FF ve THETA: Blockchain Oyununda Liderlik Yarışı

Giriş: FF ve THETA Yatırım Karşılaştırması

Kripto para piyasasında Falcon Finance (FF) ile Theta (THETA) arasındaki karşılaştırma, yatırımcılar için daima göz ardı edilmez bir başlık olmuştur. Her iki proje, piyasa değeri sıralaması, uygulama alanları ve fiyat performansı bakımından kayda değer farklılıklar gösterirken, kripto varlıkları içinde birbirinden farklı pozisyonları da temsil etmektedir.

Falcon Finance (FF): Piyasaya çıkışından itibaren, sürdürülebilir getiri fırsatları sunan evrensel teminat altyapı protokolü sayesinde piyasada dikkat çekmiştir.

Theta (THETA): 2017’den beri merkeziyetsiz video akış platformu olarak anılmakta olup, küresel işlem hacmi ve piyasa değeri açısından önde gelen kripto paralar arasındadır.

Bu makalede, FF ve THETA’nın yatırım değerleri ayrıntılı biçimde karşılaştırılacak; tarihsel fiyat eğilimlerinden arz mekanizmasına, kurumsal benimsemeden teknoloji ekosistemine ve gelecek öngörülerine kadar çok boyutlu bir analiz sunulacak ve yatırımcıların en çok yanıt aradığı şu soruya odaklanılacaktır:

"Şu anda hangisinin alımı daha avantajlı?"

