GMEE ve DOT: Dijital Varlıkların Geleceği İçin İki Yenilikçi Blockchain Çözümünün Karşılaştırılması

Giriş: GMEE ve DOT Yatırımı Karşılaştırması

Kripto para piyasasında GAMEE (GMEE) ile Polkadot (DOT) karşılaştırması, yatırımcıların gündeminden düşmeyen bir konudur. Her iki proje de piyasa değeri sıralaması, kullanım alanları ve fiyat performansı bakımından önemli farklılıklar taşırken, farklı kripto varlık konumlarını temsil etmektedir.

GAMEE (GMEE): Yayına alındığı günden bu yana, oyun platformu ve token faydasıyla piyasa tarafından benimsenmiştir.

Polkadot (DOT): 2020 yılındaki çıkışından bu yana, blok zincirler arası birlikte çalışabilirlik çözümü olarak öne çıkmış; en yüksek küresel işlem hacmi ve piyasa değerine sahip kripto paralardan biri olmuştur.

Bu makalede, GMEE ve DOT’un yatırım değerleri; tarihsel fiyat eğilimleri, arz mekanizmaları, kurumsal benimseme, teknoloji ekosistemleri ve gelecek öngörüleriyle kapsamlı olarak karşılaştırılacak, yatırımcıların en çok merak ettiği soruya yanıt aranacaktır:

"Şu anda hangisi daha avantajlı bir alım olur?"

I. Fiyat Geçmişi Karşılaştırması ve Güncel Piyasa Durumu

GMEE ve DOT Tarihsel Fiyat Eğilimleri

- 2021: GMEE, oyun tokenlarına yönelik yoğun ilgiyle $0,714328 ile zirve yaptı.

- 2020: DOT piyasaya sürüldü ve yıl sonunda fiyatı ciddi şekilde yükseldi.

- Kıyaslama: 2022 ayı piyasasında GMEE zirveden $0,00060225 seviyesine gerilerken, DOT daha dirençli kaldı ve yüksek piyasa değerini korudu.

