PVU vs APT: Comparing Two Popular Blockchain Gaming Platforms

Introduction: PVU vs APT Investment Comparison

In the cryptocurrency market, the comparison between PlantVsUndead (PVU) and Aptos (APT) has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positioning in crypto assets.

PlantVsUndead (PVU): Since its launch, it has gained market recognition for combining gaming with blockchain technology, particularly NFTs.

Aptos (APT): Launched in 2022, it has been hailed as a high-performance Layer 1 blockchain focused on security and scalability.

This article will comprehensively analyze the investment value comparison between PVU and APT, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

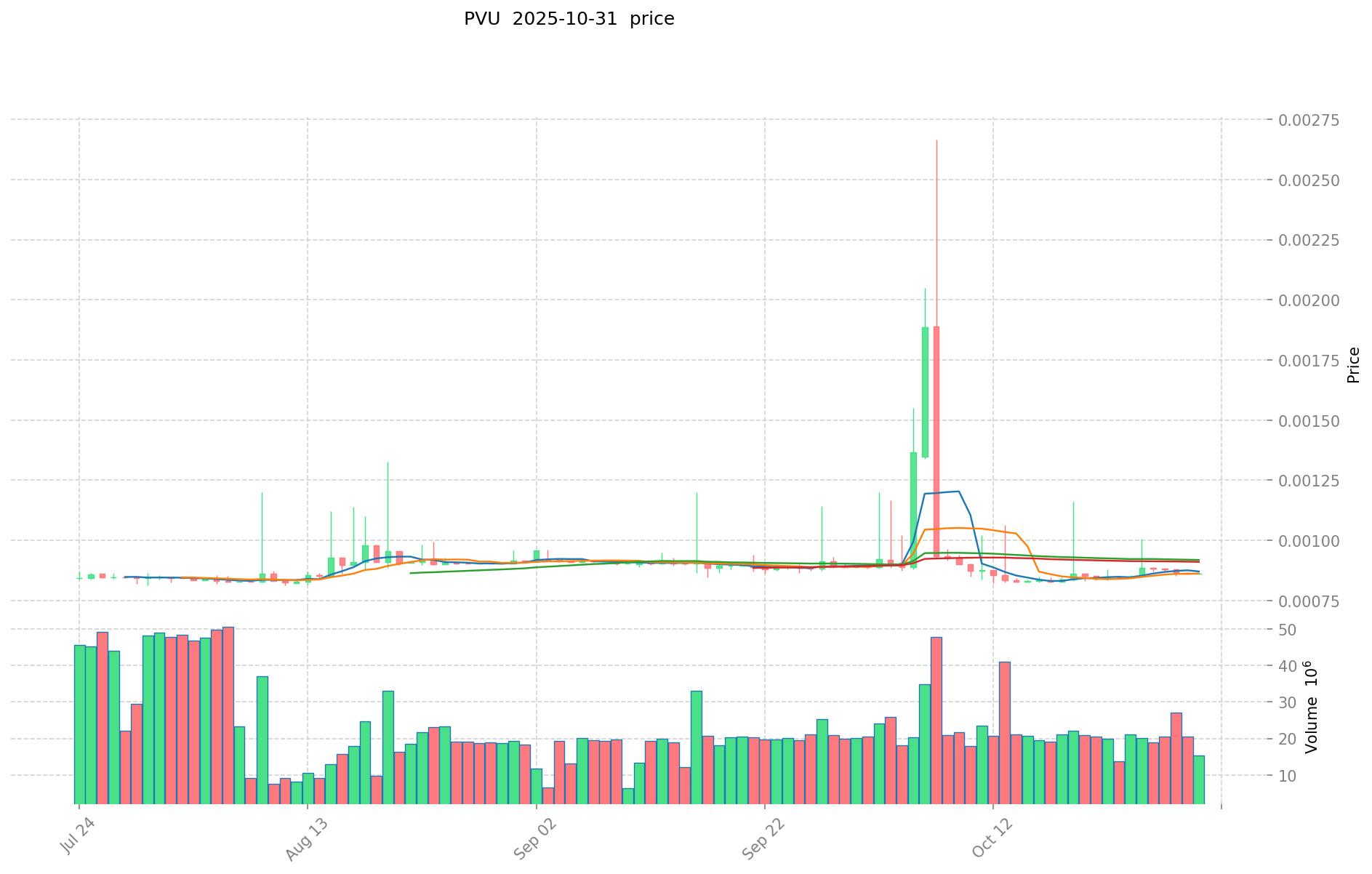

I. Price History Comparison and Current Market Status

PVU and APT Historical Price Trends

- 2021: PVU reached an all-time high of $24.73 during the peak of the NFT gaming craze.

- 2023: APT hit its all-time high of $19.92 in January, shortly after its mainnet launch.

- Comparative analysis: During the 2022-2023 bear market, PVU dropped from its peak to near-zero levels, while APT has shown more resilience, maintaining a price above $3.

