EigenLayer ($EIGEN): Ethereum Restaking Revolution, Price History & Predictions

EigenLayer ve $EIGEN'e Giriş

EigenLayer, Ethereum üzerine inşa edilmiş yenilikçi bir “yeniden bahis yapma” protokolüdür. Bu protokol, kullanıcıların bahis yaptıkları ETH'lerini yeni ağları ve hizmetleri güvence altına almak için tekrar kullanmalarına olanak tanır. Daha basit bir ifadeyle, EigenLayer, Ethereum denetleyicilerinin ve bahisçilerinin, Ethereum'dan başka modüler blockchain bileşenlerini (Active Validation Services veya AVS'ler olarak adlandırılır) doğrulamak için katılmalarına izin verir. ETH'lerini (veya stETH gibi likit bahis jetonlarını) yeniden bahis yaparak, katılımcılar diğer projelerin güvenliğini güçlendirir ve bu şekilde ekstra ödüller kazanırlar. Bu, merkezi olmayan güven pazarı oluşturur: yeni protokoller, kendi denetleyici setlerini başlatmadan Ethereum'un güvenliğinden yararlanabilir ve bahisçiler getirilerini bileşik yapma fırsatı elde eder.

EigenLayer’ın yerel jetonu $EIGEN, bu ekosistemde önemli bir rol oynar – yanı sıra ETH ile kullanılan ve teşvikleri hizalamak ve ağı yönetmek için “Evrensel İntersubjektif Çalışma Jetonu” olarak adlandırılır. Esasen, katılımcılar tarafından off-chain veri erişilebilirliğini desteklemek ve EigenLayer doğrulayıcıları hatalı davranış sergilerse kesme (cezalar) için teminat sağlamak için $EIGEN yatırılır.

Proje 2023'te başlatıldı ve hızla Ethereum çevrelerinde bir sıcak konu haline geldi, çünkü staked ETH'yi maksimum güvenlik ve verimlilik için 'rehypothecate' etme cesaretli girişimiyle dikkat çekti. Bu, Ethereum'un ölçeklenebilirliği ve DeFi'nin geleceği için heyecan verici bulunan, son derece deneysel bir fikir - ama keskin bir kenar.

Keyifli tarafı düşünürken, EigenLayer'ı ETH'nizi iki kat iş yapar gibi düşünebilirsiniz - stake edilmiş ETH'nizin spor salonuna gittiğini ve işte fazladan vardiya aldığını hayal edin. 🏋️♀️ Kripto tutkunlarını heyecanlandıran yeni bir konsept, destekçilerin bunu ağ güvenliği ve getiri açlığı olan stakerlar için kazan-kazan olarak görmesini sağlıyor.

Tabii ki, yeniden bahis oynamak risklerle doludur (kesme, hizmetler başarısız olursa veya kötü niyetli davranırlarsa fon kaybetmenize neden olabilir), bu nedenle $EIGEN ve EigenLayer teknik karmaşıklık ve dikkatli oyun teorisi ile birlikte gelir. Ancak vizyon, güven ve güvenlik modüler bir Ethereum haline geldiğinde açık bir pazar haline gelir - ve EigenLayer bu konuda öncülük ediyor.

Şimdi $EIGEN fiyatının jeton lansmanından bu yana nasıl performans gösterdiğine ve kristal topunun geleceği için neler tuttuğuna bir bakalım.

EigenLayer Fiyat Geçmişi Başlangıcından Beri (Mayıs 2024 - Şu Anda)

EigenLayer’ın $EIGEN tokenı 2024 yılında büyük bir heyecanla piyasaya çıktı ve ilk yılında dramatik fiyat dalgalanmaları yaşadı. Token’ın Token Üretim Etkinliği (TGE) Mayıs 2024'te gerçekleşti ve başlangıçta topluluk havuzundan dağıtım yapıldı ve talep süreci yaşandı (önemli bir şekilde, düzenleyici endişeler nedeniyle ABD kullanıcılarını hariç tuttu). $EIGEN hala büyük borsalarda listelenmeden önce, kripto türev piyasalarındaki spekülatörler fiyatını yaklaşık $8–$10 olarak değerlendirdi – bu da büyük bir heyecan ve tamamen seyreltilmiş bir değerlemeye yaklaşık 15 milyar dolar işaret ediyor!

