VXT ve DYDX: İki Önde Gelen Merkeziyetsiz Türev Platformu Karşılaştırması

Giriş: VXT ve DYDX Yatırımları Karşılaştırması

Kripto para piyasasında VXT ile DYDX'nin karşılaştırılması, yatırımcılar için başlıca gündemlerden biri haline gelmiştir. İki token; piyasa değeri sıralaması, kullanım alanları ve fiyat performansı açısından belirgin farklılıklar gösterirken, kripto varlık ekosisteminde de farklı pozisyonları temsil etmektedir.

VOXTO (VXT): Lansmanından bu yana DeFi ve Web3.0 ekosistemlerinde küresel ekonomiyi birbirine bağlayan bir ödeme çözümü olarak piyasada kabul görmüştür.

dYdX (DYDX): Merkeziyetsiz türev ticaret protokolü olarak, Ethereum akıllı kontratları üzerinden ERC20 tokenlarına dayalı marjin işlemleri sağladığı için sektörde tanınmaktadır.

Bu makalede, VXT ve DYDX'nin yatırım değerini tarihsel fiyat eğilimleri, arz mekanizmaları, kurumsal benimseme, teknik ekosistemler ve gelecek öngörüleri açısından kapsamlı şekilde analiz edeceğiz. Yatırımcıların en sık sorduğu soruya cevap arayacağız:

"Şu anda hangisi daha iyi bir yatırım?"

I. Fiyat Geçmişi Karşılaştırması ve Güncel Piyasa Durumu

VXT ve DYDX Tarihsel Fiyat Eğilimleri

- 2024: VXT, benimsenmenin artmasıyla beraber tüm zamanların en yüksek seviyesi olan $0,061973'e ulaştı.

- 2025: DYDX, ciddi volatilite yaşadı ve $4,52'den $0,126201'e geriledi.

- Karşılaştırma: Bu piyasa döngüsünde VXT, DYDX'nin sert fiyat dalgalanmalarına karşı daha istikrarlı bir yapı sergiledi.

Güncel Piyasa Durumu (11 Ekim 2025)

