BLOCKASSET vs APT: Dijital Varlık Yönetimi İçin İki Yenilikçi Blockchain Platformunun Karşılaştırılması

Giriş: BLOCKASSET ve APT Yatırım Karşılaştırması

Kripto para piyasasında, Blockasset ve Aptos’un karşılaştırılması yatırımcılar arasında önemli bir gündem maddesi olmuştur. Bu iki varlık, piyasa değeri sıralaması, kullanım alanları ve fiyat performansı açısından belirgin şekilde ayrılırken, aynı zamanda kripto varlık ekosisteminde farklı konumları temsil etmektedir.

Blockasset (BLOCKASSET): Sporcu onaylı NFT platformu ve ekosistemiyle piyasada yerini almış ve tanınırlık elde etmiştir.

Aptos (APT): 2022’de piyasaya sürüldüğünden bu yana, yüksek performanslı Layer 1 blokzinciri olarak öne çıkmış ve kripto piyasasının en dikkat çekici yeni projeleri arasında gösterilmiştir.

Bu makalede, Blockasset ve Aptos’un yatırım değerleri; fiyat geçmişi, arz modelleri, kurumsal benimsenme, teknolojik ekosistemler ve gelecek öngörüleri gibi başlıklarda karşılaştırmalı olarak analiz edilecek ve yatırımcıların en çok merak ettiği şu soruya odaklanılacaktır:

"Şu anda hangisi daha cazip bir alım fırsatı?"

