VERT vs MANA: Comparing Two Blockchain-Based Virtual Real Estate Platforms

Introduction: VERT vs MANA Investment Comparison

In the cryptocurrency market, the comparison between Vertus (VERT) and Decentraland (MANA) has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positions in the crypto asset landscape.

Vertus (VERT): Launched on the TON blockchain, it aims to build an extensive ecosystem of DeFi products accessible directly through Telegram, simplifying complex crypto processes for users.

Decentraland (MANA): Introduced in 2017, it has been hailed as a pioneer in blockchain-based virtual worlds, allowing users to create, experience, and monetize content and applications.

This article will provide a comprehensive analysis of the investment value comparison between VERT and MANA, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

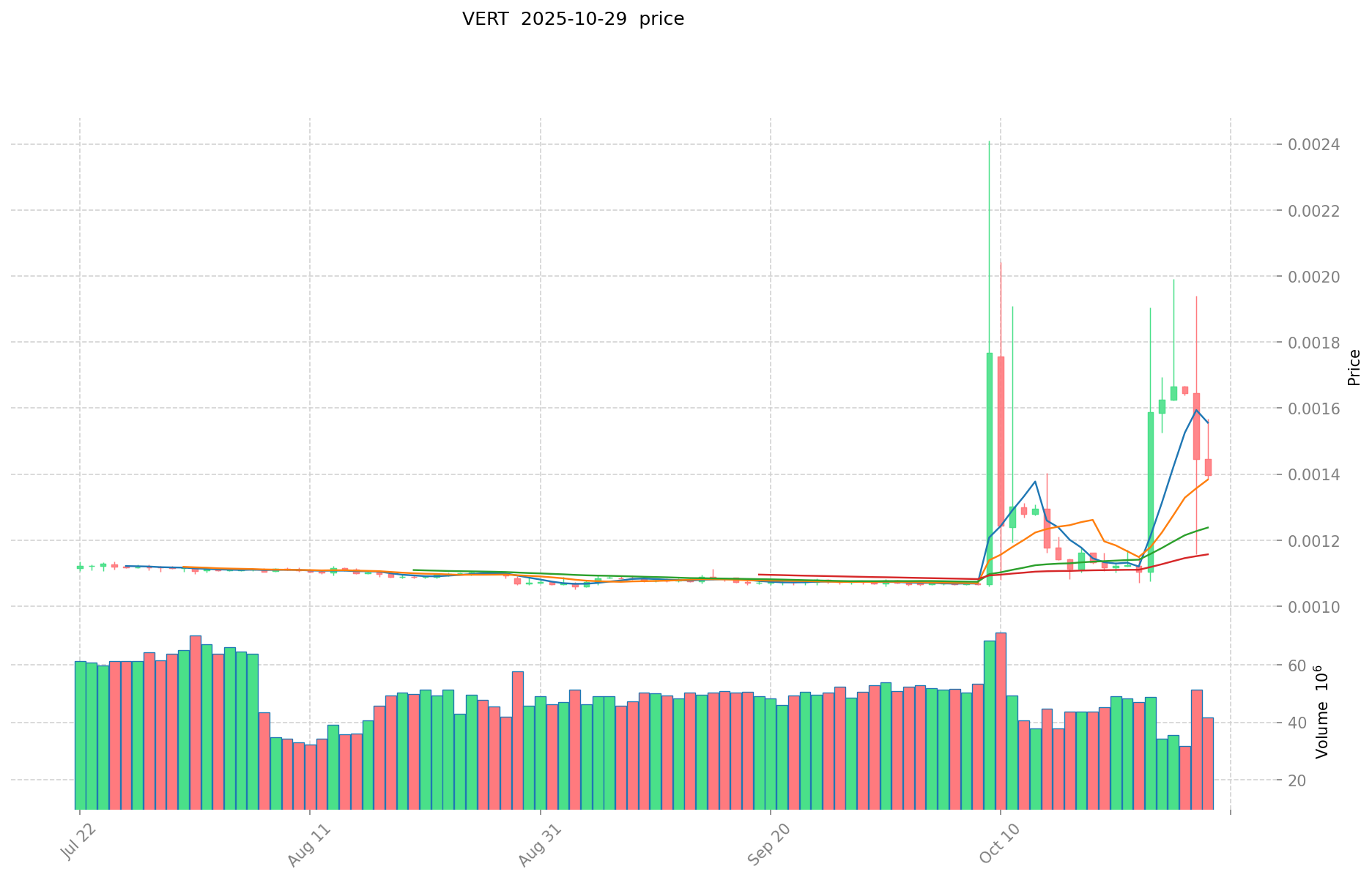

I. Price History Comparison and Current Market Status

VERT (Coin A) and MANA (Coin B) Historical Price Trends

- 2025: VERT reached an all-time high of $0.0295 on January 17, then dropped to an all-time low of $0.00045 on February 25.

- 2021: MANA surged to its all-time high of $5.85 on November 25, driven by the metaverse hype.

- Comparative Analysis: In this market cycle, VERT experienced extreme volatility within a short period, while MANA has shown a more established price history with significant highs and lows over several years.

Current Market Situation (2025-10-30)

- VERT current price: $0.0013516

- MANA current price: $0.2436

- 24-hour trading volume: VERT $65,809.76 vs MANA $44,055.72

- Market Sentiment Index (Fear & Greed Index): 51 (Neutral)

Click to view real-time prices:

- Check VERT current price Market Price

- Check MANA current price Market Price

II. Core Factors Affecting Investment Value of VERT vs MANA

Supply Mechanism Comparison (Tokenomics)

- VERT: Vertical integration model focusing on inventory management efficiency in supply chain

- MANA: Value-driven model emphasizing ethical standards and stakeholder engagement