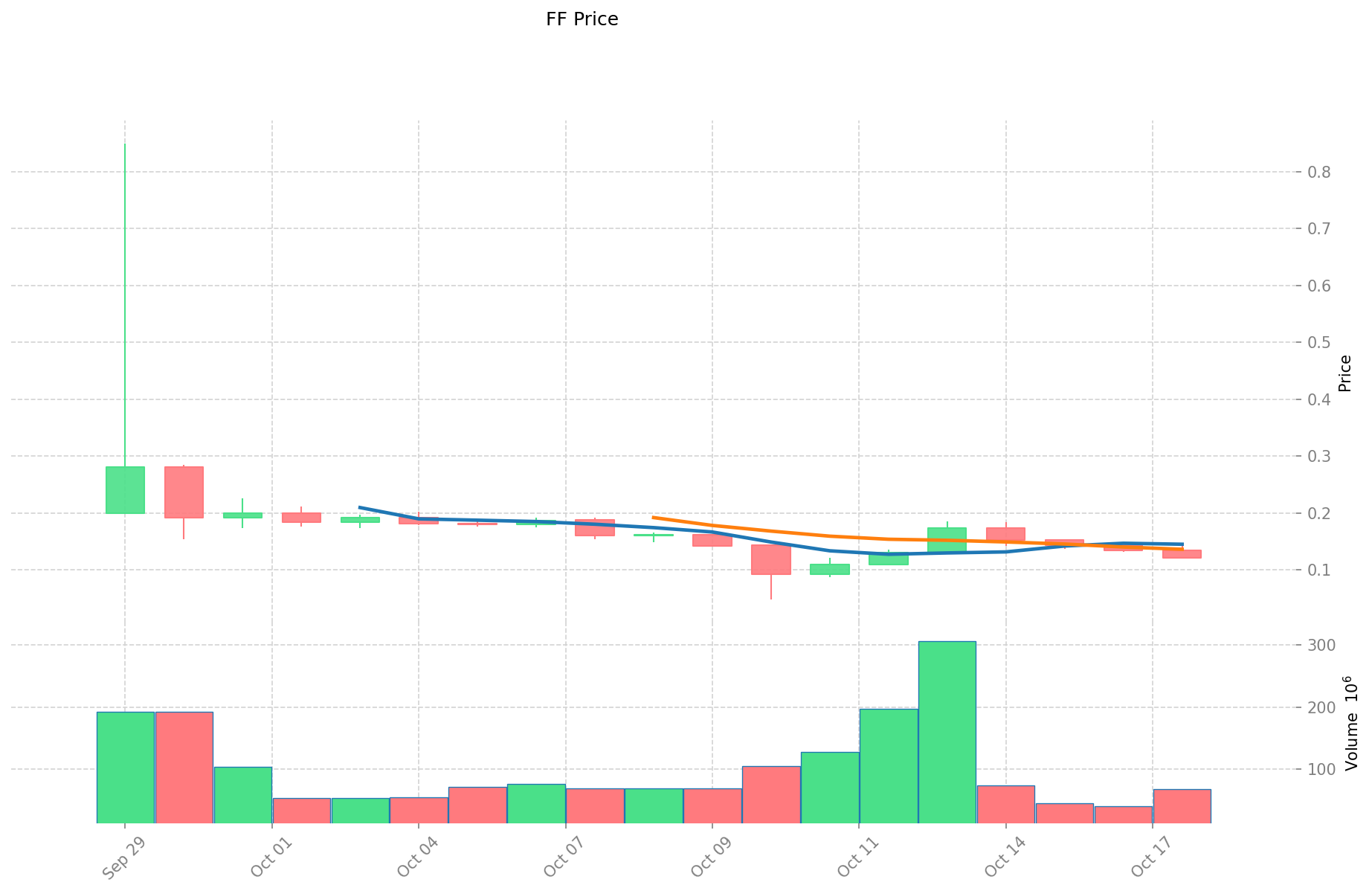

I. Fiyat Geçmişi Karşılaştırması ve Mevcut Piyasa Durumu

FF (Coin A) ve THETA (Coin B) Tarihsel Fiyat Eğilimleri

- 2025: FF, 29 Eylül’de $0,85 ile tüm zamanların zirvesini görmüş, 10 Ekim’de ise $0,04786 ile en düşük seviyesine gerilemiştir.

- 2021: THETA, 16 Nisan’da $15,72 ile en yüksek değerine ulaşmıştır ve bu, proje için önemli bir kilometre taşıdır.

- Karşılaştırmalı Analiz: Son piyasa döngüsünde FF, sadece 11 günde $0,85’ten $0,04786’ya düşerek sert dalgalanmalar yaşamıştır. THETA ise 2021’deki zirveden sonra daha yavaş bir gerileme göstererek, şu an $0,5408 seviyesinden işlem görmektedir.

Mevcut Piyasa Durumu (18 Ekim 2025)

- FF güncel fiyat: $0,12176

- THETA güncel fiyat: $0,5408

- 24 saatlik işlem hacmi: FF $8.755.241 – THETA $662.250

- Piyasa Duyarlılık Endeksi (Korku & Açgözlülük): 22 (Aşırı Korku)

Anlık fiyatları görmek için tıklayın:

- FF güncel fiyatı: Piyasa Fiyatı

- THETA güncel fiyatı: Piyasa Fiyatı

II. FF ve THETA Yatırım Değerini Etkileyen Temel Faktörler

Arz Mekanizması Karşılaştırması (Tokenomics)

- FF: 23.4 milyon ile sabitlenmiş arz; platform gelirlerinin token yakımında kullanıldığı deflasyonist model.

- THETA: Toplamda 1 milyar sabit token arzı; yeni token üretimi yok, THETA ve TFUEL’den oluşan çift token sistemi.

- 📌 Tarihi Perspektif: FF’nin deflasyonist modeli, zamanla kıtlık arttıkça fiyatı yukarı yönlü desteklerken, THETA’nın sabit arzı ve kullanım odaklı yapısı ağ benimsemesine bağlı değer artışına yol açar.

Kurumsal Benimseme ve Piyasa Uygulamaları

- Kurumsal Yatırımlar: THETA, Samsung NEXT, Sony Innovation Fund ve büyük blockchain VC’leri gibi güçlü yatırımcılar tarafından destekleniyor.

- Kurumsal Entegrasyon: THETA; Google, Samsung ve Sony ile iş ortaklıkları sağlarken FF, oyun ve içerik üretici ekonomisi entegrasyonuna odaklanıyor.

- Regülasyon: Her iki proje de benzer düzenleyici ortamlarda faaliyet gösteriyor; fakat THETA’nın büyük kurumsal iş birlikleri, regülasyon açısından avantaj sağlayabilir.

Teknik Gelişim ve Ekosistem Oluşumu

- FF Teknik Güncellemeleri: Gelişmiş işlem işleme yeteneği sunan FlamingoChain’in hayata geçirilmesi, oyun ve sosyal entegrasyona odaklanma.

- THETA Teknik Gelişim: 3.000’in üzerinde node’dan oluşan kenar ağ altyapısı, merkeziyetsiz video dağıtımı ve NFT pazar yeri uygulaması.

- Ekosistem Karşılaştırması: THETA, video akışı ve içerik dağıtımında güçlü altyapıya ve köklü iş ortaklıklarına sahipken; FF, oyun, sosyal medya ve içerik üretici ekonomisiyle yeni iş birlikleri geliştirmektedir.