Once trading began, $EIGEN’s journey has been nothing short of a rollercoaster. Let’s break down the key milestones in its price action since launch:

- Mayıs 2024 (TGE):$EIGEN havuz havuzlama iddiaları için ilk aşama canlı hale geldi. Niche platformlardaki tüccarlar, borsa listelerinden önce token başına yaklaşık 9 $ spekülasyon yapıyor. Restaking'in poster çocuğu için heyecan gökyüzünde.

- Ekim 2024 (Borsa Debutu):$EIGEN transfer edilebilir hale gelir ve büyük borsalarda listelenir (örneğin Binance) yaklaşık ~$4.00 seviyesinde. İlk gün heyecanıyla ~$4.5 seviyesine yükselir, ardından erken sahipler kar elde edince ~$3.7 seviyesine geri düşer.

- Aralık 2024 (Tüm Zamanların En Yükseği):Büyük restaking hareketi ve kripto piyasasında yükseliş trendi, EIGEN'in Aralık ortasında zirvesinde yaklaşık 5.5 $'a yükselmesine neden oldu. Bu ATH, EigenLayer'da kilitlenen toplam değerin artışını ve işlemcilerin akınını yansıttı.

- 2025'in 1. Çeyreği (Geri Çekilme): Kripto kışı geri dönüyor – 2025'in 1. çeyreğinin sonlarına doğru $EIGEN düşüşler yaşanıyor. Kâr alımları, daha geniş piyasa düşüşleri ve büyük token kilitlerinin açılması, $EIGEN Nisan 2025'teki en düşük seviyesinde ~0,74 ABD dolarına düşürüyor. Ah! 5$+'dan FOMO'ya giren erken alıcılar kırmızının derinliklerinde ve Twitter duyarlılığı, "restaking" biraz parlaklığını kaybettiği için kısa bir süreliğine düşüşe geçiyor.

- Mayıs 2025 (Kurtarma):Acımasız düşüşten sonra, $EIGEN 2025'in ortasına kadar yaklaşık $1.50'ye toparlanıyor. Fırsat avcıları ve DeFi balinaları düşük seviyelerde biriktirme yapıyor gibi görünüyor ve EigenLayer'ın Nisan 2025'te ana ağda kesme işlemini etkinleştirmesi gibi olumlu gelişme haberleri güveni yeniden tesis etmeye yardımcı oluyor. Token hala ATH'nin yaklaşık %70 altında, ancak oynaklık, piyasa değerini bulmaya çalışan yeni bir projenin oyununun bir parçasıdır.

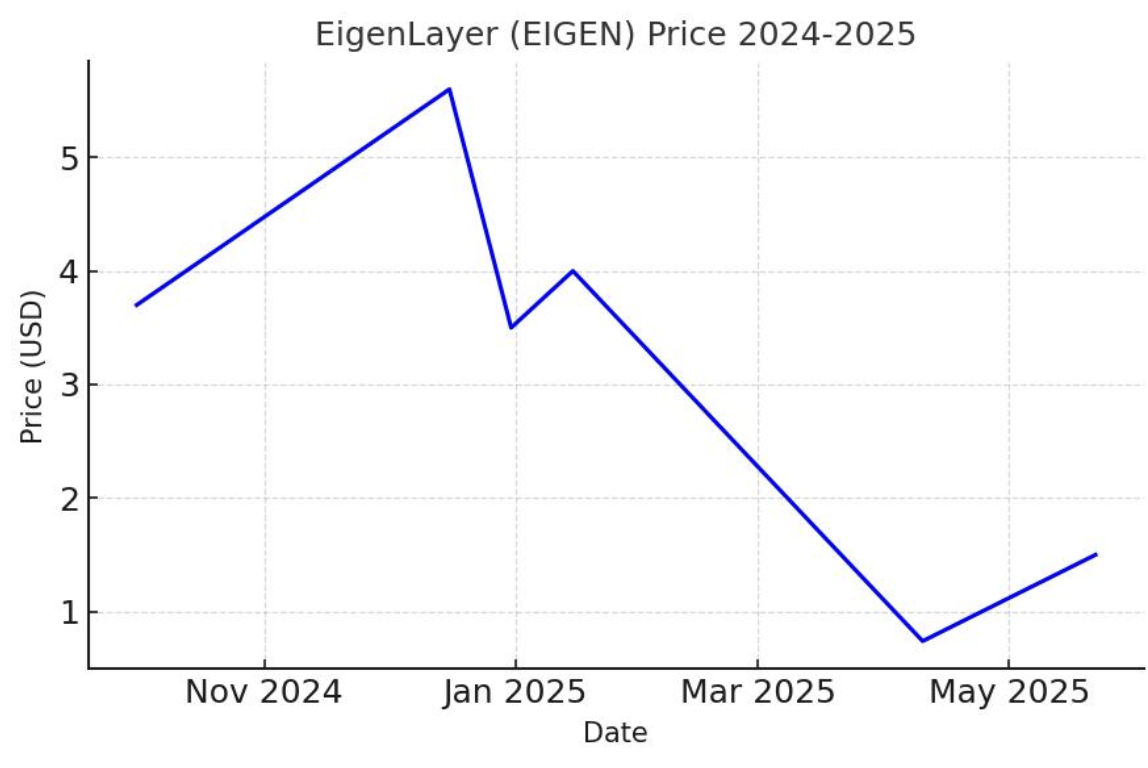

Lansmanından bu yana $EIGEN'in tarihi fiyat performansı. $4 civarında başlayan Oct '24'te, $EIGEN, 2025'in başlarına doğru derin bir düzeltme yaşamadan önce $5'in üzerinde bir zirve gördü. Şimdi ise düşüklerinden toparlanıyor.

Yukarıdaki mavi çizgi grafiği gösterdiği gibi, $EIGEN'in ilk yılı vahşi bir yolculuk oldu. Erken heyecan, yüksek bir zirveye yol açtı, ardından başlangıç heyecanı dinince klasik bir kripto düşüşü yaşandı. Temelde, EigenLayer dalgalı bir piyasaya başladı: güçlü temellere rağmen, hiçbir jeton daha genel kripto duygusundan bağışık değil.

$5'ten 1 dolardan az bir seviyeye hızlı düşüş acı vericiydi, ancak büyük ölçüde 2024 ICO/hava para tokenlarının kilidini açtıktan sonra birçok kişinin izlediği rota ile paralellik gösterdi. Olumlu tarafı, bu düşük fiyatlar EigenLayer'ın teknolojisinde uzun vadeli değer gören yeni inananları çekti. 2025'in ortasına gelindiğinde $EIGEN stabilize oldu ve tekrar yükselmeye başladı, bu da potansiyel bir dip seviyesinin 0.7 dolar civarında bulunduğunu gösteriyor. Geçmiş performans büyük oynaklık gösterirken aynı zamanda $EIGEN'ın olumlu haberlerle hızla yükselişe geçebileceğini de gösteriyor.

Özetle, TGE'den şimdiye kadar HODL ettiyseniz, zaten hem hype hem de FUD döngülerinden geçtiniz - ve bu coin için hala erken aşamalar.

Kısa Vadeli Fiyat Tahminleri (2025–2026)

2025 ve 2026 için $EIGEN fiyatı neyi getirecek? 2025 ve 2026 için kısa vadeli tahminler dikkatlice iyimser olmakla birlikte olası sonuçlar aralığına sahip. 2025 yılına gelindiğinde, EigenLayer ekosistemini olgunlaştırma konusunda daha fazla zaman geçirmiş olacak. Ethereum'un 2024 yarılanmasından sonraki boğa döngüsü devreye girerse, $EIGEN gibi altyapı jetonları için yenilenmiş talep görebiliriz.

Birçok analist, özellikle yeniden yatırımın ivme kazanması durumunda, $EIGEN'ın 2025'te $4 - $5 aralığına geri dönebileceğine inanıyor (bu da onu 2024 sonlarında zirvelerine yaklaştırabilir). Daha iyimser bir senaryoda, $EIGEN'ın bu zirveleri aşması bile mümkün - bazı topluluk tahminleri, güçlü bir kripto piyasası ve EigenLayer'ın kullanımında sürekli büyüme varsayımıyla, 2025 sonuna kadar $6 - $8 hedeflerini öne sürüyor. Konservatif bir senaryoda, piyasa durgun kalırsa ve benimseme yavaş olursa, $EIGEN 2025 boyunca $2 - $3 aralığında gezinebilir.

2026'ya bakıldığında, jetonun trajetuarı gerçek kullanıma ve ağ etkilerine bağlı olacaktır. 2026'da, restaking'in bir heves mi yoksa Ethereum'un yol haritasının temel bir parçası mı olduğunu bileceğiz. EigenLayer başarılı bir şekilde birçok AVS'yi (katman-2 ağları, oracle sistemleri vb. güvenliğini kullanan) devreye alırsa ve $EIGEN geniş çapta staked olursa, talep fiyatı orta tek hanelere doğru yükseltebilir.

Analizimiz, 2026 için $5 ile $7 arasında makul bir aralığı önermektedir; tam bir boğa piyasası, önemli benimseme ile aynı zamana denk gelirse $10'a kadar bir artış potansiyeli bulunmaktadır. Riskler arasında artan rekabet (diğer yeniden paylaşım veya modüler güvenlik projelerinin ortaya çıkması) veya heyecanı azaltabilecek teknik sorunlar bulunmaktadır. Ancak genel olarak, kısa vadeli görünüm boğa eğilimli: EigenLayer yeni bir kategoride ilk hamle yapan bir proje konumunda ve bu prestij, önümüzdeki birkaç yıl içinde fiyat artışını tetikleyebilir.

2025 ve 2026 yılı boyunca $EIGEN için tahmin edilen kısa vadeli fiyat eğilimi. Turuncu çizgi istikrarlı bir yükselişi gösteriyor ve uygun koşullar altında 2026 yılının sonuna kadar yaklaşık 6 doları aşma potansiyeline sahip.

Yukarıdaki grafikte gösterildiği gibi, kısa vadeli projeksiyonumuz, $EIGEN'in 2025 ve 2026 yılları boyunca yavaşça yükselmesini öngörüyor. Bu, gece yarısı hızlı yükselişler için bir çağrı değil, ancak proje vaatlerini yerine getirdikçe sürdürülebilir bir yükseliş eğilimidir. İzlenmesi gereken temel etkenler:

- Ethereum piyasa sağlığı- 2025 yılında ETH ve geniş kripto piyasası ralli yaparsa, muhtemelen bununla birlikte $EIGEN taşıyacak.

- Protokol kilometre taşlarıYeni EigenLayer özelliklerinin başarılı lansmanları (Örn. EigenDA veri erişimi veya büyük DeFi oyuncuları ile ortaklıklar) fiyat patlamalarını teşvik edebilir.

- Staking metrikleri- eğer EigenLayer'a yeniden yatırılan toplam ETH hızla artarsa, bu, jeton değerine yansıyabilecek güvenin güçlü bir işaretidir.

Kısa vadeli tüccarlar devam eden volatiliteye hazırlıklı olmalılar, ancak 2026'ya kadar olan trend olumlu yönde eğilim gösteriyor. Daha açık ifadeyle, EigenLayer'ın hikayesi etkileyici ve eğer kripto rüzgarlar onun lehine eserse, $EIGEN önümüzdeki 12-18 ay içinde dikkate değer şekilde daha yüksek işlem görebilir, muhtemelen ~$5 seviyesinin ötesine yeni yüksekler belirleyebilir.

Uzun Vadeli Fiyat Tahmini (2025–2028)

Geleceğe daha derinlemesine bakıldığında, EigenLayer'ın uzun vadeli perspektifleri ve $EIGEN'ın Ethereum ekosisteminde geç 2020'lerde ne kadar önemli hale geldiği bu noktada belirecek. Beş yıl kripto dünyasında uzun bir süre ve $EIGEN'ın 2028'deki fiyatı, EigenLayer'ın piyasanın güven ve kullanımının önemli bir dilimini yakalayıp yakalayamadığını yansıtacak.

Boğa piyasasının sonunda, bazı kripto futuristlerinin 2028 yılında $EIGEN'ı 10 doların üzerine çıkarmayı hayal ettikleri göz önüne alındığında, bu, sayısız blokzincir hizmetleri için tercih edilen güvenlik ara katmanı olarak başlangıçta tamamen seyreltilmiş değerini geri kazanacağı anlamına gelecektir. Bu senaryoya göre, EigenLayer tarafından Ethereum'un işlem kapasitesi ve modüler mimarisi büyük ölçüde genişletilecek ve bu da yüzlerce projenin Eigen doğrulayıcılarına ücret ödemesi anlamına gelir ve staking ve yönetim için $EIGEN token'ları çok aranan olacaktır. 10 dolarlık bir fiyat, 2025 ortalarından yaklaşık 6-7 kat daha fazla olacaktır, EigenLayer o zamana kadar katman-2 ağları veya büyük DeFi protokolleri kadar kritik hale gelirse bu gerçekçi olmayan bir durum değildir.

