Is pBTC35A (PBTC35A) a good investment?: Analyzing the Risks and Potential of This Bitcoin-Pegged Token

Introduction: Investment Status and Market Prospects of pBTC35A (PBTC35A)

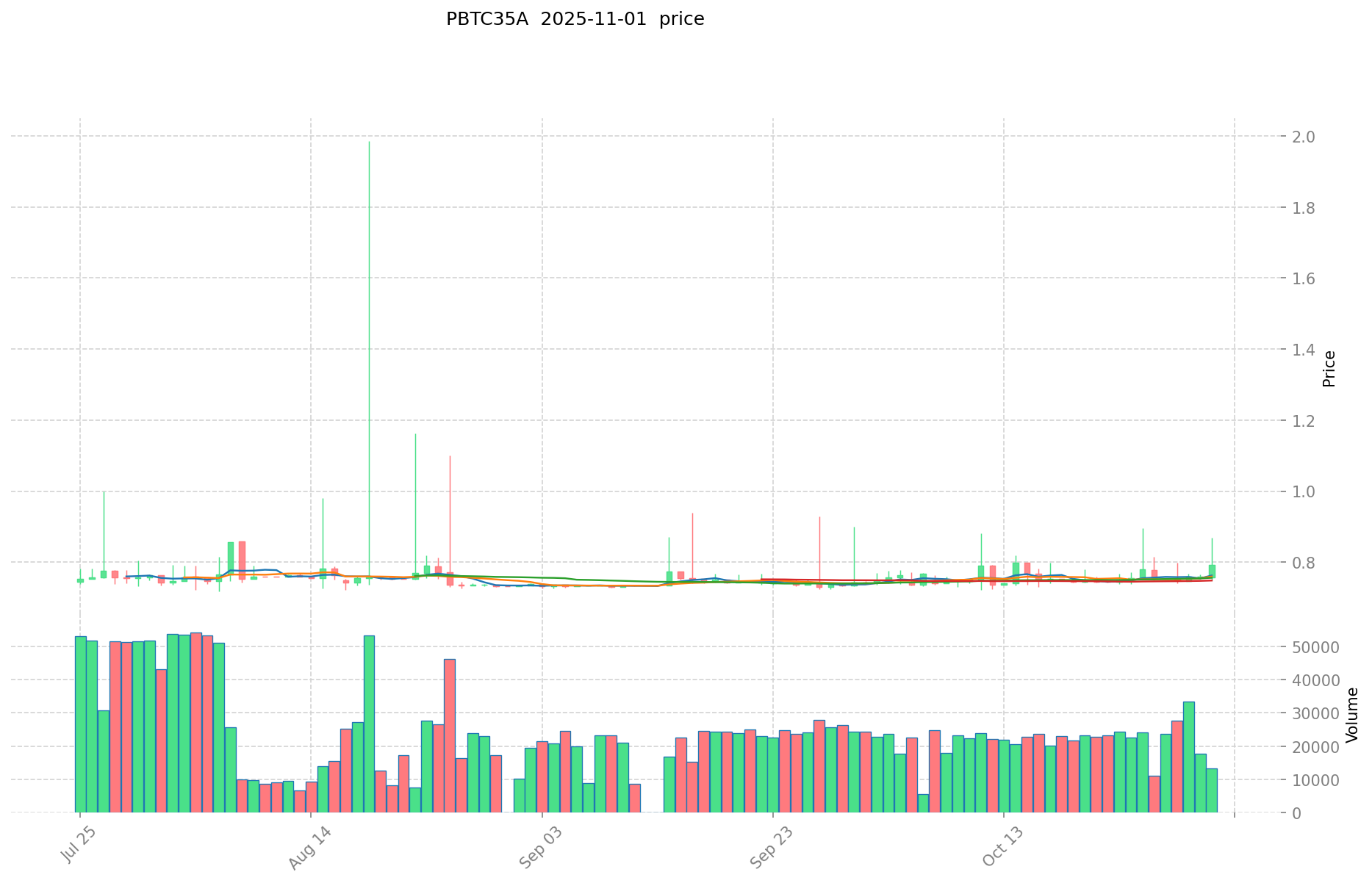

PBTC35A is an important asset in the cryptocurrency field. As of 2025, PBTC35A has a market capitalization of $169,041.99, with a circulating supply of approximately 214,601.99998208 coins, and a current price of around $0.7877. With its position as a "one-stop decentralized standard computing protocol", PBTC35A has gradually become a focal point for investors discussing "Is pBTC35A(PBTC35A) a good investment?". This article will comprehensively analyze PBTC35A's investment value, historical trends, future price predictions, and investment risks, providing a reference for investors.

I. PBTC35A Price History Review and Current Investment Value

PBTC35A Historical Price Trends and Investment Returns

- 2021: All-time high of $216.53 reached on January 14, 2021

- 2024: All-time low of $0.478614 recorded on December 22, 2024

- 2025: Current price of $0.7877 as of November 1, 2025

Current PBTC35A Investment Market Status (November 2025)

- PBTC35A current price: $0.7877

- 24-hour trading volume: $10,551.45538

- Circulating supply: 214,601.99998208 PBTC35A

- Market cap: $169,041.9953858844

Click to view real-time PBTC35A market price

II. Key Factors Affecting Whether pBTC35A(PBTC35A) is a Good Investment

Supply Mechanism and Scarcity (PBTC35A investment scarcity)

- Fixed total supply of 214,601.99998208 PBTC35A → Impacts price and investment value

- Historical pattern: Supply changes have driven cryptocurrency prices

- Investment significance: Scarcity is key to supporting long-term investment

Institutional Investment and Mainstream Adoption

- Institutional holding trend: Limited data available

- Adoption by well-known companies → Could enhance investment value

- Impact of national policies on PBTC35A investment prospects

Macroeconomic Environment's Impact on PBTC35A Investment

