USDC vs BCH: Comparing Stablecoins and Cryptocurrencies in the Digital Asset Ecosystem

Introduction: USDC vs BCH Investment Comparison

In the cryptocurrency market, USDC vs BCH comparison has always been a topic that investors can't avoid. The two not only have significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning of crypto assets.

USD Coin (USDC): Since its launch in 2018, it has gained market recognition for its stable value pegged to the US dollar.

Bitcoin Cash (BCH): Since its inception in 2017, it has been hailed as a "peer-to-peer electronic cash system," and is one of the cryptocurrencies with high global trading volume and market capitalization.

This article will comprehensively analyze the investment value comparison between USDC and BCH, focusing on historical price trends, supply mechanisms, institutional adoption, technical ecosystems, and future predictions, and attempt to answer the question that investors are most concerned about:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

USDC (Coin A) and BCH (Coin B) Historical Price Trends

- 2023: USDC experienced a significant depegging event, causing its price to drop to $0.877647 on March 11, 2023.

- 2017: BCH was created through a hard fork of Bitcoin, with an initial price of $555.89 on July 23, 2017.

- Comparative Analysis: In their respective market cycles, USDC reached an all-time high of $1.17 on May 8, 2019, while BCH peaked at $3,785.82 on December 20, 2017, demonstrating BCH's higher volatility.