2028'e kadar daha ılımlı uzun vadeli bir tahmin, $EIGEN'i 5-8 dolar aralığında gösterir. Bu, istikrarlı bir büyümeyi varsayar, ancak aynı zamanda rekabeti ve her iyimser vizyonun mükemmel bir şekilde gerçekleşmeyeceği olasılığını da kabul eder. Bu aralık içinde bile, erken yatırımcılar sağlam getiriler görecek ve $EIGEN kendisini kesin olarak en üst Ethereum ekosistem tokenları arasında sağlam bir şekilde kuracaktır.

Token arzı dinamiklerinin bir rol oynayacağını belirtmek önemlidir: sadece ~10-15% dolaşımda olan 1.6 milyar $EIGEN jeton mevcut. 2028'e gelindiğinde, büyük bir kısmı serbest bırakılmış olacak. Talep (kullanım durumları, staking ihtiyacı) bu artan arzla başa çıkamazsa, fiyat artışı sınırlı olabilir. Öte yandan, EigenLayer gerçek bir fayda sağlarsa, bu daha büyük arz uzun vadeli stakerlar arasında iyi dağıtılmış olabilir, satış baskısını hafifletebilir.

$EIGEN için uzun vadeli fiyat projeksiyonu (2025–2028). Yeşil çizgi, 2028'de yüksek tek rakamlara istikrarlı bir yükselişi göstermektedir. Bu yol, EigenLayer'ın önümüzdeki birkaç yıl içinde geniş çapta kullanılan bir Ethereum ara yazılımı haline gelmesini varsayar.

Yukarıdaki yeşil çizgili uzun vadeli grafiğimiz, kademeli bir değerlenmenin resmini çiziyor. 2024'teki hızlı yükseliş ve düşüşün aksine, fikir, $EIGEN'un fiyatının platformun benimsenmesiyle birlikte artabileceği ve birkaç yıl içinde kabaca iki katına çıkabileceğidir. 2028 yılına kadar, EigenLayer Ethereum ortamında bir demirbaş olursa (yeniden ele alma güvenlik havuzuna "takılı" birden fazla büyük protokolü hayal edin), $EIGEN tekrar tüm zamanların en yüksek seviyelerine yakın işlem görebilir.

Bazı iyimser tahminler 2028'den sonra bile uzanmakta, projenin sınırdaki durumunu koruyarak $EIGEN'ın 2030'da dolarların onlarca seviyesine ulaşabileceğini speküle etmektedir. Ancak, herhangi bir uzun vadeli kripto tahmini tuzunuzla birlikte alınmalıdır - teknoloji değişimleri, düzenleyici rüzgarlar ve piyasa döngüleri sonuçları dramatik bir şekilde değiştirebilir.

Senaryo açısından, 2028 için ayı piyasası durumu, restaking'in benimsenmemesi veya ciddi bir başarısızlık yaşaması durumunda $EIGEN'ın 3 doların altında kalması olabilir. Ancak mevcut momentum ve EigenLayer'ın güçlü desteği (üst düzey risk sermayedarları ve yetenekli bir ekip), uzun vadeli risk/ödül oranı olumlu görünüyor. Özetle, 2025-2028 görünümümüz, $EIGEN'ın muhtemelen orta ila yüksek tek haneli dolar seviyelerinde yükseldiğini ve her şey plana uygun giderse daha fazla potansiyel olduğunu gösteriyor.

X (Twitter) üzerindeki Hareketlilik ve Duygu

EigenLayer ve $EIGEN'in piyasaya sürülmesinden bu yana, Crypto Twitter (şimdi X) EigenLayer hakkında ve $EIGEN hakkında konuşmalarla alevlenmiş durumda, bu da genellikle heves, merak ve sağlıklı şüpheciliğin bir karışımını yansıtıyor. Sosyal medyadaki $EIGEN etrafındaki mevcut hareket genellikle olumlu ve heyecanlı, ancak token'ın fiyatını yansıtan olağan volatilite ile birlikte. İşte X hakkındaki duygu durumunun bir özeti:

Boğa tarafında, birçok etkileyici ve Ethereum topluluk üyesi EigenLayer'ı ETH staking için bir 'oyun değiştirici' olarak sık sık över. Restaking konseptini öven tweet'ler göreceksiniz - örneğin 'EigenLayer staked ETH'ımın fazla mesai yapmasını sağlıyor 🔥' - genellikle roket emojileri ve insanların çantalarını doldurdukları meme gifleri eşlik eder.

