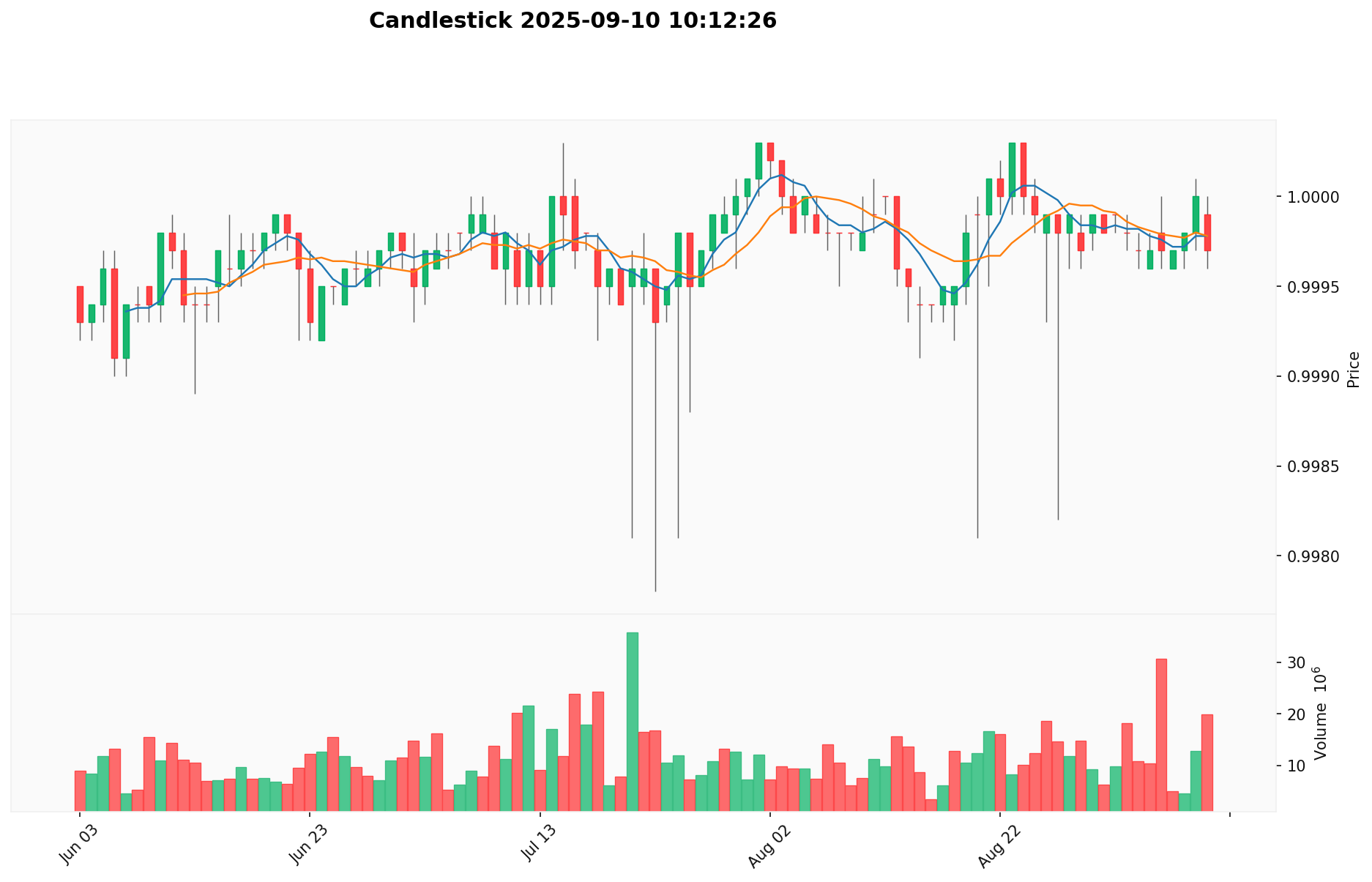

Fiyat Dalgalanmaları

USDC, 8 Mayıs 2019 tarihinde 1,17 dolar ile tüm zamanların en yüksek seviyesine erişti; bu artış muhtemelen piyasadaki oynaklık döneminde stablecoin talebinden kaynaklandı.

