GraphAI (GAI) iyi bir yatırım mı?: Bu yeni yapay zeka teknolojisinin günümüz piyasa ortamındaki potansiyelini ve risklerini inceliyoruz

Giriş: GraphAI (GAI) Yatırım Durumu ve Piyasa Beklentileri

GAI, kripto para sektöründe önemli bir varlık olarak, Web3 için yapay zeka tabanlı veri katmanı alanında lansmanından bu yana dikkat çekici başarılar elde etti. 2025 yılı itibarıyla GAI’nin piyasa değeri $18.228.000,0 seviyesinde bulunuyor; dolaşımdaki token miktarı yaklaşık 70.000.000 ve güncel fiyatı yaklaşık $0,2604 civarında seyrediyor. “Blokzincir ile yapay zeka arasında köprü” olma iddiasıyla öne çıkan GAI, “GraphAI(GAI) iyi bir yatırım mı?” sorusunu değerlendiren yatırımcıların odağında yer alıyor. Bu yazı, GAI’nin yatırım değerini, geçmiş fiyat hareketlerini, gelecek fiyat tahminlerini ve yatırım risklerini kapsamlı biçimde analiz ederek yatırımcılara yol gösterici bilgiler sunuyor.

I. GraphAI (GAI) Fiyat Geçmişi ve Güncel Yatırım Değeri

GAI'nin Tarihsel Fiyat Eğilimleri ve Yatırım Getirileri

- 2025: Proje lansmanı → İlk yatırımcı getirileri belirsiz

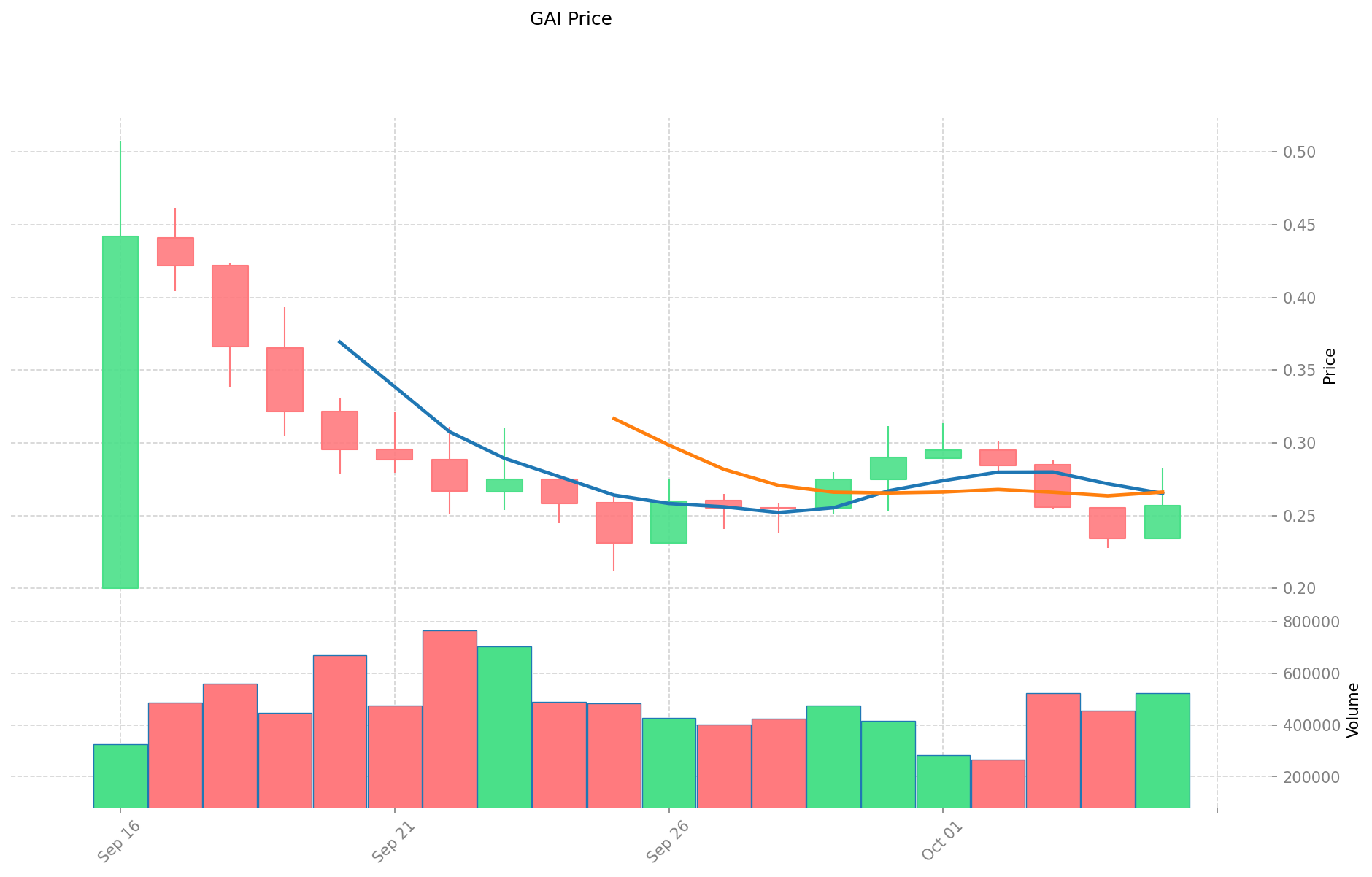

- 2025 (16 Eylül): Tüm zamanların en yüksek seviyesi → GAI fiyatı $0,5078’e ulaştı

- 2025 (16 Eylül): Piyasa düzeltmesi → Fiyat $0,5078’den $0,2’ye (en düşük seviye) geriledi

Güncel GAI Yatırım Piyasa Durumu (Ekim 2025)

- GAI güncel fiyatı: $0,2604

- 24 saatlik işlem hacmi: $151.025,30

- Dolaşımdaki arz: 70.000.000 GAI

- Piyasa değeri: $18.228.000

Gerçek zamanlı GAI piyasa fiyatını incelemek için tıklayın

II. GraphAI(GAI) Yatırımının Uygunluğunu Belirleyen Temel Faktörler

Arz Mekanizması ve Kıtlık (GAI Yatırımında Kıtlık)

- Toplam 100.000.000 GAI token arzı → Fiyat ve yatırım değerini doğrudan etkiler