Projenin başarılı ana ağ kilometre taşları (Nisan 2025'te slashing'in tanıtılması gibi), "EigenLayer yeni bir ademi merkeziyetçilik seviyesinin kilidini açtı!" tezahüratlarıyla karşılandı. EigenLayer'ın trend belirleyen bir protokol olduğuna dair elle tutulur bir his var, destekçiler kendilerini "restakers" olarak adlandırıyor ve "yeniden hisse kanıtı" getirileri kazandıkları konusunda şaka yapıyorlar. Bu inanan çekirdeği, EigenLayer'ın nasıl çalıştığına dair sık sık ileti dizileri paylaşarak güçlü bir organik ilgiye işaret ediyor.

Sosyal duygu verileri, boğa bahsinden daha fazla olduğunu gösteriyor, çoğu $EIGEN hakkındaki tweetler "yenilikçi", "boğa", "birikim" gibi olumlu anahtar kelimeler kullanıyor.

Bununla birlikte, Crypto Twitter, karşıt görüşlere ve endişelere sahip olmadan kendisi olamazdı. Birçok kullanıcı, dilimde mizahi paylaşımlarla 2025'in başında sert fiyat düşüşünü işaret etti, örneğin, "$EIGEN düşerken, "EigenLayer? Daha çok benim portföyümü EigenLAYERED etti 😂".

Bazıları, hype'ın gerçeğin önüne geçtiğinden endişeli, 'restaking = risky, don't get rekt by slashing' diye uyarıyor. Ayrıca, airdrop'a katılamayan (ABD vatandaşları gibi) topluluklardan da bir hayal kırıklığı vardı, bu da X üzerinde 'adil başlatma' hakkında bazı homurdanmalara yol açtı.

Ancak, bu eleştiriler genel sohbet içinde nispeten önemsizdir. Son zamanlarda X üzerinde hâkim olan hava beklenti olmuştur - birçok tüccar ve DeFi analisti EigenLayer'ın gelişimini yakından takip etmekte ve genellikle yeni bir proje entegrasyon duyurduğunda veya EigenLayer'ın TVL'si yukarı doğru ilerlediğinde güncellemeleri tweetlemektedir.

EigenLayer'a gönderme yapan memeler genellikle katman veya Lego blokları görüntülerini içerir, Ethereum üzerinde nasıl "istiflendiğini" vurgular ve #RestakingRevolution gibi etiketler niş çevrelerde trend olur.

Özetle, $EIGEN etrafındaki X duygusu canlı ve genellikle olumlu. Bu, daha yeni Ethereum girişimlerinden biri olarak görülüyor ve bu teknoloji heyecanı, portföyleri zorlu bir yolculuk geçirmiş olsa bile jeton için destekleyen bir topluluğa dönüşüyor. Bir popüler tweet mizahi bir şekilde şöyle dedi:

EigenLayer: balinalar tarafından güvenilen, dalgıçlar tarafından tartışılan, ayı piyasalarının karakter inşa ettiğine inananlar tarafından HODLed.

Bu, EigenLayer'ın sosyal medya hayran kitlesini karakterize eden espri ve iyimserliğin karışımını yakalar. $EIGEN'i düşünüyorsanız, Crypto Twitter'a atlamak hem en son haberlerine hem de topluluğun memlerine birinci sıra koltuğu sağlayabilir - her ikisi de kendi yolunda değerlidir!

Ethereum Fiyat Analizi: 2025 Piyasa Trendleri ve Web3 Etkisi

Ethereum’un Parabolik Atılım Potansiyeli: sonunda ETH Ay Zamanı mı?

Ethereum Fiyat Tahmini: ETH 10.000 $'a Ulaşabilir mi?

HEX Fiyatı 2025: Ethereum Blok Zinciri CD Üzerinde Uzun Vadeli Staking Ödülleri

Ethereum Classic (ETC): Değiştirilemez Ethereum Fork ve Fiyat Görünümü

ICON (ICX): Kore Ethereum ? Yine Patlayacak mı?

Dropee Günlük Kombinasyonu 11 Aralık 2025

Tomarket Günlük Kombinasyonu 11 Aralık 2025

Merkeziyetsiz Finans'ta Geçici Kayıp Nedir?

Kripto Parada Çifte Harcama: Önleme Stratejileri

Kripto Ticaretinde Wyckoff Yönteminin Anlaşılması