SMB vs ADA: Comparing Small Business Marketing and the Americans with Disabilities Act Compliance

Introduction: SMB vs ADA Investment Comparison

In the cryptocurrency market, the comparison between Social Master & Branch (SMB) and Cardano (ADA) has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positions in the crypto asset space.

Social Master & Branch (SMB): Since its launch, it has gained market recognition for its focus on Web3 commerce and digital economy models.

Cardano (ADA): Launched in 2017, it has been hailed as a technology platform capable of running financial applications used by individuals, organizations, and governments worldwide.

This article will provide a comprehensive analysis of the investment value comparison between SMB and ADA, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question most crucial to investors:

"Which is the better buy right now?"

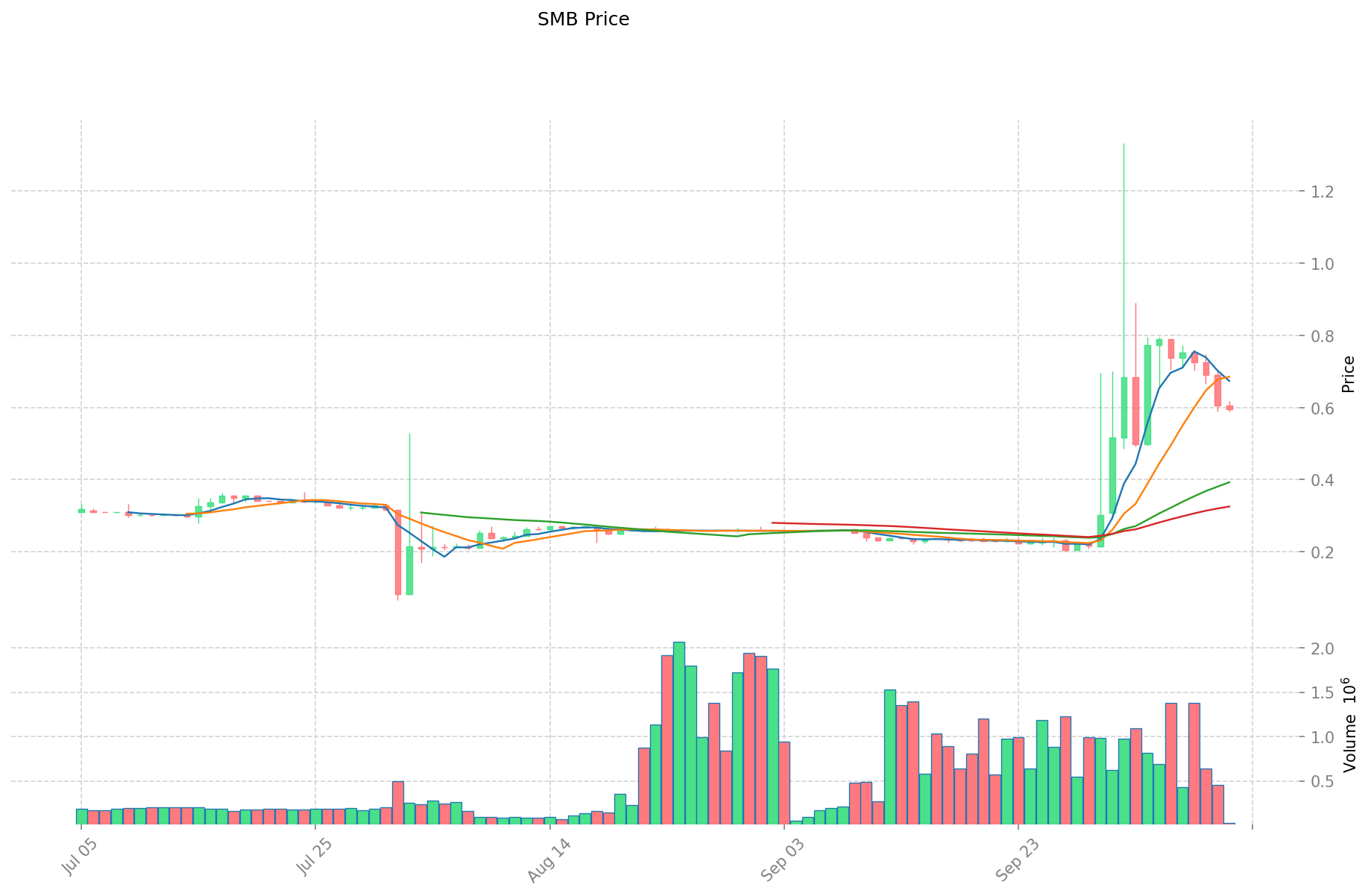

I. Price History Comparison and Current Market Status

SMB and ADA Historical Price Trends

- 2025: SMB reached its all-time high of $1.3332 on October 2nd due to increased adoption.

- 2021: ADA hit its all-time high of $3.09 on September 2nd, driven by the launch of smart contracts.

- Comparative analysis: In the recent market cycle, SMB dropped from $1.3332 to a low of $0.02844, while ADA fell from $3.09 to $0.2300.

Current Market Situation (2025-10-12)

- SMB current price: $0.59561

- ADA current price: $0.6289

- 24-hour trading volume: SMB $16,119,706 vs ADA $31,378,349

- Market Sentiment Index (Fear & Greed Index): 27 (Fear)

Click to view real-time prices:

- Check SMB current price Market Price

- Check ADA current price Market Price

II. Core Factors Influencing the Investment Value of ADA

Institutional Adoption and Market Applications

- Institutional Holdings: In 2025, institutional funds flowing into ADA have reached $73 million, with total custodial holdings exceeding $900 million.

