LIORA vs ETH: Yapay Zeka Entegrasyonu Döneminde Blockchain Alanında Üstünlük Yarışı

Giriş: LIORA ve ETH Yatırımı Karşılaştırması

Kripto para piyasasında LIORA ile ETH karşılaştırması, yatırımcıların göz ardı edemeyeceği bir gündemdir. Piyasa değeri sıralaması, kullanım alanları ve fiyat performansı açısından iki varlık ciddi biçimde farklılaşır; böylece kripto varlık ekosisteminde ayrı konumlar oluştururlar.

LIORA (LIORA): Kısa süre önce piyasaya sürülen LIORA, Web3 alanında içerik üreticilerini desteklemeye odaklanarak piyasa tarafından hızla tanındı.

Ethereum (ETH): 2015’te hayata geçtiğinden bu yana “dünyanın bilgisayarı” olarak nitelendirilen Ethereum, küresel ölçekte en yüksek piyasa değerine ve en yüksek işlem hacmine sahip kripto paralardan biri oldu.

Bu makale, LIORA ile ETH’nin yatırım değerini tarihsel fiyat eğilimleri, arz mekanizmaları, kurumsal benimseme, teknolojik ekosistemler ve gelecek öngörüleri üzerinden kapsamlı biçimde analiz edecek; yatırımcıların en çok merak ettiği şu soruya odaklanacaktır:

"Şu anda hangisi daha iyi bir yatırım fırsatı?"