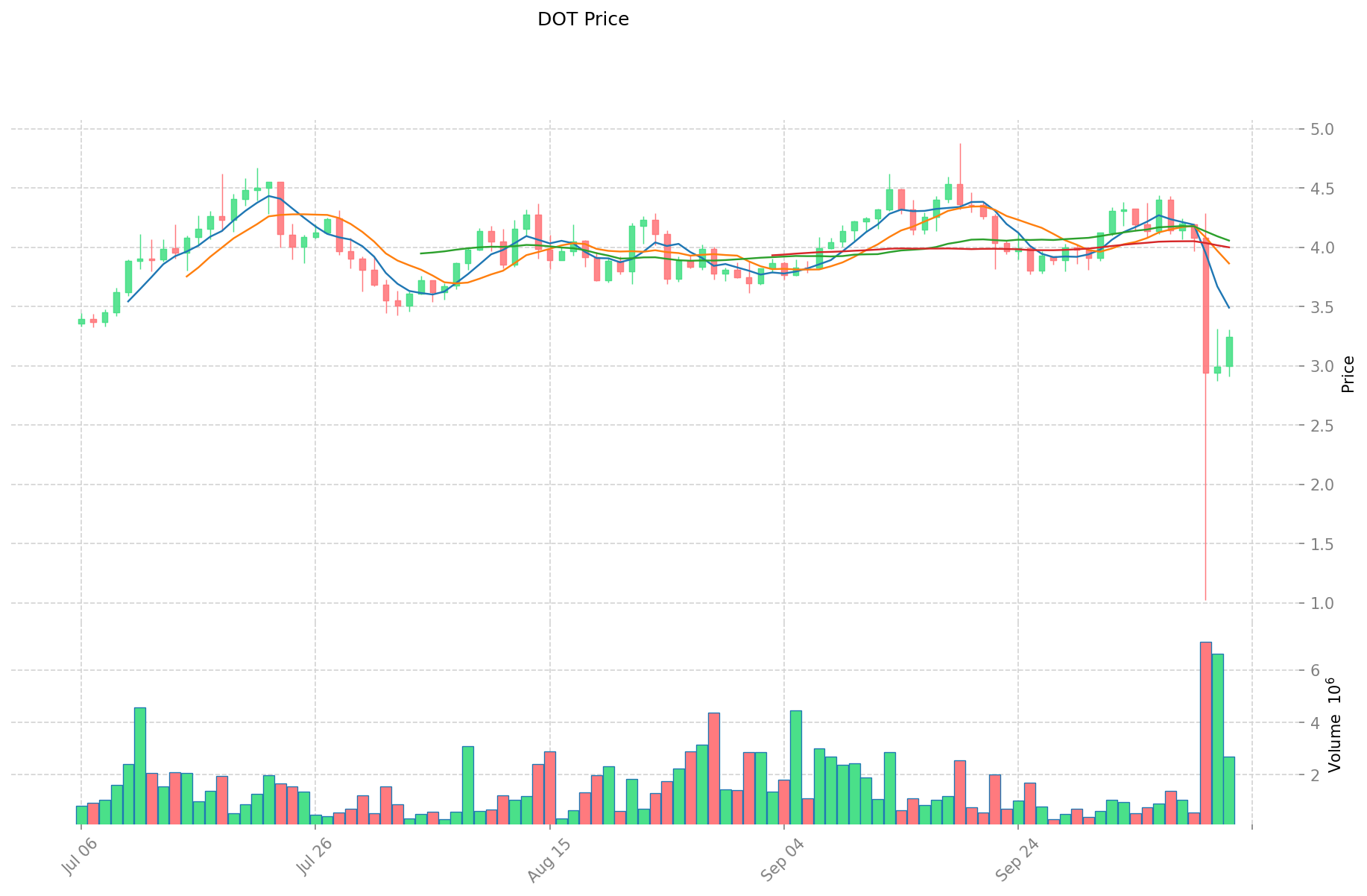

Güncel Piyasa Durumu (13 Ekim 2025)

- GMEE güncel fiyatı: $0,0026054

- DOT güncel fiyatı: $3,252

- 24 saatlik işlem hacmi: GMEE $40.743,27 – DOT $8.269.050,44

- Piyasa Duyarlılık Endeksi (Korku & Açgözlülük Endeksi): 38 (Korku)

Anlık fiyatları görmek için tıklayın:

- GMEE güncel fiyatı Piyasa Fiyatı

- DOT güncel fiyatı Piyasa Fiyatı

II. GMEE ve DOT Yatırım Değerini Etkileyen Temel Faktörler

Arz Mekanizmaları Karşılaştırması (Tokenomik)

- GMEE: Oyun ekosistemine odaklı, sınırlı arzlı bir oyun tokenı

- DOT: Staking ödülleri sunan enflasyonist modelde, Polkadot ağı için yönetişim odaklı token

- 📌 Tarihsel örüntü: Arz mekanizmaları, ağ kullanımı ve yönetişim katılımı yoluyla fiyat döngülerini belirler.

Kurumsal Benimseme ve Piyasa Uygulamaları

- Kurumsal portföyler: DOT, altyapı odağı sayesinde daha fazla kurumsal ilgi çekmektedir

- Kurumsal kullanım: DOT, blok zinciri altyapısı ve zincirler arası birlikte çalışabilirlikte daha güçlü bir konuma sahipken; GMEE, oyun sektörüne odaklanmaktadır

- Regülasyon yaklaşımları: Oyun tokenları, çoğu ülkede altyapı tokenlarına göre daha az düzenleyici incelemeye maruz kalmaktadır

Teknik Gelişim ve Ekosistem Oluşumu

- GMEE teknik odağı: Mobil oyun entegrasyonu ve kazan-kazan (play-to-earn) mekanizmaları

- DOT teknik gelişimi: Parachain açık artırmaları, zincirler arası birlikte çalışabilirlik ve ölçeklenebilirlik çözümleri

- Ekosistem karşılaştırması: DOT, DeFi ve akıllı sözleşme uygulamalarında daha geniş bir kapsama sahipken, GMEE özellikle oyun NFT’leri ve eğlence uygulamalarında uzmanlaşmıştır

Makroekonomik Faktörler ve Piyasa Döngüleri

- Enflasyon döneminde performans: DOT gibi altyapı tokenları, oyun tokenlarına kıyasla genellikle daha istikrarlı seyretmektedir

- Para politikası etkileri: Faiz oranlarındaki değişimler, DOT’un staking getirisini doğrudan etkiler

