MF ve IMX: Uzun Vadeli Büyümede Yatırım Stratejilerinin Karşılaştırılması

Giriş: MF ve IMX Yatırım Karşılaştırması

Kripto para piyasasında Moonwalk Fitness (MF) ile Immutable (IMX) arasındaki karşılaştırma, yatırımcılar açısından ilgi odağı olmayı sürdürüyor. Her iki varlık, piyasa değeri sıralaması, kullanım alanları ve fiyat performansı bakımından önemli farklılıklar gösterirken, kripto varlık ekosisteminde de özgün pozisyonlar üstlenmektedir.

Moonwalk Fitness (MF): Piyasaya çıktığı günden bu yana, fitness yolculuklarını oyunlaştırma ve adım hedeflerini sosyal rekabete dönüştürme yaklaşımıyla dikkat çekerek piyasa tarafından kabul görmüştür.

Immutable (IMX): Ethereum üzerinde NFT’ler için Katman 2 (L2) ölçeklenebilirlik çözümü olarak konumlanan IMX, anında işlem, yüksek ölçeklenebilirlik ve mint ile alım-satımda sıfır gas ücreti sunmaktadır.

Bu makalede, MF ve IMX’in yatırım değerleri; geçmiş fiyat hareketleri, arz mekanizmaları, kurumsal benimseme, teknolojik ekosistemler ve gelecek öngörüleri çerçevesinde kapsamlı biçimde analiz edilerek, yatırımcıların en kritik sorusuna yanıt aranacaktır:

"Şu anda hangisi daha avantajlı bir alım fırsatı sunuyor?"