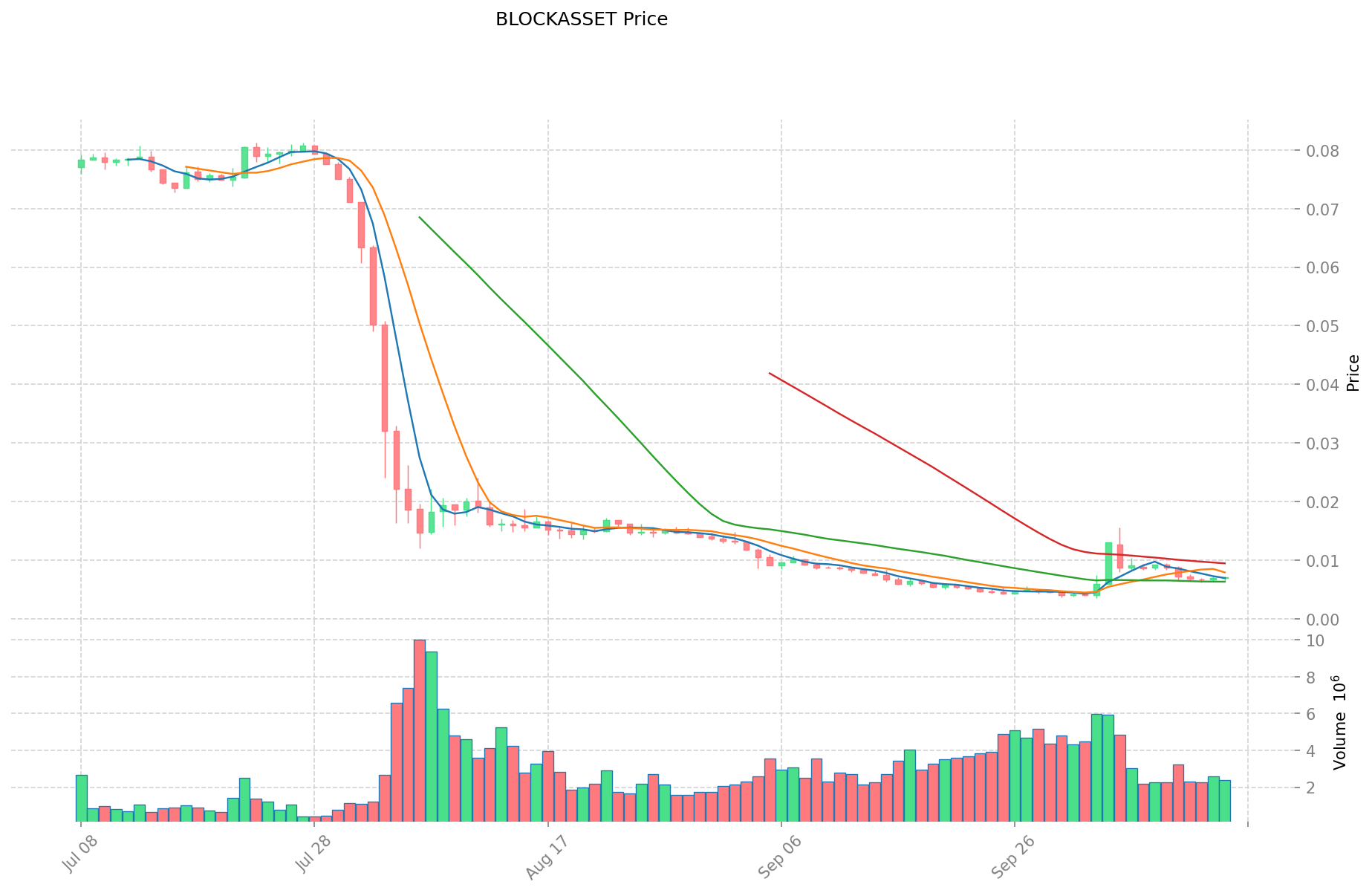

I. Fiyat Geçmişi Karşılaştırması ve Güncel Piyasa Durumu

BLOCKASSET (Coin A) ve APT (Coin B) Tarihsel Fiyat Eğilimleri

- 2021: BLOCKASSET, ilk çıkış dönemi ve piyasa ilgisi ile 0,949403 dolar ile tarihi zirvesini gördü.

- 2022: APT piyasaya çıktı ve ilk işlemlerinde yoğun fiyat dalgalanmaları yaşadı.

- Kıyaslama: Son piyasa döngüsünde BLOCKASSET, zirveden 0,00353608 dolara kadar gerilerken, APT daha istikrarlı bir seyir izleyerek yüksek piyasa değerini korudu.

Güncel Piyasa Durumu (15 Ekim 2025)

- BLOCKASSET güncel fiyatı: 0,007133 dolar

- APT güncel fiyatı: 3,639 dolar

- 24 saatlik işlem hacmi: BLOCKASSET 16.745,41 dolar, APT 2.575.939,50 dolar

- Piyasa Duyarlılık Endeksi (Korku & Açgözlülük Endeksi): 34 (Korku)

Anlık fiyatları görmek için tıklayın:

- BLOCKASSET güncel fiyatı Piyasa Fiyatı

- APT güncel fiyatı Piyasa Fiyatı

II. BLOCKASSET ve APT Yatırım Değerini Etkileyen Temel Unsurlar

Arz Mekanizması Karşılaştırması (Tokenomik)

- BLOCKASSET: Sınırlı arzıyla kıtlık, temel değer önerisidir

- APT: 86,25 milyar dolar piyasa değeriyle %0,12 piyasa payına sahip

- 📌 Tarihsel olarak, sabit kıtlık sunan arz mekanizmaları, piyasa döngülerinde değerin korunmasına katkı sağlamıştır.

Kurumsal Benimsenme ve Piyasa Uygulamaları

- Kurumsal portföyler: APT, rakiplerine göre daha düşük TVL’ye sahip olmasına rağmen önemli kurumsal ilgi görmektedir

- Kurum kullanımı: APT’nin 24 saatte 88,32 milyon dolar işlem hacmiyle aktif şekilde işlem gördüğü izlenmektedir

- Regülasyon yaklaşımı: Ülkelere göre değişken olup, bu varlıklar için özel bir bilgi sunulmamaktadır

Teknolojik Gelişim ve Ekosistem İnşası

- APT teknik konumlanması: Önde gelen L1 protokol olarak, TVL’den daha fazla piyasa ilgisi görmektedir

- Ekosistem kıyaslaması: APT (3,27 milyar dolar TVL), Sui (5,89 milyar dolar) ve Cronos’un (4,85 milyar dolar) altında toplam kilitli değere sahip olsa da, daha yüksek görünürlük elde etmiştir

Makroekonomik ve Piyasa Döngüleri

- Enflasyona karşı koruma: BLOCKASSET’in merkeziyetsiz yapısı ve kıtlığı, değer koruma potansiyeli sunar

- Piyasa göstergeleri: APT, raporlama anında son 24 saatte %1,36 fiyat artışı kaydetmiştir

- Küresel transfer: Her iki varlık da dijital olarak sınır ötesi transfer imkanı sağlar

III. 2025-2030 Fiyat Tahmini: BLOCKASSET ve APT

Kısa Vadeli Tahmin (2025)

- BLOCKASSET: Muhafazakar 0,0069787 - 0,007346 dolar | İyimser 0,007346 - 0,0099171 dolar

- APT: Muhafazakar 1,86099 - 3,649 dolar | İyimser 3,649 - 4,92615 dolar

Orta Vadeli Tahmin (2027)

- BLOCKASSET’in büyüme fazına geçmesiyle fiyat aralığı 0,00737997525 - 0,01416955248 dolar bekleniyor

- APT, yükseliş piyasasında 3,77842546875 - 7,2545769 dolar bandında hareket edebilir

- Temel etkenler: Kurumsal fon girişi, ETF gelişimi, ekosistem büyümesi

Uzun Vadeli Tahmin (2030)

- BLOCKASSET: Temel senaryo 0,014656911285559 - 0,021252521364061 dolar | İyimser senaryo 0,021252521364061 dolar üzeri

- APT: Temel senaryo 7,53344485119625 - 8,964799372923537 dolar | İyimser senaryo 8,964799372923537 dolar üzeri

Yasal Uyarı

BLOCKASSET:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 0,0099171 | 0,007346 | 0,0069787 | 2 |

| 2026 | 0,011048384 | 0,00863155 | 0,0066462935 | 21 |

| 2027 | 0,01416955248 | 0,009839967 | 0,00737997525 | 37 |

| 2028 | 0,0142856640906 | 0,01200475974 | 0,0091236174024 | 68 |

| 2029 | 0,016168610655819 | 0,0131452119153 | 0,012619403438688 | 84 |

| 2030 | 0,021252521364061 | 0,014656911285559 | 0,007914732094202 | 105 |

APT:

| Yıl | Tahmini En Yüksek Fiyat | Tahmini Ortalama Fiyat | Tahmini En Düşük Fiyat | Değişim (%) |

|---|---|---|---|---|

| 2025 | 4,92615 | 3,649 | 1,86099 | 0 |

| 2026 | 5,78822625 | 4,287575 | 3,38718425 | 17 |

| 2027 | 7,2545769 | 5,037900625 | 3,77842546875 | 38 |

| 2028 | 6,51501308825 | 6,1462387625 | 3,1960441565 | 68 |

| 2029 | 8,7362637770175 | 6,330625925375 | 3,60845677746375 | 73 |

| 2030 | 8,964799372923537 | 7,53344485119625 | 4,143394668157937 | 107 |

IV. Yatırım Stratejisi Karşılaştırması: BLOCKASSET ve APT

Uzun Vadeli ve Kısa Vadeli Yatırım Stratejisi

- BLOCKASSET: Sporcu onaylı NFT platformu ve ekosistem potansiyeline odaklanan yatırımcılar için uygun

- APT: Yüksek performanslı Layer 1 blokzincir ve ekosistem büyümesine odaklanan yatırımcılar için uygun

Risk Yönetimi ve Varlık Dağılımı

- Muhafazakar yatırımcılar: BLOCKASSET %20, APT %80

- Aggresif yatırımcılar: BLOCKASSET %40, APT %60

- Koruma araçları: Stablecoin tahsisi, opsiyonlar, çapraz döviz portföyü

V. Potansiyel Risk Karşılaştırması

Piyasa Riski

- BLOCKASSET: APT’ye kıyasla daha fazla volatilite ve düşük likidite

- APT: Layer 1 blokzincir alanında artan rekabet riski

Teknik Risk

- BLOCKASSET: Ölçeklenebilirlik ve ağ istikrarı

- APT: Hesaplama gücünde merkezileşme ve güvenlik açıkları

Düzenleyici Risk

- Küresel düzenleyici politikalar, her iki varlığı farklı düzeylerde etkileyebilir

VI. Sonuç: Hangisi Daha Avantajlı Alım?

📌 Yatırım Değeri Özeti:

- BLOCKASSET avantajları: Sporcu onaylı benzersiz NFT platformu, spor odaklı dijital varlıklarda büyüme potansiyeli

- APT avantajları: Daha yüksek piyasa görünürlüğü, aktif işlem hacmi, güçlü Layer 1 protokol konumu

✅ Yatırım Tavsiyesi:

- Yeni yatırımcılar: BLOCKASSET’e küçük oranda, APT’ye yüksek oranda portföy dağılımı önerilir

- Deneyimli yatırımcılar: Risk iştahı ve ekosistem inancına göre BLOCKASSET ve APT arasında denge kurabilir

- Kurumsal yatırımcılar: Layer 1 blokzincir potansiyeli için APT’yi, spor NFT pazarına erişim için ise BLOCKASSET’i değerlendirebilir

⚠️ Risk Uyarısı: Kripto para piyasası yüksek volatiliteye sahiptir; bu makale yatırım tavsiyesi değildir. None

VII. Sıkça Sorulan Sorular

S1: BLOCKASSET ve APT arasındaki temel farklar nelerdir? C: BLOCKASSET, sporcu onaylı bir NFT platformudur; APT ise yüksek performanslı bir Layer 1 blokzinciridir. BLOCKASSET’in piyasa değeri ve işlem hacmi düşükken, APT’nin piyasa görünürlüğü ve kurumsal ilgisi yüksektir.

S2: Hangi varlık daha fazla fiyat istikrarı sergilemiştir? C: APT, lansmanından bu yana daha istikrarlı fiyat performansı göstererek BLOCKASSET’e kıyasla yüksek piyasa değerini korumuştur. BLOCKASSET ise zirveden belirgin bir düşüş yaşamıştır.

S3: BLOCKASSET ve APT arz mekanizmaları nasıl farklılık gösteriyor? C: BLOCKASSET’in arzı sınırlı ve kıtlık odaklıdır. APT’nin ise 86,25 milyar dolar piyasa değeri ve %0,12 piyasa payı vardır.

S4: 2030 yılı için BLOCKASSET ve APT'nin beklenen fiyat aralıkları nedir? C: BLOCKASSET için temel senaryo 0,014656911285559 - 0,021252521364061 dolar, iyimser senaryo ise 0,021252521364061 doların üzeridir. APT için temel senaryo 7,53344485119625 - 8,964799372923537 dolar, iyimser senaryo ise 8,964799372923537 doların üstüdür.

S5: BLOCKASSET ve APT arasında kurumsal benimseme ve piyasada kullanım nasıl karşılaştırılır? C: APT, rakiplerine göre daha düşük TVL’ye sahip olmasına rağmen ciddi kurumsal ilgi görmektedir ve 88,32 milyon dolar 24 saatlik işlem hacmine sahiptir. BLOCKASSET’in kurumsal benimsenmesine dair özel bir bilgi mevcut değildir.

S6: Muhafazakar ve aggresif yatırımcılar için önerilen varlık dağılımı nedir? C: Muhafazakar yatırımcılar için önerilen oran: %20 BLOCKASSET, %80 APT. Aggresif yatırımcılar için: %40 BLOCKASSET, %60 APT.

S7: BLOCKASSET ve APT yatırımlarında öne çıkan başlıca riskler nelerdir? C: BLOCKASSET için başlıca riskler: yüksek volatilite, düşük likidite, ölçeklenebilirlik sorunları. APT için: Layer 1 blokzincir rekabeti, hesaplama gücünde merkezileşme, güvenlik açıkları. Her iki varlık da ülkelere göre değişebilen regülasyon riskine tabidir.

DKA ile IMX: Diyabet Yönetim Tekniklerinin Karşılaştırmalı Analizi

KOS vs IMX: Dijital Varlık Alım Satım Platformlarında Egemenlik Yarışı

INIT vs IMX: Gömülü Sistemlerde Performans ve Verimlilik Karşılaştırması

AURA ve APT: Siber güvenlikte gelişmiş tehdit algılama stratejilerinin karşılaştırılması

MILADYCULT ve ARB: Dijital Sanat Dünyasında NFT Üstünlüğü Savaşı

JOC vs IMX: Küresel tedarik zincirlerinde lojistik yönetim sistemlerinin karşılaştırmalı analizi

Dropee Günlük Kombinasyonu 12 Aralık 2025

Tomarket Günlük Kombinasyonu 12 Aralık 2025

SEI Airdrop Ödülleri’ne Katılım ve Talep Etme Kılavuzu

Kripto para birimlerinde algoritmik alım satım için etkili stratejiler

Stock-to-Flow Model ile Bitcoin'in Değerlemesini Anlamak