- Jeopolitik etkenler: Sınır ötesi blok zinciri talebindeki artış, DOT’un birlikte çalışabilirlik odağını öne çıkarır

III. 2025-2030 Fiyat Tahmini: GMEE ve DOT

Kısa Vadeli Tahmin (2025)

- GMEE: Muhafazakâr $0,002332601 – $0,0026209 | İyimser $0,0026209 – $0,003878932

- DOT: Muhafazakâr $3,01041 – $3,237 | İyimser $3,237 – $4,5318

Orta Vadeli Tahmin (2027)

- GMEE, $0,0032638906388 – $0,0042076662452 aralığında bir büyüme evresine girebilir

- DOT ise $2,6064324 – $5,6401488 aralığında boğa piyasası yaşayabilir

- Başlıca etkenler: Kurumsal sermaye girişi, ETF’ler, ekosistem büyümesi

Uzun Vadeli Tahmin (2030)

- GMEE: Temel senaryo $0,004895333102759 – $0,005189053088925 | İyimser senaryo $0,005189053088925+

- DOT: Temel senaryo $6,2842153374 – $7,666742711628 | İyimser senaryo $7,666742711628+

Feragat: Yukarıdaki tahminler, geçmiş veriler ve mevcut piyasa eğilimlerine dayanmaktadır. Kripto para piyasaları yüksek volatiliteye sahip olup anlık değişim gösterebilir. Bu öngörüler yatırım tavsiyesi değildir. Yatırım kararı almadan önce mutlaka kendi araştırmanızı yapınız.

GMEE:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,003878932 | 0,0026209 | 0,002332601 | 0 |

| 2026 | 0,00461488072 | 0,003249916 | 0,00175495464 | 24 |

| 2027 | 0,0042076662452 | 0,00393239836 | 0,0032638906388 | 50 |

| 2028 | 0,005575944254562 | 0,0040700323026 | 0,002564120350638 | 56 |

| 2029 | 0,004967677926938 | 0,004822988278581 | 0,00332786191222 | 85 |

| 2030 | 0,005189053088925 | 0,004895333102759 | 0,003720453158097 | 87 |

DOT:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 4,5318 | 3,237 | 3,01041 | 0 |

| 2026 | 4,66128 | 3,8844 | 2,71908 | 20 |

| 2027 | 5,6401488 | 4,27284 | 2,6064324 | 32 |

| 2028 | 7,18691688 | 4,9564944 | 3,46954608 | 53 |

| 2029 | 6,4967250348 | 6,07170564 | 4,6752133428 | 87 |

| 2030 | 7,666742711628 | 6,2842153374 | 3,582002742318 | 94 |

IV. Yatırım Stratejisi Karşılaştırması: GMEE ve DOT

Uzun Vadeli ve Kısa Vadeli Yatırım Stratejileri

- GMEE: Oyun ekosistemi ve NFT potansiyeline odaklanan yatırımcılar için uygundur

- DOT: Blok zinciri altyapısına ve birlikte çalışabilirlik çözümlerine yatırım yapmak isteyenler için uygundur

Risk Yönetimi ve Varlık Dağılımı

- Temkinli yatırımcılar: GMEE %10 – DOT %90

- Agresif yatırımcılar: GMEE %30 – DOT %70

- Koruma araçları: Stablecoin tahsisi, opsiyonlar, döviz çeşitlendirmesi

V. Potansiyel Risk Karşılaştırması

Piyasa Riskleri

- GMEE: Niş pazar odağı nedeniyle yüksek oynaklık

- DOT: Genel kripto piyasa dalgalanmalarına ve diğer Layer 1 protokollerden gelen rekabete duyarlı

Teknik Riskler

- GMEE: Oyun uygulamalarında ölçeklenebilirlik ve ağ istikrarı

- DOT: Parachain açık artırma süreçleri ve zincirler arası güvenlik riskleri

Regülasyon Riskleri

- Küresel regülasyon politikaları, DOT’un daha geniş altyapı rolü nedeniyle daha büyük etki yaratabilir

VI. Sonuç: Hangisi Daha Avantajlı Yatırım?

📌 Yatırım Değeri Özeti:

- GMEE avantajları: Oyun ekosistemine özel yapı, oyun sektöründe hızlı büyüme potansiyeli

- DOT avantajları: Yerleşik altyapı, güçlü kurumsal destek, zincirler arası birlikte çalışabilirlik odağı