- Monetary policy and interest rate changes → Alter investment attractiveness

- Hedging role in inflationary environments → "Digital gold" positioning

- Geopolitical uncertainties → Potentially increase demand for PBTC35A investment

Technology and Ecosystem Development

- Mars protocol: One-stop decentralized standard computing protocol → Enhances network performance and investment appeal

- Integration with Bitcoin mining → Supports long-term value

- DeFi applications: Providing liquidity on Uniswap → Drives investment value

III. PBTC35A Future Investment Forecast and Price Outlook (Is pBTC35A(PBTC35A) worth investing in 2025-2030)

Short-term PBTC35A investment outlook (2025)

- Conservative forecast: $0.675 - $0.785

- Neutral forecast: $0.785 - $0.925

- Optimistic forecast: $0.925 - $1.068

Mid-term pBTC35A(PBTC35A) investment forecast (2027-2028)

- Market stage expectation: Potential growth phase

- Investment return forecast:

- 2027: $0.716 - $1.488

- 2028: $0.725 - $1.852

- Key catalysts: Bitcoin halving, increased adoption of Bitcoin mining derivatives

Long-term investment outlook (Is PBTC35A a good long-term investment?)

- Base scenario: $1.270 - $2.210 (Assuming steady growth in Bitcoin mining industry)

- Optimistic scenario: $2.210 - $3.000 (Assuming significant increase in Bitcoin price and mining profitability)

- Risk scenario: $0.500 - $1.000 (Assuming regulatory crackdowns or major setbacks in Bitcoin mining)

Click to view PBTC35A long-term investment and price prediction: Price Prediction

2025-11-01 - 2030 Long-term Outlook

- Base scenario: $1.270 - $2.210 (Corresponding to steady progress and gradual increase in mainstream applications)

- Optimistic scenario: $2.210 - $3.000 (Corresponding to large-scale adoption and favorable market conditions)

- Transformative scenario: Above $3.000 (In case of breakthrough developments in the ecosystem and mainstream popularization)

- 2030-12-31 Predicted high: $3.500 (Based on optimistic development assumptions)

