PLA vs DYDX: Battle of the Decentralized Trading Platforms

Introduction: PLA vs DYDX Investment Comparison

In the cryptocurrency market, the comparison between PlayDapp (PLA) and dYdX (DYDX) has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positions in the crypto asset landscape.

PlayDapp (PLA): Since its launch in 2020, it has gained market recognition for its blockchain gaming platform that allows users to access digital assets and use interoperable NFTs across games.

dYdX (DYDX): Introduced in 2021, it has been hailed as a decentralized derivatives trading protocol, becoming one of the leading platforms for decentralized perpetual contract trading.

This article will comprehensively analyze the investment value comparison between PLA and DYDX, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

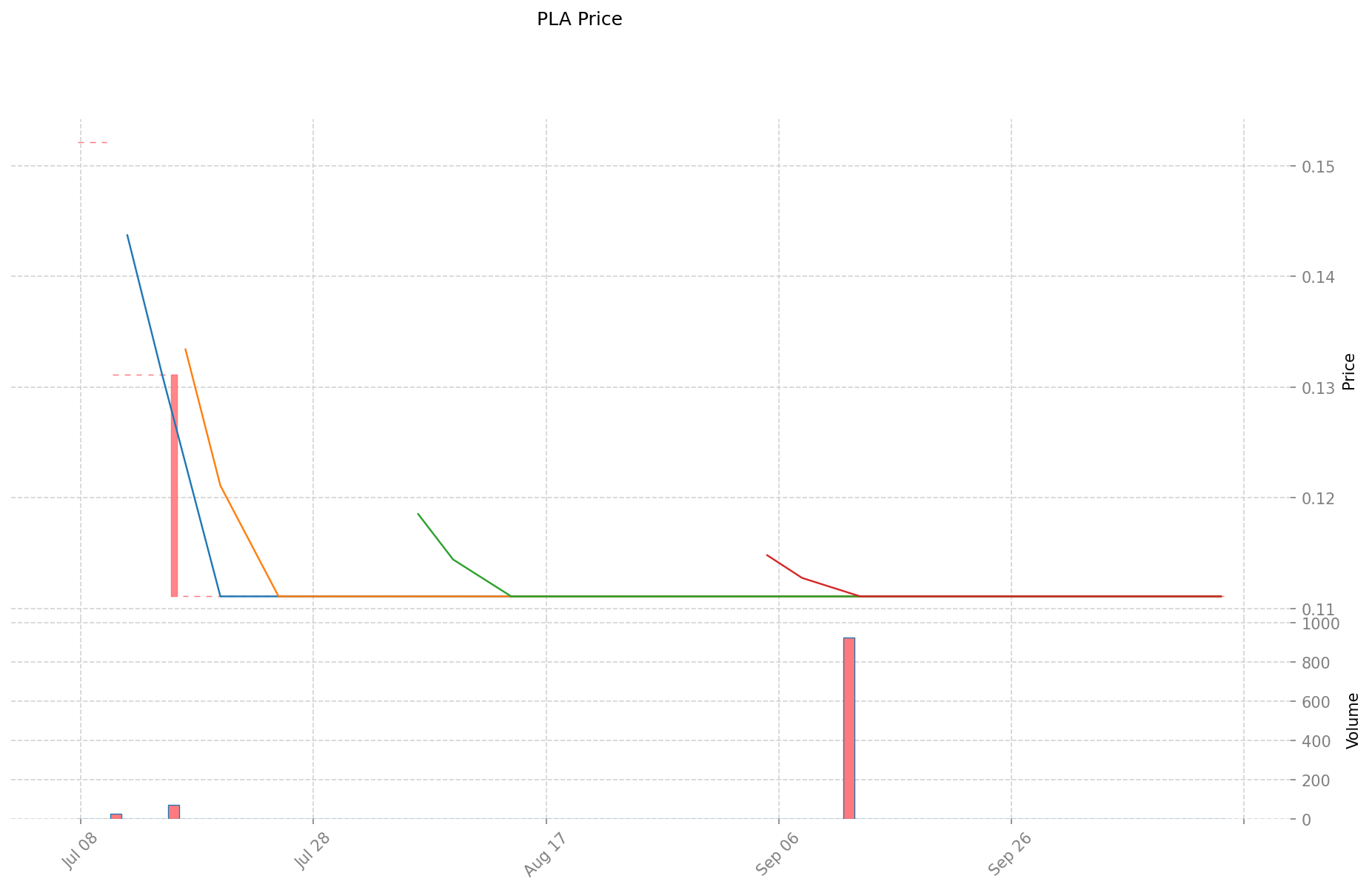

I. Price History Comparison and Current Market Status

PlayDapp (PLA) and dYdX (DYDX) Historical Price Trends

- 2021: PLA reached its all-time high of $3.74 in October 2021.

- 2024: DYDX recorded its historical peak price of $4.52 in March 2024.

- Comparative Analysis: Since their respective peaks, PLA has dropped to $0.00368, while DYDX has declined to $0.3716, representing significant decreases for both tokens in the current market cycle.

Current Market Situation (2025-10-15)

- PLA current price: $0.00368303

- DYDX current price: $0.3716

- 24-hour trading volume: PLA data not available vs DYDX $3,863,780

- Market Sentiment Index (Fear & Greed Index): 34 (Fear)

Click to view real-time prices:

- View PLA current price Market Price

- View DYDX current price Market Price

II. Core Factors Affecting Investment Value of PLA vs DYDX

Supply Mechanism Comparison (Tokenomics)

- DYDX: High inflation and unreasonable token distribution that puts significant pressure on its value

Institutional Adoption and Market Applications

- Enterprise Adoption: DYDX represents a popular decentralized exchange (DEX) with benefits from its decentralized derivatives trading platform