✅ Yatırım Tavsiyesi:

- Yeni başlayan yatırımcılar: Blok zinciri altyapısına erişim için DOT’a küçük bir pay ayırabilir

- Deneyimli yatırımcılar: GMEE ve DOT’u birlikte içeren dengeli bir portföy, risk iştahına göre dağıtılabilir

- Kurumsal yatırımcılar: DOT’a daha yüksek oran vererek yerleşik pozisyondan ve ekosistem potansiyelinden yararlanabilir

⚠️ Risk Uyarısı: Kripto para piyasasında yüksek volatilite söz konusudur. Bu makale yatırım tavsiyesi niteliği taşımaz. None

VII. SSS

S1: GMEE ve DOT arasındaki temel farklar nelerdir? C: GMEE, sınırlı arza sahip oyun odaklı bir token’dır; DOT ise blok zinciri altyapısı ve zincirler arası birlikte çalışabilirlik için tasarlanmış enflasyonist bir tokendir. GMEE oyun ekosistemini hedeflerken, DOT Polkadot ağına zincirler arası çözümler ve yönetişim sunuyor.

S2: Hangi token geçmişte daha fazla fiyat istikrarı gösterdi? C: DOT, GMEE’ye kıyasla daha istikrarlı bir fiyat performansı sergilemiştir. 2022 ayı piyasasında DOT dayanıklılığını ve piyasa değerini korurken, GMEE zirveden sert bir düşüş yaşamıştır.

S3: GMEE ve DOT’un güncel piyasa durumu nasıl? C: 13 Ekim 2025 itibarıyla GMEE’nin fiyatı $0,0026054 ve 24 saatlik işlem hacmi $40.743,27; DOT’un ise fiyatı $3,252 ve 24 saatlik işlem hacmi $8.269.050,44’tür. DOT, daha yüksek likidite ve işlem hacmine sahiptir.

S4: GMEE ve DOT’un yatırım değerini etkileyen kilit faktörler nelerdir? C: Temel faktörler; arz mekanizmaları, kurumsal benimseme, teknik gelişim, ekosistem oluşturma ve makroekonomi olarak sıralanır. DOT genellikle kurumsal yatırımcı ilgisi ve ekosistem uygulamaları bakımından daha güçlüdür.

S5: GMEE ve DOT için uzun vadeli fiyat tahminleri nasıl farklılaşıyor? C: 2030 için GMEE’nin temel senaryo tahmini $0,004895333102759 – $0,005189053088925 aralığındayken, DOT’un temel senaryo tahmini $6,2842153374 – $7,666742711628 bandındadır. DOT, daha yüksek fiyat artışı potansiyeline sahip görünmektedir.

S6: GMEE ve DOT yatırımlarıyla ilgili başlıca riskler nelerdir? C: GMEE, niş pazar odağı ve olası ölçeklenebilirlik sorunları nedeniyle yüksek volatiliteye sahiptir. DOT ise genel kripto piyasa eğilimleri, Layer 1 rekabeti ve daha geniş altyapı rolü nedeniyle regülasyon risklerine daha açıktır.

S7: Farklı yatırımcı tipleri için hangi token öneriliyor? C: Yeni başlayanlar için DOT’a küçük bir payla blok zinciri altyapısına giriş önerilir. Deneyimli yatırımcılar, GMEE ve DOT’tan oluşan dengeli bir portföy oluşturabilir. Kurumsal yatırımcılar için ise DOT’un yerleşik konumu ve ekosistem potansiyeli nedeniyle daha yüksek bir pay önerilir.

BDG ve ETC: Kurumsal Çözümlerde Blockchain Teknolojilerinin Yarışı

MBOX ve DOT: E-posta depolama formatları arasındaki farkları anlamak

WNCG vs XTZ: 2023 Yılında Blockchain Protokollerinin Performansı ve Yatırım Potansiyelinin Karşılaştırılması

VICE Token (VICE) iyi bir yatırım mı?: Dijital varlık sektöründe piyasa potansiyeli ve risk faktörlerinin incelenmesi

FPS ve DOT: Modern oyunlarda kare hızları ile zaman içinde hasar değerlerinin karşılaştırılması

ZEUM ve AVAX: Kripto Para Ekosisteminde Öne Çıkan İki Yıldızın Karşılaştırılması

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması