Polkadot (DOT) Outlook: Parachains, Partnerships & Price Predictions for 2025–2028

Polkadot, known by its ticker DOT, is a unique multi-chain network that aims to connect the dots between disparate blockchains. Launched by Ethereum co-founder Dr. Gavin Wood, Polkadot’s mission is to enable different blockchains to work together seamlessly on a unified platform. In simple terms, Polkadot acts as a blockchain of blockchains, fostering interoperability while maintaining high security and scalability. Its fun name might evoke colorful polka dot patterns, but under the hood Polkadot packs serious technology that’s ushering in the next generation of Web3 connectivity. The introduction below provides an engaging overview of Polkadot’s vision, ecosystem strengths, and what makes DOT a top 20 crypto asset by market cap.

Parachains and Interoperability: Connecting Blockchains

Polkadot’s core innovation lies in its parachains – independent blockchains that run in parallel, all connected to Polkadot’s central Relay Chain. This architecture allows each parachain to specialize (one might focus on DeFi, another on gaming, etc.) while still benefiting from the security and communication of the broader Polkadot network. By design, Polkadot makes different blockchains interoperable. For example, a transaction or data on one parachain can be trusted and used on another, bridging previously isolated blockchain ecosystems. This cross-chain superpower is enabled by Polkadot’s Cross-Chain Message Passing (XCMP) protocol, essentially letting blockchains talk to each other in a standardized way.

From a technical perspective, parachains also boost scalability. Since many parachains process transactions simultaneously (rather than one global chain doing all the work), Polkadot can handle a high throughput – recent upgrades in Polkadot 2.0 have shortened block time to 6 seconds and increased capacity, theoretically allowing hundreds of parachains to operate at once. In non-technical terms, imagine a busy highway system: Polkadot added many parallel lanes so that traffic flows faster even during rush hour. This parallel processing is a fun yet powerful concept – it means the more the merrier when it comes to blockchains in the Polkadot ecosystem.

Crucially, Polkadot ensures all these parachains remain secure through a shared pooled security model. The DOT token plays a big role here: DOT holders stake tokens to support (validate) the network, and in return Polkadot’s consensus mechanism keeps every parachain secure. This setup has made Polkadot an attractive platform for new blockchain projects. Instead of starting a blockchain from scratch and recruiting their own validators, projects can launch as a Polkadot parachain and piggyback on Polkadot’s robust security and validator community. This synergy of interoperability + shared security is often touted as Polkadot’s one-two punch in advancing a more connected, user-friendly crypto ecosystem.

Ecosystem Strength and Major Partnerships

Polkadot’s ecosystem has grown into one of the most vibrant in crypto, with dozens of live parachains and a large developer community building on its Substrate framework. In fact, Polkadot consistently ranks among the top 3 ecosystems by development activity – over 2,000 developers contribute to Polkadot and its projects, a strong sign of long-term commitment. This includes not just independent teams but also Parity Technologies (the main development arm behind Polkadot) and the Web3 Foundation which funds ecosystem projects. From decentralized finance platforms like Acala and Moonbeam, to smart contract hubs like Astar Network, Polkadot’s parachains cover a wide range of use cases. The network’s on-chain treasury (holding over $200 million in DOT) actively supports innovation, funding new proposals and community initiatives regularly.

Such a strong ecosystem has attracted notable partnerships and integrations. For example, Polkadot has collaborated with Chainlink to bring reliable oracles into its parachains, and partnered with projects like Energy Web to help corporate giants (including Shell and Volkswagen) leverage Polkadot’s tech for carbon reduction initiatives. Even the world of sports has taken notice – in 2023, Inter Miami CF (the Major League Soccer team co-owned by David Beckham) announced a partnership with Polkadot to explore blockchain solutions for fan engagement. Polkadot’s presence in academia is growing too; it inked a deal with the University of Buenos Aires to support blockchain education and research. These partnerships signal a broad confidence in Polkadot’s technology beyond just the crypto sphere.

Another pillar of Polkadot’s strength is its governance and community. DOT holders have a say in network upgrades and resource allocation via on-chain governance votes, embodying the project’s decentralized ethos. Polkadot’s governance system was bold enough to eliminate its Sudo super-user key early on, fully handing control to the token community. This approach has earned respect and trust – the community has smoothly enacted major upgrades like Polkadot 2.0 features through transparent voting. All these factors contribute to a positive feedback loop: strong tech → engaged developers → real-world partnerships → increased network effect. It’s no surprise the social buzz around Polkadot remains high (more on that later). Next, let’s dive into DOT’s market performance and what the future might hold for its price.