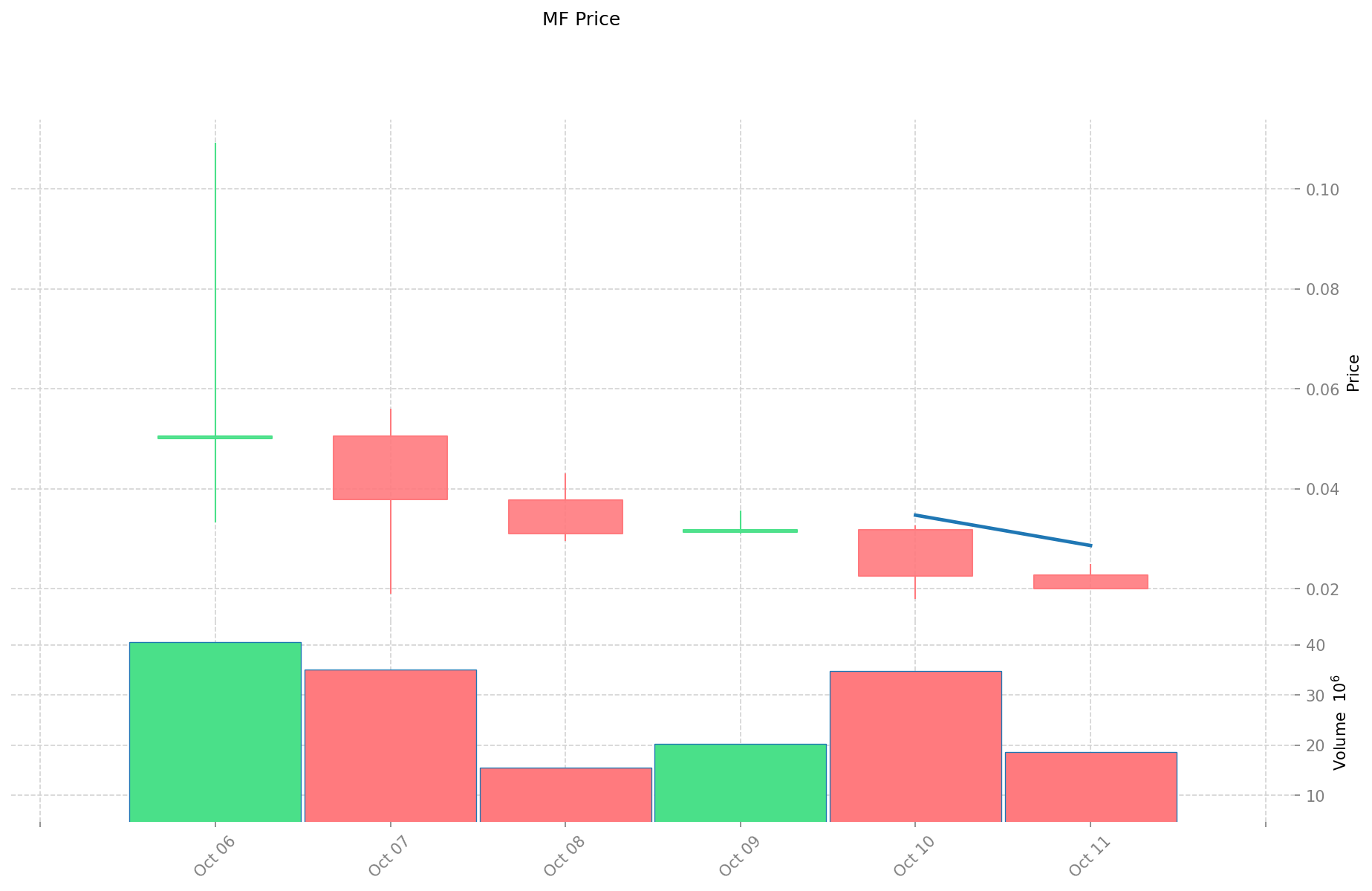

I. Fiyat Geçmişi Karşılaştırması ve Güncel Piyasa Durumu

Moonwalk Fitness (MF) ve Immutable (IMX) Tarihsel Fiyat Eğilimleri

- 2025: MF piyasaya sürüldü ve yeni olması nedeniyle ciddi fiyat oynaklığı yaşadı.

- 2021: IMX, artan benimseme ve piyasa iyimserliğiyle 26 Kasım’da $9,52 ile tüm zamanların en yüksek seviyesine ulaştı.

- Kıyaslama: Son piyasa döngüsünde MF, zirvesi olan $0,10922’den $0,01801’e kadar gerilerken; IMX ise zirveden $0,4783 seviyelerine indi.

Güncel Piyasa Durumu (12 Ekim 2025)

- MF güncel fiyat: $0,02003

- IMX güncel fiyat: $0,4783

- 24 saatlik işlem hacmi: MF $406.877,22 - IMX $1.250.850,57

- Piyasa Duyarlılık Endeksi (Korku & Açgözlülük Endeksi): 24 (Aşırı Korku)

Anlık fiyatları görüntülemek için tıklayın:

- MF güncel fiyatı: Piyasa Fiyatı

- IMX güncel fiyatı: Piyasa Fiyatı

II. MF ve IMX Yatırım Değerini Etkileyen Temel Faktörler

Teknik Gelişim ve Ekosistem Kurulumu

- IMX teknik avantajları: StarkWare iş birliğiyle geliştirilen Cairo teknolojisini kullanması sayesinde ileri seviye Turing-tamamlama işlemleri gerçekleştirebilir

- IMX ekosistem özelliği: Yoğunlaştırılmış likidite ile oyun varlıklarının IMX’in desteklediği tüm borsalarda anında işlem görebilmesi

- Ekosistem karşılaştırması: IMX, özellikle oyun varlıkları ve NFT segmentinde güçlü bir pozisyonda yer alıyor

Piyasa Benimsenmesi ve Uygulama Alanları

- Kurumsal benimseme: IMX, oyun varlığı altyapısı ve NFT pazar entegrasyonunda öne çıkıyor

- Piyasa katılımı: NFT sektörü, kurumsal yatırımcılar, yüksek sermayeli bireyler ve büyük fonlardan artan ilgi görüyor

- Proje aktivitesi: NFT ekosisteminde proje sayısı ve piyasa katılımı düzenli olarak yükseliyor

Arz Mekanizmaları (Tokenomik)

- IMX, oyun varlıklarında likidite yönetimini, desteklenen borsalarda yoğunlaştırılmış likidite yaklaşımıyla ön plana çıkarıyor

Makroekonomik ve Piyasa Döngüleri

- Piyasa trendleri: NFT projeleri, token fiyat artışlarıyla dikkat çekiyor

- Piyasa gelişimi: NFT sektörü, yeni bir yatırım kategorisi olarak giderek daha çok ilgi çekiyor

III. 2025-2030 Fiyat Tahmini: MF ve IMX

Kısa Vadeli Tahmin (2025)

- MF: Temkinli $0,0194873 - $0,02009 | İyimser $0,02009 - $0,0210945

- IMX: Temkinli $0,250432 - $0,4816 | İyimser $0,4816 - $0,573104

Orta Vadeli Tahmin (2027)