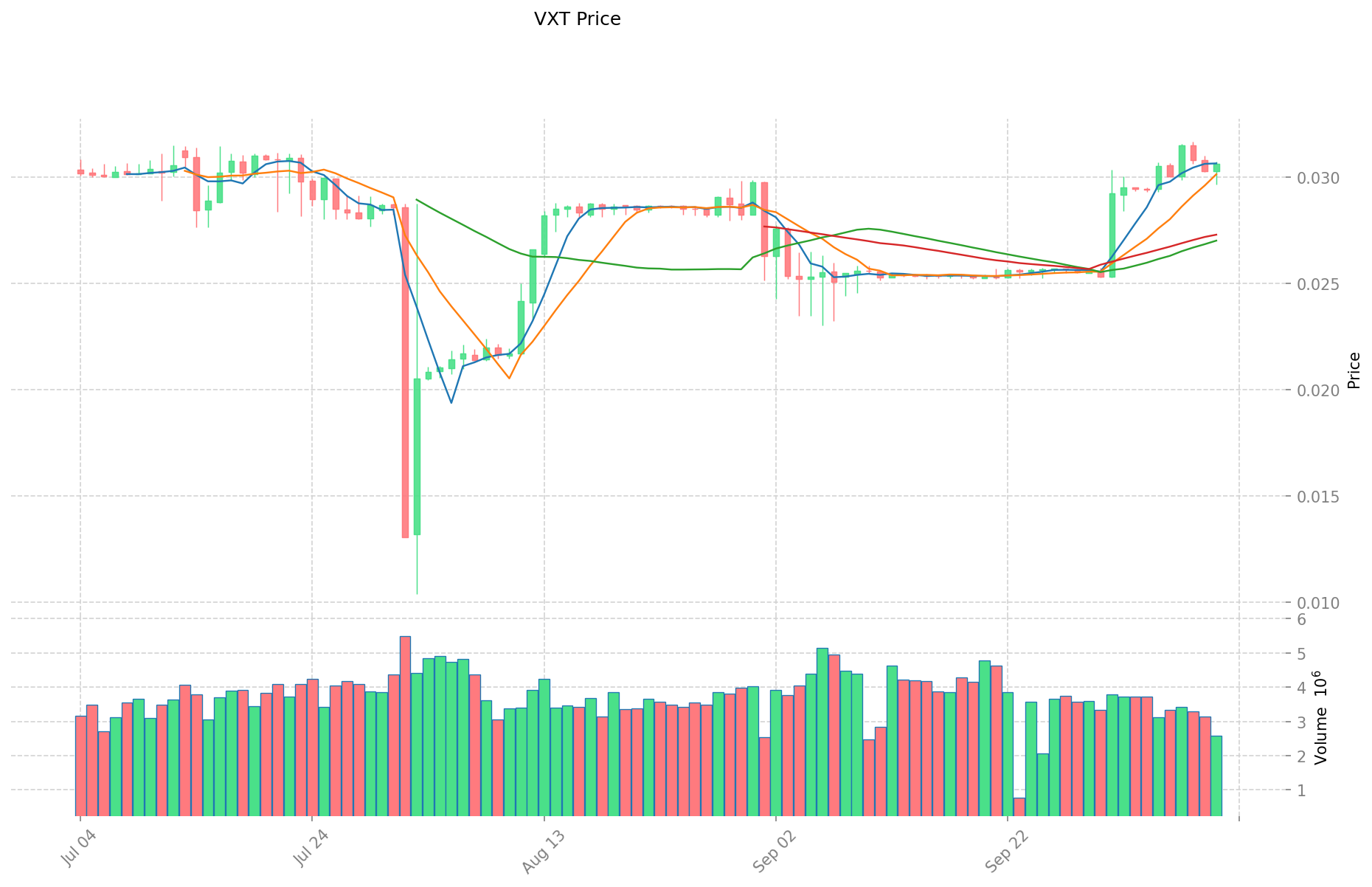

- VXT güncel fiyatı: $0,03065

- DYDX güncel fiyatı: $0,3362

- 24 saatlik işlem hacmi: VXT $77.723, DYDX $5.100.584

- Piyasa Duyarlılığı Endeksi (Korku & Açgözlülük Endeksi): 64 (Açgözlülük)

Anlık fiyatları görüntülemek için tıklayın:

- VXT güncel fiyatına bakın Piyasa Fiyatı

- DYDX güncel fiyatına bakın Piyasa Fiyatı

II. VXT ve DYDX Yatırım Değerini Belirleyen Temel Unsurlar

Arz Mekanizması Karşılaştırması (Tokenomik)

- VXT: Farming ve staking ödülleriyle sürekli dağıtım yapan enflasyonist model; toplam 10 milyar token arzı, %20'si topluluk ödüllerine ayrılmıştır

- dYdX: 1 milyar sabit DYDX tokenı arzı, işlem ücretlerinin yakılmasıyla deflasyonist bir yapı; %50'si topluluk teşvikleri ve ödüllerine tahsis edilmiştir

- 📌 Tarihsel eğilim: DYDX gibi deflasyonist tokenomikler, boğa piyasalarında genellikle daha güçlü fiyat artışını desteklerken, VXT'nin sürekli arzı satış baskısı yaratır.

Kurumsal Benimseme ve Piyasa Kullanımları

- Kurumsal varlıklar: dYdX, a16z, Paradigm ve Three Arrows Capital gibi önde gelen kripto VC'lerin desteğiyle daha güçlü kurumsal yatırımı çekmiştir

- Piyasa benimsemesi: dYdX, ViteX'e kıyasla daha yüksek işlem hacmi ve likiditeyle merkeziyetsiz türev borsası alanında lider olmuştur

- Düzenleyici politikalar: Her iki token da birçok bölgede regülasyon engelleriyle karşılaşırken, dYdX ABD kullanıcıları için coğrafi sınırlamalar uygular; ViteX ise daha belirsiz bir regülasyon ortamında işlem görür

Teknik Gelişim ve Ekosistem Oluşumu

- VXT Teknik Gelişmeleri: DAG tabanlı Vite blokzinciri üzerinde ücrete tabi olmayan işlemler ve yüksek TPS sunar; çapraz zincir özellikli DEX'e sahiptir

- dYdX Teknik Gelişimi: Ethereum L2'den Cosmos tabanlı bir appchain'e (V4) geçişle daha iyi performans ve düşük maliyet; merkeziyetsiz emir defterleri devreye giriyor

- Ekosistem karşılaştırması: dYdX, türev ticaretine odaklanmış, daha yüksek TVL ve işlem hacmine sahip olgun bir ekosistem sunarken; ViteX çoklu zincir desteği sağlıyor ancak piyasa derinliği daha düşük