Technical Development and Ecosystem Building

- DYDX Technical Development: As a decentralized exchange platform, DYDX has potential for further blockchain-based trading platform developments

- Ecosystem Comparison: DEXs like DYDX are core to the DeFi ecosystem, with strong market demand and high liquidity

Macroeconomic and Market Cycles

- Inflationary Environment Performance: DYDX faces challenges due to high inflation that negatively impacts its token value

- Macroeconomic Monetary Policy: Early token airdrops to active traders created a surge in trading volume for DYDX, but activity declined once incentives were reduced, causing the token to lose approximately 70% of its value III. 2025-2030 Price Prediction: PLA vs DYDX

Short-term Prediction (2025)

- PLA: Conservative $0.096657 - $0.1111 | Optimistic $0.1111 - $0.126654

- DYDX: Conservative $0.2442 - $0.37 | Optimistic $0.37 - $0.3959

Mid-term Prediction (2027)

- PLA may enter a growth phase, with expected prices $0.1149778344 - $0.135995288

- DYDX may enter a bullish market, with expected prices $0.254853225 - $0.597746655

- Key drivers: Institutional capital inflow, ETFs, ecosystem development

Long-term Prediction (2030)

- PLA: Base scenario $0.1605989991606 - $0.223232608833234 | Optimistic scenario $0.223232608833234+

- DYDX: Base scenario $0.760820283135 - $1.13362222187115 | Optimistic scenario $1.13362222187115+

Disclaimer

PLA:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.126654 | 0.1111 | 0.096657 | 2916 |

| 2026 | 0.12838716 | 0.118877 | 0.11055561 | 3127 |

| 2027 | 0.135995288 | 0.12363208 | 0.1149778344 | 3256 |

| 2028 | 0.16486337868 | 0.129813684 | 0.07918634724 | 3424 |

| 2029 | 0.1738594669812 | 0.14733853134 | 0.0869297334906 | 3900 |

| 2030 | 0.223232608833234 | 0.1605989991606 | 0.125267219345268 | 4260 |

DYDX:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.3959 | 0.37 | 0.2442 | 0 |