- Enterprise Adoption: Cardano's development is guided by peer-reviewed research methods, aiming to build a scientific, robust, and secure blockchain infrastructure to attract institutional and government investors.

Technical Development and Ecosystem Building

- ADA Technical Development: Cardano is developed using a scientific, peer-reviewed research methodology, focusing on building a robust and secure blockchain infrastructure.

- Ecosystem Comparison: ADA offers staking capabilities that provide users with annual percentage yield (APY), paid into accounts weekly.

Macroeconomic and Market Cycles

- Macroeconomic Policy Impact: Analysts predict that if the Federal Reserve implements rate cuts in September, ADA could potentially reach $3.

- Market Trends: As the cryptocurrency market enters a new cycle, Cardano (ADA) has regained focus as an established public chain project, with analysts examining technical indicators, on-chain data, and ecosystem development.

III. 2025-2030 Price Prediction: SMB vs ADA

Short-term Prediction (2025)

- SMB: Conservative $0.30-$0.59 | Optimistic $0.59-$0.83

- ADA: Conservative $0.61-$0.63 | Optimistic $0.63-$0.81

Mid-term Prediction (2027)

- SMB may enter a growth phase, with expected price range $0.54-$1.15

- ADA may enter a steady growth phase, with expected price range $0.70-$1.05

- Key drivers: Institutional capital inflow, ETF, ecosystem development

Long-term Prediction (2030)

- SMB: Base scenario $1.31-$1.44 | Optimistic scenario $1.44-$1.45

- ADA: Base scenario $1.08-$1.58 | Optimistic scenario $1.58-$1.58

Disclaimer

SMB:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.8279952 | 0.59568 | 0.3037968 | 0 |

| 2026 | 0.946744008 | 0.7118376 | 0.654890592 | 19 |

| 2027 | 1.15271421756 | 0.829290804 | 0.5390390226 | 39 |

| 2028 | 1.189203012936 | 0.99100251078 | 0.6045115315758 | 66 |

| 2029 | 1.53704489421978 | 1.090102761858 | 0.99199351329078 | 83 |

| 2030 | 1.444931210842779 | 1.31357382803889 | 1.247895136636945 | 120 |

ADA:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.80576 | 0.6295 | 0.610615 | 0 |

| 2026 | 0.7391589 | 0.71763 | 0.5166936 | 14 |

| 2027 | 1.048888008 | 0.72839445 | 0.699258672 | 15 |

| 2028 | 1.04859665022 | 0.888641229 | 0.70202657091 | 41 |

| 2029 | 1.1914012957203 | 0.96861893961 | 0.8620708562529 | 54 |

| 2030 | 1.576814771791119 | 1.08001011766515 | 0.907208498838726 | 71 |

IV. Investment Strategy Comparison: SMB vs ADA

Long-term vs Short-term Investment Strategies

- SMB: Suitable for investors focused on Web3 commerce and digital economy potential

- ADA: Suitable for investors seeking technological innovation and institutional adoption

Risk Management and Asset Allocation

- Conservative investors: SMB: 30% vs ADA: 70%

- Aggressive investors: SMB: 60% vs ADA: 40%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolio

V. Potential Risk Comparison

Market Risk

- SMB: Higher volatility due to lower market cap and trading volume

- ADA: Susceptible to overall crypto market trends and macroeconomic factors

Technical Risk

- SMB: Scalability, network stability

- ADA: Smart contract vulnerabilities, potential delays in development roadmap

Regulatory Risk

- Global regulatory policies may have different impacts on both assets

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- SMB advantages: Focus on Web3 commerce, potential for high growth in digital economy

- ADA advantages: Scientific approach to development, institutional adoption, established ecosystem

✅ Investment Advice:

- New investors: Consider a balanced approach with a higher allocation to ADA for its established market presence

- Experienced investors: Explore opportunities in both assets, with a higher risk-reward potential in SMB

- Institutional investors: Focus on ADA for its institutional-grade development and adoption

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the key differences between SMB and ADA? A: SMB focuses on Web3 commerce and digital economy models, while ADA is a technology platform for financial applications. SMB has a lower market cap and higher volatility, whereas ADA has a more established ecosystem and institutional adoption.

Q2: Which asset has shown better price performance recently? A: As of October 12, 2025, SMB is priced at $0.59561, while ADA is at $0.6289. SMB has shown higher volatility, dropping from an all-time high of $1.3332 to a low of $0.02844, compared to ADA's fall from $3.09 to $0.2300.

Q3: How do the long-term price predictions for SMB and ADA compare? A: By 2030, SMB is predicted to reach $1.31-$1.45, while ADA is expected to be in the range of $1.08-$1.58. Both assets show potential for growth, with SMB having a slightly higher upside in the optimistic scenario.

Q4: What are the main risks associated with investing in SMB and ADA? A: SMB faces higher volatility risk due to its lower market cap and trading volume, as well as potential scalability issues. ADA is more susceptible to overall crypto market trends and may face smart contract vulnerabilities or development delays.

Q5: How do institutional adoptions differ between SMB and ADA? A: ADA has seen significant institutional adoption, with institutional funds reaching $73 million and total custodial holdings exceeding $900 million in 2025. SMB's institutional adoption is not specified but is likely lower due to its focus on Web3 commerce and smaller market presence.

Q6: What investment strategies are recommended for SMB and ADA? A: For conservative investors, a 30% SMB to 70% ADA allocation is suggested. Aggressive investors might consider 60% SMB to 40% ADA. New investors may prefer a higher allocation to ADA for its established market presence, while experienced investors could explore opportunities in both assets.

Share

Content