GHO vs ICP: Comparing Aave's Stablecoin to Internet Computer's Native Token

Introduction: GHO vs ICP Investment Comparison

In the cryptocurrency market, the comparison between GHO and ICP has been an unavoidable topic for investors. The two not only show significant differences in market cap ranking, application scenarios, and price performance, but also represent different positions in the crypto asset space.

GHO (GHO): Since its launch, it has gained market recognition as a decentralized, over-collateralized stablecoin native to the Aave Protocol.

Internet Computer (ICP): Introduced in 2021, it has been hailed as a "World Computer" capable of running any online system or service entirely on-the-blockchain.

This article will comprehensively analyze the investment value comparison between GHO and ICP, focusing on historical price trends, supply mechanisms, institutional adoption, technological ecosystems, and future predictions, attempting to answer the question investors care about most:

"Which is the better buy right now?"

I. Price History Comparison and Current Market Status

GHO and ICP Historical Price Trends

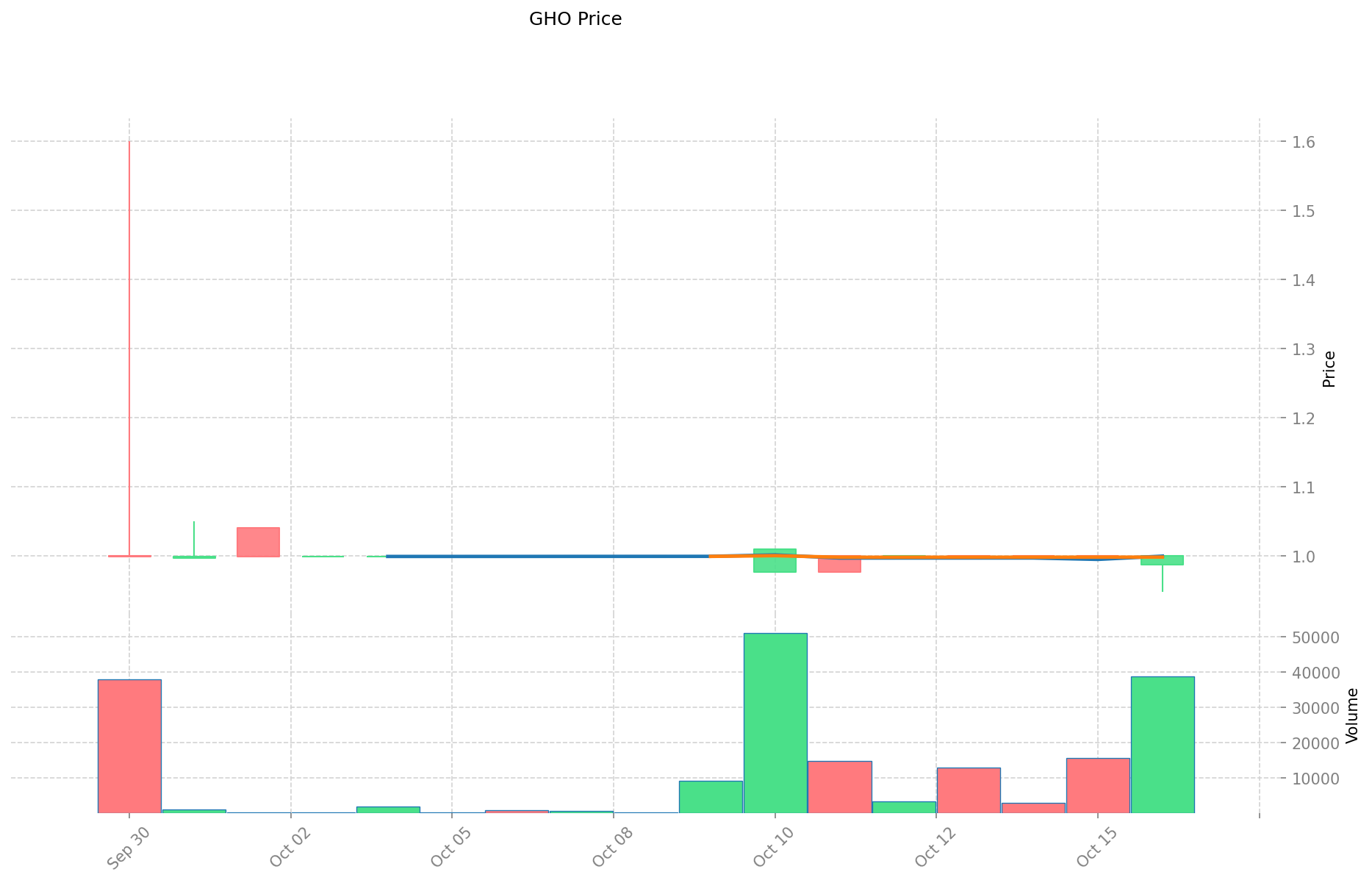

- 2025: GHO maintained a stable price around $1, as designed for a stablecoin.