En düşük fiyatı 0,877647 dolar ile 11 Mart 2023 tarihinde gerçekleşti; bu ise geçici parite bozulması endişeleri veya genel piyasa dalgalanmasından kaynaklanmış olabilir.

Bu dalgalanmalar, piyasa hissiyatı, benimsenme eğilimleri ve stablecoin piyasasını etkileyen dış faktörleri yansıtır.

Güncel USDC piyasa fiyatını görmek için tıklayın

Zincir Üstü Metri̇kler

- Günlük İşlem Hacmi: 19.125.364,482816 dolar (ağdaki aktiviteyi gösterir)

- Aktif Adresler: 3.813.786 (kullanıcı etkileşimini yansıtır)

USDC Ekosistemi: Uygulamalar ve İş Birlikleri

Temel Kullanım Alanları

USDC ekosistemi çeşitli alanlarda kullanılmaktadır:

- DeFi: Aave, borç verme ve alma hizmetleri sunar.

- Ödemeler: Circle, sınır ötesi transferleri mümkün kılar.

Stratejik İş Birlikleri

USDC; Visa, Mastercard ve önde gelen bankalarla ortaklık kurarak teknolojik kapasitesini ve piyasa gücünü artırmıştır. Bu iş birlikleri, USDC ekosisteminin büyümesine sağlam zemin hazırlar.

Tartışmalar ve Zorluklar

USDC'nin karşılaştığı temel zorluklar şunlardır:

- Düzenleyici denetim: Finansal düzenleyicilerden artan gözetim

- Rekabet: Diğer stablecoinlerin popülaritesinin artışı

- Piyasa oynaklığı: Çok yoğun piyasa koşullarında endeksin korunması

Bu konular topluluk ve piyasada tartışmalara yol açarak USDC'nin sürekli inovasyonunu teşvik etmiştir.

USDC Topluluğu ve Sosyal Medya Etkisi

Topluluk Heyecanı

USDC topluluğu dinamik ve etkin; günlük işlem hacimleri milyar dolar seviyelerine ulaşmaktadır.

X platformunda #USDC gibi hashtagler ve paylaşımlar sıklıkla gündem oluyor ve aylık paylaşım miktarı milyonlarla ifade ediliyor.

Yeni iş birlikleri ve entegrasyonlar toplulukta büyük bir heyecan yaratıyor.

Sosyal Medya Duyarlılığı

X üzerinde duyarlılık çeşitlilik gösteriyor:

- Destekçiler, USDC'nin istikrarını ve şeffaflığını öne çıkarıyor ve onu "dijital dolarların geleceği" olarak görüyor.

- Eleştirmenler ise merkezileşme ve regülasyon risklerine odaklanıyor.

Son gelişmeler özellikle piyasa istikrarı dönemlerinde olumlu bir duyarlılık ortaya koyuyor. Duyarlılık genellikle pozitif seyrediyor.

Gündemdeki Başlıklar

X kullanıcıları USDC'nin düzenleyici uyumunu, geleneksel finans sektöründeki benimsenmesini ve DeFi'deki rolünü yoğun biçimde tartışıyor. Bu görüşmeler, hem dönüştürücü potansiyelini hem de yaygın kullanım yolunda karşılaşılan güçlükleri vurguluyor.

USDC Hakkında Daha Fazla Bilgi Kaynağı

- Resmi Web Sitesi: Özellikler, kullanım alanları ve güncel gelişmeler için USDC'nin resmi web sitesini ziyaret edin.

- Whitepaper: USDC teknik dokümanı mimari, hedef ve vizyonunu ayrıntılı biçimde anlatır.