I. Fiyat Geçmişi ve Güncel Piyasa Durumu Karşılaştırması

LIORA ve ETH Tarihsel Fiyat Eğilimleri

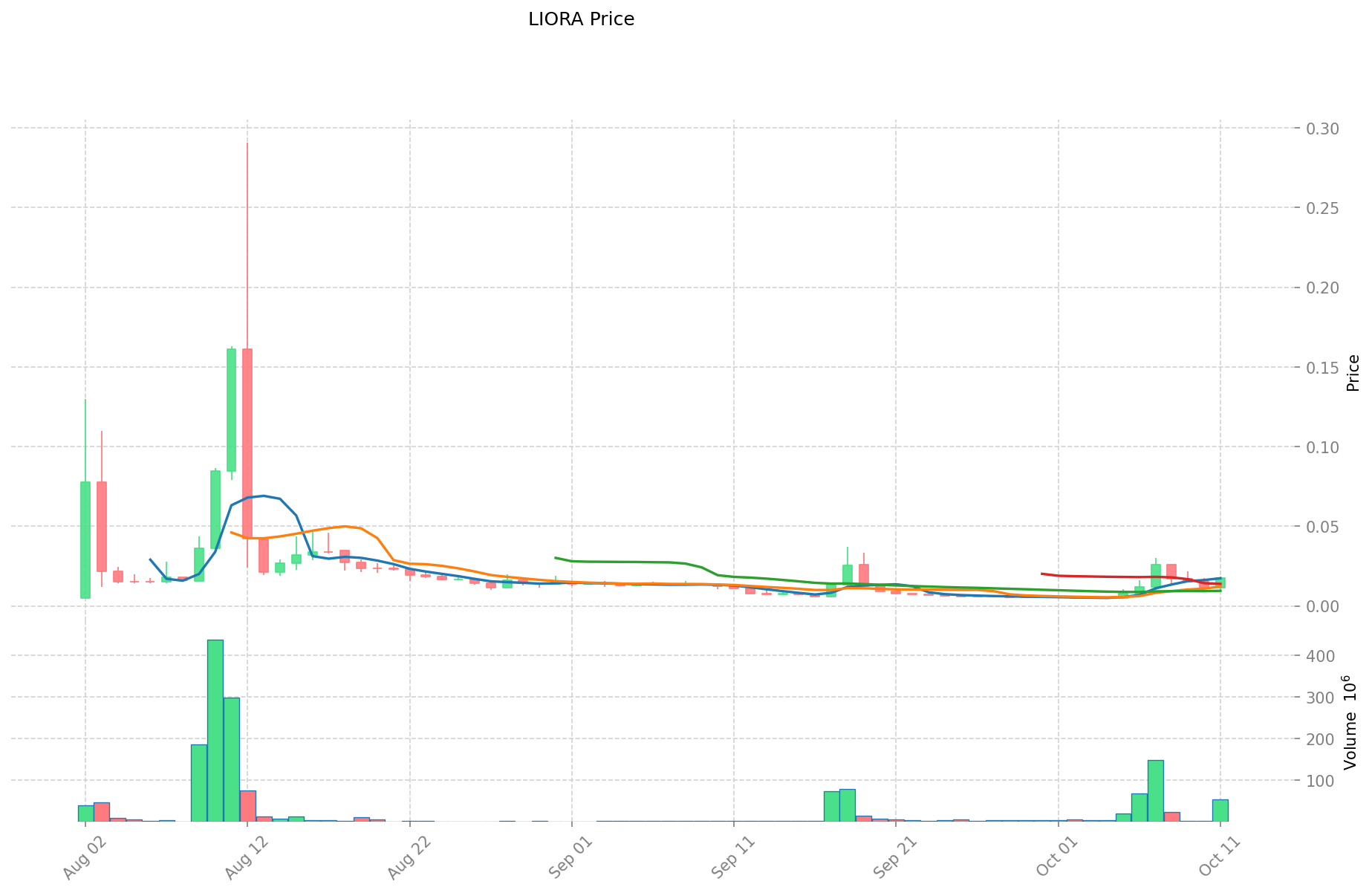

- 2025: LIORA, büyük fiyat dalgalanmaları yaşadı ve 12 Ağustos 2025’te $0,29083’lük tüm zamanların en yükseğine ulaştı.

- 2025: ETH, 25 Ağustos 2025’te $4.946,05 ile yeni bir zirve yaptı; bu durumun genel kripto piyasa hareketlerinden kaynaklandığı tahmin ediliyor.

- Karşılaştırmalı analiz: Son piyasa döngüsünde LIORA, zirve olan $0,29083’ten $0,004725 seviyesine kadar düştü. ETH ise daha istikrarlı kaldı ve $3.000 üzerindeki fiyatını korudu.

Güncel Piyasa Durumu (12 Ekim 2025)

- LIORA güncel fiyatı: $0,0173

- ETH güncel fiyatı: $3.733,65

- 24 saatlik işlem hacmi: LIORA $976.349, ETH $2.034.649.836

- Piyasa Duyarlılık Endeksi (Korku & Açgözlülük Endeksi): 27 (Korku)

Gerçek zamanlı fiyatları görüntülemek için tıklayın:

- LIORA güncel fiyatı için Piyasa Fiyatı

- ETH güncel fiyatı için Piyasa Fiyatı

II. LIORA ve ETH Yatırım Değerini Etkileyen Temel Unsurlar

Arz Mekanizmaları Karşılaştırması (Tokenomics)

- LIORA: İçerik üreticisi ekonomisine odaklanan merkeziyetsiz Web3 platformu; değerin tamamı üreticilere dağıtılır

- ETH: EIP-1559 ile işlem ücretlerinin yakılması sonucu deflasyonist bir model izlenir

- 📌 Tarihsel Seyir: LIORA’da saatlik %1,8 artış, günlük %4,0 artış ve haftalık %20,2 düşüş ile son dönemde yüksek oynaklık gözlendi

Kurumsal Benimseme ve Piyasa Uygulamaları

- Kurumsal Yatırım: LIORA, yapay zekâ tabanlı saha iyileştirme teknolojisi için yakın zamanda $5,1 milyon yatırım aldı

- Kurumsal Kullanım: LIORA, Web2’de yaygın olan %80’lik platform komisyonunu ortadan kaldırarak üretici ekonomisine odaklanır

- Düzenleyici Durum: LIORA, saha yönetimi ve iyileştirme alanında teknoloji lideri olarak konumlanıyor

Teknoloji Gelişimi ve Ekosistem Oluşturma

- LIORA Teknoloji Güncellemesi: Gerçek zamanlı sensör ağları, öngörücü analizler ve yapay zekâ tabanlı içgörülerin entegrasyonu

- ETH Teknoloji Gelişimi: Yaygın şekilde benimsenmiş akıllı sözleşme platformu

- Ekosistem Karşılaştırması: LIORA, üretici token’ları, NFT entegrasyonu ve merkeziyetsiz yönetişim ile sansür karşıtı bir içerik ekosistemi kuruyor

Makroekonomik Faktörler ve Piyasa Döngüleri

- Enflasyonist Dönemlerde Performans: LIORA’nın günlük işlem hacmi ETH2,7505 ile dengeli piyasa aktivitesi gösteriyor

