Is sUSD (SUSD) a Good Investment?: Analyzing the Stability and Potential of This Synthetic USD Stablecoin in Today's Crypto Market

Introduction: Investment Status and Market Prospects of sUSD (SUSD)

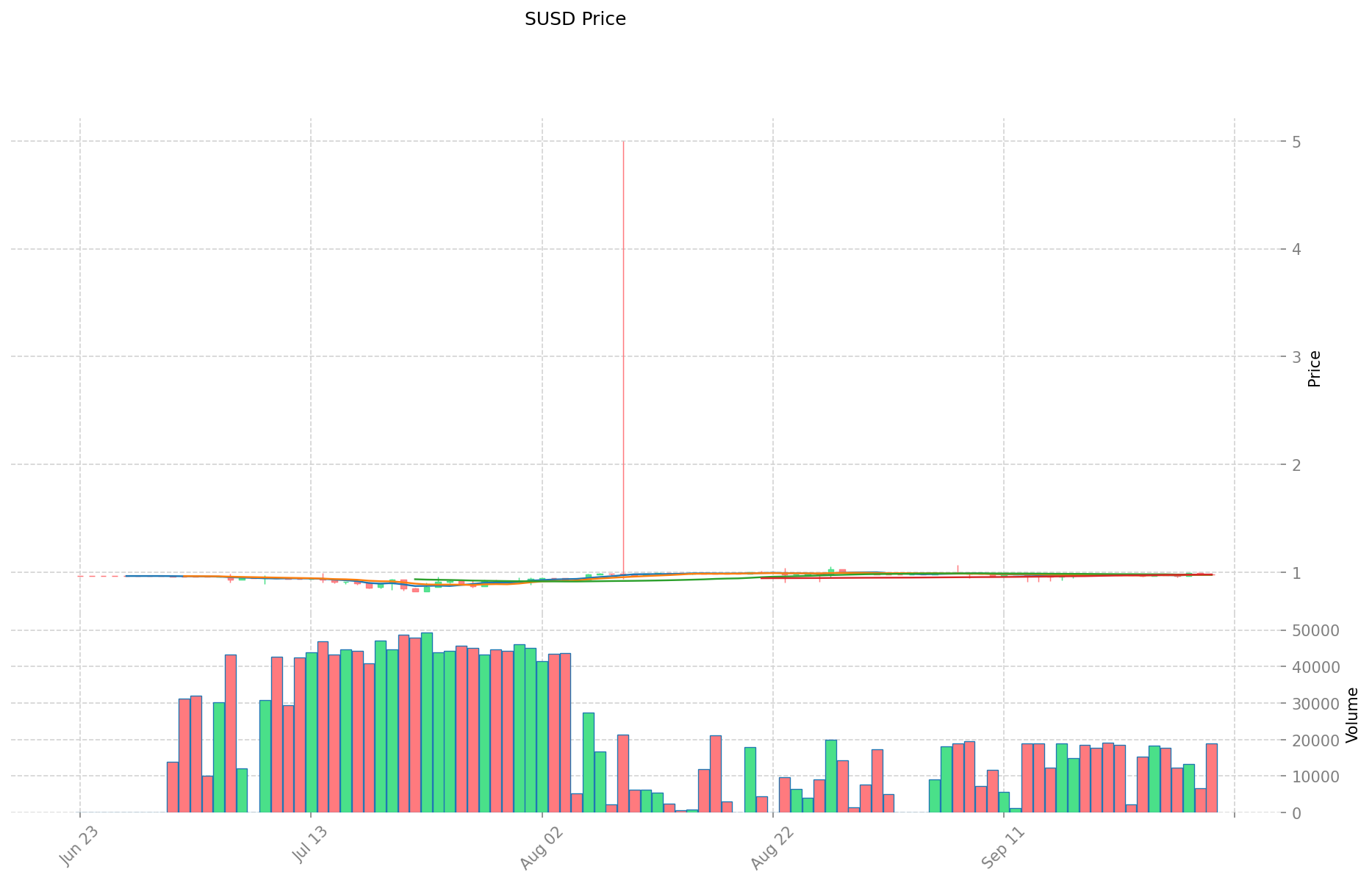

SUSD is an important asset in the cryptocurrency field, making significant achievements in stablecoin and liquidity provision since its inception. As of 2025, SUSD has a market capitalization of $47,373,906, with a circulating supply of approximately 48,276,680 tokens, and a current price hovering around $0.9813. With its positioning as a "stable cryptocurrency", SUSD has gradually become a focal point for investors discussing "Is sUSD(SUSD) a good investment?". This article will comprehensively analyze SUSD's investment value, historical trends, future price predictions, and investment risks, providing a reference for investors.