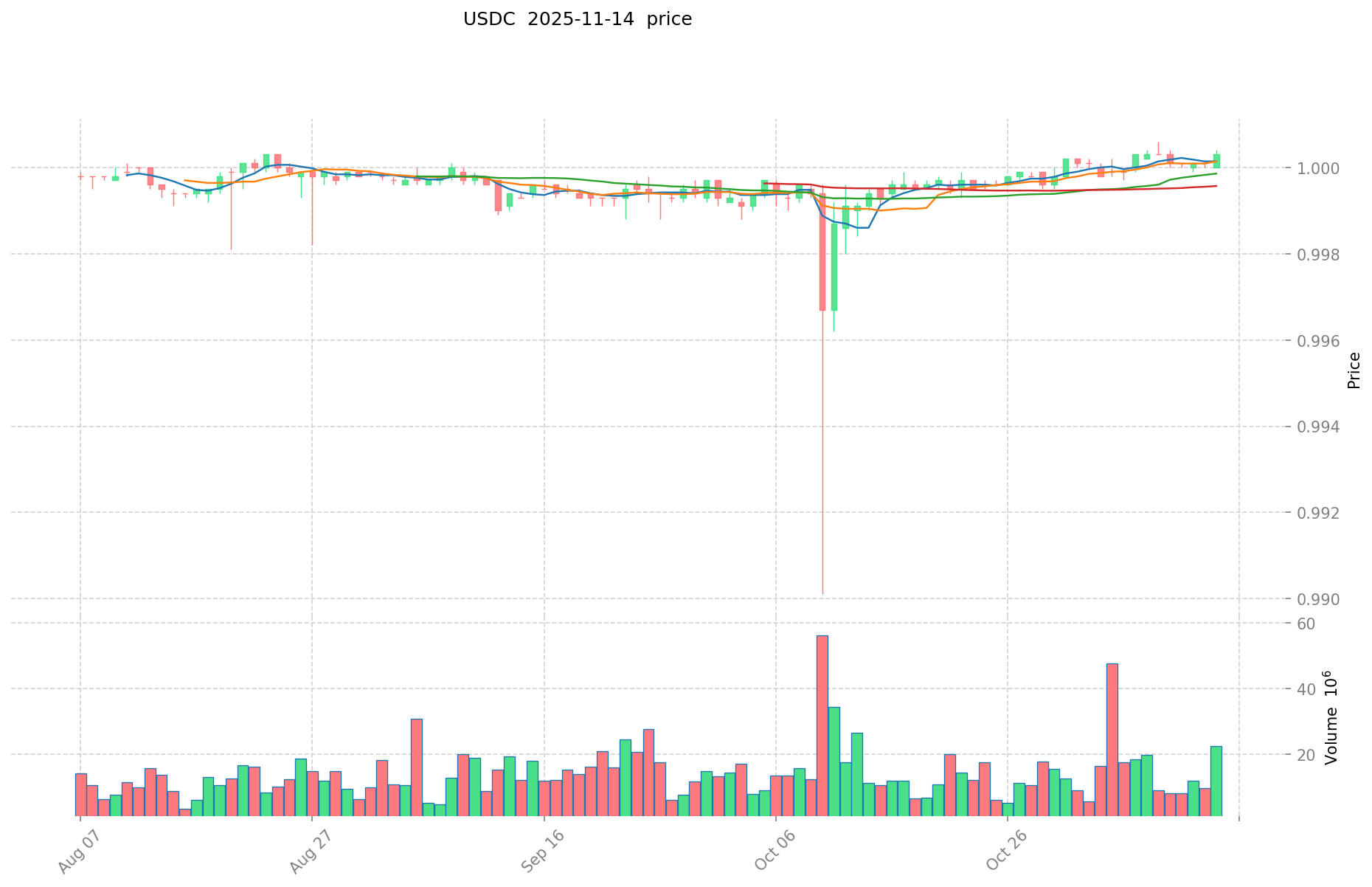

Current Market Situation (2025-11-14)

- USDC current price: $1.00

- BCH current price: $496.8

- 24-hour trading volume: USDC $12,162,611 vs BCH $7,584,732

- Market Sentiment Index (Fear & Greed Index): 16 (Extreme Fear)

Click to view real-time prices:

- Check USDC current price Market Price

- Check BCH current price Market Price

II. Core Factors Affecting USDC vs BCH Investment Value

Supply Mechanism Comparison (Tokenomics)

- USDC: Fully collateralized stablecoin with 1:1 USD backing, allowing minting and burning based on demand

- BCH: Fixed supply cap of 21 million coins with halving mechanism similar to Bitcoin

- 📌 Historical pattern: While USDC maintains price stability around $1, BCH experiences volatility cycles influenced by its halving events and market demand.

Institutional Adoption and Market Applications

- Institutional holdings: USDC is significantly more favored by institutions as a settlement layer and treasury reserve asset

- Enterprise adoption: USDC dominates in cross-border payments and settlement systems, while BCH has focused more on merchant payment solutions

- National policies: Regulatory clarity for USDC has improved in the US with Circle's compliance efforts, while BCH faces varying regulatory treatments across jurisdictions

Technical Development and Ecosystem Building

- USDC technical upgrades: Multichain expansion across Ethereum, Solana, Algorand and other networks; integration with Cross-Chain Transfer Protocol

- BCH technical development: Ongoing focus on scalability with larger block sizes; implementation of smart contract functionality through SmartBCH sidechain

- Ecosystem comparison: USDC has extensive DeFi integrations and lending protocols, while BCH ecosystem focuses primarily on payment applications with limited DeFi adoption

Macroeconomic Environment and Market Cycles

- Performance in inflationary environments: USDC offers stability but faces devaluation alongside USD, while BCH has potential hedge properties similar to Bitcoin

- Macroeconomic monetary policy: Interest rates directly impact USDC yields, while BCH price tends to correlate with broader crypto market cycles

- Geopolitical factors: USDC faces challenges in regions with US sanctions or restrictions, while BCH offers more censorship-resistant cross-border transactions

III. 2025-2030 Price Prediction: USDC vs BCH

Short-term Prediction (2025)

- USDC: Conservative $1.00 - $1.00 | Optimistic $1.00 - $1.00

- BCH: Conservative $421.50 - $495.88 | Optimistic $495.88 - $614.89

Mid-term Prediction (2027)