- X Güncellemeleri: USDC'nin @circlepay hesabı, Eylül 2025 itibarıyla 250.000'in üzerinde takipçiye sahiptir. Paylaşımlar teknoloji yenilikleri, iş birlikleri ve regülasyon uyumu içerir ve yüksek etkileşim sağlar.

USDC Gelecek Yol Haritası

- 2026: Gelişmiş zincirler arası birlikte çalışabilirlik lansmanı

- Ekosistem Hedefleri: Küresel ödeme ağlarıyla entegrasyon sağlamak

- Uzun Vadeli Vizyon: Dijital dolar işlemlerinin dünya standardı haline gelmek

USDC Ekosistemine Nasıl Katılabilirsiniz?

- Satın Alma Kanalları: Gate.com üzerinden USDC alın

- Saklama Çözümleri: Güvenli cüzdanlarda saklayın

- Yönetim Katılımı: USDC'nin güncellemeleri için Circle'ın resmi kanallarını takip edin

- Ekosistem Geliştirme: Circle geliştirici dokümantasyonunu kullanarak USDC'yi projelerinize entegre edin

Özet

USDC, blockchain teknolojisiyle dijital para kavramını yeniden şekillendiriyor; şeffaflık, istikrar ve yüksek verimli ödeme avantajları sunuyor. Canlı topluluğu, geniş kaynakları ve güçlü piyasa performansı ile kripto para sektöründe öne çıkıyor. Her ne kadar düzenleyici zorluklar yaşasa da, USDC'nin inovatif karakteri ve net yol haritası, merkeziyetsiz teknoloji alanındaki geleceğini garanti altına alıyor. İster yeni başlayan ister deneyimli bir yatırımcı olun, USDC'yi takip edip ekosisteme katılım göstermek büyük fayda sağlayabilir.

Sıkça Sorulan Sorular

USDC her zaman 1 dolar mı?

USDC, Amerikan doları karşılığında 1:1 oranını korumayı amaçlar. Dolar rezervleriyle tamamen desteklenir; fakat piyasada küçük fiyat dalgalanmaları oluşabilir.

USDC iyi bir yatırım mı?

USDC, düşük volatiliteye ve kripto piyasasında geniş kabul gören, istikrarlı bir yatırım seçeneğidir. Dolar endeksi ve yüksek piyasa değeri ile likidite ve değer koruma açısından avantaj sağlar.

USDC'yi banka hesabıma aktarabilir miyim?

Hayır, USDC'yi doğrudan banka hesabınıza aktarmazsınız. Öncelikle bir kripto para borsasında itibari para birimine çevirmeniz gerekmektedir.

USDC sahibi olmanın amacı nedir?

USDC; değer transferinde istikrar, faiz geliri elde etme ve merkezi ile merkeziyetsiz finans ekosistemlerinde işlem kolaylığı sağlar.

USDC nedir: Popüler stabilcoin’i ve kripto ekosistemindeki rolünü anlamak

Rain'in White Paper'ının arkasındaki temel mantık nedir?

2025'te USDC'nin piyasa değeri ne olacak? Stablecoin piyasa manzarasının analizi.

2025'te USDC Nasıl Alınır: Çaylak Yatırımcılar için Kapsamlı Bir Rehber

USDC Fiyat Tahmini: 2025 Yılı İçin Stabilcoin Pazarındaki Eğilimler ve Yatırım Olanakları

USD1 stablecoin: 2025 yılında Kripto Varlıklar ekosistemindeki avantajlar ve özellikler

Öne Çıkan Önemli NFT Sanatçıları

Fantom Blockchain Teknolojisini Anlamak: Temel Özellikler Açıklandı

NFT Nadirliği Anlamak: Puanlama Sistemleri Rehberi

Blokzincirde Proof-of-Work Konsensüs Mekanizmasını Anlamak

Satoshi'den Bitcoin'e Dönüşümün Anlaşılması: Kolay Anlatım