Current Market Situation (2025-11-01)

- PVU current price: $0.0006304

- APT current price: $3.26

- 24-hour trading volume: PVU $18,976.64 vs APT $846,905.53

- Market Sentiment Index (Fear & Greed Index): 29 (Fear)

Click to view real-time prices:

- View PVU current price Market Price

- View APT current price Market Price

Core Factors in PVU vs APT Investment Value

Technology and Innovation

- PVU: Focus on advanced manufacturing and technological innovation in specialized sectors

- APT: Emphasizes development in semiconductor and integrated circuit industry, with progress in 28nm logic chip manufacturing

- 📌 Historical pattern: Companies with strong technological capabilities tend to maintain competitive advantages and higher valuation multiples

Market Demand and Growth Potential

- Market trends: Both operate in high-growth sectors with increasing demand for advanced technologies

- Competitive positioning: APT's tungsten resources represent 80%+ of global capacity, creating significant market leverage

- Industry outlook: Semiconductor industry experiencing cyclical challenges but with long-term growth trajectory

Financial Performance Metrics

- Revenue growth: Strong performers show consistent growth patterns even during industry downturns

- Profitability indicators: Margin stability during raw material price fluctuations is crucial for valuation

- Cash flow generation: Companies with positive operating cash flow during expansion phases demonstrate better investment value

Operational Excellence

- Manufacturing capabilities: Production efficiency and technological process improvements drive cost advantages

- Supply chain integration: Vertical integration can significantly enhance profit margins and competitive positioning

- R&D investment: Continuous innovation and product development correlate with long-term investment returns

III. 2025-2030 Price Prediction: PVU vs APT

Short-term Prediction (2025)

- PVU: Conservative $0.000523232 - $0.0006304 | Optimistic $0.0006304 - $0.000699744

- APT: Conservative $2.31531 - $3.261 | Optimistic $3.261 - $4.82628

Mid-term Prediction (2027-2028)

- PVU may enter a growth phase, with prices expected between $0.0005684370384 - $0.001275956593728

- APT may enter a bullish market, with prices expected between $4.483588032 - $7.72531558722

- Key drivers: Institutional inflows, ETF developments, ecosystem growth

Long-term Prediction (2030)

- PVU: Base scenario $0.001108797716482 - $0.00094247805901 | Optimistic scenario $0.001441437031427

- APT: Base scenario $6.8407947413883 - $6.15671526724947 | Optimistic scenario $9.850744427599152

Disclaimer: This analysis is based on historical data and market projections. Cryptocurrency markets are highly volatile and unpredictable. These predictions should not be considered as financial advice. Always conduct your own research before making investment decisions.

PVU:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.000699744 | 0.0006304 | 0.000523232 | 0 |

| 2026 | 0.00081138784 | 0.000665072 | 0.00045224896 | 5 |

| 2027 | 0.0009744634944 | 0.00073822992 | 0.0005684370384 | 17 |

| 2028 | 0.001275956593728 | 0.0008563467072 | 0.000462427221888 | 36 |

| 2029 | 0.001151443782501 | 0.001066151650464 | 0.000906228902894 | 69 |

| 2030 | 0.001441437031427 | 0.001108797716482 | 0.00094247805901 | 76 |

APT:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 4.82628 | 3.261 | 2.31531 | 0 |

| 2026 | 5.2971684 | 4.04364 | 2.5474932 | 24 |

| 2027 | 6.445157796 | 4.6704042 | 4.483588032 | 43 |

| 2028 | 7.72531558722 | 5.557780998 | 4.94642508822 | 70 |

| 2029 | 7.0400411901666 | 6.64154829261 | 5.8445624974968 | 103 |

| 2030 | 9.850744427599152 | 6.8407947413883 | 6.15671526724947 | 109 |

IV. Investment Strategy Comparison: PVU vs APT

Long-term vs Short-term Investment Strategies

- PVU: Suitable for investors focused on gaming and NFT ecosystems

- APT: Suitable for investors seeking exposure to high-performance blockchain infrastructure

Risk Management and Asset Allocation

- Conservative investors: PVU: 10% vs APT: 90%

- Aggressive investors: PVU: 30% vs APT: 70%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolio

V. Potential Risk Comparison

Market Risks

- PVU: High volatility due to gaming sector trends and NFT market fluctuations

- APT: Susceptible to overall crypto market sentiment and Layer 1 competition

Technical Risks

- PVU: Scalability, network stability

- APT: Concentration of validators, potential security vulnerabilities

Regulatory Risks

- Global regulatory policies may impact both differently, with gaming tokens potentially facing more scrutiny

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- PVU advantages: Unique gaming ecosystem, NFT integration

- APT advantages: High-performance blockchain, institutional backing, scalability

✅ Investment Advice:

- Novice investors: Consider APT for its stronger fundamentals and market position

- Experienced investors: Diversify with a larger allocation to APT and smaller exposure to PVU

- Institutional investors: Focus on APT for its potential as a leading Layer 1 solution

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between PVU and APT in terms of investment potential? A: PVU focuses on gaming and NFT ecosystems, while APT is a high-performance Layer 1 blockchain. APT generally shows more stability and institutional backing, while PVU offers exposure to the gaming and NFT sectors but with higher volatility.

Q2: Which cryptocurrency has shown better price performance in recent years? A: APT has shown better price performance and resilience. During the 2022-2023 bear market, PVU dropped from its peak to near-zero levels, while APT maintained a price above $3.

Q3: What are the price predictions for PVU and APT by 2030? A: By 2030, PVU is predicted to reach between $0.00094247805901 and $0.001441437031427, while APT is expected to be between $6.15671526724947 and $9.850744427599152 in the base and optimistic scenarios respectively.

Q4: How should investors allocate their portfolio between PVU and APT? A: Conservative investors might consider allocating 10% to PVU and 90% to APT, while aggressive investors could opt for 30% PVU and 70% APT. However, individual allocation should be based on personal risk tolerance and investment goals.

Q5: What are the main risks associated with investing in PVU and APT? A: PVU faces high volatility due to gaming sector trends and NFT market fluctuations, as well as technical risks related to scalability. APT is susceptible to overall crypto market sentiment, Layer 1 competition, and potential security vulnerabilities. Both face regulatory risks, with gaming tokens potentially facing more scrutiny.

Q6: Which cryptocurrency is recommended for novice investors? A: For novice investors, APT is generally recommended due to its stronger fundamentals and market position. It offers exposure to high-performance blockchain infrastructure with less volatility compared to PVU.

Share

Content