- USDC may remain stable, expected price $1.00

- BCH may enter a growth phase, expected price $445.86 - $786.45

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- USDC: Base scenario $1.00 - $1.00 | Optimistic scenario $1.00 - $1.00

- BCH: Base scenario $546.91 - $868.11 | Optimistic scenario $868.11 - $902.84

Disclaimer

USDC:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

BCH:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 614.8912 | 495.88 | 421.498 | 0 |

| 2026 | 683.124288 | 555.3856 | 488.739328 | 12 |

| 2027 | 786.45377888 | 619.254944 | 445.86355968 | 25 |

| 2028 | 991.0246496304 | 702.85436144 | 358.4557243344 | 42 |

| 2029 | 889.28648081196 | 846.9395055352 | 762.24555498168 | 71 |

| 2030 | 902.8375129005232 | 868.11299317358 | 546.9111856993554 | 75 |

IV. Investment Strategy Comparison: USDC vs BCH

Long-term vs Short-term Investment Strategies

- USDC: Suitable for investors focused on stability and capital preservation

- BCH: Suitable for investors looking for potential growth and adoption in payment scenarios

Risk Management and Asset Allocation

- Conservative investors: USDC: 80% vs BCH: 20%

- Aggressive investors: USDC: 40% vs BCH: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolio

V. Potential Risk Comparison

Market Risk

- USDC: Depegging risk, as seen in March 2023 event

- BCH: High volatility and susceptibility to market sentiment

Technical Risk

- USDC: Smart contract vulnerabilities, cross-chain bridge risks

- BCH: Network congestion, potential 51% attacks

Regulatory Risk

- Global regulatory policies have different impacts on both assets, with USDC facing more scrutiny as a stablecoin

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- USDC advantages: Stability, wide institutional adoption, extensive DeFi integrations

- BCH advantages: Potential for price appreciation, focus on payment solutions, censorship-resistant transactions

✅ Investment Advice:

- Novice investors: Consider a higher allocation to USDC for stability

- Experienced investors: Balanced portfolio with both USDC and BCH based on risk tolerance

- Institutional investors: USDC for treasury management, BCH for diversification and potential growth

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

FAQ

Q1: What are the key differences between USDC and BCH? A: USDC is a stablecoin pegged to the US dollar, offering price stability. BCH is a cryptocurrency focused on being a peer-to-peer electronic cash system with a fixed supply cap. USDC is widely used in DeFi and institutional settlements, while BCH focuses more on payment solutions.

Q2: Which asset is better for long-term investment? A: This depends on your investment goals. USDC is better for capital preservation and stability, while BCH offers potential for price appreciation but with higher volatility. A balanced portfolio may include both assets based on your risk tolerance.

Q3: How do the supply mechanisms of USDC and BCH differ? A: USDC has a flexible supply mechanism, with tokens minted or burned based on demand, always maintaining a 1:1 USD backing. BCH has a fixed supply cap of 21 million coins with a halving mechanism similar to Bitcoin.

Q4: What are the main risks associated with investing in USDC and BCH? A: USDC faces depegging risk and regulatory scrutiny as a stablecoin. BCH is subject to high market volatility and potential network security risks. Both assets may be impacted by changing regulatory environments globally.

Q5: How do institutional adoptions compare between USDC and BCH? A: USDC has gained significant institutional adoption for treasury management and as a settlement layer. BCH has less institutional backing but focuses on merchant adoption for payment solutions.

Q6: What are the price predictions for USDC and BCH by 2030? A: USDC is expected to maintain its $1.00 value. BCH predictions range from $546.91 to $902.84 in optimistic scenarios. However, these predictions are speculative and not guaranteed.

Q7: How do the technical ecosystems of USDC and BCH compare? A: USDC has expanded to multiple blockchains and is widely integrated into DeFi protocols. BCH focuses on scalability improvements and has implemented smart contract functionality through the SmartBCH sidechain, but has more limited DeFi adoption compared to USDC.

Share

Content