- MF, büyüme evresine geçebilir ve fiyatının $0,016339950375 ile $0,031495846375 arasında olması bekleniyor

- IMX, istikrarlı büyüme evresine geçerek $0,4353554436 ile $0,7108968636 arasında fiyatlanabilir

- Kilit etkenler: Kurumların piyasaya girişi, ETF’ler, ekosistem gelişimi

Uzun Vadeli Tahmin (2030)

- MF: Temel senaryo $0,034523517813914 - $0,043154397267392 | İyimser senaryo $0,043154397267392 üzeri

- IMX: Temel senaryo $0,79163986806828 - $1,044964625850129 | İyimser senaryo $1,044964625850129 üzeri

Uyarı: Yukarıdaki tahminler, tarihsel veriler ve piyasa analizlerine dayanmaktadır. Kripto para piyasası yüksek volatiliteye sahiptir ve öngörülmesi zordur. Bu bilgiler yatırım tavsiyesi niteliği taşımaz. Lütfen yatırım kararı öncesinde kendi araştırmanızı yapınız.

MF:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.0210945 | 0.02009 | 0.0194873 | 0 |

| 2026 | 0.026769925 | 0.02059225 | 0.0146204975 | 2 |

| 2027 | 0.031495846375 | 0.0236810875 | 0.016339950375 | 17 |

| 2028 | 0.037244430365625 | 0.0275884669375 | 0.01600131082375 | 37 |

| 2029 | 0.036630586976265 | 0.032416448651562 | 0.024636500975187 | 61 |

| 2030 | 0.043154397267392 | 0.034523517813914 | 0.025892638360435 | 71 |

IMX:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 0.573104 | 0.4816 | 0.250432 | 0 |

| 2026 | 0.57481368 | 0.527352 | 0.4218816 | 10 |

| 2027 | 0.7108968636 | 0.55108284 | 0.4353554436 | 15 |

| 2028 | 0.921245183628 | 0.6309898518 | 0.530031475512 | 31 |

| 2029 | 0.80716221842256 | 0.776117517714 | 0.52775991204552 | 62 |

| 2030 | 1.044964625850129 | 0.79163986806828 | 0.704559482580769 | 65 |

IV. MF ve IMX Yatırım Stratejilerinin Karşılaştırılması

Uzun Vadeli – Kısa Vadeli Yatırım Stratejileri

- MF: Fitness tabanlı uygulamalar ve sosyal oyunlaştırma potansiyeline ilgi duyan yatırımcılar için uygundur

- IMX: NFT altyapısı ve oyun varlığı ekosistemine odaklanan yatırımcılar için daha uygundur

Risk Yönetimi ve Portföy Dağılımı

- Temkinli yatırımcılar: MF %20, IMX %80

- Agresif yatırımcılar: MF %40, IMX %60

- Hedging araçları: Stablecoin tahsisi, opsiyonlar, döviz sepetleri

V. Potansiyel Risk Karşılaştırması

Piyasa Riski

- MF: Yenilikçi olması ve fitness uygulama sektöründeki rekabet nedeniyle yüksek oynaklık

- IMX: NFT ve oyun piyasalarındaki genel dalgalanmalara karşı hassasiyet

Teknik Risk

- MF: Ölçeklenebilirlik ve ağ istikrarı sorunları

- IMX: Katman 2 teknolojisine bağımlılık ve potansiyel güvenlik açıkları

Regülasyon Riski

- Küresel regülasyon politikaları, fitness temalı tokenlar ile NFT altyapı tokenları üzerinde farklı etkiler oluşturabilir

VI. Sonuç: Hangisi Daha İyi Bir Alım?

📌 Yatırım Değeri Özeti:

- MF avantajları: Fitness oyunlaştırmasında özgün pozisyon, kullanıcı tabanında büyüme potansiyeli

- IMX avantajları: NFT altyapısında güçlü varlık, oyun varlığı likiditesi

✅ Yatırım Tavsiyesi:

- Yeni yatırımcılar: Çeşitlendirilmiş portföy kapsamında IMX’e küçük miktarda yatırım yapılabilir

- Deneyimli yatırımcılar: Hem MF hem IMX değerlendirilmeli, IMX’e daha fazla ağırlık verilebilir

- Kurumsal yatırımcılar: Kurulu ekosistemi ve NFT pazarındaki büyüme potansiyeli nedeniyle IMX’e odaklanabilirler

⚠️ Risk Uyarısı: Kripto para piyasası yüksek derecede oynaktır. Bu makale yatırım tavsiyesi değildir. None

VII. Sıkça Sorulan Sorular (SSS)

S1: MF ile IMX arasındaki temel farklar nedir? C: MF, fitness yolculuğunu oyunlaştırmaya odaklanırken; IMX, Ethereum üzerinde NFT’ler için Katman 2 ölçeklendirme çözümüdür. MF daha yeni olup fitness uygulama pazarını hedeflerken; IMX, NFT ve oyun varlığı altyapısında daha köklüdür.