- 📌 Historical Pattern: Efficient supply mechanisms with vertical integration tend to create more sustainable value cycles.

Institutional Adoption and Market Application

- Institutional Holdings: Research indicates long-term investment horizons (10-15 years) are common for these assets

- Enterprise Adoption: VERT shows advantages in supply chain management and inventory efficiency

- Regulatory Attitudes: Corporate governance standards emphasize ethical conduct to prevent conflicts of interest

Technical Development and Ecosystem Building

- VERT Technical Upgrades: Improvements in vertical integration and inventory management systems

- MANA Technical Development: Enhanced frameworks for stakeholder communication and ethical standards

- Ecosystem Comparison: MANA appears to emphasize quality service delivery that creates additional enterprise value

Macroeconomic Factors and Market Cycles

- Inflation Environment Performance: Comprehensive solutions in energy systems management provide competitive advantages

- Macroeconomic Policy Impact: Management committees with regular meetings help align with vision and core values

- Geopolitical Factors: Integration of traditional knowledge with scientific methods creates additional value through cross-cultural exchange

III. 2025-2030 Price Prediction: VERT vs MANA

Short-term Prediction (2025)

- VERT: Conservative $0.001199 - $0.001347 | Optimistic $0.001347 - $0.001388

- MANA: Conservative $0.152901 - $0.2427 | Optimistic $0.2427 - $0.356769

Mid-term Prediction (2027)

- VERT may enter a growth phase, with expected price range of $0.00133 - $0.00199

- MANA may enter a bullish market, with expected price range of $0.31211 - $0.46642

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- VERT: Base scenario $0.001659 - $0.002212 | Optimistic scenario $0.002212 - $0.002344

- MANA: Base scenario $0.409026 - $0.498813 | Optimistic scenario $0.498813 - $0.583611

Disclaimer: This analysis is based on historical data and current market trends. Cryptocurrency markets are highly volatile and unpredictable. Always conduct your own research before making investment decisions.