Makroekonomik ve Piyasa Döngüleri

- Enflasyon Ortamında Performans: Her iki token için enflasyon ile ilgili geçmiş veri sınırlı olsa da FF’nin deflasyonist mekanizması teorik olarak daha iyi koruma sunar.

- Makro Para Politikası: Kripto varlıkların çoğunda olduğu gibi, her ikisi de faiz oranı ve dolar değerindeki değişikliklere hassastır; THETA’nın oturmuş kullanım alanı daha yüksek istikrar sağlar.

- Jeopolitik Unsurlar: THETA’nın video dağıtım altyapısı, küresel dijital içerik tüketiminden fayda sağlayabilir; FF’nin cazibesi ise bölgesel oyun ve sosyal medya regülasyonlarına bağlı olarak değişebilir.

III. 2025-2030 Fiyat Tahmini: FF vs THETA

Kısa Vadeli Tahmin (2025)

- FF: Muhafazakar $0,084868 - $0,12124 | İyimser $0,12124 - $0,1285144

- THETA: Muhafazakar $0,511765 - $0,5387 | İyimser $0,5387 - $0,678762

Orta Vadeli Tahmin (2027)

- FF, büyüme evresine geçebilir; beklenen fiyat aralığı $0,136428341 - $0,1996162042

- THETA, istikrara ulaşabilir; beklenen fiyat aralığı $0,34317210125 - $0,648907246

- Temel etkenler: Kurumsal sermaye, ETF’ler, ekosistem gelişimi

Uzun Vadeli Tahmin (2030)

- FF: Temel senaryo $0,21738154374307 - $0,232598251805084 | İyimser senaryo $0,232598251805084+

- THETA: Temel senaryo $0,688344895850287 - $0,867314568771362 | İyimser senaryo $0,867314568771362+

Feragatname

FF:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,1285144 | 0,12124 | 0,084868 | 0 |

| 2026 | 0,16234036 | 0,1248772 | 0,111140708 | 2 |

| 2027 | 0,1996162042 | 0,14360878 | 0,136428341 | 17 |

| 2028 | 0,192205991152 | 0,1716124921 | 0,156167367811 | 40 |

| 2029 | 0,25285384586014 | 0,181909241626 | 0,09823099047804 | 49 |

| 2030 | 0,232598251805084 | 0,21738154374307 | 0,132602741683272 | 78 |

THETA:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim Oranı |

|---|---|---|---|---|

| 2025 | 0,678762 | 0,5387 | 0,511765 | 0 |

| 2026 | 0,63916755 | 0,608731 | 0,56003252 | 12 |

| 2027 | 0,648907246 | 0,623949275 | 0,34317210125 | 15 |

| 2028 | 0,680978238735 | 0,6364282605 | 0,502778325795 | 17 |

| 2029 | 0,717986542083075 | 0,6587032496175 | 0,6060069896481 | 21 |

| 2030 | 0,867314568771362 | 0,688344895850287 | 0,488724876053704 | 27 |

IV. Yatırım Stratejisi Karşılaştırması: FF vs THETA

Uzun Vadeli ve Kısa Vadeli Yatırım Stratejileri

- FF: Oyun ve içerik üretici ekonomisinin potansiyeline odaklanan yatırımcılar için uygun

- THETA: Oturmuş video akış altyapısı ve iş ortaklıkları arayan yatırımcılar için uygun

Risk Yönetimi ve Varlık Dağılımı

- Temkinli yatırımcılar için: FF %30 – THETA %70

- Agresif yatırımcılar için: FF %60 – THETA %40

- Koruma araçları: Stablecoin tahsisi, opsiyonlar, çapraz para portföyleri

V. Potansiyel Risk Karşılaştırması

Piyasa Riski

- FF: Yüksek volatilite, görece yeni bir proje

- THETA: Video akışı pazarı büyümesine bağımlılık

Teknik Risk

- FF: Ölçeklenebilirlik, ağ istikrarı

- THETA: Node dağılımı, güvenlik açıkları

Regülasyon Riski

- Küresel regülasyon politikaları ikisini farklı şekilde etkileyebilir; THETA, güçlü kurumsal ortaklıkları sayesinde avantajlı olabilir

VI. Sonuç: Hangisi Daha Avantajlı Alım?

📌 Yatırım Değeri Özeti:

- FF’nin avantajları: Deflasyonist model, oyun ve sosyal entegrasyona odaklanma

- THETA’nın avantajları: Güçlü iş ortaklıkları, gelişmiş video akış altyapısı

✅ Yatırım Tavsiyesi:

- Yeni yatırımcılar: Dengeli portföy önerilir, THETA’nın köklü konumuna ağırlık verilebilir

- Tecrübeli yatırımcılar: Yüksek getiri için FF’yi değerlendirin, istikrar için THETA’yı elde tutun

- Kurumsal yatırımcılar: THETA’nın iş ortaklıklarını ve altyapısını analiz edin, FF’nin oyun sektöründeki büyümesini izleyin

⚠️ Risk Uyarısı: Kripto para piyasası yüksek volatiliteye sahiptir. Bu makale yatırım tavsiyesi değildir. None

VII. SSS

S1: FF ile THETA arasındaki temel farklar nelerdir? C: FF, oyun ve içerik üretici ekonomisine odaklanan, deflasyonist token modeline sahip yeni bir projedir. THETA ise sabit token arzına ve büyük kurumsal iş ortaklıklarına sahip, köklü bir video akış platformudur.

S2: Geçmişte hangi token daha iyi performans gösterdi? C: THETA, Nisan 2021’de $15,72 ile zirveye ulaşırken FF, Eylül 2025’te $0,85’e çıkarak sonrasında hızlı bir dalgalanma yaşamıştır. THETA’nın fiyat hareketleri genel olarak daha istikrarlıdır.

S3: FF ve THETA’nın arz mekanizması nasıl farklılaşıyor? C: FF, 23.4 milyon sabit token arzına ve deflasyonist modele sahipken; THETA, 1 milyar sabit token arzı ve çift token (THETA ve TFUEL) sistemini kullanır.

S4: Hangi proje kurumsal alanda daha güçlü? C: THETA, Samsung NEXT, Sony Innovation Fund gibi yatırımcılar ve Google ile Sony iş ortaklıklarına sahipken; FF, oyun ve sosyal medya alanlarında iş birliklerini geliştirme aşamasındadır.

S5: Projelerin teknik açıdan öne çıkan yönleri nelerdir? C: FF, gelişmiş işlem işleme için FlamingoChain’i kullanır ve oyun ile sosyal entegrasyona odaklanır. THETA ise 3.000+ node’dan oluşan kenar ağ altyapısı, merkeziyetsiz video dağıtımı ve NFT pazar yeri sunar.

S6: FF ve THETA’nın uzun vadeli fiyat tahminleri nasıl karşılaştırılıyor? C: 2030’da FF’nin temel senaryosu $0,21738154374307 - $0,232598251805084, THETA’nın ise $0,688344895850287 - $0,867314568771362 aralığındadır. Her iki projede de iyimser senaryolar mümkündür.

S7: FF ve THETA’ya yatırımda başlıca riskler nelerdir? C: FF’de yüksek volatilite ve yeni olma riski, THETA’da ise video akışı pazarının büyümesine bağlı riskler öne çıkar. Her iki projede regülasyon ve teknik riskler bulunmakla birlikte, FF ölçeklenebilirlik açısından daha fazla zorluk yaşayabilir.

S8: Yatırımcılar portföy dağılımında FF ve THETA’ya nasıl ağırlık vermeli? C: Temkinli yatırımcılar FF’ye %30, THETA’ya %70; agresif yatırımcılar FF’ye %60, THETA’ya %40 ayırabilir. Nihai oranlar, kişinin risk iştahına ve yatırım hedeflerine göre belirlenmelidir.

2025 AXS Fiyat Tahmini: Boğa Koşusu Analizi ve Oyun Token Pazarında Stratejik Yatırım Fırsatları

2025 ORBR Fiyat Tahmini: Uzun Vadeli Yatırımcılar İçin Büyüme Potansiyeli ile Piyasa Faktörlerinin Analizi

2025 MON Fiyat Tahmini: Piyasa Trendleri ve Yatırımcılar İçin Büyüme Potansiyeli Analizi

Guild of Guardians (GOG) iyi bir yatırım mı?: Bu blokzincir tabanlı mobil RPG'nin potansiyelini ve risklerini değerlendiriyoruz

SUPE (SUPE) iyi bir yatırım mı?: Bu yükselen kripto paranın potansiyelini ve risklerini değerlendiriyoruz

READY (READY) iyi bir yatırım mı?: Yeni yatırımcılar için piyasa potansiyeli ve risk faktörlerinin analizi

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması