Is GHO (GHO) a good investment?: Analyzing the Potential and Risks of Aave's New Stablecoin

Introduction: Investment Status and Market Prospects of GHO (GHO)

GHO is an important asset in the cryptocurrency space, designed as a decentralized, over-collateralized stablecoin native to the Aave Protocol. As of November 2025, GHO's market capitalization stands at $352,680,189.47, with a circulating supply of approximately 352,821,318 tokens, and a current price maintaining around $0.9996. With its positioning as a "fully backed and transparent" stablecoin, GHO has gradually become a focal point for investors discussing "Is GHO (GHO) a good investment?" This article will comprehensively analyze GHO's investment value, historical trends, future price predictions, and investment risks, providing reference for investors.

I. GHO Price History Review and Current Investment Value

GHO (GHO) investment performance

- 2025: Launch on Aave Protocol → Price stabilized around $1

Current GHO investment market status (November 2025)

- GHO current price: $0.9996

- 24-hour trading volume: $54,395.14494

- Circulating supply: 352,821,318 GHO

Click to view real-time GHO market price

II. GHO Project Overview and Core Features

What is GHO?

GHO (pronounced "go") is a decentralised, over-collateralised stablecoin that is fully backed, transparent, and native to the Aave Protocol. Designed to maintain a value pegged to the U.S. dollar, GHO is minted by users on demand, subject to mint cap limitations set by Aave's governance. Its stability is maintained through market efficiencies and over-collateralisation mechanisms inherent in the Aave Protocol.

Key features of GHO

- Decentralized and over-collateralized

- Fully backed and transparent

- Native to Aave Protocol

- User-minted on demand

- Mint cap limitations set by governance

- Stability maintained through market efficiencies and over-collateralization

GHO's technical architecture

GHO operates on the Ethereum blockchain as an ERC-20 token.

III. GHO Market Performance Analysis

GHO market capitalization and ranking

- Current market cap: $352,680,189.47

- Ranking: 183rd

- Market dominance: 0.010%

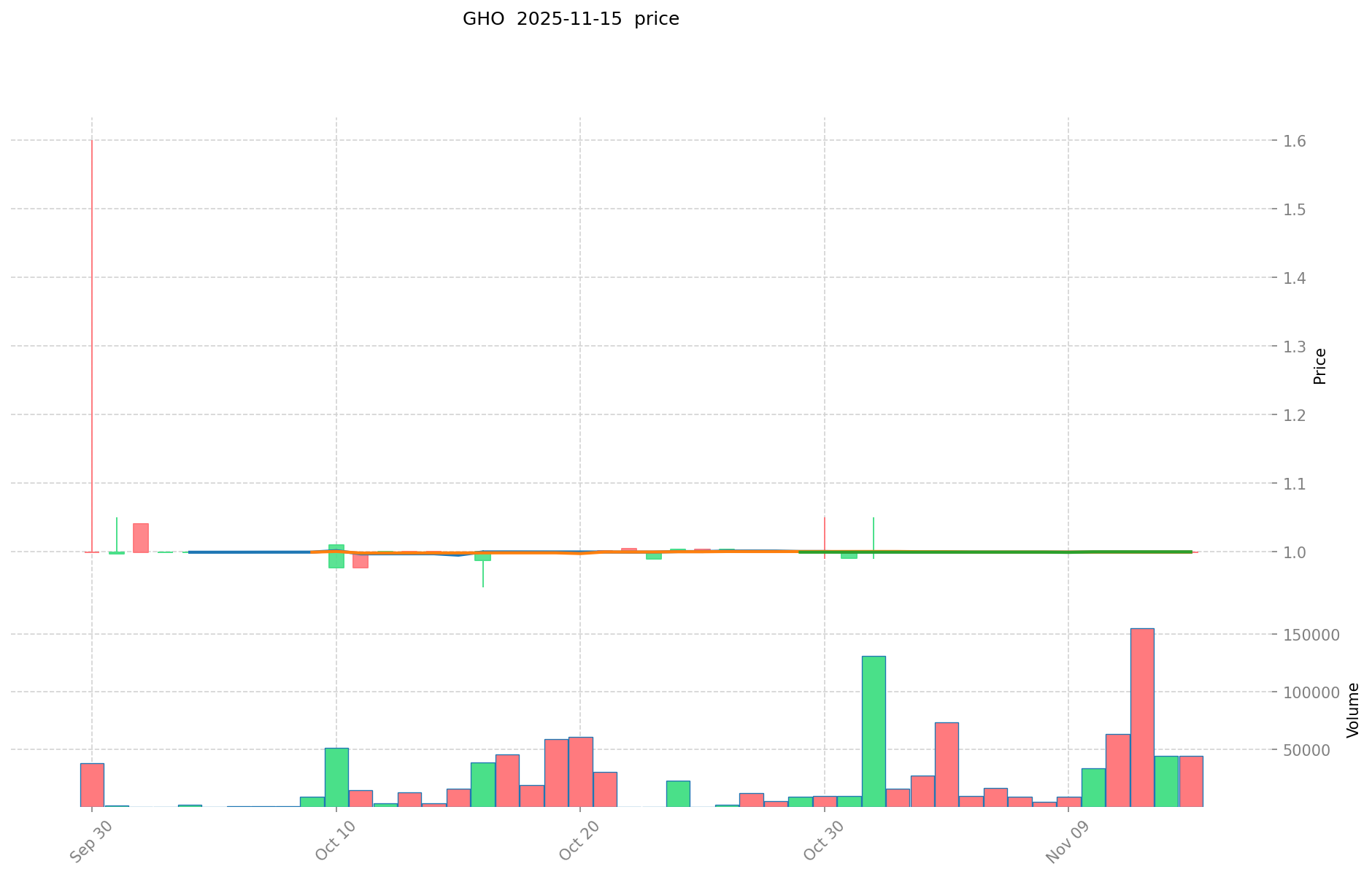

GHO price analysis

- Current price: $0.9996

- All-time high: $1.6 (September 30, 2025)

- All-time low: $0.9478 (October 16, 2025)

- 24-hour price range: $0.9995 - $0.9997

GHO trading volume

24-hour trading volume: $54,395.14494

GHO supply statistics

- Circulating supply: 352,821,318 GHO

- Total supply: 352,821,318 GHO

- Max supply: ∞

- Circulation ratio: 100.0%

IV. GHO Investment Outlook and Risk Analysis

GHO investment prospects

- Stability: As a stablecoin pegged to the U.S. dollar, GHO offers relative price stability.

- Aave ecosystem integration: Being native to the Aave Protocol provides potential advantages within the Aave ecosystem.

- Transparent backing: Fully backed and transparent nature may appeal to users seeking trustworthy stablecoins.

Potential risks

- Regulatory risks: Stablecoins face increasing scrutiny from regulators worldwide.

- Competition: The stablecoin market is highly competitive with established players.

- Peg maintenance: Challenges in maintaining the U.S. dollar peg could affect user confidence.

- Dependency on Aave: GHO's success is closely tied to the performance and adoption of the Aave Protocol.

V. How to Invest in GHO

Where to buy GHO

GHO can be traded on cryptocurrency exchanges that list the token. Always ensure you're using reputable and secure platforms for transactions.

Steps to invest in GHO

- Choose a cryptocurrency exchange that supports GHO.

- Create an account and complete any required verification processes.

- Fund your account with fiat currency or other cryptocurrencies.

- Place an order to buy GHO at your desired price.

- Store your GHO tokens securely, preferably in a hardware wallet for long-term holding.

Investment strategies for GHO

- Stablecoin allocation: Use GHO as part of a stablecoin portfolio for stability.

- Aave ecosystem participation: Utilize GHO within the Aave Protocol for potential benefits.

- Dollar-cost averaging: Regularly invest small amounts to average out price volatility.

Disclaimer: This report is for informational purposes only and should not be considered as financial advice. Always conduct your own research and consult with a qualified financial advisor before making investment decisions.

II. Key Factors Influencing Whether GHO (GHO) is a Good Investment

Supply Mechanism and Scarcity (GHO investment scarcity)

- Minting on demand with governance-set caps → Impacts price and investment value

- Historical pattern: Supply changes have driven GHO price movements

- Investment significance: Scarcity is key to supporting long-term investment

Institutional Investment and Mainstream Adoption (Institutional investment in GHO)

- Institutional holding trends: Data not available

- Adoption by Aave Protocol → Enhances its investment value

- Impact of regulatory policies on GHO investment prospects

Macroeconomic Environment's Impact on GHO Investment

- Monetary policy and interest rate changes → Alter investment attractiveness

- Hedging role in inflationary environments → "Digital dollar" positioning

- Geopolitical uncertainties → Potentially increase demand for GHO investment

Technology and Ecosystem Development (Technology & Ecosystem for GHO investment)

- Aave Protocol upgrades: Improve network performance → Enhance investment appeal

- Ecosystem expansion: Broaden applications → Support long-term value

- DeFi applications driving investment value

III. GHO Future Investment Forecast and Price Outlook (Is GHO(GHO) worth investing in 2025-2030)

Short-term GHO investment outlook (2025)

- Conservative forecast: $0.57 - $0.80

- Neutral forecast: $0.80 - $1.00

- Optimistic forecast: $1.00 - $1.10

Mid-term GHO(GHO) investment forecast (2027-2028)

- Market phase expectation: Potential growth and increased adoption

- Investment return forecast:

- 2027: $0.90 - $1.86

- 2028: $1.01 - $2.15

- Key catalysts: Expansion of Aave ecosystem, increased DeFi adoption

Long-term investment outlook (Is GHO a good long-term investment?)

- Base scenario: $1.74 - $2.24 (Steady growth in DeFi and stablecoin usage)

- Optimistic scenario: $2.24 - $2.80 (Widespread adoption and favorable market conditions)

- Risk scenario: $0.95 - $1.74 (Regulatory challenges or market downturns)

Click to view GHO long-term investment and price prediction: Price Prediction

2025-11-15 - 2030 Long-term Outlook

- Base scenario: $1.74 - $2.24 (Corresponding to steady progress and gradual mainstream application)

- Optimistic scenario: $2.24 - $2.80 (Corresponding to large-scale adoption and favorable market conditions)

- Transformative scenario: Above $2.80 (In case of breakthrough developments in the ecosystem and mainstream adoption)

- 2030-12-31 Predicted high: $2.24 (Based on optimistic development assumptions)

Disclaimer

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.09967 | 0.9997 | 0.569829 | 0 |

| 2026 | 1.45906215 | 1.049685 | 0.6927921 | 5 |

| 2027 | 1.856472891 | 1.254373575 | 0.903148974 | 25 |

| 2028 | 2.14648406154 | 1.555423233 | 1.01102510145 | 55 |

| 2029 | 2.1841253037786 | 1.85095364727 | 1.295667553089 | 85 |

| 2030 | 2.239468817831973 | 2.0175394755243 | 1.735083948950898 | 101 |

IV. How to invest in GHO

GHO investment strategy

- HODL GHO: Suitable for conservative investors

- Active trading: Relies on technical analysis and swing trading

Risk management for GHO investment

- Asset allocation ratio: Conservative / Aggressive / Professional investors

- Risk hedging strategies: Multi-asset portfolio + hedging tools

- Secure storage: Hot and cold wallets + recommended hardware wallets

V. Risks of investing in stablecoins

- Market risks: High volatility, price manipulation

- Regulatory risks: Policy uncertainties in different countries

- Technical risks: Network security vulnerabilities, upgrade failures

VI. Conclusion: Is GHO a Good Investment?

- Investment value summary: GHO shows significant long-term investment potential, but experiences severe short-term price fluctuations.

- Investor recommendations: ✅ Beginners: Dollar-cost averaging + secure wallet storage ✅ Experienced investors: Swing trading + portfolio allocation ✅ Institutional investors: Strategic long-term allocation

⚠️ Note: Cryptocurrency investment carries high risks. This article is for reference only and does not constitute investment advice.

VII. FAQ

Q1: What is GHO and how does it work? A: GHO is a decentralized, over-collateralized stablecoin native to the Aave Protocol. It's designed to maintain a value pegged to the U.S. dollar and is minted by users on demand, subject to mint cap limitations set by Aave's governance. Its stability is maintained through market efficiencies and over-collateralization mechanisms inherent in the Aave Protocol.

Q2: Where can I buy GHO? A: GHO can be traded on cryptocurrency exchanges that list the token. To invest in GHO, choose a reputable exchange that supports it, create an account, complete any required verification processes, fund your account, and then place an order to buy GHO at your desired price.

Q3: What are the key features of GHO? A: The key features of GHO include being decentralized and over-collateralized, fully backed and transparent, native to the Aave Protocol, user-minted on demand, subject to mint cap limitations set by governance, and maintaining stability through market efficiencies and over-collateralization.

Q4: What are the potential risks of investing in GHO? A: Potential risks include regulatory uncertainties surrounding stablecoins, competition in the stablecoin market, challenges in maintaining the U.S. dollar peg, and dependency on the performance and adoption of the Aave Protocol.

Q5: What is the long-term investment outlook for GHO? A: The long-term investment outlook for GHO varies based on different scenarios. The base scenario projects a range of $1.74 - $2.24, assuming steady growth in DeFi and stablecoin usage. An optimistic scenario suggests $2.24 - $2.80 with widespread adoption and favorable market conditions. However, a risk scenario of $0.95 - $1.74 is also considered in case of regulatory challenges or market downturns.

Q6: How can I safely store my GHO tokens? A: For long-term holding, it's recommended to store your GHO tokens in a secure hardware wallet. This provides an extra layer of security compared to keeping them on an exchange or in a software wallet.

Q7: Is GHO a good investment for beginners? A: For beginners, GHO could be considered as part of a diversified cryptocurrency portfolio. It's recommended to use a dollar-cost averaging strategy and ensure secure storage. However, as with all cryptocurrency investments, it's crucial to conduct thorough research and understand the risks involved before investing.

Share

Content