- Tarihsel eğilim: Arz dinamiklerindeki değişimler kripto para piyasasında fiyatları şekillendirmiştir

- Yatırım önemi: Kıtlık, uzun vadeli yatırımın temel dayanağıdır

Kurumsal Yatırım ve Ana Akım Benimsenme

- Kurumsal sahiplik eğilimi: Veri bulunmamakta

- GAI’nin büyük işletmelerce benimsenmesi → Yatırım değerini artırabilir

- Ulusal politika düzenlemelerinin GAI yatırım potansiyeline etkisi

Makroekonomik Koşulların GAI Yatırımına Etkisi

- Para politikası ve faiz oranı değişiklikleri → Yatırımın cazibesini etkiler

- Enflasyona karşı koruma rolü → “Dijital altın” yaklaşımı

- Jeopolitik belirsizlikler → GAI yatırımına olan talebi artırabilir

Teknoloji ve Ekosistem Gelişimi (GAI Yatırımı için Teknoloji ve Ekosistem)

- GraphEngine: Alt grafik oluşturma, sorgulama ve analizde ölçeklenebilirlik sağlar → Ağ performansını ve yatırım çekiciliğini artırır

- Base, Ethereum ve Artificial Superintelligence Alliance entegrasyonları → Ekosistem uygulamalarını geliştirir, uzun vadeli değer yaratır

- Web3 için yapay zeka tabanlı veri katmanı; DeFi, NFT ve ödeme uygulamaları üzerinden yatırım değerini destekler

III. GAI Gelecek Yatırım Tahmini ve Fiyat Beklentisi (GraphAI(GAI) 2025-2030 Döneminde Yatırımı Değerli mi?)

Kısa Vadeli GAI Yatırım Beklentisi (2025)

- İhtiyatlı tahmin: $0,218 - $0,240

- Tarafsız tahmin: $0,240 - $0,260

- İyimser tahmin: $0,260 - $0,281

Orta Vadeli GraphAI(GAI) Yatırım Tahmini (2027)

- Piyasa aşaması beklentisi: Yapay zeka ve blokzincir entegrasyonunun olgunlaşmasıyla potansiyel büyüme dönemi

- Yatırım getirisi tahminleri:

- 2026: $0,221 - $0,362

- 2027: $0,300 - $0,386

- Kilit katalizörler: AI tabanlı veri katmanının geniş çapta benimsenmesi, güçlü blokzincir ekosistemleriyle iş birlikleri

Uzun Vadeli Yatırım Beklentisi (GAI Uzun Vadede İyi Bir Yatırım mı?)

- Temel senaryo: $0,390 - $0,472 (Web3 AI uygulamalarında istikrarlı büyüme varsayımıyla)

- İyimser senaryo: $0,500 - $0,600 (GraphAI teknolojisinin yaygın benimsenmesiyle)

- Risk senaryosu: $0,200 - $0,300 (Düzenleyici engeller veya rekabet baskısı halinde)

GAI'nin uzun vadeli yatırım ve fiyat tahmini için tıklayın: Fiyat Tahmini

06 Ekim 2025 - 2030 Uzun Vadeli Öngörü

- Temel senaryo: $0,390 - $0,472 (İstikrarlı ilerleme ve ana akım uygulamalarda büyüme ile uyumlu)

- İyimser senaryo: $0,500 - $0,600 (Kapsamlı benimsenme ve olumlu piyasa koşullarıyla)

- Dönüştürücü senaryo: $0,700 üzeri (Ekosistemde radikal gelişmeler ve yaygın benimsenme halinde)

- 2030-31 Aralık tahmini zirve: $0,722 (İyimser gelişme senaryosuna göre)

Feragatname

| Yıl | En Yüksek Tahmini Fiyat | Ortalama Tahmini Fiyat | En Düşük Tahmini Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,281124 | 0,2603 | 0,218652 | 1 |

| 2026 | 0,36275408 | 0,270712 | 0,22198384 | 5 |

| 2027 | 0,3864143088 | 0,31673304 | 0,300896388 | 23 |

| 2028 | 0,418372672536 | 0,3515736744 | 0,274227466032 | 36 |

| 2029 | 0,39652236867204 | 0,384973173468 | 0,25793202622356 | 49 |

| 2030 | 0,472804802994724 | 0,39074777107002 | 0,20709631866711 | 51 |

IV. GraphAI (GAI)'ye Yatırım Nasıl Yapılır?

GraphAI (GAI) Yatırım Stratejisi

- "HODL" GraphAI: Temkinli yatırımcılar için uygundur

- Aktif al-sat: Teknik analiz ve dalgalı işlem yaklaşımı gerektirir

GraphAI (GAI) Yatırımında Risk Yönetimi

- Varlık dağılım oranı: Temkinli / Agresif / Profesyonel yatırımcı grupları

- Riskten korunma stratejileri: Çoklu varlık portföyü ve hedge araçları

- Güvenli saklama: Sıcak ve soğuk cüzdanlar ile donanım cüzdanı kullanımı

V. GraphAI (GAI)'ye Yatırımın Riskleri

- Piyasa riskleri: Yüksek volatilite, fiyat manipülasyonu olasılığı

- Düzenleyici riskler: Farklı ülkelerdeki mevzuat belirsizlikleri

- Teknik riskler: Ağ güvenlik açıkları, güncelleme başarısızlıkları

VI. Sonuç: GraphAI (GAI) Yatırıma Değer mi?

- Yatırım özeti: GraphAI, uzun vadede güçlü yatırım potansiyeli sunarken kısa vadede sert fiyat dalgalanmalarıyla karşılaşıyor.

- Yatırımcıya öneriler: ✅ Yeni başlayanlar: Maliyet ortalaması + güvenli cüzdanda saklama ✅ Deneyimli yatırımcılar: Dalgalı al-sat ve portföy yönetimi ✅ Kurumsal yatırımcılar: Stratejik uzun vadeli portföy tahsisi

⚠️ Not: Kripto para yatırımları yüksek risk içerir. Bu makale yalnızca bilgilendirme amaçlı olup yatırım tavsiyesi niteliği taşımamaktadır.