Historical DOT Price Performance

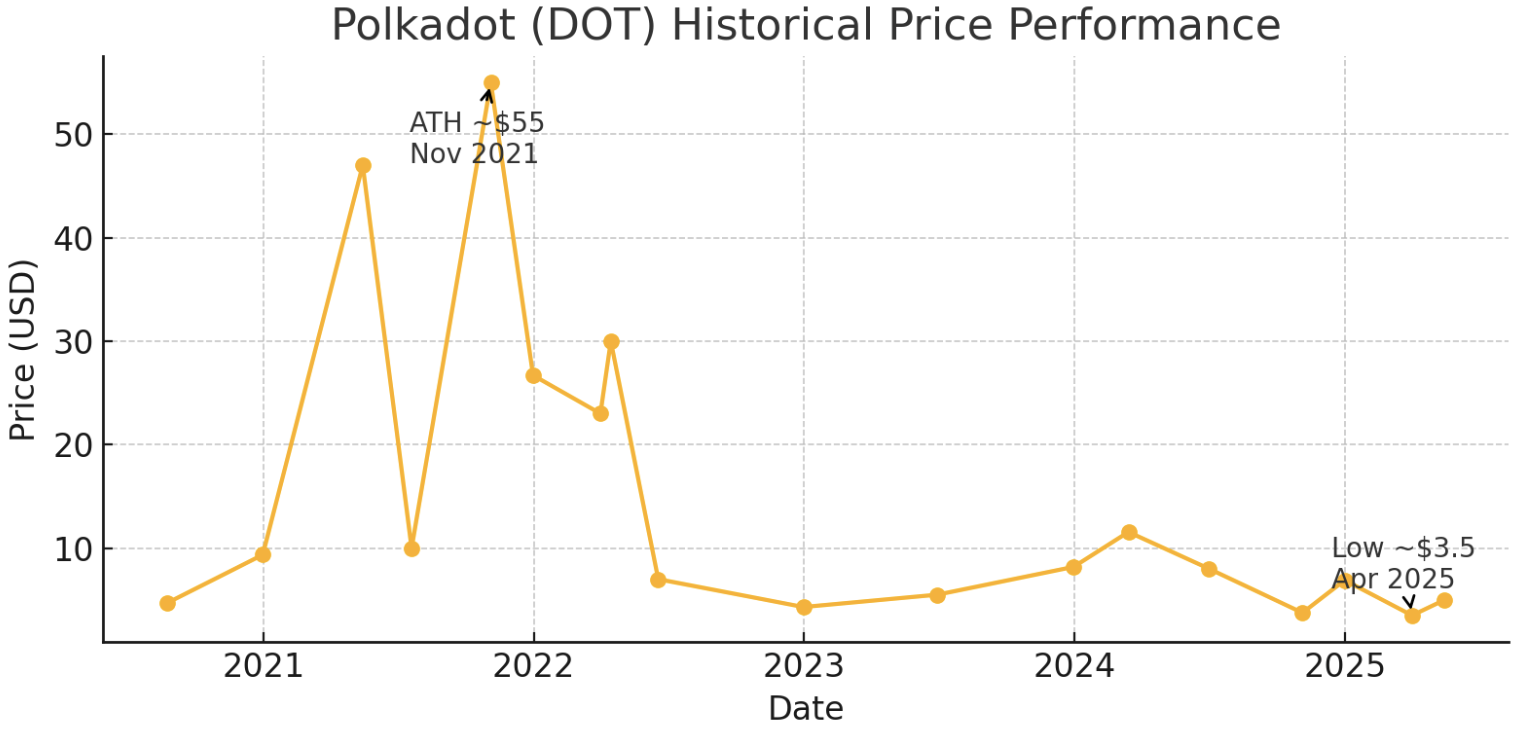

Polkadot’s price history has been a rollercoaster ride, reflective of the broader crypto market’s booms and busts. DOT first hit exchanges in late 2020 around the $3–$5 range after a redenomination (Polkadot multiplied its token supply by 100 in August 2020, turning old DOT into new DOT at 1:100). In the 2021 crypto bull run, DOT shot up dramatically. By May 2021, as excitement over parachain auctions built, DOT surged to around $47. After a mid-year dip (cooling to about $10 during summer 2021’s market pullback), DOT reached its all-time high of ~$55 in November 2021. This peak coincided with Polkadot’s first parachain slot auctions and a frenzy of investor optimism. DOT’s market capitalization at that time briefly cracked the top 5 of all cryptocurrencies – not bad for a project in its infancy!

However, like many altcoins, Polkadot suffered a harsh comedown in the subsequent bear market. Through 2022, DOT’s price steadily declined amid rising interest rates and risk-off sentiment, ending 2022 near $4 (over 90% down from its high). The year 2023 saw modest recovery and consolidation; DOT traded mostly in the $5–$7 range, with a late-2023 rally pushing it back above $8 as the crypto market showed signs of life. The macro downturn of 2024 hit DOT hard once again – despite Polkadot’s successful 2.0 tech upgrades, the token fell to a new cycle low of approximately $3.5 in late 2024 and early 2025. Essentially, DOT round-tripped from its 2021 heights back to early 2020s levels, shaking out speculators along the way.

The chart above vividly illustrates these peaks and valleys. Polkadot went from hero to zero (and perhaps back to hero in the making): a meteoric rise in 2021, a brutal drawdown through 2022–2024, and stabilization around spring 2025. Long-term holders often note that despite price volatility, Polkadot’s fundamentals have only strengthened – development activity hit all-time highs and parachain adoption grew even as the token price languished. This divergence sets the stage for intriguing price predictions ahead. With DOT currently trading in the mid-single digits (around $4–$5 as of mid-2025), what’s the outlook for the next few years? Let’s analyze the short-term and long-term possibilities using both technical charts and fundamental trends.

DOT Price Predictions for 2025–2026 (Short Term)

Short-term, Polkadot’s price trajectory will largely depend on a crypto market recovery and Polkadot’s ability to reclaim key technical levels. On the bullish side, if a new crypto cycle kicks off in 2025 (historically post-Bitcoin-halving periods spark bullish momentum), DOT could ride a wave of renewed interest. Technically, traders are watching the $10 level as a major resistance – this was roughly the peak during a 2024 relief rally. A break above $10, especially with strong trading volume, would signal a trend reversal out of the multi-year downtrend. From there, the next targets could be around $15 (a price zone DOT flirted with in early 2022) by mid-2026. Our moderate scenario chart (orange line above) shows a gradual climb, with DOT potentially doubling from current prices to reach the low teens by 2026.

Fundamental factors support this cautious optimism. By 2025–2026, Polkadot 2.0’s benefits will be fully realized – the network now offers easier on-boarding for new projects (no more cumbersome parachain auctions) and vastly higher throughput. If developers continue to flock to Polkadot, usage of the network (and demand for DOT for transaction fees, staking, etc.) should increase. Major upcoming events, like Polkadot Decoded conferences or new parachain launches, could also act as price catalysts by drawing social media buzz and investor attention. There’s also Polkadot’s hefty on-chain treasury that can be deployed to grow the ecosystem, potentially boosting confidence. From a valuation perspective, DOT around $5 looks relatively undervalued compared to its peak – some analysts argue that as interoperability plays become essential (connecting Ethereum, BSC, Cosmos, and others), Polkadot is well-positioned to capture that trend.

Of course, risks remain on the table. In a bearish scenario, if the wider crypto market remains flat or falls further, DOT might struggle to gain upside traction. It could bounce between, say, $5 and $8 through 2025, failing to break $10 until real bullish sentiment returns. Competition is another factor: Polkadot isn’t the only interoperability project – rivals like Cosmos (ATOM) also aim to connect blockchains and could limit Polkadot’s growth if they solve the puzzle better or faster. Additionally, investors will be watching adoption: lots of technical promise needs to translate into user activity on parachains (TVL in DeFi apps, NFT volume, etc.). In summary, a balanced short-term outlook for DOT might be a base case of ~$10 by end of 2025, with upside toward $15 in 2026 if the stars align, and downside protection around the recent lows of $3–$4. Volatility will no doubt persist, but for active DOT community members, the next two years are an opportunity to prove Polkadot’s real-world staying power.

DOT Price Predictions for 2027–2028 (Long Term)

Looking further out, Polkadot’s long-term price potential could be significantly higher – but it hinges on delivering fundamental growth. By 2027–2028, we will have seen another full crypto market cycle play out. If Polkadot succeeds in becoming a backbone of the Web3 internet, some bullish forecasts suggest DOT could approach or even exceed its previous all-time high (~$55) by 2028. Our optimistic scenario (pink zone in the chart) envisions DOT climbing into the $40–$60 range within the next 3–4 years. This would assume that Polkadot captures a large share of cross-chain activity – for instance, hundreds of blockchains and dApps using Polkadot’s infrastructure to seamlessly interconnect, resulting in much higher demand for DOT (for staking, gas, bonding, etc.). Under such conditions, DOT would be a top performer as interoperability becomes a must-have feature across the industry.