- Makroekonomik Para Politikası: Son fiyat hareketleri, LIORA’nın ETH0,053299 seviyesinde olduğunu ve ETH ile fiyat korelasyonu olduğunu gösteriyor

- Jeopolitik Etkenler: LIORA’nın kirli saha kapatma teknolojisi, çevresel iyileştirme uygulamalarına işaret ediyor

III. 2025-2030 Fiyat Öngörüsü: LIORA ve ETH

Kısa Vadeli Tahmin (2025)

- LIORA: Muhafazakâr $0,01659767 - $0,017111 | İyimser $0,017111 - $0,01984876

- ETH: Muhafazakâr $3.535,805 - $3.721,9 | İyimser $3.721,9 - $5.136,222

Orta Vadeli Tahmin (2027)

- LIORA büyüme dönemine girebilir, beklenen fiyat aralığı $0,0191266758 - $0,02390834475

- ETH boğa piyasasına girebilir, beklenen fiyat aralığı $4.849,821795 - $7.177,7362566

- Temel etkenler: Kurumsal sermaye girişi, ETF’ler, ekosistem büyümesi

Uzun Vadeli Tahmin (2030)

- LIORA: Temel senaryo $0,02405657648745 - $0,024981829429275 | İyimser senaryo $0,024981829429275 - $0,026702799901069

- ETH: Temel senaryo $8.054,25424925394 - $8.456,966961716637 | İyimser senaryo $8.456,966961716637 - $9.282,86930422488

Feragatname

LIORA:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 0,01984876 | 0,017111 | 0,01659767 | -1 |

| 2026 | 0,0197734716 | 0,01847988 | 0,0096095376 | 6 |

| 2027 | 0,02390834475 | 0,0191266758 | 0,01051967169 | 10 |

| 2028 | 0,02474513681625 | 0,021517510275 | 0,0176443584255 | 24 |

| 2029 | 0,024981829429275 | 0,023131323545625 | 0,017579805894675 | 33 |

| 2030 | 0,026702799901069 | 0,02405657648745 | 0,016358472011466 | 39 |

ETH:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Fiyat Değişimi (%) |

|---|---|---|---|---|

| 2025 | 5.136,222 | 3.721,9 | 3.535,805 | 0 |

| 2026 | 5.270,58259 | 4.429,061 | 3.321,79575 | 18 |

| 2027 | 7.177,7362566 | 4.849,821795 | 3.249,38060265 | 30 |

| 2028 | 7.637,499362766 | 6.013,7790258 | 3.307,57846419 | 61 |

| 2029 | 9.282,86930422488 | 6.825,639194283 | 5.050,97300376942 | 83 |

| 2030 | 8.456,966961716637 | 8.054,25424925394 | 4.913,0950920449034 | 116 |

IV. Yatırım Stratejisi Karşılaştırması: LIORA ve ETH

Uzun Vadeli ve Kısa Vadeli Yatırım Stratejileri

- LIORA: Web3 potansiyeline ve üretici ekonomisine odaklanan yatırımcılar için uygun

- ETH: İstikrar ve oturmuş ekosistem arayan yatırımcılar için uygun

Risk Yönetimi ve Varlık Dağılımı

- Temkinli yatırımcılar için: LIORA %10, ETH %90

- Daha agresif yatırımcılar için: LIORA %30, ETH %70

- Koruma araçları: Stablecoin tahsisi, opsiyonlar, çapraz para portföyleri

V. Potansiyel Risk Karşılaştırması

Piyasa Riskleri

- LIORA: Yüksek oynaklık, kısa işlem geçmişi

- ETH: Piyasa döngüleri, kripto genel trendleriyle korelasyon

Teknik Riskler

- LIORA: Ölçeklenebilirlik, ağ istikrarı

- ETH: Ağ tıkanıklığı, yüksek işlem ücretleri

Düzenleyici Riskler

- Küresel düzenleyici politikalar iki varlığı farklı etkileyebilir; ETH daha büyük piyasa varlığı nedeniyle daha fazla inceleme görebilir

VI. Sonuç: Hangisi Daha İyi Alım?

📌 Yatırım Değeri Özeti:

- LIORA avantajları: Üretici ekonomisine odaklanma, yapay zekâ tabanlı teknoloji, büyüme potansiyeli

- ETH avantajları: Oturmuş ekosistem, kurumsal benimseme, deflasyonist model

✅ Yatırım Tavsiyesi:

- Yeni yatırımcılar: Çeşitlendirilmiş portföyde LIORA’ya küçük bir pay ayırmayı değerlendirin

- Tecrübeli yatırımcılar: Risk toleransına göre LIORA ve ETH arasında denge kurun

- Kurumsal yatırımcılar: İstikrar için ETH, yüksek büyüme için LIORA

⚠️ Risk Uyarısı: Kripto para piyasaları yüksek oynaklığa sahiptir. Bu makale yatırım tavsiyesi değildir. None

VII. SSS

S1: LIORA ile ETH arasındaki temel farklar nelerdir? C: LIORA, Web3 alanında içerik üreticilerini destekleyen yeni bir kripto para iken ETH, “dünyanın bilgisayarı” olarak bilinen ve büyük piyasa değeri ile köklü bir platformdur. LIORA, üreticiler için platform ücretlerini ortadan kaldırmayı hedefler; ETH ise deflasyonist modeli ve akıllı sözleşmelerin yaygın kullanımı ile öne çıkar.

S2: Son dönemde hangi kripto para daha iyi fiyat performansı gösterdi? C: ETH son dönemde daha istikrarlı olup $3.000 üzerinde fiyatını korurken, LIORA zirve değeri olan $0,29083’ten $0,004725 seviyesine kadar sert dalgalandı.

S3: LIORA ve ETH’nin arz mekanizmaları nasıl farklılık gösteriyor? C: LIORA, merkeziyetsiz Web3 platformunda değerin tamamını üreticilere dağıtır. ETH ise EIP-1559 ile işlem ücretlerinin yakılması sonucu deflasyonist bir model izler.

S4: LIORA ve ETH’nin yatırım değerini etkileyen ana faktörler nelerdir? C: Arz mekanizmaları, kurumsal benimseme, teknoloji gelişimi, ekosistem oluşturma ve enflasyon ile para politikası gibi makroekonomik faktörler etkili olur.

S5: LIORA ve ETH için uzun vadeli fiyat öngörüleri nasıl karşılaştırılıyor? C: 2030 için LIORA’nın temel senaryo fiyat aralığı $0,02405657648745 - $0,024981829429275; ETH’nin ise $8.054,25424925394 - $8.456,966961716637 olup, ETH’de daha yüksek büyüme potansiyeli öngörülmektedir.

S6: LIORA ve ETH’ye yatırım yaparken karşılaşılabilecek ana riskler nelerdir? C: LIORA’da yüksek oynaklık ve kısa işlem geçmişi, ETH’de ise piyasa döngüleri ve ağ tıkanıklığı riskleri söz konusu. Her iki kripto para da düzenleyici risklere açıktır; ETH daha büyük piyasa varlığı nedeniyle daha fazla inceleme görebilir.

S7: Yatırımcılar portföy dağılımını LIORA ve ETH arasında nasıl yapmalı? C: Temkinli yatırımcılar %10 LIORA ve %90 ETH dağılımını, agresif yatırımcılar ise %30 LIORA ve %70 ETH dağılımını tercih edebilir. Dağılım, bireysel risk toleransı ve yatırım hedeflerine göre belirlenmelidir.

1inch Network White Paper: 2025'te Kritik DeFi Zorluklarını Ele Alma

2025 LPT Fiyat Tahmini: Livepeer Token’ın Piyasa Trendleri ve Büyüme Potansiyeli Analizi

FET Nedir: Alan-Etkili Transistörler ve Modern Elektronikteki Uygulamaları

AITECH nedir: Yapay zekâ uygulamalarında devrim yaratan en son teknolojiyi keşfetmek

Mira Ağı Fiyat Tahmini ve Pazar İçgörüleri

$COAI BNB Zinciri'nde: Blok Zinciri Aracılığıyla Yapay Zeka İnovasyonunu Güçlendirmek

İşlem hızının blockchain verimliliğini nasıl etkilediğini anlamak

ENS Domainleri ile Web3 Kimlik Yönetimi

DeFi'de Flash Loan'ları Anlamak: Başlangıç Seviyesi Bir Rehber

GameFi'ye Giriş: Blockchain Oyunları için Yeni Başlayanlar Kılavuzu

Web3 entegrasyonunda ENS Wallet kullanımına yönelik rehber