| 2026 | 0.543789 | 0.38295 | 0.291042 | 3 |

| 2027 | 0.597746655 | 0.4633695 | 0.254853225 | 24 |

| 2028 | 0.7427813085 | 0.5305580775 | 0.4668911082 | 42 |

| 2029 | 0.88497087327 | 0.636669693 | 0.54753593598 | 71 |

| 2030 | 1.13362222187115 | 0.760820283135 | 0.608656226508 | 104 |

IV. Investment Strategy Comparison: PLA vs DYDX

Long-term vs Short-term Investment Strategies

- PLA: Suitable for investors interested in blockchain gaming and NFT ecosystems

- DYDX: Suitable for investors focused on decentralized finance (DeFi) and derivatives trading platforms

Risk Management and Asset Allocation

- Conservative investors: PLA: 20% vs DYDX: 80%

- Aggressive investors: PLA: 40% vs DYDX: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency combinations

V. Potential Risk Comparison

Market Risks

- PLA: Volatility in the gaming and NFT markets

- DYDX: Susceptibility to DeFi market trends and competition from other decentralized exchanges

Technical Risks

- PLA: Scalability, network stability

- DYDX: Smart contract vulnerabilities, liquidity risks

Regulatory Risks

- Global regulatory policies may impact both tokens differently, with potential stricter oversight on DeFi platforms like DYDX

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- PLA advantages: Potential growth in blockchain gaming sector, NFT interoperability

- DYDX advantages: Established position in decentralized derivatives trading, potential for DeFi ecosystem expansion

✅ Investment Advice:

- Novice investors: Consider a balanced approach with a slight preference for DYDX due to its more established market position

- Experienced investors: Explore opportunities in both tokens, with a higher allocation to DYDX for its DeFi potential

- Institutional investors: Focus on DYDX for its liquidity and potential institutional adoption in the DeFi space

⚠️ Risk Warning: The cryptocurrency market is highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the main differences between PlayDapp (PLA) and dYdX (DYDX)? A: PlayDapp (PLA) is focused on blockchain gaming and NFT interoperability, while dYdX (DYDX) is a decentralized derivatives trading platform. PLA targets the gaming sector, while DYDX is positioned in the DeFi space.

Q2: Which token has performed better historically? A: Both tokens have seen significant declines from their all-time highs. PLA reached $3.74 in October 2021 and has dropped to $0.00368, while DYDX peaked at $4.52 in March 2024 and has fallen to $0.3716 as of October 15, 2025.

Q3: What are the key factors affecting the investment value of PLA and DYDX? A: Key factors include supply mechanisms, institutional adoption, technical development, ecosystem building, and macroeconomic conditions. DYDX faces challenges with high inflation but benefits from its position in the DeFi ecosystem.

Q4: What are the price predictions for PLA and DYDX in 2030? A: For PLA, the base scenario predicts $0.1605989991606 - $0.223232608833234, with an optimistic scenario above $0.223232608833234. For DYDX, the base scenario predicts $0.760820283135 - $1.13362222187115, with an optimistic scenario above $1.13362222187115.

Q5: How should investors allocate their assets between PLA and DYDX? A: Conservative investors might consider 20% PLA and 80% DYDX, while aggressive investors might opt for 40% PLA and 60% DYDX. The specific allocation should be based on individual risk tolerance and investment goals.

Q6: What are the main risks associated with investing in PLA and DYDX? A: Risks include market volatility, technical issues (such as scalability for PLA and smart contract vulnerabilities for DYDX), and regulatory challenges, particularly for DeFi platforms like DYDX.

Q7: Which token is considered the better buy? A: The better buy depends on the investor's profile. DYDX may be preferable for its established position in decentralized derivatives trading and DeFi potential, while PLA offers exposure to the blockchain gaming sector. Novice investors might lean towards DYDX, while experienced investors could consider a balanced approach.