However, a more moderate expectation might temper that enthusiasm. In a steady growth scenario (the pink line above), Polkadot could steadily appreciate toward the $20–$30 range by 2028. That would imply roughly a 5x from current prices over four years – a strong return, but not outrageous by crypto standards. Achieving $25+ would likely require at least one strong bull market somewhere in those years, as well as continuous expansion of the Polkadot ecosystem’s user base. Fundamental metrics to watch include the number of parachains (Polkadot is designed to scale to 100+ parachains, and upgrades might expand this to 1,000), total value locked in Polkadot’s DeFi projects, and the volume of cross-chain transactions flowing through Polkadot’s interoperability channels. If these metrics grow exponentially, they provide justification for DOT’s price to rise correspondingly.

In a bear-case scenario where Polkadot underperforms, DOT might stay under $15 through 2028, implying that it never really escaped crypto winter or that newer technologies overshadowed it. This could happen if, say, enterprises and developers favor alternative interoperability solutions, or if regulatory issues hamper Polkadot’s global adoption. It’s worth noting though that Polkadot has some built-in advantages for longevity: its on-chain governance allows it to adapt (the community can upgrade the network without hard forks), and its treasury ensures continued funding for development. Also, Polkadot’s staking rewards (roughly 14% annual yield at present) incentivize long-term holding of DOT, which can reduce circulating supply pressure. All things considered, the long-term outlook for Polkadot (DOT) skews positive – even competitors often acknowledge Polkadot’s technical prowess. If the 2025–2028 timeframe ushers in the era of the interconnected blockchain multiverse, Polkadot aims to be right at the center of it, which would likely be reflected in DOT’s market value.

Social Media Sentiment: What X (Twitter) Is Saying

In the social sphere, Polkadot has maintained a notable buzz on X (formerly Twitter), with a community that is both passionate and highly technical. On crypto Twitter, you’ll often see developers and enthusiasts sharing updates about Polkadot’s latest releases – for example, the successful implementation of asynchronous backing and Agile Coretime in 2024 (key Polkadot 2.0 upgrades) received a lot of praise and excitement online. Sentiment analysis indicates the community leans optimistic. One recent community poll on X rated Polkadot’s sentiment 4.1 out of 5, highlighting strong confidence among DOT holders even during the bear market. Common hashtags like #Polkadot, #DOT, and #Parachains trend whenever there’s a major event, such as a parachain auction result or the annual Polkadot Decoded conference showcasing new ecosystem projects.

That said, the sentiment isn’t all sunshine and rainbows – healthy debate and humor exist too. Some posts playfully compare Polkadot to its rival Cosmos, noting how both are racing to connect blockchains (one tongue-in-cheek tweet referenced Polkadot and Cosmos in a “battle of the interchain”). Overall, Polkadot’s social media presence reflects a project in active development: there’s a constant stream of technical discussions, community AMAs with Polkadot developers, and governance proposal debates. Notably, Polkadot’s co-founder Gavin Wood occasionally shares visionary insights on his channel, which the community amplifies enthusiastically. And with Polkadot’s decentralized governance, even ordinary DOT holders have a voice – it’s not uncommon to see community members on Twitter rallying votes for or against proposals, truly engaging in the network’s direction. This grassroots energy, combined with Polkadot’s official channels, keeps the project in the social media limelight. In summary, the Twitter buzz around Polkadot suggests a community that’s in it for the tech and confident about Polkadot’s future, even as they acknowledge the challenges ahead.

Conclusion

Polkadot (DOT) presents a fun mix of technical brilliance and a grand vision for a web of interoperable blockchains. From its parachain architecture enabling scalability and specialization, to an ecosystem rich with developers, partnerships, and community governance, Polkadot has positioned itself as a long-term player in the crypto space. While DOT’s price has seen extreme highs and lows, the coming years (2025–2028) could see Polkadot reassert itself – potentially climbing back toward previous highs if its fundamentals translate into real-world adoption. As with any crypto venture, there are no guarantees, but one thing is certain: Polkadot’s journey will be exciting to watch. By connecting the dots of the blockchain world, Polkadot aims to turn the fragmented crypto landscape into a unified, interoperable tapestry – and that ambitious goal is exactly why so many in the community continue to bet on DOT’s bright future.

Share

Content