S2: Geçmişte hangi token daha iyi performans gösterdi? C: IMX, Kasım 2021’de $9,52 ile zirveye ulaşarak daha güçlü bir geçmiş performans sergiledi. MF ise yeni bir token olduğu için piyasaya çıktığı günden bu yana yüksek oynaklık yaşadı.

S3: MF ve IMX’in güncel fiyatları nedir? C: 12 Ekim 2025 itibarıyla MF’in güncel fiyatı $0,02003, IMX’in güncel fiyatı ise $0,4783’tür.

S4: Bu tokenların yatırım değerini etkileyen ana faktörler nedir? C: Teknik gelişim, ekosistem oluşturma, piyasa benimsenmesi, arz mekanizmaları ve makroekonomik eğilimler ön plandadır. IMX, NFT altyapısı ve oyun varlığı likiditesinde avantaj sağlamaktadır.

S5: MF ve IMX için uzun vadeli fiyat tahmini nedir? C: 2030 için baz senaryoda MF $0,034523517813914 - $0,043154397267392; IMX ise $0,79163986806828 - $1,044964625850129 aralığında öngörülmektedir. Ancak bu tahminler piyasa dalgalanmalarına tabidir ve yatırım tavsiyesi değildir.

S6: Yatırımcılar MF ile IMX arasında varlık dağılımını nasıl yapmalı? C: Temkinli yatırımcılar MF’e %20, IMX’e %80; agresif yatırımcılar ise MF’e %40, IMX’e %60 oranında portföy ayırabilir. Dağılım, yatırımcının risk iştahına ve piyasa koşullarına göre şekillenmelidir.

S7: MF ve IMX yatırımlarında karşılaşılabilecek potansiyel riskler nelerdir? C: Piyasa oynaklığı, teknik zorluklar (ölçeklenebilirlik ve güvenlik gibi) ve regülasyon belirsizlikleri temel risklerdir. MF, yeni olması nedeniyle ek riskler taşırken; IMX, NFT ve oyun piyasasının genel dalgalanmalarından etkilenebilir.

S8: Hangi token daha iyi bir yatırım olarak öne çıkıyor? C: En iyi yatırım tercihi, bireysel hedeflere ve risk iştahına bağlıdır. IMX, köklü ekosistemiyle yeni yatırımcılar için daha güvenli bir seçenek olabilirken; deneyimli yatırımcılar her iki varlığı da değerlendirebilir. Ancak, yatırım öncesinde detaylı araştırma yapılmalı ve profesyonel finansal danışmanlıktan yararlanılmalıdır.

PROM ve IMX: Modern dijital kameralarda öne çıkan iki görüntü sensörü teknolojisinin karşılaştırılması

MLP ve IMX: Modern makine öğrenimi mimarilerinde performans ve verimliliğin karşılaştırılması

STIK vs IMX: Sürükleyici Ekran Teknolojisinde Liderlik Yarışı

GMMT ve IMX: İleri Üretim Teknolojilerinin Karşılaştırmalı Analizi

Adventure Gold (AGLD) İyi Bir Yatırım mı?: NFT Ekosisteminde Bu Oyun Token’ının Uzun Vadeli Potansiyeli Nasıl Değerlendirilmeli?

ALICE (ALICE) iyi bir yatırım mı?: Bu oyun token’ının günümüz kripto piyasasındaki potansiyeli ve risklerinin analizi

Kripto varlıklarınızı güvence altına almak için özel anahtarları anlamak: Güvenlik önerileri

Ethereum ölçeklenebilirliğini geliştirmek amacıyla Layer 2 çözümlerini keşfetmek

Blockchain Node İşlevselliğini Anlamak: Yeni Başlayanlar İçin Rehber

Taproot teknolojisini destekleyen en güvenli Bitcoin cüzdanları

Ethereum İşlem Maliyetlerinin Yapısını Kavramak ve Bunları Azaltma Yöntemleri