- 2025: ICP experienced significant volatility, dropping from a high of $700.65 to a low of $2.23.

- Comparative analysis: While GHO remained stable as a stablecoin, ICP showed extreme price fluctuations in the market cycle.

Current Market Situation (2025-10-17)

- GHO current price: $1.00

- ICP current price: $3.15

- 24-hour trading volume: GHO $36,715.71 vs ICP $3,856,043.65

- Market Sentiment Index (Fear & Greed Index): 28 (Fear)

Click to view real-time prices:

- Check GHO current price Market Price

- Check ICP current price Market Price

Analysis of GHO and ICP Investment Value Factors

I. Core Factors Influencing GHO vs ICP Investment Value

Supply Mechanism Comparison (Tokenomics)

- GHO: Decentralized, multi-collateral stablecoin with value pegged to USD; supply determined by collateral deposits and governed by Aave DAO

- ICP: Supply mechanism influenced by development needs and network adoption; subject to volatility based on Internet Computer protocol performance

- 📌 Historical Pattern: Stablecoins like GHO typically maintain price stability through collateral mechanisms, while ICP experiences more price cyclicality based on adoption metrics.

Institutional Adoption and Market Applications

- Institutional Holdings: GHO benefits from Aave's established DeFi presence, while ICP has backing from DFINITY Foundation and venture capital firms

- Enterprise Adoption: GHO serves as a DeFi liquidity instrument and settlement layer; ICP functions as infrastructure for decentralized applications and services

- Regulatory Stance: Stablecoins face increasing regulatory scrutiny globally (GENIUS Act in US, Hong Kong's Stablecoin Ordinance), while ICP operates in a less defined regulatory environment

Technical Development and Ecosystem Building

- GHO Technical Structure: Built on Aave's lending protocol with multi-collateral mechanisms and DAO governance; benefits from integration with existing DeFi infrastructure

- ICP Technology: Internet Computer protocol aims to extend blockchain capabilities with web-speed performance and lower costs; focuses on creating a decentralized alternative to traditional cloud services

- Ecosystem Comparison: GHO embedded within mature DeFi ecosystem with established liquidity pools and lending markets; ICP building developer tools and applications for decentralized web services

Macroeconomic Factors and Market Cycles

- Inflation Environment: GHO designed to maintain stable value during inflationary periods; ICP more vulnerable to market sentiment shifts during economic uncertainty

- Monetary Policy Impact: Interest rate changes potentially affect GHO stability mechanisms and collateralization requirements; ICP price may experience higher correlation with broader crypto market movements

- Geopolitical Factors: GHO could benefit from demand for stable digital assets during financial instability; ICP's adoption depends on global acceptance of decentralized infrastructure

II. Risk Assessment and Long-term Viability

Stability Mechanisms and Trust Factors

- GHO: Stability depends on collateral quality, governance effectiveness, and regulatory compliance

- ICP: Value tied to Internet Computer protocol adoption, developer community growth, and technological advancement

- Trust Dependencies: Both rely on community support but through different mechanisms - GHO through collateral verification and ICP through network participation

III. 2025-2030 Price Prediction: GHO vs ICP

Short-term Prediction (2025)

- GHO: Conservative $0.82-$1.00 | Optimistic $1.00-$1.16

- ICP: Conservative $2.041-$3.14 | Optimistic $3.14-$3.5168

Mid-term Prediction (2027)

- GHO may enter a growth phase, expected price range $1.067256-$1.554768

- ICP may enter a consolidation phase, expected price range $2.8832265-$4.0065615

- Key drivers: Institutional capital inflow, ETFs, ecosystem development

Long-term Prediction (2030)

- GHO: Base scenario $1.129689408744-$2.0920174236 | Optimistic scenario $2.0920174236-$2.280298991724

- ICP: Base scenario $4.49914825978425-$4.837793827725 | Optimistic scenario $4.837793827725-$6.579399605706