VERT:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.001387616 | 0.0013472 | 0.001199008 | 0 |

| 2026 | 0.00165456368 | 0.001367408 | 0.00098453376 | 1 |

| 2027 | 0.0019945013088 | 0.00151098584 | 0.0013296675392 | 11 |

| 2028 | 0.001857908188864 | 0.0017527435744 | 0.001682633831424 | 29 |

| 2029 | 0.002617722528366 | 0.001805325881632 | 0.001353994411224 | 33 |

| 2030 | 0.002344215657299 | 0.002211524204999 | 0.001658643153749 | 63 |

MANA:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.356769 | 0.2427 | 0.152901 | 0 |

| 2026 | 0.40164423 | 0.2997345 | 0.26376636 | 23 |

| 2027 | 0.46641685545 | 0.350689365 | 0.31211353485 | 43 |

| 2028 | 0.48617820116775 | 0.408553110225 | 0.33909908148675 | 67 |

| 2029 | 0.550259756506541 | 0.447365655696375 | 0.420523716354592 | 83 |

| 2030 | 0.583610866138705 | 0.498812706101458 | 0.409026419003195 | 104 |

IV. Investment Strategy Comparison: VERT vs MANA

Long-term vs Short-term Investment Strategy

- VERT: Suitable for investors focused on DeFi ecosystems and Telegram integration

- MANA: Suitable for investors interested in metaverse and virtual world applications

Risk Management and Asset Allocation

- Conservative investors: VERT 20% vs MANA 80%

- Aggressive investors: VERT 60% vs MANA 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risk

- VERT: High volatility due to recent launch and smaller market cap

- MANA: Susceptible to metaverse hype cycles and broader crypto market trends

Technical Risk

- VERT: Scalability, network stability on TON blockchain

- MANA: Platform security, smart contract vulnerabilities

Regulatory Risk

- Global regulatory policies may impact both differently, with MANA potentially facing more scrutiny due to its established presence

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- VERT advantages: DeFi integration with Telegram, potential for rapid growth

- MANA advantages: Established metaverse platform, longer track record

✅ Investment Advice:

- New investors: Consider a small allocation to MANA for exposure to established metaverse projects

- Experienced investors: Balanced approach with both VERT and MANA, adjusting based on risk tolerance

- Institutional investors: Conduct thorough due diligence on both, with potential focus on MANA for its established ecosystem

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the key differences between VERT and MANA? A: VERT is a newer token focused on DeFi integration with Telegram on the TON blockchain, while MANA is an established token for the Decentraland metaverse platform. VERT has a smaller market cap and higher volatility, whereas MANA has a longer track record and is more widely recognized in the crypto space.

Q2: Which token has shown better price performance recently? A: As of October 30, 2025, VERT has shown higher 24-hour trading volume ($65,809.76) compared to MANA ($44,055.72). However, MANA has a higher current price ($0.2436) compared to VERT ($0.0013516). VERT experienced extreme volatility earlier in 2025, while MANA has had a more established price history over several years.

Q3: What are the long-term price predictions for VERT and MANA? A: By 2030, VERT is predicted to reach $0.001659 - $0.002344 in the base to optimistic scenarios. MANA is expected to reach $0.409026 - $0.583611 in the same timeframe. These predictions are based on current trends and should be taken as estimates, not guarantees.

Q4: How do the supply mechanisms of VERT and MANA differ? A: VERT employs a vertical integration model focusing on inventory management efficiency in the supply chain. MANA uses a value-driven model emphasizing ethical standards and stakeholder engagement. Historically, efficient supply mechanisms with vertical integration tend to create more sustainable value cycles.

Q5: What are the main risks associated with investing in VERT and MANA? A: VERT risks include high volatility due to its recent launch and smaller market cap, as well as potential scalability issues on the TON blockchain. MANA risks include susceptibility to metaverse hype cycles, broader crypto market trends, and potential platform security vulnerabilities. Both face regulatory risks, with MANA potentially facing more scrutiny due to its established presence.

Q6: How should different types of investors approach VERT and MANA? A: New investors might consider a small allocation to MANA for exposure to established metaverse projects. Experienced investors could take a balanced approach with both VERT and MANA, adjusting based on risk tolerance. Institutional investors should conduct thorough due diligence on both, with a potential focus on MANA for its established ecosystem.

Share

Content