Is GUSD (GUSD) a good investment?: Analyzing the Potential and Risks of the Gemini Dollar Stablecoin

Introduction: Investment Status and Market Prospects of GUSD (GUSD)

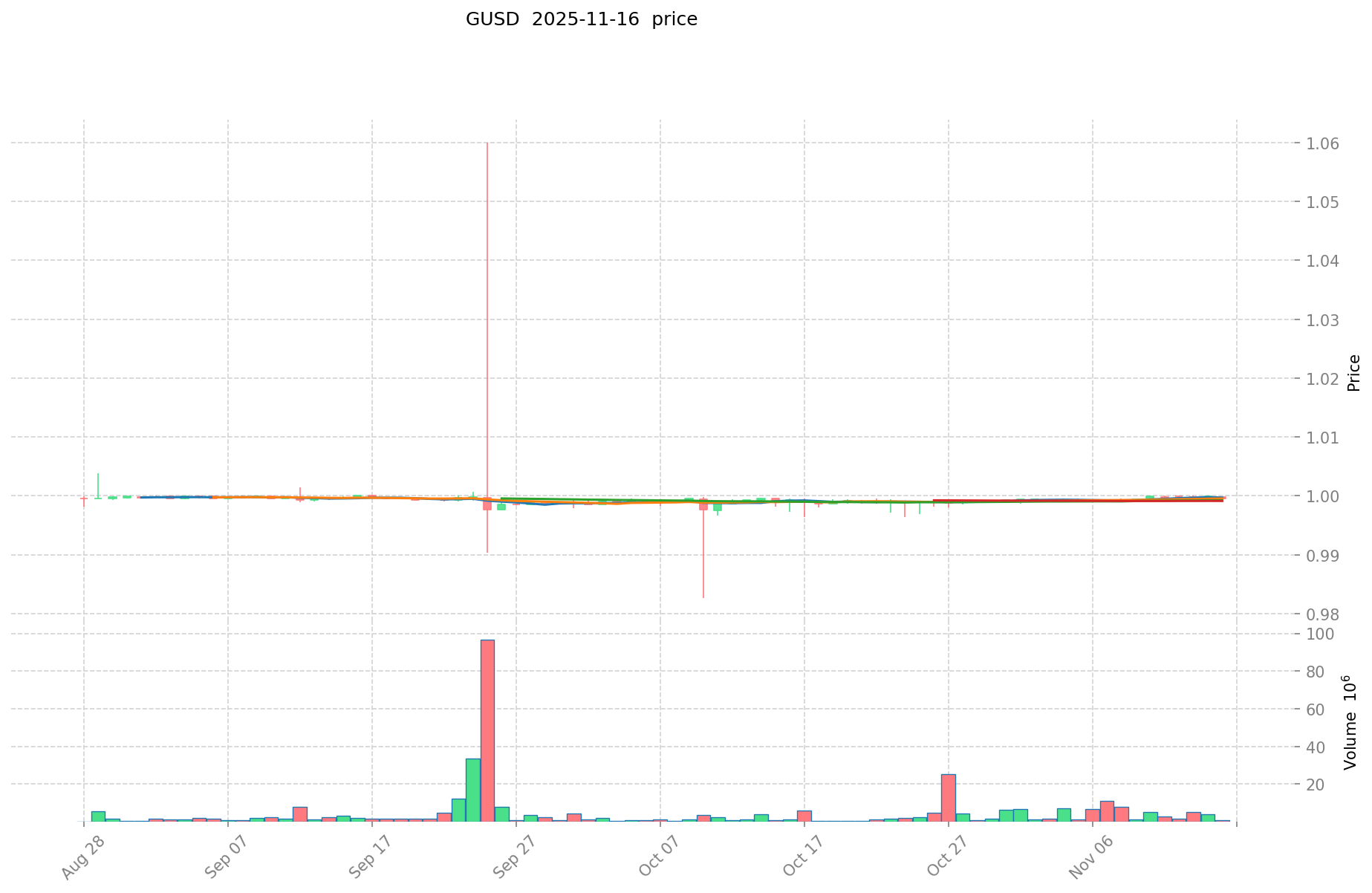

GUSD is a significant asset in the cryptocurrency realm, having made notable achievements in the field of flexible, principal-protected investment products since its inception. As of 2025, GUSD's market capitalization stands at $149,723,124.97, with a circulating supply of approximately 149,783,038 tokens, and a current price hovering around $0.9996. With its position as a "yield-bearing certificate" backed by real-world assets, GUSD has gradually become a focal point for investors discussing "Is GUSD (GUSD) a good investment?" This article will comprehensively analyze GUSD's investment value, historical trends, future price predictions, and investment risks, providing a reference for investors.

I. GUSD Price History Review and Current Investment Value

GUSD(GUSD) investment performance

- 2025: Product launch → Initial price set at $1

Current GUSD investment market status (November 2025)

- GUSD current price: $0.9996

- Market sentiment: Neutral (based on price stability near $1)

- 24-hour trading volume: $767,838.14069

- Institutional investor holdings: Data not available

Click to view real-time GUSD market price

II. Key Factors Affecting Whether GUSD(GUSD) is a Good Investment

Supply Mechanism and Scarcity (GUSD investment scarcity)

- GUSD's supply is directly tied to user minting and redemption → Impacts price and investment value

- Historical pattern: Supply changes have driven GUSD price stability

- Investment significance: Controlled supply is key to supporting long-term investment

Institutional Investment in GUSD

- Institutional holding trend: Limited data available due to GUSD's recent launch

- Gate's backing of GUSD → Enhances its investment value

- Regulatory policies' impact on GUSD's investment prospects

Macroeconomic Environment's Impact on GUSD Investment

- Monetary policy and interest rate changes → Alter investment attractiveness

- Hedging role in inflationary environments → "Digital yield-bearing asset" positioning

- Geopolitical uncertainties → May increase demand for GUSD as a stable investment

Technology & Ecosystem for GUSD Investment

- Yield generation from Gate ecosystem revenue and RWA → Enhances investment appeal

- Expansion of use cases (trading and collateral) → Supports long-term value

- Integration with DeFi and payment applications driving investment value

III. GUSD Future Investment Forecast and Price Outlook (Is GUSD(GUSD) worth investing in 2025-2030)

Short-term GUSD investment outlook (2025)

- Conservative forecast: $0.9995 - $1.0005

- Neutral forecast: $0.9998 - $1.0002

- Optimistic forecast: $0.9999 - $1.0001

Mid-term GUSD(GUSD) investment forecast (2027-2028)

- Market stage expectation: Stable

- Investment return forecast:

- 2027: $0.9999 - $1.0001

- 2028: $0.9999 - $1.0001

- Key catalysts: Continued stability as a stablecoin

Long-term investment outlook (Is GUSD a good long-term investment?)

- Base scenario: $0.9999 - $1.0001 (Assuming continued stability)

- Optimistic scenario: $1.0000 - $1.0000 (Assuming perfect stability)

- Risk scenario: $0.9900 - $1.0100 (Under extreme market conditions)

Click to view GUSD long-term investment and price prediction: Price Prediction

2025-11-16 - 2030 Long-term Outlook

- Base scenario: $0.9999 - $1.0001 (Corresponding to steady progress and gradual improvement in mainstream applications)

- Optimistic scenario: $1.0000 - $1.0000 (Corresponding to large-scale adoption and favorable market conditions)

- Transformative scenario: Above $1.0000 (In case of breakthrough progress in the ecosystem and mainstream popularization)

- 2030-12-31 Predicted high: $1.0000 (Based on optimistic development assumptions)

Disclaimer

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1 | 1 | 1 | 0 |

| 2026 | 1 | 1 | 1 | 0 |

| 2027 | 1 | 1 | 1 | 0 |

| 2028 | 1 | 1 | 1 | 0 |

| 2029 | 1 | 1 | 1 | 0 |

| 2030 | 1 | 1 | 1 | 0 |

IV. How to invest in GUSD

GUSD investment strategy

- HODL GUSD: Suitable for conservative investors seeking stable returns

- Active trading: Limited potential due to GUSD's stable nature

Risk management for GUSD investment

- Asset allocation ratio: Conservative: 5-10% of portfolio Moderate: 10-20% of portfolio Aggressive: 20-30% of portfolio

- Risk hedging: Diversify across multiple stablecoins and traditional assets

- Secure storage: Use reputable exchanges or hardware wallets for long-term holdings

V. Risks of investing in stablecoins

- Market risk: De-pegging events, though rare for GUSD

- Regulatory risk: Potential changes in stablecoin regulations

- Technical risk: Smart contract vulnerabilities, cybersecurity threats

VI. Conclusion: Is GUSD a Good Investment?

-

Investment value summary: GUSD offers stable returns with low volatility, making it suitable for risk-averse investors seeking yield on their stablecoin holdings.

-

Investor recommendations: ✅ Beginners: Use GUSD for yield generation on stablecoin holdings ✅ Experienced investors: Incorporate GUSD as part of a diversified stablecoin strategy ✅ Institutional investors: Consider GUSD for treasury management and low-risk yield generation

⚠️ Note: While GUSD is designed to be stable, all investments carry risks. This article is for informational purposes only and does not constitute investment advice.

VII. FAQ

Q1: What is GUSD and how does it differ from other stablecoins? A: GUSD is a stablecoin issued by Gate that aims to maintain a 1:1 peg with the US dollar. It differs from other stablecoins by acting as a "yield-bearing certificate" backed by real-world assets, offering potential returns to holders through the Gate ecosystem revenue and RWA investments.

Q2: Is GUSD a good investment for 2025-2030? A: GUSD is designed to maintain a stable value close to $1, making it a potentially good investment for those seeking low-risk, stable returns. However, it's not expected to appreciate significantly in value. Its suitability depends on individual investment goals and risk tolerance.

Q3: What are the main risks associated with investing in GUSD? A: The main risks include market risk (potential de-pegging events), regulatory risk (changes in stablecoin regulations), and technical risk (smart contract vulnerabilities or cybersecurity threats). While GUSD is designed to be stable, all investments carry some level of risk.

Q4: How can I invest in GUSD? A: You can invest in GUSD by purchasing it on cryptocurrency exchanges that list the token, such as Gate. Strategies include holding GUSD for stable returns or using it in DeFi applications. Ensure to use reputable exchanges or hardware wallets for secure storage.

Q5: What is the expected price range for GUSD in the coming years? A: GUSD is expected to maintain a price very close to $1 due to its nature as a stablecoin. The forecasted price range for 2025-2030 is typically between $0.9999 and $1.0001 under normal market conditions.

Q6: How does GUSD generate yield for holders? A: GUSD generates yield through Gate ecosystem revenue and investments in real-world assets (RWA). This mechanism allows holders to potentially earn returns on their GUSD holdings, distinguishing it from traditional non-yield-bearing stablecoins.

Q7: What percentage of my portfolio should I allocate to GUSD? A: The allocation depends on your risk tolerance and investment strategy. A conservative approach might allocate 5-10% of the portfolio to GUSD, while a more aggressive strategy could go up to 20-30%. Always diversify your investments and consult with a financial advisor for personalized advice.

Share

Content