VII. Sıkça Sorulan Sorular

S1: GraphAI (GAI) nedir ve blokzincir ile yapay zeka ile bağlantısı nedir? C: GraphAI (GAI), kendini “blokzincir ve yapay zeka arasında köprü” olarak tanımlayan bir kripto para projesidir. Web3 için AI tabanlı veri katmanı sunar; GraphEngine teknolojisi ile ölçeklenebilir alt grafik oluşturma, sorgulama ve analiz sağlar. GAI, ağ performansını artırmayı ve DeFi, NFT ile ödeme uygulamalarında ekosistem kapsamını genişletmeyi hedefler.

S2: GAI’nin güncel piyasa durumu nedir? C: Ekim 2025 itibarıyla GAI'nin fiyatı $0,2604, 24 saatlik işlem hacmi $151.025,30’dur. Dolaşımdaki arz 70.000.000 GAI token ve piyasa değeri $18.228.000’dır.

S3: GAI’nin yatırım potansiyelini etkileyen başlıca faktörler nelerdir? C: Temel faktörler; arz mekanizması ve kıtlık (toplam arz 100.000.000 token), kurumsal yatırım ve ana akım benimsenme, makroekonomik koşullar ve teknoloji ile ekosistem gelişimidir.

S4: GAI için kısa ve uzun vadeli fiyat tahminleri nedir? C: Kısa vadeli (2025) tahminler $0,218 ile $0,281 aralığında. 2030 için temel senaryoda $0,390 - $0,472, iyimser senaryoda $0,500 - $0,600; 2030 için tahmin edilen en yüksek fiyat ise $0,722’dir.

S5: GAI'ye nasıl yatırım yapılabilir? C: Yatırımcılar için "HODL" stratejisi (temkinli yatırımcılar için) veya teknik analizle aktif al-sat yöntemleri tercih edilebilir. Yatırımda varlık dağılımı, riskten korunma stratejileri ve güvenli saklama seçenekleri dikkate alınmalıdır.

S6: GAI’ye yatırımın başlıca riskleri nelerdir? C: Başlıca riskler; piyasa volatilitesi, fiyat manipülasyonu riski, düzenleyici belirsizlikler ve ağ güvenlik açıkları veya güncelleme başarısızlığı gibi teknik risklerdir.

S7: GAI iyi bir yatırım olarak kabul edilir mi? C: GAI, uzun vadede ciddi yatırım potansiyeli sunarken kısa vadede önemli fiyat dalgalanmaları yaşar. Yatırımın uygunluğu kişisel risk toleransı ve yatırım hedeflerine bağlıdır. Yeni başlayanlar için maliyet ortalaması, deneyimli yatırımcılar için dalgalı al-sat ve portföy yönetimi, kurumsal yatırımcılar için ise stratejik uzun vadeli portföy önerilmektedir.

AITECH nedir: Yapay zekâ uygulamalarında devrim yaratan en son teknolojiyi keşfetmek

GT-Protocol (GTAI) iyi bir yatırım olarak değerlendirilebilir mi?: Bu yükselen yapay zeka odaklı kripto paranın potansiyeli ve riskleri üzerine bir analiz

UB ve ICP: Blockchain Konsensüs Mekanizmalarına İki Farklı Yaklaşımın Karşılaştırılması

MIRAI vs XTZ: Yapay Zeka, Blockchain Liderliği İçin Tezos ile Yarışıyor

2025 SWARMS Fiyat Tahmini: Merkeziyetsiz Yapay Zekâ Ağı’nın Piyasa Trendleri ve Büyüme Potansiyeli Analizi

DIN (DIN) iyi bir yatırım mı?: Bu merkeziyetsiz kimlik ağı tokeninin potansiyelini değerlendiriyoruz

Ethereum Katmanı 2'de Yenilikçi Ölçeklendirme: Geleceğe Milyon Dolarlık Atılım

En İyi Layer 0 Blockchain Çözümleri ile Güçlü Bir Altyapı

Benzersiz NFT sanatı oluşturmak için en iyi yapay zeka araçları

Dijital Varlık Whitepaper’larını Anlamak ve Bilinçli Yatırım Kararları Almak

SEI Ödüllerine Erişim: Airdrop'a Katılım için Adım Adım Kılavuz