Makroekonomik ve Piyasa Döngüleri

- Enflasyon performansı: dYdX, sabit arzı ve işlem ücretlerinin yakılması sayesinde enflasyon ortamlarında değerini daha iyi korumuştur

- Para politikası etkisi: Her iki token da faiz oranı değişikliklerine karşı genel kripto piyasası hareketleriyle yakın korelasyon gösterir

- Jeopolitik etkenler: dYdX, piyasa oynaklığı dönemlerinde sınır ötesi ticaret talebinden faydalanırken; ViteX, Asya pazarlarında daha güçlü konumlanmıştır

III. 2025-2030 Fiyat Tahmini: VXT ve DYDX

Kısa Vadeli Tahmin (2025)

- VXT: Muhafazakâr $0,027567 - $0,03063 | İyimser $0,03063 - $0,0373686

- DYDX: Muhafazakâr $0,248616 - $0,3453 | İyimser $0,3453 - $0,41436

Orta Vadeli Tahmin (2027)

- VXT'nin büyüme fazına girmesiyle fiyatların $0,02636645715 - $0,050735455425 aralığında olması bekleniyor

- DYDX'nin boğa piyasası ile $0,2237388615 - $0,6536684385 aralığında olması öngörülüyor

- Temel faktörler: Kurumsal sermaye girişi, ETF, ekosistem gelişimi

Uzun Vadeli Tahmin (2030)

- VXT: Temel senaryo $0,049631404874795 - $0,061273339351599 | İyimser senaryo $0,061273339351599 - $0,083944474911691

- DYDX: Temel senaryo $0,5373828906818 - $0,756877310819437 | İyimser senaryo $0,756877310819437 - $0,908252772983325

Feragatname

VXT:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Artış Oranı |

|---|---|---|---|---|

| 2025 | 0,0373686 | 0,03063 | 0,027567 | 0 |

| 2026 | 0,045899055 | 0,0339993 | 0,024139503 | 10 |

| 2027 | 0,050735455425 | 0,0399491775 | 0,02636645715 | 30 |

| 2028 | 0,06075870405975 | 0,0453423164625 | 0,02992592886525 | 47 |

| 2029 | 0,069496168442073 | 0,053050510261125 | 0,047745459235012 | 73 |

| 2030 | 0,083944474911691 | 0,061273339351599 | 0,049631404874795 | 99 |

DYDX:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Artış Oranı |

|---|---|---|---|---|

| 2025 | 0,41436 | 0,3453 | 0,248616 | 2 |

| 2026 | 0,4975773 | 0,37983 | 0,2810742 | 12 |

| 2027 | 0,6536684385 | 0,43870365 | 0,2237388615 | 30 |

| 2028 | 0,710041857525 | 0,54618604425 | 0,404177672745 | 62 |

| 2029 | 0,885640670751375 | 0,6281139508875 | 0,54017799776325 | 86 |

| 2030 | 0,908252772983325 | 0,756877310819437 | 0,5373828906818 | 125 |

IV. Yatırım Stratejisi Karşılaştırması: VXT ve DYDX

Uzun Vadeli ve Kısa Vadeli Yatırım Stratejileri

- VXT: Ödeme çözümleri ve çoklu zincir ekosistem potansiyeline odaklananlar için ideal

- DYDX: Türev ticareti ve deflasyonist tokenomik ilgilenenler için uygun

Risk Yönetimi ve Varlık Dağılımı

- Temkinli yatırımcılar: VXT %30, DYDX %70

- Agresif yatırımcılar: VXT %40, DYDX %60

- Koruma araçları: Stablecoin tahsisi, opsiyonlar ve çapraz para portföyü

V. Potansiyel Risk Karşılaştırması

Piyasa Riski

- VXT: Enflasyonist tokenomik ve düşük işlem hacmi nedeniyle yüksek volatilite

- DYDX: Türev piyasası dalgalanmaları ve regülasyon belirsizliklerine maruz kalma

Teknik Risk

- VXT: DAG tabanlı blokzincirde ölçeklenebilirlik sorunları ve ağ istikrarı riski

- DYDX: Merkezileşme endişeleri ve akıllı kontrat açıkları riski

Regülasyon Riski

- Küresel regülasyon politikaları her iki tokenı farklı etkileyebilir; DYDX türev ticaret odağı nedeniyle daha fazla denetime tabidir

VI. Sonuç: Hangisi Daha Avantajlı?

📌 Yatırım Değeri Özeti:

- VXT'nin avantajları: Çoklu zincir desteği, ücretsiz işlemler ve ödeme çözümlerindeki yaygınlaşma potansiyeli

- DYDX'nin avantajları: Sektörde yerleşmiş türev ticaret platformu, deflasyonist tokenomik ve güçlü kurumsal destek

✅ Yatırım Tavsiyesi:

- Yeni yatırımcılar: DYDX'nin daha yerleşik piyasa konumu nedeniyle dengeli ve DYDX ağırlıklı yaklaşım benimseyin

- Deneyimli yatırımcılar: Her iki tokenı içeren, DYDX ağırlığı yüksek çeşitlendirilmiş portföy oluşturun

- Kurumsal yatırımcılar: Türev piyasası likiditesi ve derinliği nedeniyle DYDX odaklı stratejiyi tercih edin

⚠️ Risk Uyarısı: Kripto para piyasası yüksek volatiliteye sahiptir, bu makale yatırım tavsiyesi niteliğinde değildir. None

VII. Sıkça Sorulan Sorular

S1: VXT ve DYDX arasındaki temel farklar nelerdir? C: VXT, ücretsiz işlemler sunan DAG tabanlı Vite blokzinciri üzerine inşa edilmiştir; DYDX ise merkeziyetsiz türev ticaret protokolüdür. VXT enflasyonist tokenomik modele sahipken, DYDX sabit arzlı ve deflasyonist mekanizmaya sahiptir.

S2: Tarihsel olarak hangi token daha istikrarlı fiyat performansı gösterdi? C: Tarihsel verilere göre VXT, DYDX'ye göre daha stabil fiyat hareketleri sergilemiştir; DYDX ise daha volatil bir seyir izlemiştir.

S3: VXT ve DYDX'nin kurumsal benimsemesi nasıldır? C: DYDX, a16z ve Paradigm gibi büyük kripto VC'lerden güçlü kurumsal destek almıştır. Ayrıca, VXT'nin kullanıldığı ViteX'e göre daha yüksek işlem hacmi ve likidite sunar.

S4: Her bir token için başlıca teknik gelişmeler nelerdir? C: VXT çapraz zincir ve çoklu zincir desteği uygulamaktadır. DYDX ise Cosmos tabanlı appchain'e (V4) geçiyor, performans ve maliyet avantajı sunarken tamamen merkeziyetsiz emir defterlerine odaklanıyor.

S5: Uzun vadeli fiyat tahminleri bakımından VXT ve DYDX nasıl karşılaştırılır? C: 2030'da VXT'nin temel senaryo fiyat aralığı $0,049631404874795 - $0,061273339351599; DYDX'nin ise $0,5373828906818 - $0,756877310819437 olarak öngörülüyor.

S6: Her bir token için başlıca risk faktörleri nelerdir? C: VXT, enflasyonist tokenomik ve düşük işlem hacmi nedeniyle yüksek volatilite riskine sahip. DYDX ise türev piyasası dalgalanmaları ve regülasyon belirsizliklerine maruz kalıyor.

S7: Farklı yatırımcı tipleri için hangi token daha uygun olabilir? C: Yeni yatırımcılar, DYDX'nin daha yerleşik piyasa konumu nedeniyle dengeli ve DYDX ağırlıklı yaklaşımı tercih edebilir. Deneyimli yatırımcılar, DYDX ağırlığı yüksek çeşitlendirilmiş portföy oluşturabilir. Kurumsal yatırımcılar ise türev piyasası likiditesi ve derinliği nedeniyle DYDX odaklı stratejiyi benimseyebilir.

Kripto para sektöründe Otomatik Piyasa Yapıcıların (Automated Market Maker) Rolünü Keşfetmek

Merkeziyetsiz protokollerle otomatik kripto alım satımını keşfetmek

xStocks: 2025'te Hisse Senedi Ticareti için Merkeziyetsizlik Geleceği

Hashflow'a Derinlemesine Bakış: Beyaz Kağıt Mantığı, Teknik Yenilikler ve VC Destekleri

2025 SOL Fiyat Tahmini: Solana'nın Gelecekteki Değerine Yönelik Büyüme Katalizörleri ve Piyasa Senaryolarının Analizi

MYX Coin Yatırım Rehberi: 2025 için Analiz ve Stratejiler

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak

İşlem hızının blockchain verimliliğini nasıl etkilediğini anlamak

ENS Domainleri ile Web3 Kimlik Yönetimi