Disclaimer

GHO:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 1.16 | 1 | 0.82 | 0 |

| 2026 | 1.5552 | 1.08 | 1.0044 | 8 |

| 2027 | 1.554768 | 1.3176 | 1.067256 | 31 |

| 2028 | 2.13991416 | 1.436184 | 0.80426304 | 43 |

| 2029 | 2.3959857672 | 1.78804908 | 1.34103681 | 78 |

| 2030 | 2.280298991724 | 2.0920174236 | 1.129689408744 | 109 |

ICP:

| 年份 | 预测最高价 | 预测平均价格 | 预测最低价 | 涨跌幅 |

|---|---|---|---|---|

| 2025 | 3.5168 | 3.14 | 2.041 | 0 |

| 2026 | 4.1605 | 3.3284 | 3.16198 | 5 |

| 2027 | 4.0065615 | 3.74445 | 2.8832265 | 18 |

| 2028 | 4.6118518425 | 3.87550575 | 2.402813565 | 23 |

| 2029 | 5.4319088592 | 4.24367879625 | 2.800828005525 | 34 |

| 2030 | 6.579399605706 | 4.837793827725 | 4.49914825978425 | 53 |

IV. Investment Strategy Comparison: GHO vs ICP

Long-term vs Short-term Investment Strategies

- GHO: Suitable for investors seeking stable value and DeFi liquidity solutions

- ICP: Suitable for investors interested in decentralized cloud computing potential

Risk Management and Asset Allocation

- Conservative investors: GHO: 70% vs ICP: 30%

- Aggressive investors: GHO: 40% vs ICP: 60%

- Hedging tools: Stablecoin allocation, options, cross-currency portfolios

V. Potential Risk Comparison

Market Risks

- GHO: Collateral volatility, liquidity risks in extreme market conditions

- ICP: High price volatility, susceptibility to market sentiment shifts

Technical Risks

- GHO: Smart contract vulnerabilities, governance attacks

- ICP: Scalability challenges, network stability issues

Regulatory Risks

- Global regulatory policies may impact GHO more due to increased scrutiny on stablecoins, while ICP faces less defined regulatory environment

VI. Conclusion: Which Is the Better Buy?

📌 Investment Value Summary:

- GHO advantages: Stable value, integration with DeFi ecosystem, potential for consistent returns

- ICP advantages: Innovative technology, potential for high growth if widely adopted

✅ Investment Advice:

- New investors: Consider a higher allocation to GHO for stability

- Experienced investors: Balanced approach with both GHO and ICP based on risk tolerance

- Institutional investors: Strategic allocation to both, with GHO for liquidity management and ICP for long-term technological bet

⚠️ Risk Warning: Cryptocurrency markets are highly volatile. This article does not constitute investment advice. None

VII. FAQ

Q1: What are the key differences between GHO and ICP? A: GHO is a stablecoin pegged to USD, while ICP is a volatile cryptocurrency. GHO is built on the Aave protocol for DeFi applications, whereas ICP aims to create a decentralized "World Computer" infrastructure.

Q2: Which has shown better price stability, GHO or ICP? A: GHO, as a stablecoin, has maintained a steady price around $1. ICP has experienced significant volatility, with prices ranging from $700.65 to $2.23.

Q3: How do the supply mechanisms of GHO and ICP differ? A: GHO's supply is determined by collateral deposits and governed by Aave DAO. ICP's supply is influenced by development needs and network adoption, subject to protocol performance.

Q4: What are the main use cases for GHO and ICP? A: GHO serves as a DeFi liquidity instrument and settlement layer. ICP functions as infrastructure for decentralized applications and services, aiming to replace traditional cloud services.

Q5: How do regulatory factors affect GHO and ICP? A: Stablecoins like GHO face increasing regulatory scrutiny globally. ICP operates in a less defined regulatory environment but may be subject to future regulations on decentralized infrastructure.

Q6: What are the predicted price ranges for GHO and ICP by 2030? A: GHO is predicted to range from $1.129689408744 to $2.280298991724. ICP is expected to range from $4.49914825978425 to $6.579399605706.

Q7: Which investment strategy is recommended for each asset? A: GHO is suitable for investors seeking stable value and DeFi liquidity solutions. ICP is more appropriate for those interested in the potential of decentralized cloud computing and willing to accept higher volatility.

Q8: What are the primary risks associated with investing in GHO and ICP? A: GHO risks include collateral volatility and potential smart contract vulnerabilities. ICP faces high price volatility, scalability challenges, and network stability issues. Both are subject to evolving regulatory landscapes.

Share

Content