I. sUSD (SUSD) Price History Review and Current Investment Value

sUSD (SUSD) Investment Performance

- 2020: Historical high of $2.45 on February 18 → Significant price volatility

- 2020: Historical low of $0.429697 on March 18 → Sharp price decline

- 2020-2025: Gradual recovery and stabilization → Price fluctuating around $1

Current sUSD Investment Market Status (September 2025)

- sUSD current price: $0.9813

- Market sentiment: Neutral (based on price stability)

- 24-hour trading volume: $18,422.24

- Circulating supply: 48,276,680.24 SUSD

Click to view real-time SUSD market price

II. sUSD (SUSD) Project Overview

Basic Information

- Full Name: sUSD

- Ticker: SUSD

- Project Launch: Predecessor nUSD issued by Havven Foundation

- Current Ranking: 702

Core Features

- Stablecoin: Designed to maintain a stable value, typically pegged to $1 USD

- Direct Creation: Created in issuer's wallet

- Proportional Fee Distribution: Fees paid based on user nominations to improve liquidity

- Foundation Intervention: Stability maintained through direct market intervention by the foundation

Technical Architecture

- Blockchain: Ethereum

- Contract Address: 0x57Ab1ec28D129707052df4dF418D58a2D46d5f51

- Token Standard: ERC-20

III. Market Performance Analysis

Market Capitalization

- Current Market Cap: $47,373,906.32

- Fully Diluted Valuation: $47,373,906.32

- Market Dominance: 0.0011%

Supply Information

- Circulating Supply: 48,276,680.24 SUSD

- Total Supply: 48,276,680.24 SUSD

- Max Supply: 48,276,680.24 SUSD

- Circulation Ratio: 100%

Price Trends

- 1 Hour: -0.01% ($-0.000098)

- 24 Hours: +0.23% ($+0.002252)

- 7 Days: +1.9% ($+0.018297)

- 30 Days: +0.2% ($+0.001959)

- 1 Year: +4.53% ($+0.042526)

Trading Activity

- 24h Trading Volume: $18,422.24

- Number of Exchanges Listed: 2

- Number of Token Holders: 14,309

IV. Project Development and Community Engagement

Development Activity

Community and Social Media Presence

- Website: https://synthetix.io

- Twitter: https://twitter.com/synthetix_io

- Reddit: https://www.reddit.com/r/synthetix_io

V. Investment Considerations

Strengths

- Stable value: Designed to maintain price stability around $1

- Ethereum-based: Benefits from Ethereum's security and ecosystem

- Active development: Ongoing project improvements and updates

Risks

- Market intervention dependency: Relies on foundation's intervention for stability

- Limited exchange listings: Only available on 2 exchanges, potentially affecting liquidity

- Competitive stablecoin market: Faces competition from other established stablecoins

Potential Catalysts

- Increased adoption within the Synthetix ecosystem

- Expansion to more exchanges and trading pairs

- Improvements in stability mechanisms and transparency

VI. Conclusion

sUSD (SUSD) serves as a stablecoin within the Synthetix ecosystem, maintaining relative price stability around the $1 mark. While it has shown resilience and gradual growth since its inception, investors should be aware of its reliance on foundation intervention and limited exchange presence. As with any cryptocurrency investment, thorough research and risk assessment are essential before considering a position in sUSD.

II. Key Factors Affecting Whether sUSD(SUSD) is a Good Investment

Supply Mechanism and Scarcity (SUSD investment scarcity)

- Direct creation in issuer's wallet → Impacts price and investment value

- Historical pattern: Supply changes have driven SUSD price movements

- Investment significance: Scarcity is key to supporting long-term investment

Institutional Investment and Mainstream Adoption

- Institutional holding trend: Data not available

- Foundation's market intervention → Enhances investment value

- Regulatory policies' impact on SUSD investment prospects

Macroeconomic Environment's Impact on SUSD Investment

- Monetary policy and interest rate changes → Alter investment attractiveness

- Hedging role in inflationary environments → "Digital stablecoin" positioning

- Geopolitical uncertainties → May increase demand for SUSD investment

Technology and Ecosystem Development

- Liquidity improvement: Enhances network performance → Increases investment appeal

- Ecosystem expansion: Supports long-term value

- DeFi applications driving investment value

III. SUSD Future Investment Predictions and Price Outlook (Is sUSD(SUSD) worth investing in 2025-2030)

Short-term SUSD investment outlook (2025)

- Conservative prediction: $0.69 - $0.98

- Neutral prediction: $0.98 - $1.22

- Optimistic prediction: $1.22 - $1.46

Mid-term sUSD(SUSD) investment forecast (2027-2028)

- Market stage expectation: Potential growth phase

- Investment return forecast:

- 2027: $0.73 - $2.04

- 2028: $1.01 - $2.28

- Key catalysts: Increased adoption, market sentiment, ecosystem developments

Long-term investment outlook (Is SUSD a good long-term investment?)

- Base scenario: $1.84 - $3.42 (Assuming steady growth and adoption)

- Optimistic scenario: $3.42 - $4.00 (Assuming widespread adoption and favorable market conditions)

- Risk scenario: $0.69 - $1.00 (Under extreme market volatility or regulatory challenges)

Click to view SUSD long-term investment and price prediction: Price Prediction

2025-09-30 - 2030 Long-term Outlook

- Base scenario: $1.84 - $3.42 (Corresponding to steady progress and gradual increase in mainstream applications)

- Optimistic scenario: $3.42 - $4.00 (Corresponding to large-scale adoption and favorable market environment)

- Transformative scenario: Above $4.00 (In case of breakthrough developments in the ecosystem and mainstream adoption)

- 2030-12-31 Predicted high: $3.42 (Based on optimistic development assumptions)

Disclaimer

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.461839 | 0.9811 | 0.696581 | 0 |

| 2026 | 1.56348096 | 1.2214695 | 0.92831682 | 24 |

| 2027 | 2.0469385881 | 1.39247523 | 0.7380118719 | 41 |

| 2028 | 2.2872101890365 | 1.71970690905 | 1.0146270763395 | 75 |

| 2029 | 2.925049481603145 | 2.00345854904325 | 1.262178885897247 | 104 |

| 2030 | 3.425313081299244 | 2.464254015323197 | 1.848190511492398 | 151 |

IV. How to invest in stablecoins

sUSD investment strategy

- HODL sUSD: Suitable for conservative investors seeking stability

- Active trading: Limited opportunities due to stable price

Risk management for sUSD investment

- Asset allocation ratio: Conservative: 5-10% of portfolio Aggressive: 10-20% of portfolio Professional: Up to 30% of portfolio

- Risk hedging: Diversify across multiple stablecoins

- Secure storage: Hardware wallets recommended (e.g. Ledger, Trezor)

V. Risks of investing in stablecoins

- Market risk: De-pegging events, liquidity crises

- Regulatory risk: Uncertainty around stablecoin regulations

- Technical risk: Smart contract vulnerabilities, oracle failures

VI. Conclusion: Is stablecoin a Good Investment?

- Investment value summary: sUSD offers stability but limited upside potential.

- Investor advice: ✅ Beginners: Use as a safe haven during market volatility ✅ Experienced investors: Yield farming opportunities ✅ Institutional investors: Treasury management tool

⚠️ Disclaimer: Cryptocurrency investments carry high risk. This report is for informational purposes only and does not constitute investment advice.

VII. FAQ

Q1: What is sUSD and how does it work? A: sUSD is a stablecoin designed to maintain a value of $1 USD. It is created directly in the issuer's wallet and uses a system of proportional fee distribution and foundation intervention to maintain its stability.

Q2: Is sUSD a good investment in 2025? A: sUSD's investment potential in 2025 is moderate. Price predictions range from $0.69 to $1.46, with a neutral forecast of $0.98 to $1.22. As a stablecoin, it offers stability but limited upside potential.

Q3: What are the main risks of investing in sUSD? A: The main risks include market risk (de-pegging events), regulatory uncertainty, and technical vulnerabilities. Additionally, sUSD's reliance on foundation intervention for stability and limited exchange listings pose specific risks.

Q4: How does sUSD compare to other stablecoins? A: sUSD is Ethereum-based and offers stability similar to other stablecoins. However, it has a smaller market cap and is listed on fewer exchanges compared to major stablecoins like USDT or USDC.

Q5: What is the long-term outlook for sUSD investment? A: The long-term outlook (2025-2030) for sUSD ranges from $1.84 to $3.42 in the base scenario, with an optimistic scenario reaching up to $4.00. However, as a stablecoin, significant price appreciation is not its primary design goal.

Q6: How can I invest in sUSD? A: You can invest in sUSD by purchasing it on supported cryptocurrency exchanges. Investment strategies include holding it as a stable asset or using it in yield farming. Always practice proper risk management and consider your overall portfolio allocation.

Share

Content