Disclaimer: This information is for educational purposes only and should not be considered as financial advice. Cryptocurrency investments are highly speculative and volatile. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.068008 | 0.7853 | 0.675358 | 0 |

| 2026 | 1.27878252 | 0.926654 | 0.76912282 | 17 |

| 2027 | 1.488669651 | 1.10271826 | 0.716766869 | 39 |

| 2028 | 1.852842356365 | 1.2956939555 | 0.72558861508 | 64 |

| 2029 | 2.10951932894955 | 1.5742681559325 | 1.0075316197968 | 99 |

| 2030 | 2.21027249092923 | 1.841893742441025 | 1.270906682284307 | 133 |

IV. How to invest in pBTC35A

pBTC35A investment strategy

- HODL pBTC35A: Suitable for conservative investors looking for long-term exposure to Bitcoin mining power

- Active trading: Relies on technical analysis and swing trading, suitable for experienced traders

Risk management for pBTC35A investment

- Asset allocation ratio:

- Conservative: 1-3% of portfolio

- Aggressive: 5-10% of portfolio

- Professional: Up to 20% of portfolio

- Risk hedging: Diversify across multiple crypto assets and use traditional hedging instruments

- Secure storage: Use a combination of hot wallets for trading and cold/hardware wallets for long-term storage

V. Risks of investing in pBTC35A

- Market risk: High volatility, potential for price manipulation in low liquidity environments

- Regulatory risk: Uncertain regulatory landscape for crypto mining tokens in different jurisdictions

- Technical risk: Smart contract vulnerabilities, potential issues with the underlying Bitcoin mining operations

VI. Conclusion: Is pBTC35A a Good Investment?

- Investment value summary: pBTC35A offers unique exposure to Bitcoin mining power, but carries significant risks and volatility.

- Investor recommendations: ✅ Beginners: Consider dollar-cost averaging and prioritize secure storage ✅ Experienced investors: Implement swing trading strategies and maintain a diversified portfolio ✅ Institutional investors: Evaluate as part of a broader crypto mining exposure strategy

⚠️ Warning: Cryptocurrency investments carry high risk. This report is for informational purposes only and does not constitute investment advice.

VII. FAQ

Q1: What is pBTC35A and how does it relate to Bitcoin mining? A: pBTC35A is a cryptocurrency token that represents a share of Bitcoin mining power. It's designed to provide investors with exposure to Bitcoin mining operations without the need to directly own and operate mining hardware.

Q2: How volatile is pBTC35A compared to Bitcoin? A: pBTC35A can be highly volatile, potentially even more so than Bitcoin itself. Its price is influenced not only by Bitcoin's price movements but also by factors specific to mining operations and the token's own market dynamics.

Q3: What are the main risks of investing in pBTC35A? A: The main risks include market volatility, regulatory uncertainties surrounding crypto mining tokens, and technical risks associated with smart contracts and the underlying mining operations.

Q4: Where can I buy and store pBTC35A? A: pBTC35A can be purchased on cryptocurrency exchanges that list the token. For storage, it's recommended to use a combination of hot wallets for trading and cold/hardware wallets for long-term, secure storage.

Q5: Is pBTC35A a good long-term investment? A: The long-term potential of pBTC35A depends on various factors, including Bitcoin's price performance, mining profitability, and regulatory environment. While it offers unique exposure to Bitcoin mining, it's considered a high-risk investment that should be approached cautiously.

Q6: How does the fixed supply of pBTC35A affect its investment potential? A: The fixed supply of 214,601.99998208 pBTC35A tokens contributes to its scarcity, which could potentially support long-term value. However, this scarcity should be balanced against other factors such as demand and overall market conditions.

Q7: What should I consider before investing in pBTC35A? A: Before investing, consider your risk tolerance, investment goals, and overall portfolio strategy. Research the token's technology, team, and market performance. It's also crucial to understand the regulatory landscape and potential impacts on crypto mining tokens in your jurisdiction.

Share

Content